How to explain Bitcoin to your No-Coiner Loved Ones

Having to explain Bitcoin to no-coiners can feel a bit like having your teeth pulled while you're busy getting punched in the face. But what about when you're invited home for a nice Christmas dinner with your family? Everyone's sitting around the table, enjoying their eggnog and roast beef, when one of your uncles looks up and goes, "So what's this Bitcoin I hear you've been investing in?"

The voices fall silent. The whole room goes dark. Even the lights from the Christmas tree are dimming just for you, as all eyes rest on the spotlight cast over your head.

"Well, it goes a little something like this..."

But first, you make sure everyone at the dinner table has their seatbelts strapped in tight, because the ride to the moon is a wild one (with high highs and low lows!).

Bitcoin: How fast is too fast?

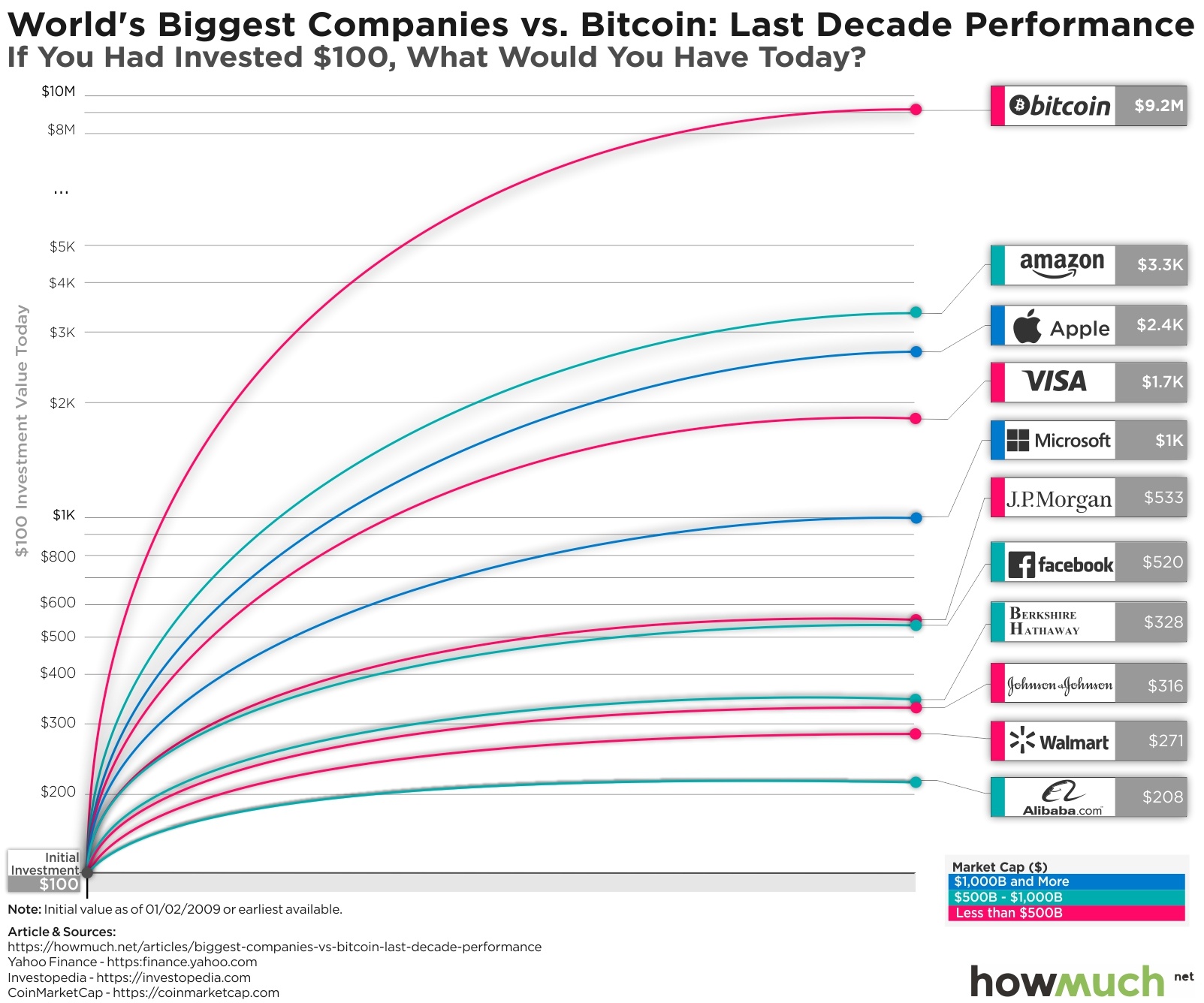

The fastest growing asset class in history is... Bitcoin. As you can see from the image below, it's not even a fair contest. The chart only details the largest major corporations vs. Bitcoin. But even against other asset classes like gold and silver, Bitcoin comes out on top—by a mile.

