Mixed Nonfarm Payrolls, Bitcoin Remains Range-Bound

Summary

-

Macro Environment: U.S. November nonfarm payrolls exceeded expectations, but the unemployment rate climbed to a four-year high, presenting a mixed picture. Combined with the U.S. December Markit Composite PMI hitting a six-month low and retail data failing to shift expectations, markets largely maintained their bets on rate cuts, with a January pause next year still the consensus. U.S. equities were mixed: tech stocks rebounded and lifted the Nasdaq, while the S&P 500 and Dow extended their losing streaks.

-

Crypto Market: The mixed NFP data failed to provide clear direction, and Bitcoin continued to trade sideways. Altcoins underperformed Bitcoin in terms of price rebound, though trading volumes recovered. Market sentiment improved modestly but remained firmly in the “extreme fear” zone.

-

Project Updates:

-

Trending Tokens: PTB, SWARMS, OM

-

Coinbase to host a product launch event; BASE ecosystem tokens ZORA and MORPHO rallied

-

AAVE: The U.S. SEC concluded its four-year investigation into the Aave protocol

-

Continued momentum around Solana’s Firedancer upgrade and integration with Coinbase DEX; on-chain activity remained strong, with meme tokens SWARMS, SACHI, TROLL, and SPANKMAS rising

-

OM: Completed migration from ERC-20 to MANTRA Chain

-

XLM: The Marshall Islands completed the world’s first on-chain UBI distribution via the Stellar network

-

PIPPIN: Reports revealed insiders control 80% of supply, triggering a 40% price drop

-

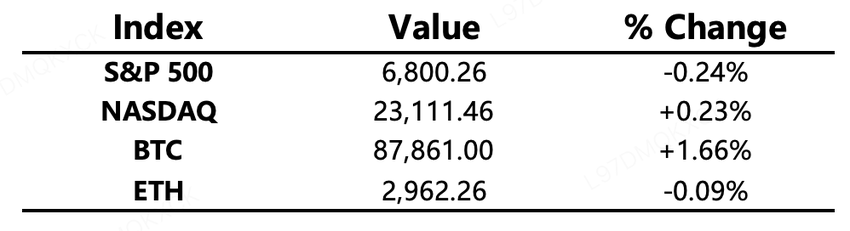

Major Asset Performance

Crypto Fear & Greed Index: 16 (vs. 11 24 hours earlier), level: Extreme Fear

Today’s Outlook

-

FOMC permanent voter and New York Fed President John Williams to deliver opening remarks at a foreign exchange market structure conference

-

Coinbase to hold a product event, with expectations of announcing prediction markets and tokenized stocks

-

HASHKEY to begin trading on the Hong Kong Stock Exchange

Macroeconomy

-

U.S. November nonfarm payrolls rose by 64,000, above expectations; unemployment rate unexpectedly climbed to 4.6%, the highest since 2021

-

U.S. December Markit Composite PMI hit a six-month low

-

Trump to interview current Fed Governor Christopher Waller regarding the Fed chair position

-

U.S. Treasury Secretary Bessent: Fed chair pick likely to be announced in early January

-

Fed’s Bostic reiterated a hawkish stance, projecting inflation to remain above 2.5% through the end of next year

Policy Direction

-

UK regulators launched consultations on new crypto regulations

-

Bank of Canada set standards for “quality money” stablecoins

-

U.S. SEC concluded its four-year investigation into the Aave protocol

-

U.S. FTC demanded compensation from Nomad cross-chain bridge operators over the $186 million hack in January 2022

-

Spanish regulators issued MiCA transitional rules for crypto platforms

Industry Highlights

-

KuCoin’s brand film featuring ambassador Adam Scott won a Vega Awards honor

-

Several of the top 25 U.S. banks have launched or announced Bitcoin-related products

-

Visa began supporting U.S. financial institutions in settling transactions using USDC on Solana

-

Stablecoin payments firm RedotPay completed a $107 million Series B funding round

-

Exodus partnered with MoonPay to launch a USD stablecoin

-

China Zhiyu Investment plans to purchase and hold BNB as a strategic reserve asset

-

Bitcoin treasury company KindlyMD faces potential Nasdaq delisting risk

Industry Highlights Extended Analysis

-

KuCoin’s brand film featuring ambassador Adam Scott won a Vega Awards honor

KuCoin's brand film winning a Vega Award honor is more than just a marketing triumph; it signifies a major step in the mainstream branding and cultural integration of cryptocurrency exchanges. Securing a well-known mainstream figure like Adam Scott as an ambassador and receiving an international creative award enhances KuCoin's brand trust and professionalism among traditional finance and broader consumer audiences. This strategy effectively separates the crypto exchange platform from the niche labels of technology and speculation, positioning it as a mature, sophisticated fintech brand globally, which helps the platform attract a wider user base beyond crypto natives.

