KuCoin Ventures Weekly Report 20250505-0511

2025/05/13 07:13:29

KuCoin Ventures Weekly Report: Global Macro Boost Propels BTC Beyond $100K: Easing Trade Tensions, Pectra Upgrade Fuel Crypto Surge Amid Looming Monetary Policy Challenges

1. Weekly Market Highlights

BTC Reclaims $100,000, Challenging All-Time Highs; Pectra Upgrade Boosts ETH to $2,600, Altcoins Stage a Comeback

On Thursday, BTC surged over 6% in a single day, breaking the $100,000 mark for the first time since early February. Following Trump’s inauguration, slower-than-expected crypto policy advancements and escalating tariff trade wars led to a sustained BTC decline from February to April, even dropping to $75,000 at one point. However, as tariff tensions eased, BTC rebounded from $75,000 to above $100,000 in just five weeks. The core driver behind this $100,000 breakthrough remains the positive developments in tariff policies. On May 8, U.S. President Trump and U.K. Prime Minister Keir Starmer announced a trade agreement imposing a 10% tariff on U.K. goods imported to the U.S., while the U.K. lowered its tariffs from 5.1% to 1.8% and granted greater market access for U.S. goods. This marks the first major trade deal between global powers since Trump’s tariff hikes and intensified trade wars, signaling a positive shift in global trade relations. Additionally, the Trump administration plans to initiate trade negotiations with around 20 countries, including Japan and South Korea, aiming for swift, standardized agreements. Highly anticipated U.S.-China talks are also expected to commence.

The ETH/BTC exchange rate soared over 20% that week, marking the largest weekly gain since late May 2024. The crypto community expressed surprise at ETH’s rally, with China’s largest short-video platform Douyin (TikTok’s international version) featuring a trending topic: “ETH Surges 40% in 3 Days, What Happened?” That week, Ethereum successfully implemented the Pectra upgrade, incorporating 11 EIPs, including EIP-770, which grants EOAs smart contract capabilities; EIP-7251, optimizing validator operations and increasing the maximum effective balance; and EIP-7691, enhancing Layer 2 scalability and boosting Blob throughput. Surprisingly, ETH’s price underperformed on the day of the Pectra upgrade. Santiment’s analysis suggests that some traders, particularly retail investors, sold ETH to chase Memecoins. However, as retail panic subsided, ETH staged a significant recovery, rebounding above $2,000 and briefly surpassing $2,600, highlighting the profitability of contrarian strategies against retail sentiment.

Data Source: CoinMarketCap, 2025/05/12

The so-called “altcoin season” remains dominated by the Memecoin frenzy led by Pump Fun, alongside the allure of low-valuation VCcoins introduced through Binance’s Alpha 2.0 and Wallet IDO mechanisms.

2. Weekly Selected Market Signals

Improved Macro Liquidity Supports Crypto Rebound, Yet Debt, Tax, & Fed Uncertainties Pose Medium-Term Challenges

Data Source: Tradingview, 2025/05/12

Besides the easing of sentiment regarding trade frictions, macro liquidity has also laid a relatively good foundation for the rebound of Bitcoin and the crypto market. As can be seen from the chart above, although global central bank net liquidity (bottom blue line) has not shown significant recent growth, looking at the 10-week (72-day) leading indicators of M2 total supply (yellow line) and M2 YoY growth rate (area chart, green part), the current global peripheral capital situation is relatively abundant, which is a good foundation for subsequent new capital inflows into the crypto market.

In the chart above, analyzing Bitcoin's own technical indicators, its weekly MACD indicator, after undergoing adjustments from January to April, has now formed a golden cross. This technical signal indicates that, provided the liquidity environment remains stable and there are no major black swan event impacts, the market is expected to usher in a phased rebound.

