KuCoin Ventures Weekly Report: The ETH Treasury Race, Shifting Capital Flows, and Crypto's New Real-World Playbook

2025/07/28 08:53:07

1. Weekly Market Highlights

Institutional Change of Guard, Whale Calls: ETH Leads Altcoin Season to a Crossroads

Last week, the crypto market was marked by a significant divergence, particularly within the altcoin sector. On one hand, ETH surged ahead, powerfully driven by institutional forces and sentiment from key influencers, serving as the market's engine. Even the long-dormant NFT space experienced a strong, sector-wide rebound. On the other hand, the broader altcoin market, despite attempts to follow suit, exhibited intermittent, pulse-like rallies, ultimately failing to sustain upward momentum.

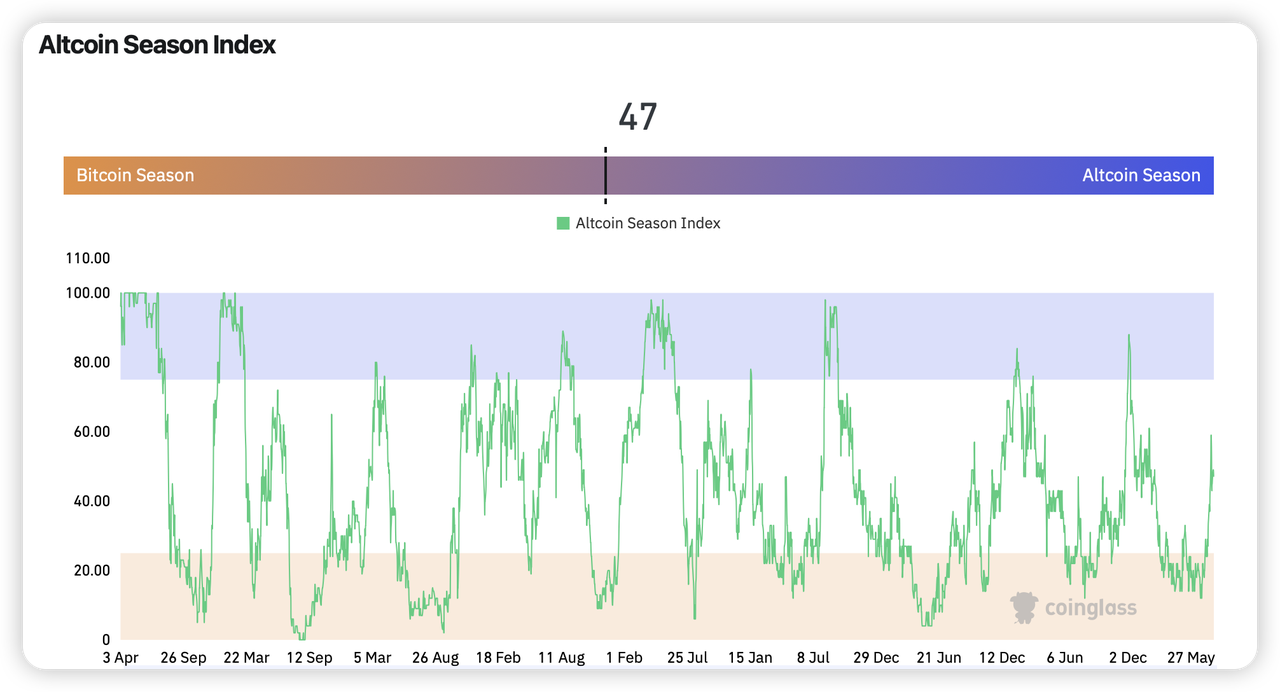

Quantitative indicators also confirm this sense of being at a crossroads. According to Coinglass data, the Altcoin Season Index peaked at 59 on July 21st, nearing the 75 mark that would confirm an "altcoin season." However, it quickly fell back to the neutral zone around 50 in the following days, highlighting the market's hesitation and division.

Data Source: https://www.coinglass.com/pro/i/alt-coin-season

The force driving ETH's price surge last week was not merely a cyclical market rebound but a fundamental transformation unfolding behind the scenes, built on several key pillars:

