How to Buy Ethereum (ETH)

Price of Ethereum (24h)$1,946.65 8.75%Log In to Buy Ethereum(ETH)

8.75%Log In to Buy Ethereum(ETH)

Interested in buying Ethereum (ETH) or exploring other cryptocurrencies? This is the right place for you! KuCoin offers safe and easy ways to let you buy Ethereum (ETH) instantly wherever you are! Check out all the ways you can buy ETH on KuCoin.

Buy Ethereum (ETH) on KuCoin in Four Simple Steps

Create Your Free KuCoin Account

- Sign up on KuCoin with your email address/mobile phone number and country of residence, and create a strong password to secure your account.

Secure Your Account

- Ensure stronger protection of your account by setting Google 2FA code, anti-phishing code, and trading password.

Verify Your Account

- Verify your identity by entering your personal information and uploading a valid Photo ID.

Add a Payment Method

- Add a credit/debit card or bank account after verifying your KuCoin account.

Buy Ethereum (ETH)

- Use a variety of payment options to buy Ethereum on KuCoin. We'll show you how.

Choose How You Want to Buy Ethereum on KuCoin

Buying cryptocurrencies is easy and intuitive on KuCoin. Let's explore the different ways of buying Ethereum (ETH).

- 1

Buy Ethereum (ETH) with a Credit or Debit Card

This is the easiest way for new users to purchase (ETH). Link your credit or debit card to your account, enter the purchase amount, then wait for the transaction to be completed.

Video Tutorial

How to Buy Crypto With Credit Debit Card Web - 2

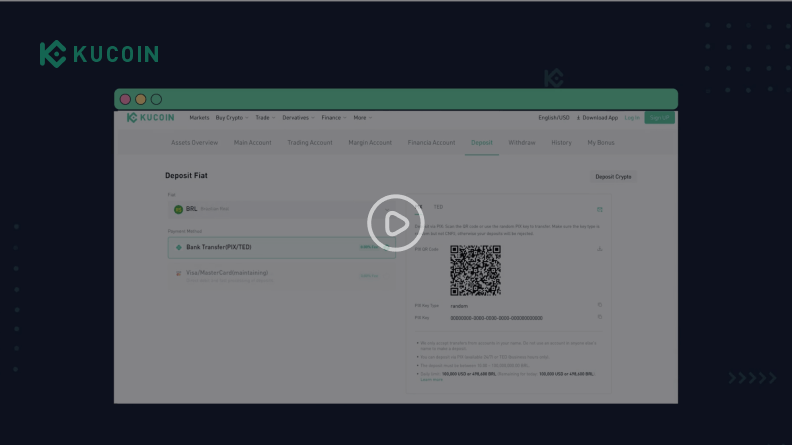

Buy Ethereum (ETH) via Bank Transfer

Depending on the region you are in, bank transfers are also a safe and convenient way to buy Ethereum. You can purchase ETH once the funds arrive in your account.

Video Tutorial

How to Deposit Fiat on KuCoin - 3

Buy Ethereum (ETH) on the KuCoin P2P Market

You can buy ETH with zero trading fees directly from sellers on KuCoin's P2P marketplace. Your purchased ETH will be released to your Funding Account from escrow once the seller confirms the receipt of payment.

Video Tutorial

How to Buy Crypto on KuCoin P2P - 4

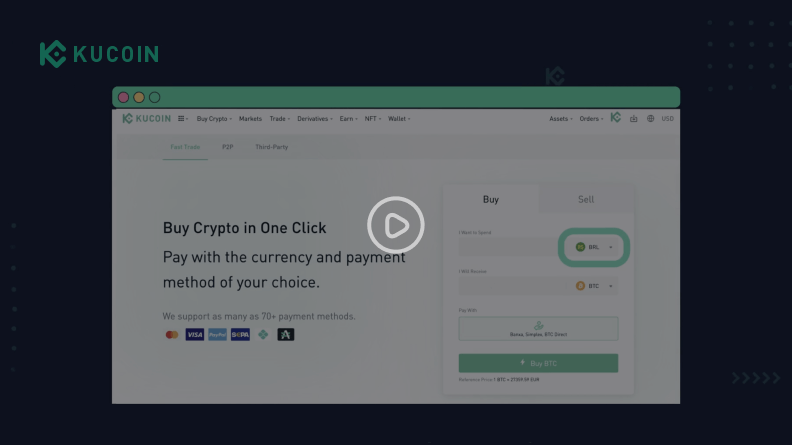

Buy Ethereum (ETH) Using Third-Party Channels

KuCoin supports a variety of leading third-party payment processors. Visit our third-party payment page to view available methods in your region.

