Everything You Need to Know About Ethereum (ETH)

2025/09/05 10:45:02

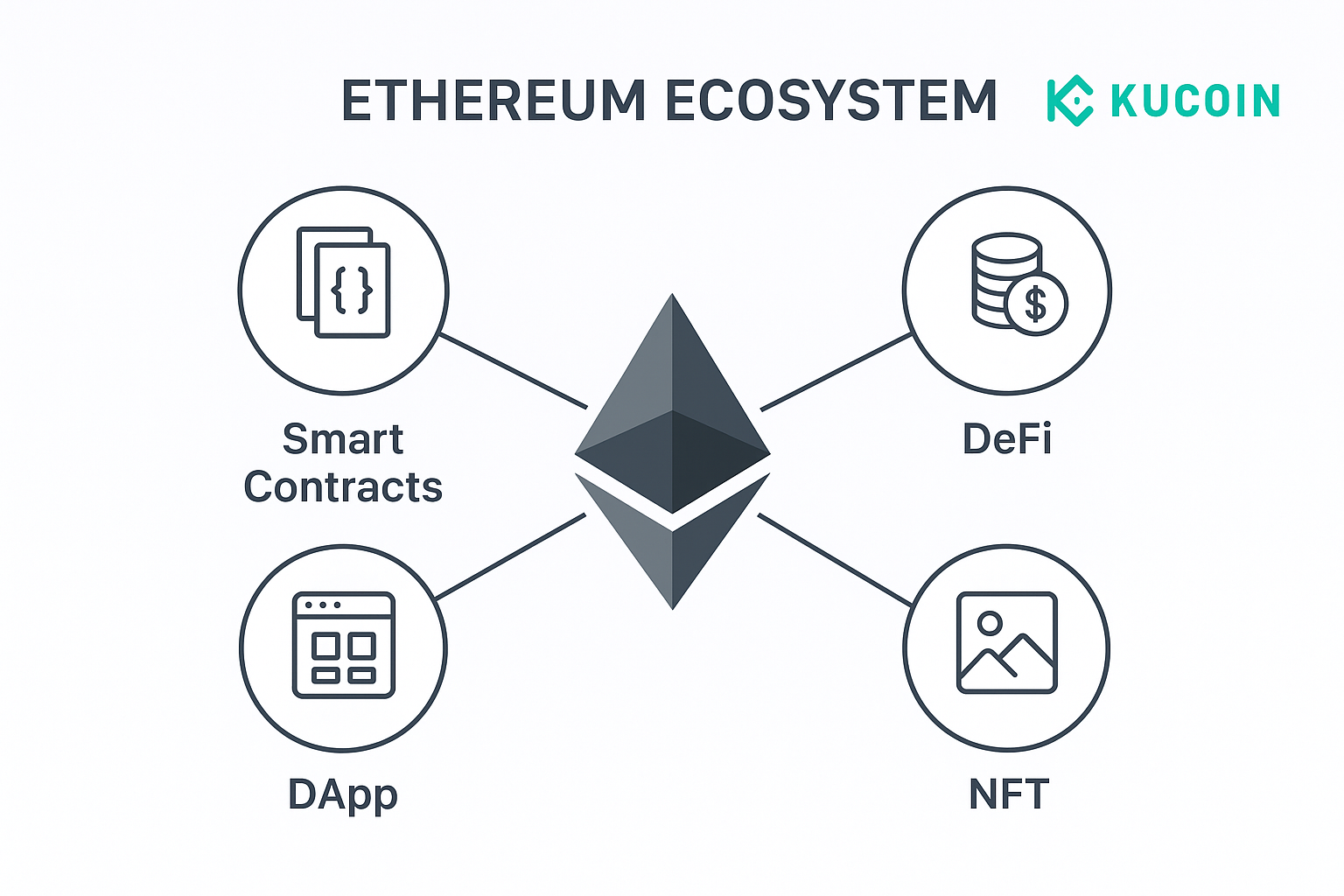

As the crypto world's giant second only to Bitcoin, Ethereum is more than just a simple digital currency. It's a vast decentralized network, serving as the foundation for smart contracts, decentralized finance (DeFi), non-fungible tokens (NFTs), and countless decentralized applications (DApps). For anyone looking to enter the world of cryptocurrency, understanding Ethereum and its native currency, ETH, is a crucial first step.

This article will use the KuCoin platform as an example to provide you with a comprehensive guide on ETH, complete with a deep dive into its latest market dynamics.

The Core Value of Ethereum: More Than Just a Digital Currency

If Bitcoin is considered "digital gold," Ethereum is more like "digital oil." The value of ETH isn't just in its tradable asset status; it's also the "fuel" for the Ethereum network, known as Gas fees. Every time a smart contract is executed, a transaction is made, or an NFT is minted or traded on the network, ETH is consumed. This inherent utility gives ETH a unique value, distinguishing it from many purely speculative tokens.

