Fed Minutes Reveal Internal Divergence; Bitcoin Holds in a Range

Summary

-

Macro Environment: Minutes from the Fed’s December meeting indicate disagreements over rate cuts. The probability of rates remaining unchanged at the January 2026 meeting stands at 85.1%. With liquidity tightening during the New Year holiday week, the three major U.S. stock indices fell for three consecutive sessions. Precious metals diverged: silver rebounded strongly, while gold closed nearly flat.

-

Crypto Market: Total crypto market cap rose 1.12%. Bitcoin continued its range-bound trend, briefly rebounding to $89.4K before pulling back again. Altcoins remained under pressure, with both market share and trading volume declining. Market sentiment remains in “Extreme Fear.”

-

Project Developments:

-

Trending Tokens: LIT, ELIZAOS, TAO

-

LIT: Lighter officially announced its native token LIT and completed the airdrop, with each point redeemable for 20 LIT tokens; current FDV is ~$2.65B.

-

ELIZAOS: The founder’s X (Twitter) account was unbanned after a 6-month suspension, pushing ELIZAOS up by over 80%.

-

CC: Canton Network released its annual report, achieving its first U.S. digital bond issuance and planning to begin tokenizing U.S. Treasuries in 2026.

-

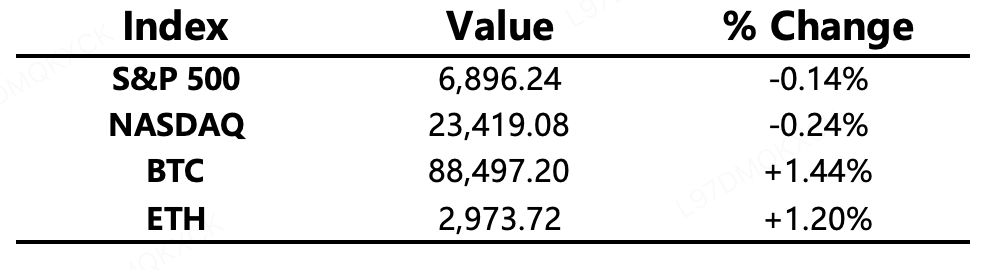

Mainstream Asset Performance

Crypto Fear & Greed Index: 21 (vs 23 24 hours ago) — Extreme Fear

Ahead Today

-

U.S. Initial Jobless Claims (week ending Dec 27)

-

Optimism (OP) unlock of ~31.34M tokens (~$8.6M)

Macro

-

Fed minutes show divergence on rate cuts: most officials expect continued easing, but timing and magnitude remain uncertain.

Policy Outlook

-

UK plans to fully integrate crypto assets into its financial regulatory framework by October 2027.

-

OECD crypto tax framework takes effect January 1, 2026.

-

South Korea’s FSC proposes limiting major shareholder stakes in domestic exchanges to 15–20%.

Industry Highlights

-

Bitmine stakes another 118,944 ETH; total staked exceeds 460K ETH.

-

Sui: privacy transactions coming in 2026.

-

BNB Chain 2026 roadmap: lower gas fees; 20,000 TPS with sub-second finality.

-

SlowMist security report: $2.935B in losses from exploits in 2025; generative AI frequently used in attacks.

-

Beckham-backed Prenetics Global abandons Bitcoin treasury expansion plans.

-

Grayscale submits initial S-1 for GTAO, converting Bittensor Trust to an ETF.

Industry Highlights Extended Analysis

-

Bitmine Stakes 119k ETH; Total Staked Exceeds 460k ETH

Bitmine (BMNR) is aggressively pivoting from a passive holder to an active yield generator by leveraging its massive ETH treasury (approximately 4.11 million ETH, or 3.4% of the total supply). This move signals a major shift in institutional strategy toward "yield-bearing assets." With its proprietary "Made in USA" validator network (MAVAN) set for a 2026 launch, Bitmine aims to become the world’s largest institutional Ethereum validator. While this provides hundreds of millions in passive income, it also intensifies concerns regarding network centralization, as a single entity controlling such a high percentage of staked ETH could impact Ethereum's neutrality.

-

Sui to Introduce Privacy Transactions in 2026

The integration of privacy features is a strategic move by Sui to capture the Institutional Finance (TradFi) market. For enterprise users, total on-chain transparency is often a barrier due to compliance and competitive sensitivities. Sui’s roadmap focuses on balancing "auditability" with "privacy"—allowing regulators to perform necessary checks without exposing sensitive transaction details to the public. If successful in 2026, this will give Sui a significant competitive edge over Solana and Aptos, particularly in the Real-World Asset (RWA) tokenization space where commercial confidentiality is non-negotiable.

-

BNB Chain 2026 Roadmap: 20k TPS and Sub-second Finality

The 2026 roadmap highlights BNB Chain’s ambition to achieve Web2-level performance through its "dual-client strategy" (utilizing Reth for performance and Geth for stability). Achieving 20,000 TPS with sub-second finality is designed to support high-frequency trading and large-scale AI Agent collaboration. By further driving down gas fees, BNB Chain is doubling down on its identity as the "high-efficiency execution layer," aiming to retain cost-sensitive retail users and high-frequency app developers even as Ethereum Layer 2s continue to proliferate.

-

SlowMist Security Report: $2.935B Lost to Exploits in 2025; AI Attacks Surge

Despite advancements in security, the massive losses in 2025 reflect the professionalization and "AI-fication" of cybercrime. The SlowMist report underscores the role of Generative AI, which attackers are using to craft flawless phishing scripts, automate vulnerability discovery, and bypass biometric verification. Major exchange breaches (such as the Bybit incident) prove that private key management remains the industry's "Achilles' heel." Moving forward, the security landscape will evolve into an "AI vs. AI" battle, requiring defenders to implement real-time monitoring and automated "circuit breaker" protocols.

-

Prenetics Global Abandons Bitcoin Treasury Expansion

This pivot reflects a growing trend of "returning to core business fundamentals." Despite the high-profile backing of David Beckham, Prenetics’ decision stems from the explosive growth of its IM8 health brand (tracking over $100M in annual revenue). The company realized that capital allocation toward business expansion offers higher shareholder value than holding a volatile asset like Bitcoin. While they will keep their existing 510 BTC, they are halting further purchases. This serves as a cautionary tale for firms attempting to mimic MicroStrategy: if a Bitcoin treasury distracts from core operations, the market will ultimately prioritize cash-flow generation.

-

Grayscale Submits S-1 for GTAO (Bittensor ETF)

Grayscale’s move marks the formal entry of the "Crypto + AI" sector into Wall Street's mainstream. Converting the Bittensor Trust into a spot ETF positions the TAO token as the primary vehicle for traditional investors seeking exposure to decentralized AI, alongside BTC, ETH, and SOL. Following its first halving in December 2025, the combination of reduced supply and the potential liquidity influx from an ETF could trigger a major valuation re-rating in 2026. This also suggests that 2026 will see a wave of "sector-specific" ETFs targeting decentralized compute, storage, and oracles.