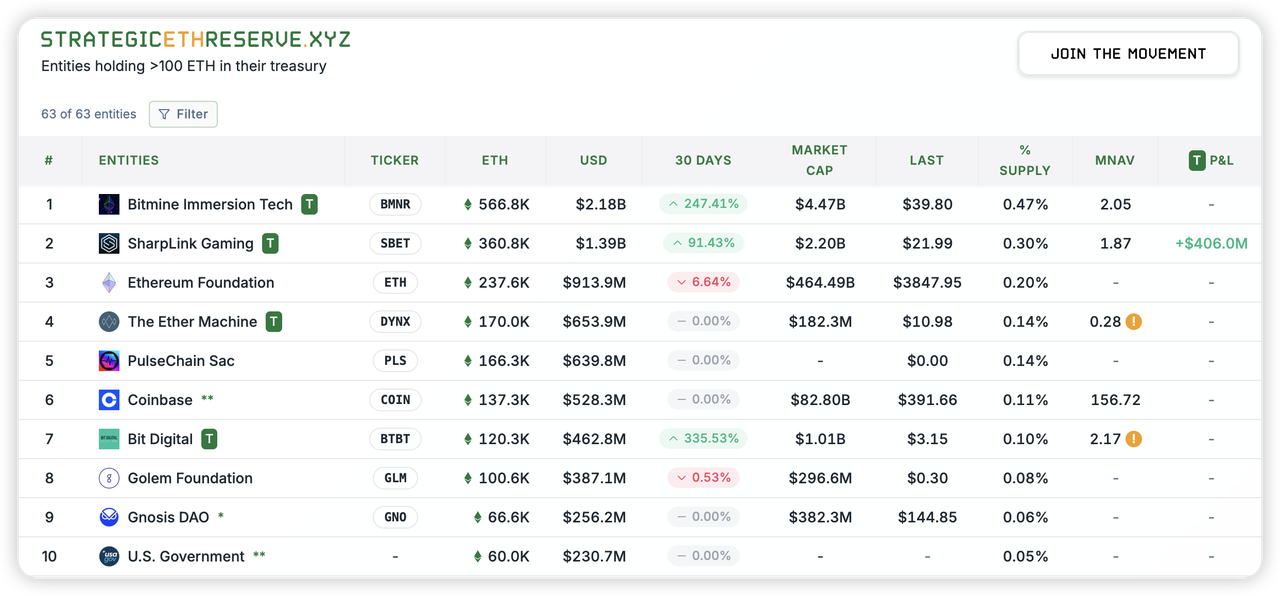

A clear signal: from the perspective of its holder structure, Ethereum's "change of guard" is complete, with a shift in its dominant forces. Led by Ethereum co-founder Joe Lubin, publicly traded company SharpLink Gaming raised over $400 million through an at-the-market share offering. On July 16th, SharpLink increased its total ETH holdings to 280,706 ETH. This was a landmark moment: for the first time, a public company officially surpassed the Ethereum Foundation in ETH holdings.

However, the real show in this ETH treasury race was just beginning. BitMine, a Bitcoin mining firm joined by star Wall Street strategist Tom Lee less than a month prior, announced that it had purchased 566,000 ETH, worth $2 billion, in just 16 days, quickly overtaking SharpLink to become the world's largest corporate holder of ETH.

Data Source: https://www.strategicethreserve.xyz/

We are witnessing an "ETH treasury race" led by public companies and even directed by top-tier Wall Street strategists. Moreover, unlike companies like MicroStrategy, which primarily use Bitcoin for value storage, these ETH-hoarding firms view ETH as a productive asset, as they can generate stable returns and continuous cash flow through ETH Staking.

This institutional accumulation quickly received positive feedback from the market. The stock prices of both BitMine and SharpLink recorded astonishing gains after announcing their ETH strategies. Simultaneously, BlackRock, the world's largest asset manager, is actively applying to add a staking feature to its spot ETH ETF. If approved, it means that not only companies directly hoarding ETH but also other institutions and retail investors could share in the dividend-like returns from the ETH network through the most compliant channels.

Alongside capital and product innovation, market influencers were also making bold bullish calls. From Eric Trump's optimistic statements about the market to entrepreneurial influencers like Arthur Hayes and Tom Lee calling for ETH to reach price targets of $10,000 to $15,000 through blogs and podcasts, market fervor reached a fever pitch.

However, beneath the surface of ETH's prosperity, some concerns have emerged. On-chain data shows up to $1.9 billion worth of ETH queued for unstaking, a piece of news initially interpreted as a signal of profit-taking and selling pressure. The popular project Pump.fun plummeted against the market trend, with its co-founder's negative livestream being seen as the final straw. At a time when community confidence was already fragile, the founder's vague and evasive answers to core questions about airdrops and buybacks ignited the community's fury, causing its token, $PUMP, to crash.

The market's core was driven by ETH's strong rally, which gained mainstream attention and temporarily ignited market sentiment. However, this enthusiasm failed to effectively spread, and the market showed clear signs of fatigue by mid-week. Ultimately, this rally felt more like a localized battle led by institutions and focused on a specific asset, rather than a broad-based celebration involving retail investors—a pattern almost identical to BTC's rallies over the past three years.