Ethereum's revolutionary nature lies in its open and programmable characteristics, which have given rise to the following core functionalities and ecosystems:

-

Smart Contracts: These are the soul of Ethereum. They are code stored on the blockchain that automatically executes when pre-set conditions are met, without the need for any middlemen. This has completely transformed traditional contract models, laying the foundation for decentralized trust.

-

DeFi (Decentralized Finance): The rise of smart contracts has made it possible to conduct financial activities like lending, earning yield, and exchanging assets without traditional banks. On Ethereum, you can deposit ETH into lending protocols to earn returns or trade on decentralized exchanges (DEXs).

-

NFTs (Non-Fungible Tokens): NFTs grant unique ownership of digital assets, widely used in digital art, collectibles, virtual land, and gaming items. ETH is the preferred currency for the vast majority of NFT transactions.

-

DApps (Decentralized Applications): From social media and gaming to supply chain management, countless applications are built on the Ethereum blockchain. These apps are not controlled by a centralized authority, making their data more transparent and secure.

ETH Price Trend: Why Is It Getting So Much Attention?

Recently, Ethereum has once again become a market focal point. According to the latest market data, the price of ETH has seen a staggering 200% rally over the past five months, re-establishing its status as "digital oil." Although the market has seen a recent pullback, with the price dipping to around $4,300, its fundamentals and institutional support remain robust. This strong momentum is not accidental and is driven by several key factors:

-

Continuous Institutional Inflows: Wall Street institutions are showing a significantly increased interest in Ethereum, viewing it as a "growth asset." Ethereum's powerful DeFi and NFT ecosystems offer immense potential, attracting substantial institutional capital through channels like spot ETFs. Since the launch of Ether spot ETFs in July 2024, net inflows have been steadily rising. This institutional force is a major driver of ETH's price increase.

-

Optimism for Spot ETFs: Following the successful approval of Bitcoin spot ETFs in the U.S., the market is highly optimistic about the potential approval of an Ethereum spot ETF. This anticipation has led to a large influx of capital in preemptive positioning, pushing the price higher. While not yet officially approved, this sentiment is seen as a significant potential catalyst.

-

Market Capital Rotation: As Bitcoin's price consolidates at a high level, analysts have observed a "capital rotation" phenomenon, where some investors are moving funds from Bitcoin into Ethereum and other high-potential altcoins in search of higher returns. There are reports of "Bitcoin whales" even selling off Bitcoin to purchase ETH, which is a strong signal of shifting market confidence.