- 5

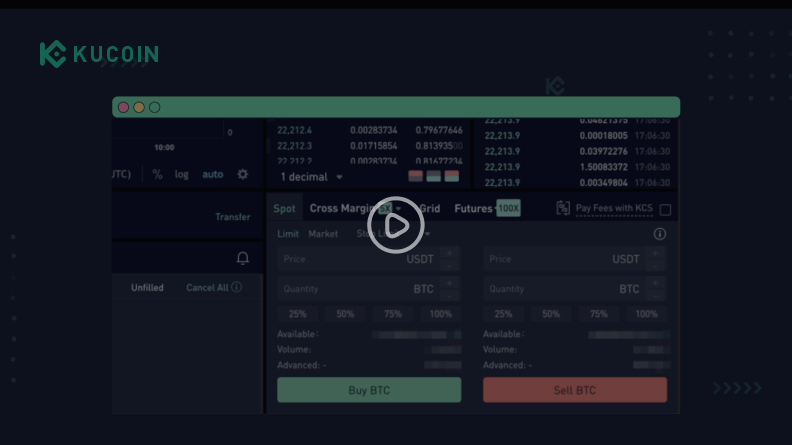

Buy Ethereum (ETH) with crypto on the KuCoin Spot Market

With support for 700+ digital assets, the KuCoin spot market is the most popular place to buy Ethereum (ETH). Here's how to buy:1. Buy stablecoins such as USDT on KuCoin using the Fast Trade service, P2P, or through third-party sellers. Alternatively, transfer your current crypto holdings from another wallet or trading platform to KuCoin. Make sure your blockchain network is correct, since depositing crypto to the wrong address may result in loss of assets.

2. Transfer your crypto to a KuCoin Trading Account. Find your desired Ethereum (ETH) trading pairs in the KuCoin spot market. Place an order to exchange your existing crypto for Ethereum (ETH).

Tip: KuCoin offers a variety of order types to buy Ethereum (ETH) in the spot market, such as market orders for instant purchases and limit orders for buying crypto at a specified price. For more information about order types on KuCoin, click here.3. As soon as your order is successfully executed, you will be able to see your available Ethereum (ETH) in your Trading Account.

Video Tutorial

How to Buy Crypto on the Spot Market Web

How to Buy Crypto on the Spot Market App

Get Your First Ethereum (ETH) with KuCoin

Get Started Now

How to Store Ethereum (ETH)

The best way to store Ethereum (ETH) varies based on your needs and preferences. Review the pros and cons to find the best method of storing Ethereum (ETH).

- Store Ethereum in Your KuCoin Account

Holding your crypto in your KuCoin account provides quick access to trading products, such as spot and futures trading, staking, lending, and more. KuCoin serves as the custodian of your crypto assets to help you avoid the hassle of securing your private keys on your own. Make sure to set up a strong password and upgrade your security settings to prevent malicious actors from accessing your funds.

- Hold Your Ethereum in Non-Custodial Wallets

"Not your keys, not your coins" is a widely recognized rule in the crypto community. If security is your top concern, you can withdraw your Ethereum (ETH) to a non-custodial wallet. Storing Ethereum (ETH) in a non-custodial or self-custodial wallet grants you complete control over your private keys. You can use any type of wallet, including hardware wallets, Web3 wallets, or paper wallets. Note that this option may be less convenient if you wish to trade your Ethereum (ETH) frequently or put your assets to work. Be sure to store your private keys in a secure location as losing them may result in the permanent loss of your Ethereum (ETH).

What Can You Do with Ethereum (ETH) on KuCoin?

Hold

- Store your Ethereum (ETH) in your KuCoin account.

Trade

- Trade Ethereum (ETH) in the spot and futures markets.

Earn

- Earn passive income by staking or lending Ethereum (ETH).

Why Is KuCoin the Best Platform to Buy Ethereum (ETH)?

Safe and Trusted

Our regular Proof of Reserves (PoR) mechanism ensures that customer funds are backed by 1:1 real assets. KuCoin was named one of the Best Crypto Exchanges by Forbes in 2021 and selected by Ascent as the Best Crypto App in 2022.

High Liquidity

Boasting a high liquidity order book for all listed cryptocurrencies, KuCoin delivers a liquid trading experience with tight spreads.

Home of Crypto Gems

KuCoin supports more than 700 cryptocurrencies and is the best place to find the next crypto gem. Buy Ethereum and trade it against various digital assets on KuCoin.

Intuitive Interface

Buying Ethereum (ETH) on KuCoin is quick and easy, thanks to our intuitive interface and powerful technology. Obtain ETH in an instant when you buy on KuCoin.