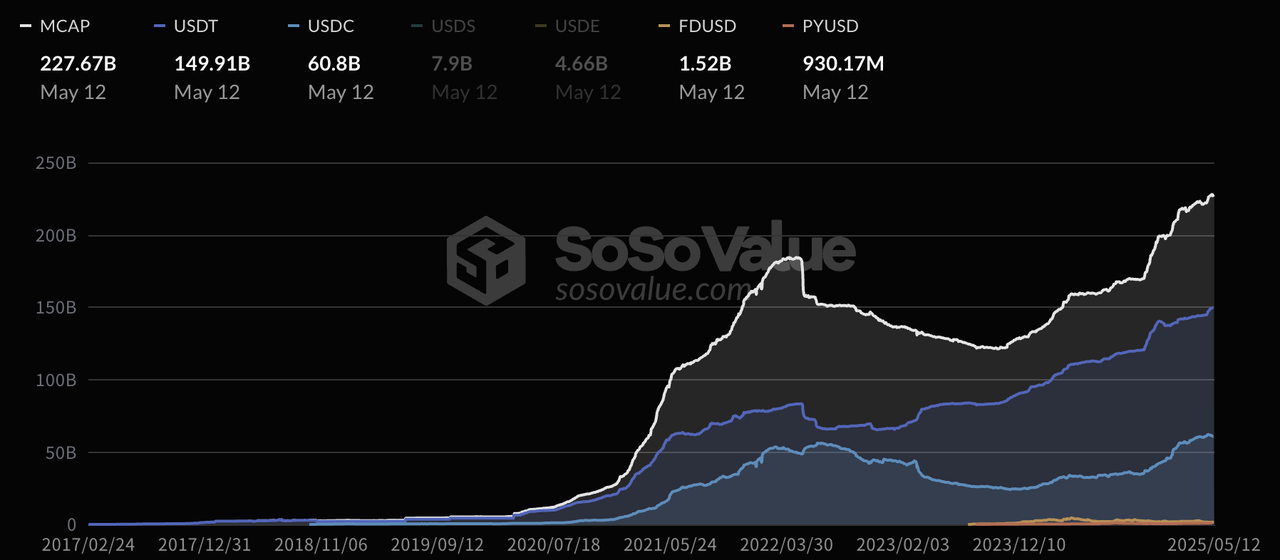

Data Source: SosoValue, 2025/05/12

Liquidity within the crypto ecosystem also shows a positive trend. Specifically, although the issuance of USDC fell back slightly in early May, the issuance rate of USDT has significantly accelerated since April 23rd, driving the total market capitalization of stablecoins to accelerate its growth since mid-April and recently hit a new all-time high. This clearly reflects a positive signal of capital flowing into the crypto market.

Data Source:SosoValue, 2025/05/12

Bitcoin spot ETFs have seen a resurgence of net inflows, and their total Assets Under Management (AUM) have also returned to the range of USD 110 billion to USD 120 billion. However, it is worth noting that although ETF capital continues to flow in, their weekly net inflow volume shows a marginally decreasing trend alongside the rebound in Bitcoin's price.

Data Source:cmegroup.com , 2025/05/12

According to the CME FedWatch tool, market traders widely expect the Federal Reserve may initiate interest rate cuts in July or September, and there is a higher probability that the policy rate will be reduced to the 4.00%-4.25% range in September. In addition to rate cut expectations, the market is more focused on the Federal Reserve's stance on further slowing or even stopping Quantitative Tightening (QT), and does not rule out the possibility of restarting Quantitative Easing (QE) under certain conditions.

Overall, the phased easing of trade frictions, the shift in tensions between major economies towards negotiation and gamesmanship, coupled with a relatively abundant macro liquidity environment, the development of mainstream market narratives, and a significant improvement in investor sentiment, these factors collectively provide support for the current market rebound. However, whether this rebound can be sustained, especially the subsequent performance of Bitcoin and other crypto assets, depends not only on the evolution of narratives and speculative hotspots within the crypto market itself, but more critically on changes at the macro level and in liquidity prospects. In the coming months, the following aspects deserve close attention:

-

Progress and outcomes of US trade friction tariff negotiations

-

Seasonal impact of the US tax season in May-June on liquidity

-

Potential fiscal operational changes due to the US debt ceiling issue in June-July (especially the liquidity drain from rebuilding the TGA account)

-

Statements from the Federal Reserve regarding the path of interest rate cuts and the timing of QT conclusion at the upcoming FOMC meetings on June 18th and July 30th These factors will all be key variables affecting medium-term market liquidity and crypto asset prices.