Looking ahead, the market is likely to continue this pattern of divergence. The old method of indiscriminately buying and waiting for an "a rising tide lifts all boats" altcoin season is likely a thing of the past. A more selective "quality altcoin season" that tests investors' discernment and research skills may be brewing.

2. Weekly Selected Market Signals

Crypto Market Consolidates at High Levels, Strong Institutional Inflows into ETH ETFs, and Notable Growth in USDe and USDS Supplies

Last Friday, buoyed by solid earnings expectations and optimism over a potential U.S.-EU trade deal, U.S. equities continued to climb, with both the S&P 500 and Nasdaq reaching new record highs. Following former President Trump’s comment that “Powell is ready to cut rates,” U.S. Treasury yields fell, and gold dropped over 1% intraday, closing lower for the third consecutive session. Over the weekend, the U.S. and EU reached a trade agreement setting tariffs at 15%, which led to a modest rally in U.S. equity futures on Monday, with Nasdaq 100 and S&P 500 futures up 0.5% and 0.4%, respectively, while spot gold briefly approached $3,320.5.

Against this backdrop, the crypto market has remained in a range-bound consolidation phase. Bitcoin briefly dipped to $114,700 last week before rebounding to stabilize around $118,000. Ethereum has been trading sideways around the $3,750 level, dipping to $3,500 at one point, and facing resistance near $3,850, with the ETH/BTC ratio steady at around 0.032.

Data Source: TradingView

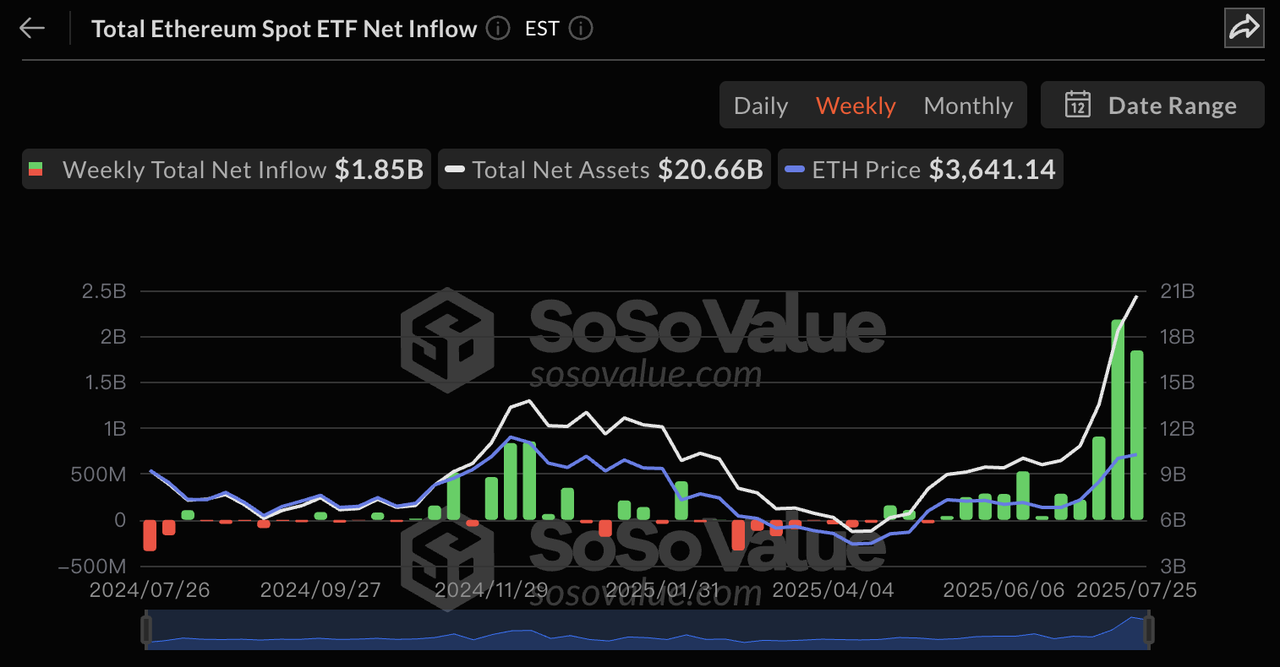

Despite a continued streak of net inflows for BTC ETFs, the weekly volume decreased to $72M, its lowest in seven weeks. In stark contrast, ETH ETFs recorded a substantial net inflow of $1.85B, marking their second-highest level on record. This sustained institutional demand provides a solid price floor for ETH.