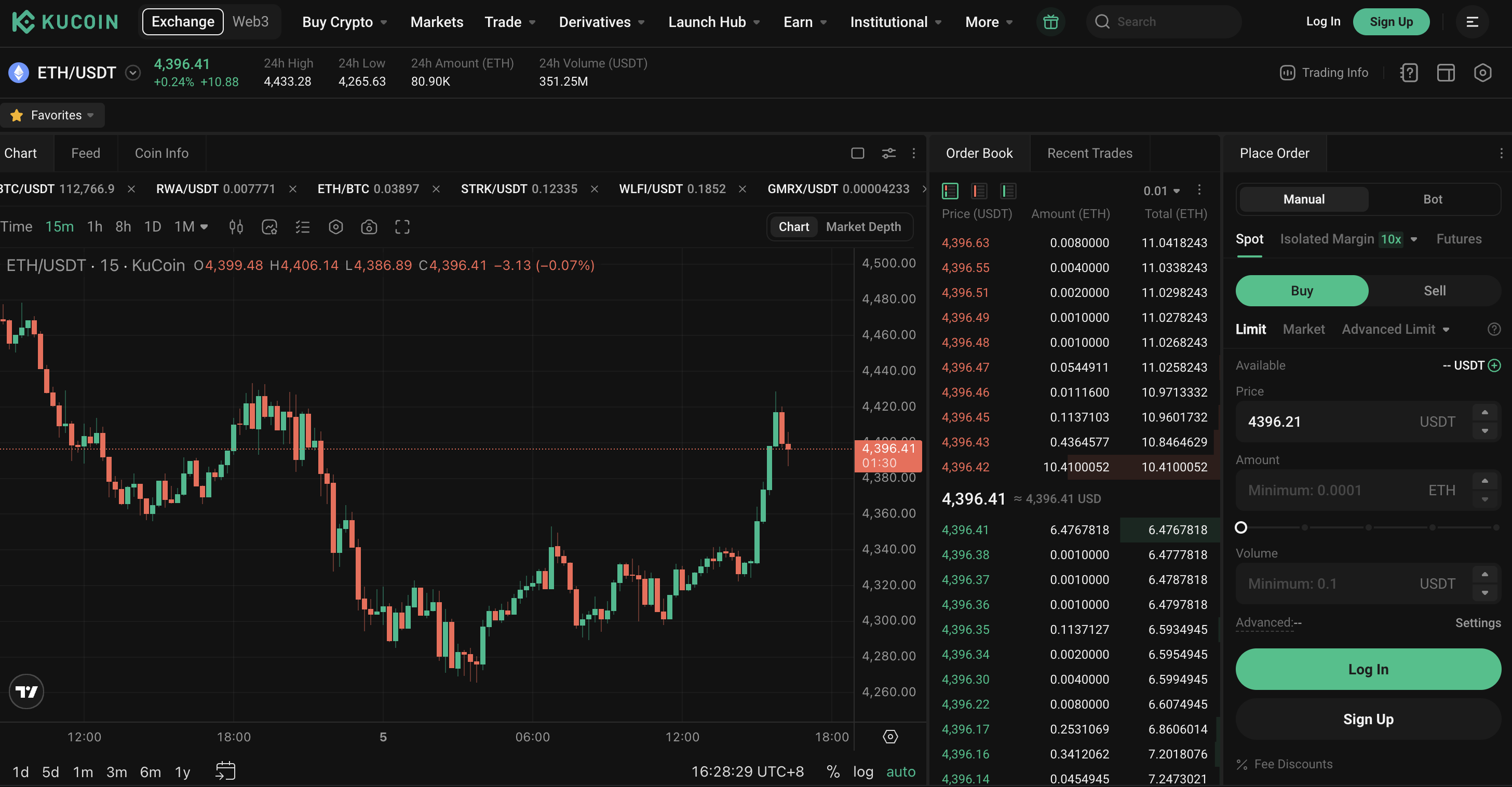

You can view the ETH real-time price chart on the KuCoin website for a more intuitive understanding of its market trend and price volatility. While short-term market volatility has increased, many analysts remain optimistic about ETH's long-term trajectory. Some believe that with continued institutional inflows and favorable macroeconomic conditions, the price of ETH could challenge the $7,500 to $8,000 range before the end of the year.

How to Trade ETH on KuCoin: From Beginner to Expert

As one of the world's leading cryptocurrency trading platforms, KuCoin offers secure and convenient ETH trading services. Whether you are a beginner or an experienced trader, you can find a suitable trading method on KuCoin.

-

Account Registration and Verification

First, you need to complete account registration on the KuCoin official website. To protect your funds and unlock all trading features, it is recommended that you complete identity verification (KYC). This usually takes only a few minutes but significantly enhances your account security.

-

Deposit and Purchase

On KuCoin, you can acquire ETH in several ways:

-

Fiat Purchase: If you want to buy ETH directly with a bank card or credit card, you can use the KuCoin OTC service to buy ETH.

-

Crypto Deposit: If you already hold Bitcoin or other cryptocurrencies on another platform, you can deposit them into your KuCoin account.

-

Start Spot Trading

Once your account is funded, you can start trading. Log in and find "Trade" or "Spot Trading," then enter ETH in the search bar. You can select a trading pair like ETH/USDT. You can go directly to the KuCoin ETH trading page to start trading.

-

Placing an Order

On the trading interface, you can choose different order types:

-

Limit Order: You can set a desired buy or sell price. When the market price reaches your set price, the order will be executed automatically. This method helps you trade at a more ideal price.

-

Market Order: You can immediately buy or sell ETH at the best available market price. If you are in a hurry to complete a trade, this is the fastest option.

After the transaction is complete, you can view your ETH holdings in "Assets" or "Wallet." You can also use the KuCoin converter to quickly check the ETH value in USD, allowing you to stay on top of your asset value at any time.

Looking Ahead: The Impact of Ethereum 2.0

In 2022, Ethereum completed the historic "Merge," officially transitioning from the energy-intensive Proof-of-Work (PoW) mechanism to the efficient Proof-of-Stake (PoS) mechanism. This major upgrade not only reduced Ethereum's carbon footprint by 99.95% but also paved the way for future scaling upgrades (such as sharding), which are expected to fundamentally resolve the network's long-standing congestion and high gas fee issues. As the Ethereum ecosystem continues to grow, this transition is crucial to its long-term value and appeal.

FAQ

-

Why choose to trade ETH on KuCoin?

-

KuCoin is known for its wide range of trading pairs, competitive fees, secure and stable platform, and user-friendly interface, making it a trusted crypto exchange for users worldwide.

-

-

Which is better, Ethereum or Bitcoin?

-

They each have their own advantages. Bitcoin is seen as "digital gold," primarily as a store of value, while Ethereum, with its powerful application ecosystem (DeFi, NFTs), is seen as "digital oil" and an innovation platform. Which one to invest in depends on your risk tolerance and investment goals.

-

-

Will ETH continue to rise?

-

The cryptocurrency market is highly volatile, and prices are influenced by multiple factors. While analysts are generally optimistic about its long-term prospects, investing requires caution.

-

-

Where can I find the latest ETH news?

-

You can follow official KuCoin announcements, and reputable crypto news websites and analysis platforms (like CoinMarketCap, CoinGecko, PANews) for the latest updates.

-

Further Reading:

-

ETH Staking https://www.kucoin.com/support/27434793193497