Primary Market Financing Observation: Rejuvenation of Established Narratives Runs Parallel with Leadership in the Compliance Track

DogeOS / Miden Secure New Financing from Major VCs: Established Public Chains Remain Hot, Can Old Wine in New Bottles Once Again Attract Market Attention?

Recently, Dogecoin ecosystem application development layer DogeOS completed $6.9 million in financing, led by Polychain Capital. The project aims to provide developers with operating system-level tools based on the Dogecoin blockchain, supporting the development of consumer-grade applications such as games and AI.

Meanwhile, a16z, Hack VC, and 1kx co-led a $25 million financing round for Polygon Miden. Miden is an Ethereum Layer 2 scaling solution launched by Polygon, based on zk-STARKs (Zero-Knowledge Scalable Transparent ARguments of Knowledge), aimed at enhancing the scalability and security of the Ethereum network.

Both Dogecoin and Polygon have previously had multiple scaling solutions or Layer 2 projects receive financing and even go live. Now, prominent VCs are choosing to continue investing in derivative narratives of these mature public chains. Whether this can truly lead to products with widespread practical use cases and ultimately gain recognition from users and the secondary market remains to be tested by time.

Securitize / BVNK / Deribit Financing and M&A: Compliance and Payment Narratives Remain Hot, Industry Consolidation Accelerates

Securitize, a leading company in the RWA tokenization field, recently announced a strategic equity investment from Jump Crypto, further consolidating its market position. BVNK, which provides banking services and stablecoin payment solutions for crypto-native businesses, also successfully secured a new round of investment from payment giant VISA. These cases clearly indicate that under the current regulatory environment, startups focusing within the compliance framework, especially those with compliance experience, licensing resources, and deep engagement in areas like asset tokenization and stablecoin payments, are becoming investment hotspots that the market cannot ignore.

In addition to direct financing, large-scale M&A deals also reveal new trends in industry development. Last week, Coinbase announced the acquisition of crypto derivatives exchange Deribit for $2.9 billion. This transaction value not only broke the previous record set by Kraken's acquisition of NinjaTrader but also became the largest acquisition event in the cryptocurrency industry to date.

Previous market reports indicated that both Kraken and Coinbase had prior contact with Deribit. Coinbase's decisive move this time clearly reflects that mainstream European and American exchanges are attempting to accelerate the strengthening of their weaknesses in the futures and derivatives markets through strategic M&A. Looking ahead, as the trend of industry consolidation continues to strengthen, this wave of M&A led by top exchanges may only be the beginning.

3. Project Spotlight

Ethereum Pectra Upgrade: Technological Innovations and Market Reactions

On May 7, 2025, the Ethereum mainnet successfully completed the Pectra upgrade, hailed as the most significant enhancement since "The Merge" in 2022. This upgrade integrated improvements from both the execution layer (Prague) and the consensus layer (Electra), encompassing 10 Ethereum Improvement Proposals (EIPs) aimed at boosting the network's scalability, user experience, and staking mechanisms.

The four key improvement proposals include:

-

EIP-7251 raised the maximum effective balance for validators from 32 ETH to 2,048 ETH. This allows large node operators to consolidate multiple validator identities, thereby alleviating the network burden caused by over one million validators. This change enhances the efficiency of the staking system and aligns better with Ethereum's L1 positioning, which prioritizes security.