Data Source: SoSoValue

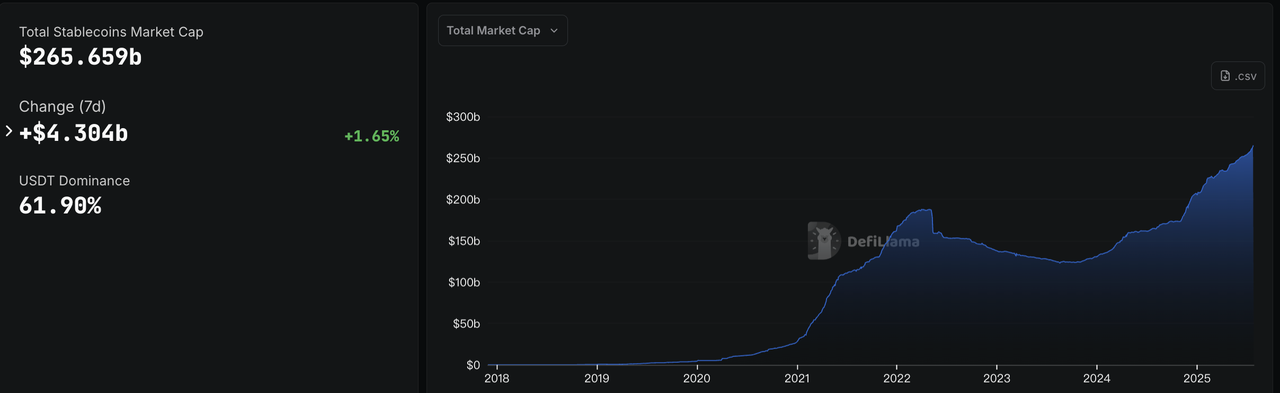

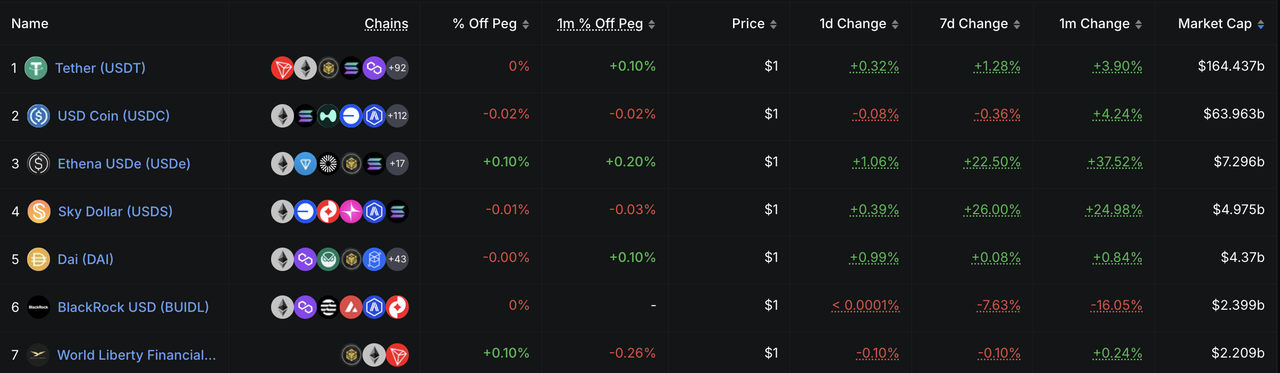

Stablecoin supply grew by approximately 1.65% over the past week. While USDT saw a modest 1.28% increase and USDC a slight 0.36% decline, the standout performers were Ethena's USDe and Spark Protocol's USDS. As market activity recovers and funding rates for perpetual contracts rise, the yield on sUSDe has increased, now back to 12%. Consequently, the market cap of USDe has seen significant growth, with its official supply reaching $7.47B.