-

Several of the top 25 U.S. banks have launched or announced Bitcoin-related products

The launch or announcement of Bitcoin-related products by several top 25 U.S. banks marks another significant milestone in Traditional Finance (TradFi) adoption of crypto assets. This reflects the realization among large banks that there is robust demand for crypto allocation from institutional and high-net-worth clients, having overcome earlier concerns about regulation and risk. These products likely include custody, trading services, or potentially structured products based on Bitcoin ETFs. The participation of major banks not only introduces substantial funding potential to the crypto market but, crucially, provides Bitcoin with regulatory legitimacy and credibility, significantly lowering the barrier to entry for mainstream investors.

-

Visa began supporting U.S. financial institutions in settling transactions using USDC on Solana

Visa's move to support U.S. financial institutions in settling transactions using USDC on Solana represents a new peak in the central role of stablecoins in payment infrastructure and the efficiency of blockchain technology adoption. Solana was selected by Visa as a new settlement layer due to its high throughput and extremely low transaction costs, underscoring its technical advantage in institutional-grade payment solutions. This action signifies that USDC and Solana are no longer merely tools within the crypto ecosystem but are being deeply integrated into the global mainstream payment system, offering a faster, cheaper alternative for cross-border transactions and B2B settlement, thereby greatly boosting stablecoin utility and adoption.

-

Stablecoin payments firm RedotPay completed a $107 million Series B funding round

Stablecoin payments firm RedotPay completing a $107 million Series B funding round reflects the market's high valuation of stablecoins' long-term utility and commercial potential as payment and settlement instruments. Stablecoins demonstrate strong practicality in scenarios like cross-border e-commerce, payroll distribution, and daily payments, especially compared to the volatility of crypto assets. This significant funding will support RedotPay's expansion of its global payment network, enhance its compliance infrastructure, and likely accelerate its integration with traditional financial and commercial institutions, signaling that the stablecoin payments sector is moving from its early exploratory phase toward a stage of rapid expansion and scaled application.

-

Exodus partnered with MoonPay to launch a USD stablecoin

Exodus's partnership with MoonPay to launch a USD stablecoin highlights the industry trend of cryptocurrency wallet providers transitioning into comprehensive financial service providers. As a non-custodial wallet, Exodus aims to enhance its ecosystem's user experience and financial closed-loop capabilities by collaborating with a fiat-on/off-ramp service provider like MoonPay to issue a stablecoin. This not only provides wallet users with easier fiat gateways and a more stable store of value tool but also allows Exodus to more effectively capture value generated by users transacting, lending, or paying within its ecosystem—a clear illustration of a vertical integration strategy.

-

China Zhiyu Investment plans to purchase and hold BNB as a strategic reserve asset

China Zhiyu Investment's plan to purchase and hold BNB as a strategic reserve asset is a notable signal because it elevates the asset utility of BNB (Binance Coin) to a strategic reserve level. While this may be a regional corporate decision, it reflects the beginning of institutional recognition of top exchange platform tokens, not just as tools for transaction fee discounts, but as diversified digital assets possessing exchange ecosystem utility, DeFi usability, and potential deflationary mechanisms. This action could help boost BNB's market profile and long-term holder base, and potentially prompt other institutions to re-evaluate platform tokens as viable reserve assets.

-

Bitcoin treasury company KindlyMD faces potential Nasdaq delisting risk

The potential Nasdaq delisting risk faced by Bitcoin treasury company KindlyMD serves as a reminder to the market of the potential conflicts and challenges between the stringent compliance requirements of traditional financial systems and crypto asset business models. While the company's inclusion of Bitcoin on its balance sheet demonstrates an acknowledgment of BTC's value, the delisting risk likely stems more from the financial performance of its core business or failure to meet Nasdaq's minimum requirements for market capitalization or liquidity. This emphasizes that publicly traded companies adopting Bitcoin as a reserve asset must still be underpinned by a robust primary business and strict financial compliance; mere holding of Bitcoin assets cannot circumvent systemic risks inherent in traditional financial markets.