Image source: HowMuch.net, a financial literacy website

Sure, it's caught some slack lately because of its apparent limitations as a solely transactional blockchain. But that's when it's compared to other newer crypto projects, which isn't fair. (It's like comparing gold to cash. They each have their uses.)

Ethereum is only the second crypto project to come into existence after Bitcoin. Yet, it dubs itself "The World Computer" and birthed DeFi, opening up a whole new world of possibilities in finance.

But critics would be remiss to dismiss the OG of crypto so quickly. Pretty much every cryptocurrency exchange (especially decentralized exchanges) presents available tokens with BTC pairs. And let's not forget that if you're purchasing crypto with a credit card, Bitcoin is the easiest coin you can get your hands on.

As a payment method, Bitcoin payments are some of the easiest to make. This is especially true if you're sending money to a place where conventional currencies and legacy financial services aren't readily accessible. Most (if not all) digital wallets today also support Bitcoin, and many stores worldwide also accept Bitcoin as a form of payment.

Yes, we're still early. Mm-hmm. This is just the beginning. But really. What did the very beginning look like?

A brief history of Bitcoin: An Origins Story

If Bitcoin were a superhero, he'd be an anonymous Japanese cypherpunk and researcher named Satoshi Nakamoto. Bitcoin may in fact have been borne out of frustration with reckless government spending and bailouts.

The genesis block (aka the first block in the chain ever to be created) includes the memo:

"The Times Jan/03/2009 Chancellor on brink of second bailout for banks."

A passive observer might dismiss this as simply noting the date of the genesis block, but that ain't it, chief. If you pay close attention, Inflation is in the fine print here. But let's get back to that a little later.

I won't give you the typical, "How much money would you have made if you invested $20 into Bitcoin in 2009?" (It's US$1 million, btw, but I told you I wouldn't do that. ) Forget all-time-high headlines. No, what we find much more interesting is what Bitcoin actually is, and what it represents.

See, money must comprise 1 or more of these 3 general properties to be considered "sound":

1. A store of value

2. A unit of account

3. A medium of exchange

Bitcoin definitely fits the first definition. (Any appreciating asset does.) The second and third are a bit harder because of Bitcoin's price volatility, but don't let that scare you. As they say on Wall Street, "Volatility is our friend."

In fact, the main reason Bitcoin and crypto are volatile is because they're a nascent industry. And new things tend to be volatile, whereas mature things tend to be, well, fairly stable.

Let's take a quick comparative example:

Say you have $1000 to invest in either Microsoft stocks or Bitcoin. (Oh, the most challenging of financial decisions!)

Microsoft has had decades to stabilize its price. How much upside potential does it really have? Will Microsoft release several mind-blowing innovations this year that can beat its cost of capital?

Say the real rate of inflation is somewhere around 10%, which is being generous. This would mean that Microsoft would have to grow at a pace of 10% per year (!) to break even.

Why does this happen? Because we're living in a system that actually values traditional currencies. Governments print money, which devalues the purchasing power of your fiat.

Compare this to Bitcoin. Bitcoin isn't only considered a hedge against inflation. (It's deflationary since scarcity was programmed into the algorithm.) Bitcoin is a key to opt out of the fiat system. By holding Bitcoin, you're no longer beholden to those who continuously devalue your assets and your purchasing power. Now you've got your own asset, free from external devaluation.

The Fundamentals: Why Decentralization Matters

Decentralization matters for 3 main reasons:

1. Decentralization renders intermediaries redundant.

Decentralization lets us rebuild a separate financial system, one independent of any central authority or third party. Every central bank and their commercial counterparts play no part in this separate world. (That's why the most they can do is yell FUD from the rooftop of their HQ. Yanno, next to the helipad?)

2. Bitcoin decentralization enables trustless exchange and transparency.

Bitcoin—and most cryptocurrencies—are essentially a "decentralized ledger". But what does this actually mean? This decentralization is possible because the Bitcoin blockchain is a public ledger. In other words, everyone has the exact same copy of that same ledger. This makes it so that if a false block is submitted to the chain, verification of that block would be grossly infeasible.

3. Decentralization makes the network antifragile, and thus, better able to withstand attacks.

It's worth taking a closer look under Bitcoin's hood to see how Bitcoin is actually decentralized, and why that matters.

See, it's the structure of Bitcoin that makes Bitcoin—and all important cryptocurrencies—possible. But most people have a very black and white definition of decentralization. They think that something is either decentralized, or it's not, but that's just not the case.

Decentralization happens on a scale.