Data Source: DeFiLlama

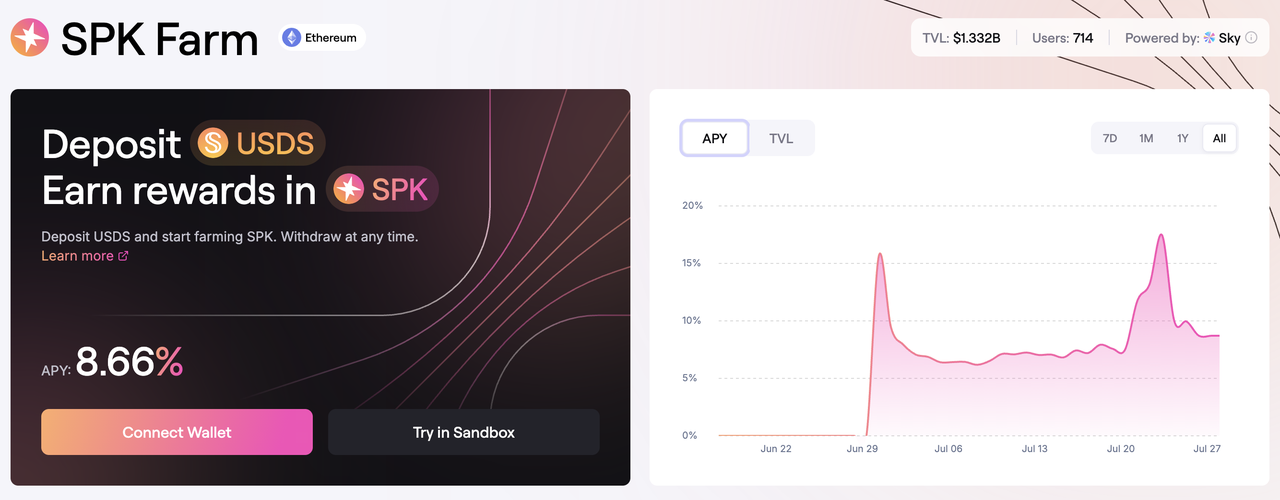

Spark Protocol, a modular DeFi protocol built around Sky (formerly MakerDAO)'s stablecoin USDS, has been a key driver of USDS growth. The protocol allows users to mint USDS at low cost by staking stablecoins like USDC and DAI, offering an APY of up to 4.5% by leveraging US Treasury yields, high-yield DeFi positions, and strategic vaults. Furthermore, users can stake USDS to farm its native token, $SPK, with an APY that briefly exceeded 16%. This self-reinforcing ecosystem, driven by Spark's high-yield strategy and a 166% weekly surge in the $SPK token price, has propelled USDS supply to a weekly growth of over 26%, making it a key asset to watch.

Data Source: Spark Finance Official Website

Key Macro Events to Watch This Week

-

Fed Interest Rate Decision: On July 31, the FOMC will announce its interest rate decision, followed by a press conference with Fed Chair Jerome Powell, amid continued pressure from the White House for rate cuts.

-

Key Economic Data: The July Non-Farm Payrolls report, June PCE Price Index, and Q2 GDP data are scheduled for release.

-

Trump's Trade Policy: The August 1st deadline for U.S. trade tariff policy will finalize reciprocal tariff rates for over 200 trading partners. U.S.-China trade talks are also set to occur from July 27-30 in Sweden.

-

Big Tech Earnings: Four of the "Magnificent Seven"—Microsoft, Meta, Amazon, and Apple—will report earnings, setting the tone for market sentiment.