-

EIP-7691 expanded the number of blobs that can be accommodated per block, increasing it from a target/limit of 3/6 to 6/9. This enhances the accessibility for Layer 2 solutions in terms of data availability. Following the Dencun upgrade, blob utilization had already approached its target cap. This increase is expected to lower the barrier to entry for L2s, drive more data migration to L1, and improve on-chain data accessibility.

-

EIP-7702 introduced a flexible account abstraction mechanism, temporarily adding smart contract code to Externally Owned Accounts (EOAs). This allows users to sign bundled transactions, use any token to pay for gas, and even supports features like social recovery. This marks a critical step for account abstraction towards "fully on-chain programs," enhancing user interaction experience and wallet composability.

-

EIP-7623 increased the cost of using legacy calldata, employing economic incentives to guide L2 projects towards adopting blob solutions. This improves the efficiency of data feedback to the mainnet and is conducive to promoting economic synergy between L1 and L2.

While the Pectra upgrade does not solve all scaling challenges—for instance, even if full Danksharding is implemented in the future, Ethereum will still lag behind some newer public chains in raw data throughput—its advantages in security and data correctness verification remain significant. Currently, the security foundation built by over one million validators remains its irreplaceable core value as a data availability layer.

Despite the numerous improvements brought by the technological upgrade, ETH's price reaction on the day of the upgrade was relatively modest. Subsequently, in resonance with a broader market recovery cycle, ETH recorded its largest single-week gain since late May 2024, significantly boosting market sentiment. This phenomenon echoes patterns observed in previous upgrade cycles: technological evolution and price performance do not have a direct corresponding relationship, but the enhanced narrative brought by upgrades often acts as a catalyst for market movements.

Although some voices suggest that the repricing of the blob market will affect ETH's fee pathway and even limit its price upside, several mechanism changes in Pectra (such as allowing non-ETH tokens for gas payments and increasing the staking cap) are expected to enhance network participation and system efficiency in the long run, strengthening ETH's status as a systemic asset. Overall, Pectra is a technically robust and strategically clear upgrade, laying a new foundation for Ethereum's subsequent development during a period of structural rebuilding in the crypto market.

Binance Wallet's Alpha Trading Surge, OKX DEX Relaunches with Upgrades

Recently, the Alpha module of Binance Wallet has experienced explosive growth in both trading volume and user activity. Driven by trading competitions and a points-based incentive system, Alpha 2.0 has repeatedly hit record highs, with cumulative trading volume surpassing $3 billion as of May 10. Notably, BNB Chain accounted for over 50% of this volume. Since May 7, daily trading on BNB Chain alone has made up as much as 95% of Alpha’s total four-chain volume, firmly establishing it as the dominant battleground.

Data Source: Dune Analytics, 2025/05/12

The ongoing trading frenzy has pushed average transaction size on BNB Chain above $1,000. Expectations of airdrops and the current point accumulation model in Binance Wallet have further fueled user engagement. However, the growing intensity of competition has led to a surge in “volume-farming” behavior, where users focus on generating artificial trade volume to gain more rewards. In this context, introducing point consumption mechanisms or dynamic scoring weights could help curb ineffective competition and enhance genuine user participation.

Meanwhile, OKX DEX has officially relaunched, offering zero-fee on-chain trading alongside new features such as trade tracking and a robust on-chain analytics dashboard. Although Binance currently enjoys a first-mover advantage thanks to its integrated CEX-level liquidity and seamless Alpha module, OKX DEX’s product richness and historical user retention give it a strong foundation for long-term competition.

The rivalry between exchange wallets over on-chain trading scenarios is still in its early stages. Innovations in functional modules and user incentive design will play a decisive role in shaping the next phase of growth. The Alpha trading boom may just be the beginning—the next breakout moment in the on-chain wallet ecosystem is well worth watching.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer: This content is provided for general informational purposes only, without any representation or warranty of any kind, nor shall it be construed as financial or investment advice. KuCoin Ventures shall not be liable for any errors or omissions, or for any outcomes resulting from the use of this information. Investments in digital assets can be risky.