And the challenge with Bitcoin is to make it as decentralized as possible. In game theory, there's an age-old problem called the "Byzantine Generals Problem". And it's worth exploring a bit.

Say you're an army surrounding the city. You've got 5 generals, and you all have to attack at the same time. But one or more of your generals is unreliable, and you don't know which. If you don't all attack at the same time, the attack will fail.

What do you do?

This is the problem Satoshi Nakamoto solved with Bitcoin. He created a Proof-of-Work consensus mechanism that incentivizes all trustless peers to act in their self-interest. That self-interest happens to be perfectly aligned with those of the network as well.

These trustless peers are Bitcoin miners, who help secure the network by validating the correct blocks and adding them to the chain. In return, they receive compensation in miner fees.

Nakamoto solves this problem by paying miners in Bitcoin (aka the same coin used by the Bitcoin network). In other words, miners wanting to compromise the network would be acting against their own self-interest. After all, the value of their coin is tied directly to the network's integrity.

Moreover, by having many nodes, Bitcoin has no single point of failure, or centralized servers vulnerable to attack. Think of the Bitcoin network as a hydra, a many-headed entity. The more heads you cut off, others grow in their place to further strengthen the network.

Bitcoin mining: A revolutionary concept

Let's break down mining here.

Say you learn how much Bitcoin is, and you want to buy in. You hear mining is profitable, but you've got to invest in a mining rig. See, back in my day, you could mine Bitcoin with a CPU on any old laptop. But as the number of Bitcoins left to be mined decreased, the hash rate increased in tandem.

Wait. What's a "hash rate", you ask? Fair question. It's the computational power required to solve the cryptographic puzzle that identifies the correct block. Solve this, and you win the mining reward.

Today, you need very powerful computers that specialize in mining. They're called ASIC miners, they mine Bitcoin, and they are very, very expensive. (We're talking US$10,000 for an ASIC with a decent hash rate.)

The reasoning for mining goes something like this:

Say you want to accumulate small amounts of Bitcoin over time. You've invested $10,000 of your hard-earned fiat (say, US dollars) into one ASIC miner. So it would be pretty silly for you to turn around and compromise the very same network that pays you, right? (Talk about shooting yourself in the foot and biting the hand that feeds you, at the same time.)

The only way to attack the Bitcoin network is via a 51% attack. This would involve investing in and owning more than half of the entire network. That's the only way you can theoretically start to validate false blocks to compromise it. (You know, that network you just paid ridiculous amounts of dinero to own more than 50% of?)

This is why more miner nodes equates to a more distributed and decentralized network. If there are only 5 miners, 3 of them being compromised could lead to a successful attack on the network.

But if there are 5 million individual miners... trying to convince more than half of those miners to compromise the network would be a hard sell. Such an attack becomes even more infeasible when you consider every miner having to act against their own self-interest.

A mind-blowing past? Or a future?

Many writers try to entice crypto newcomers to join by telling them the price of a certain crypto from years ago. Those prices do not concern you. (You can't FOMO into the past.) What does concern you, though, is the future (specifically, your bright financial future).

Let's recap real quick. If your savings are in fiat currency like USD, according to official figures, you're losing roughly 7% of your purchasing power every year. This means that the cost of living is going up across the board, and on average, it's costing you 7%. (Housing is up 25% from the past year, to give you an idea.)

In other words, think of all your savings like a bag of sand with a hole in the bottom. But in this case, it's your money falling out of a hole in your pocket.

Bitcoin is frequently referred to as a hedge against inflation. But that's doing Bitcoin a disservice. Bitcoin isn't just a hedge. It's a way to opt out of the fiat system and leave it behind forever.

Here's some wise investment advice from Bitcoin whale Michael Saylor:

"You don't have to invest all your money in Bitcoin. Just the money you want to keep."

2021 was a big year for Bitcoin. We saw the emergence of the first Bitcoin City, a city in El Salvador that mines Bitcoin with the energy drawn from an active volcano. The city is tax-free, and everyone owns Bitcoin.

The president of El Salvador Nayib Bukele (whose Twitter handle refers to himself as "CEO of El Salvador") has made Bitcoin legal tender.

What a time to be alive.

Stay tuned and watch the KuCoin Blog for more interesting and valuable educational content. All the best!

Did you know that KuCoin offers premium TradingView charts to all of its clients? With this, you can step up your technical analysis and easily trade your favorite cryptos even in the bear market.

Disclaimer: KuCoin does not provide financial advice. Please do your own risk assessment when deciding how to invest in cryptocurrency and blockchain technology.

Sign up on KuCoin, and start trading today!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange_New

Download KuCoin App >>> https://www.kucoin.com/download

Also Subscribe to our Youtube Channel >>>Listen to 60s Podcast