Primary Market Financing Observation

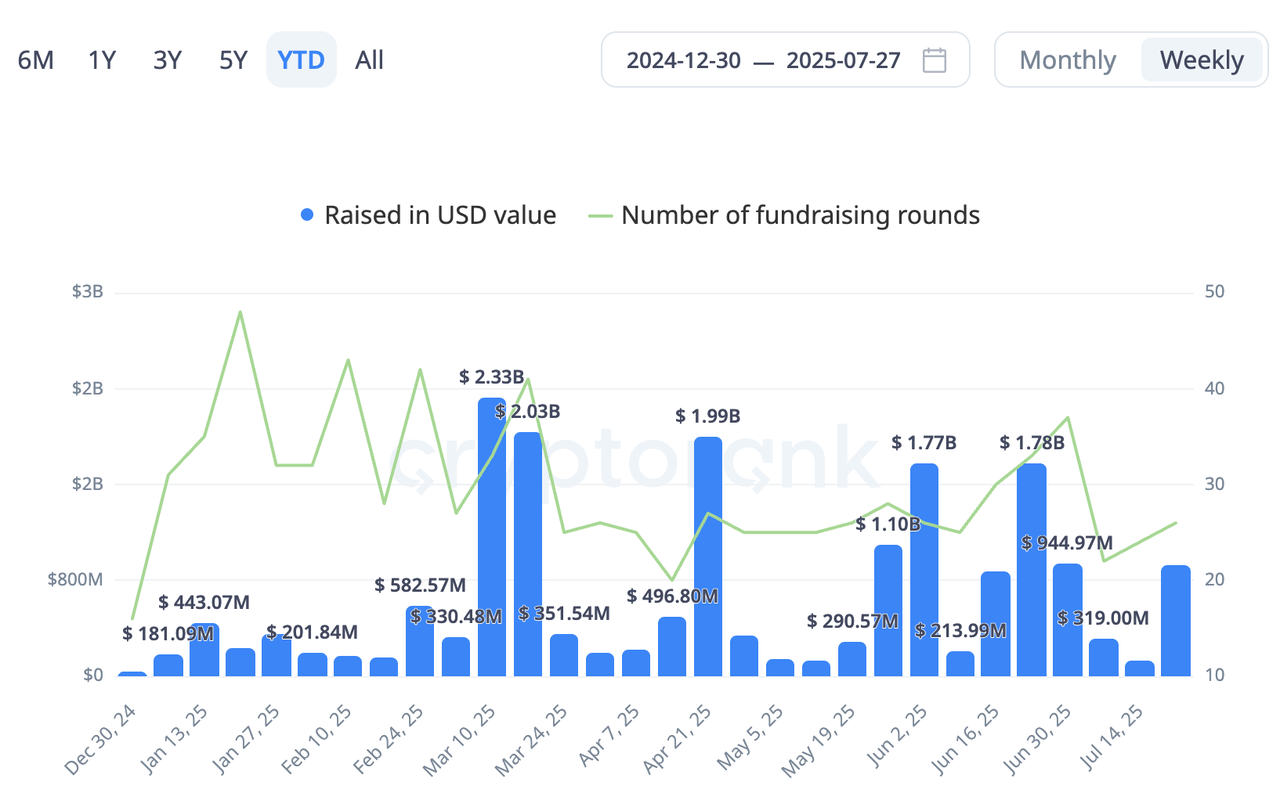

The primary market saw 26 funding rounds this past week, totaling approximately $924M. Notably, over 68% of this capital was raised by publicly listed companies through secondary market financing, indicating a growing convergence of traditional financing and corporate crypto treasury strategies.

-

OSL Group (HKG: 0863): The Hong Kong-licensed exchange completed a $300M public equity offering, the largest in Asia's digital asset sector. The capital is earmarked for strategic acquisitions, expansion into new business lines like stablecoins and payments, and strengthening working capital.

-

Satsuma (formerly Tao Alpha): The UK-listed participant in the Bittensor ecosystem raised ~$135M in a post-IPO financing to accelerate the buildup of its BTC treasury and pursue a listing on the London Main Market.

-

Mercurity Fintech Holding (Nasdaq: MFH): The company announced a $200M equity line of credit with Solana Ventures to initiate its "SOL treasury strategy," which includes accumulating SOL tokens, earning yield through staking and validation, and investing in the Solana ecosystem.

Data Source: CryptoRank

Polymarket to Re-enter U.S. Market via $112M Acquisition of Derivatives Exchange QCX

Following the conclusion of investigations by the U.S. Department of Justice (DOJ) and the CFTC, the world's largest online prediction market, Polymarket, recently acquired the compliant derivatives exchange QCX for $112M. Through this acquisition, Polymarket has officially secured a CFTC-approved Designated Contract Market (DCM) license. This move addresses a long-standing compliance gap and enables its legal return to the U.S. market.

Despite being restricted from U.S. users since the 2022 CFTC investigation, Polymarket has seen rapid growth in overseas markets, with trading volume reaching ~$6B in H1 2024 alone. Its core offering involves event-driven contracts, allowing users to speculate on real-world events across politics, finance, and sports.

The regulatory clearance not only provides institutional legitimacy for its core product in the U.S. but also removes major obstacles for a potential token launch, product commercialization, and expansion to institutional clients. Prediction markets are increasingly viewed as an efficient form of "collective intelligence" and an alternative data source, potentially becoming a significant supplement to event-driven trading in U.S. financial markets.

a16z Crypto Leads $15M Seed Round for Poseidon to Decentralize AI Training Data

On July 23, Poseidon announced a $15M seed round led by a16z Crypto. Incubated by the Story Protocol team, the project aims to build a decentralized platform for IP-compliant AI training data.

Poseidon leverages the Story Protocol for on-chain data registration, licensing, attribution, and provenance, addressing the core industry challenge of sourcing high-quality, legally compliant training data. The platform plans to offer developers licensed access to real-world datasets and automated settlement mechanisms through on-chain structured management, lowering the barriers to data compliance and acquisition for AI model training.

This financing is a key strategic move for a16z to bolster the Story Protocol—an IP management Layer 1—and lays the groundwork for decentralized AI model training and on-chain distribution, potentially expanding the frontiers of AI infrastructure.

3. Project Spotlight

LTC Steps onto Wall Street: MEI Pharma Soars with "Litecoin Treasury" Play

Nasdaq-listed MEI Pharma (MEIP) just raised $100M via private placement to build a Litecoin treasury strategy, selling 29,239,767 shares at $3.42 each. Litecoin founder Charlie Lee and crypto market maker GSR led the investment, joined by the Litecoin Foundation, ParaFi, and Primitive. Charlie Lee’s also snagging a board seat. This makes MEI Pharma the first U.S. public company to hold LTC as a treasury reserve. MEIP’s stock has nearly doubled since the placement.

MEI Pharma, a biotech focused on cancer drugs, has posted negative earnings for six straight quarters—prime target for crypto capital to swoop in. For LTC, it’s a desperate bid for relevance. Among OG large-cap tokens, Litecoin’s been fading, lacking hype or narrative, and needs a 3-4x pump to hit its 2021 peak (over $400).

Post-BTC treasury success, scooping up a low-market-cap, money-losing company as a shell has become a go-to for token rescue missions. MEI’s investor lineup screams this playbook: Litecoin Foundation/founder buys into a public company, company buys LTC—classic engineered institutional demand. MEI, a biotech with zero crypto asset management chops, dumped 100% of the raise into LTC, leaning on GSR for risk management. It’s basically a token-holding conduit.

Short-term, this coin-stock linkage pumps both MEIP and LTC prices. Long-term, it’s a high-risk capital game. MEI’s core cancer drug biz is sidelined, now a vehicle for LTC price volatility. The coin-stock manipulation draws in retail chasing gains, but sustained buying power isn’t guaranteed. For alts pulling this move, the stock’s just a shell—value hinges on the underlying token. If LTC lacks long-term fundamentals and relies on project-controlled pumps and dumps, it’s a shaky bet. Plus, it’s diluted by other projects playing the same shell-acquisition game.

ETH Rally Sparks DeFi Revival, Undervalued Blue-Chip Spark Soars Then Crashes

As public companies like Bitmine and SharpLink stack ETH in their treasury strategies, ETH’s price has ripped, boosting blue-chip DeFi protocols built on its backbone. Most DeFi protocols are essentially ETH whales, and they’re cashing in. Spark, a standout with its token price multiplying this week, is a prime example. Spark’s products—SparkLend (lending module) and Spark Liquidity Layer (stablecoin liquidity)—boast a total TVL of $82.02B, with WSTETH making up 40% ($33.33B). Solid fundamentals set the stage for token hype and buying pressure, and Spark’s SPK token, with dirt-cheap MC/FDV (0.11) and MC/TVL (0.01) ratios, screams undervaluation to funds hunting for a pump. Even after the first hype wave, SPK’s market cap is ~$100M. Still, as a Sky Protocol sub-project, SPK’s market cap is unlikely to surpass SKY’s. Estimating SPK at 10-20% of SKY’s market cap puts it in the $200-400M range, but SPK already hit near $200M and quickly got slashed in half.

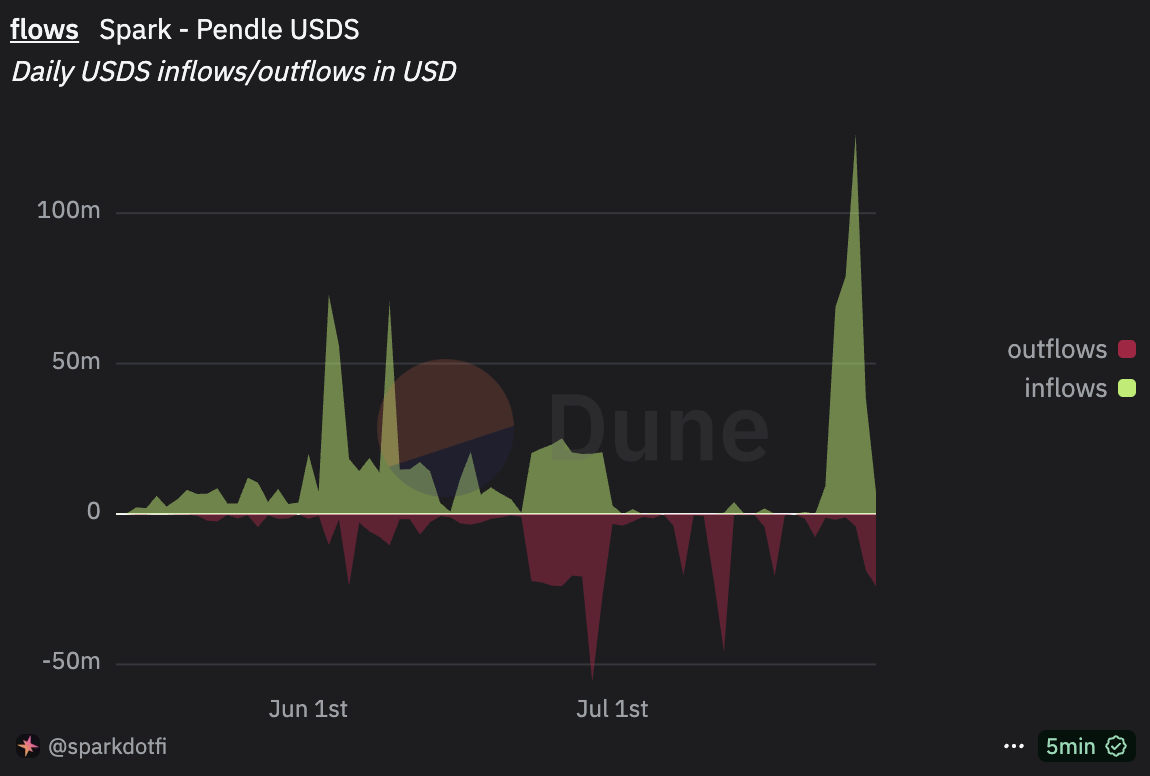

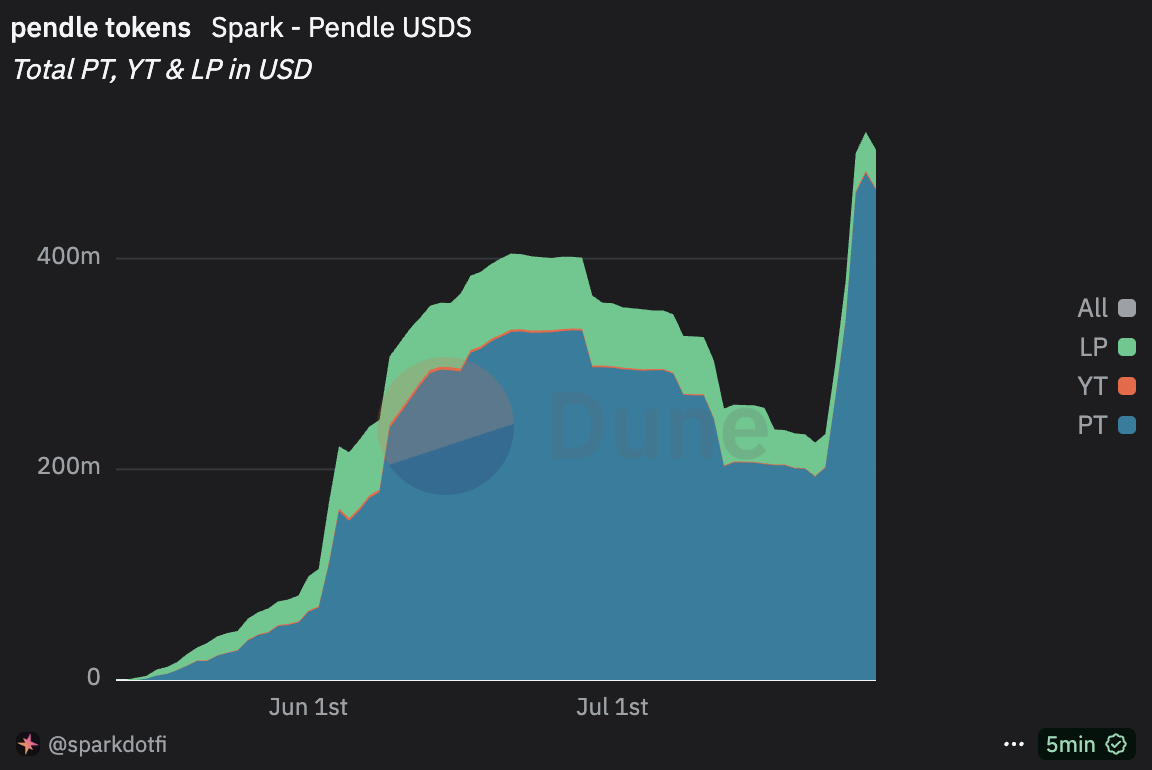

As the first yap project from Cookie Fun, Spark’s been simmering for months. The spark (pun intended) likely came from USDS and Pendle. USDS, formerly DAI, rebranded under MakerDAO’s shift to Sky Protocol, with Spark as Sky’s inaugural Sky Star. Spark taps Sky Protocol’s stablecoin reserves for liquidity in its lending and savings products. Over the past week, USDS supply surged by over $800M, up 10%. Instead of flowing into sUSDS savings, most of that went to SPK Farm and Pendle. SPK Farm, a Sky Protocol-backed SPK farming product, saw TVL jump from $770M to $1.32B in a week, with APY peaking at 17% before cooling to 8%—sucking up most USDS inflows. Meanwhile, Pendle’s USDS pool exploded to over $500M in TVL, with $120M+ net inflows on July 25 alone. Most Pendle USDS funds are chasing PTs to lock in current yields until the points program ends on August 12.

As one of Ethereum’s most enduring financial plays, blue-chip DeFi remains a top focus. Tokens with high TVL and low MC/TVL ratios have serious pump potential, especially projects that can capture real value from TVL growth. Integration with mainstream yield protocols like Pendle is also a key bullish signal.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer: This content is provided for general informational purposes only, without any representation or warranty of any kind, nor shall it be construed as financial or investment advice. KuCoin Ventures shall not be liable for any errors or omissions, or for any outcomes resulting from the use of this information. Investments in digital assets can be risky.