A Guide to Trading on Ethereum: What You Need to Know, Plus Recent ETH Price Movements

2025/08/30 06:21:02

You’ve likely heard about Ethereum and its native cryptocurrency, ETH. But it’s more than just the second-largest digital asset; it's a massive decentralized network that powers thousands of applications. For anyone looking to enter the crypto world, understanding how to trade on Ethereum is the crucial first step.

This article will provide a comprehensive guide, from preparing your tools to executing your first trade, and will also analyze ETH’s recent price trends.

1.Why Is Ethereum a Good Starting Point for Beginners?

For newcomers, the world of cryptocurrency can feel overwhelming. Many start with Bitcoin, but Ethereum offers a unique set of benefits that make it an excellent entry point into the broader Web3 ecosystem.

-

A "Full-Featured" Ecosystem: While Bitcoin is primarily a store of value, Ethereum is a programmable platform. Learning to use Ethereum means you're learning the fundamentals of the entire Web3 space, including how to interact with DeFi, NFTs, and other decentralized applications.

-

Widespread Support: ETH is available on virtually every major exchange and is supported by most crypto wallets. This widespread accessibility makes it incredibly easy to buy, sell, and manage.

-

The Bridge to Web3: The skills you learn on Ethereum—such as managing a wallet, understanding gas fees, and connecting to DApps—are transferable to almost every other blockchain. Ethereum acts as a universal training ground for the decentralized world.

2.Get Your Tools Ready: Choosing the Right Wallet

The first step to trading on Ethereum is to have a crypto wallet. Think of it as your digital bank account, an essential tool for storing, sending, and receiving ETH. The choice of wallet depends on your goals and your level of comfort with technology.

-

Centralized Wallets: These are custodial wallets managed by a centralized exchange, like KuCoin. They're incredibly convenient and user-friendly, allowing you to easily buy and sell ETH using fiat currency. However, you don't own the private keys, which means the exchange has ultimate control over your funds. For new traders focused on quick, simple transactions, a centralized wallet is often the ideal starting point.

-

Decentralized Wallets: These are self-custodial wallets, such as MetaMask or Trust Wallet. With these, you are the sole owner of your private keys and seed phrase, giving you complete command of your assets. This autonomy is the core principle of Web3, but it comes with a major responsibility: if you lose your private keys or seed phrase, your funds are gone forever. For those who want to explore DeFi, NFTs, and other decentralized applications (DApps), a decentralized wallet is a must-have.

3.Understand Trading Costs: What Is Gas?

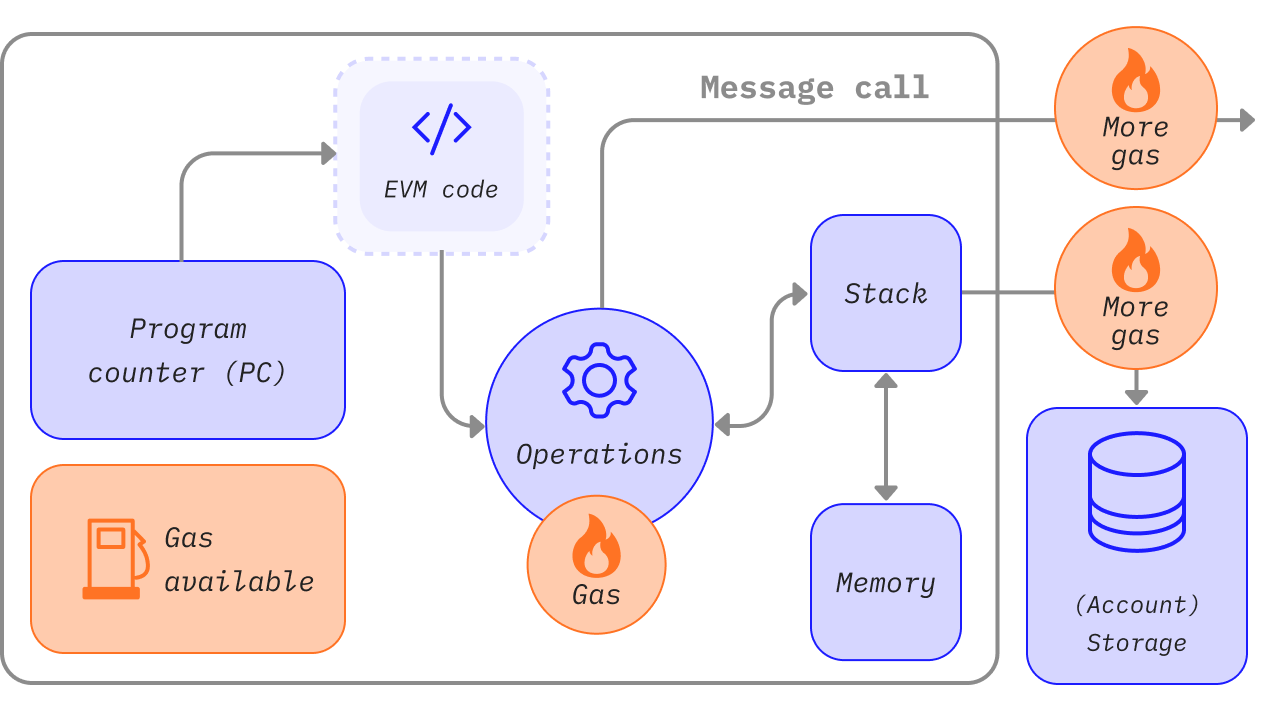

(Source: ETH)

To execute any transaction on Ethereum—whether you're sending ETH or interacting with a smart contract—you need to pay a fee called Gas. This concept can be confusing for newcomers, but it’s fundamental to how the network operates.

-

What is Gas? Gas is a unit of measurement for the computational effort required to execute a transaction or a smart contract operation on the Ethereum blockchain. It acts as the "fuel" for the network, ensuring that transactions are prioritized and processed securely.

-

How is the Gas fee calculated? The fee is calculated as: Gas Units x Gas Price.

-

Gas Units: The amount of work your transaction requires. A simple ETH transfer uses a fixed amount of Gas Units, while a complex smart contract interaction can require much more.

-

Gas Price: This is the price you pay for each unit of Gas, often measured in Gwei (a small fraction of an ETH). The Gas Price is determined by the current network congestion. The busier the network, the higher the Gas Price, and the more expensive your transaction will be. You can monitor the Gas Price on sites like Etherscan to find the best time to transact.

-

You can visit https://www.kucoin.com/learn/glossary/gas-fees to learn more about ETH Gas fee.

Make Your First Trade: A Step-by-Step Guide

Once you have a wallet and understand Gas fees, you can start trading. Here is a simple guide to get you started.

-

Fund Your Wallet: The first step is to get some ETH. The easiest way to do this is to use a centralized exchange to buy ETH with fiat currency (like USD or EUR).

-

Transfer ETH: If you want to move your ETH from your exchange account to a decentralized wallet or to another person, you'll need to initiate a transfer. Simply copy and paste the recipient's wallet address, specify the amount you want to send, and confirm the transaction. The transaction will be processed on the Ethereum network, and you will pay the necessary Gas fee.

-

Explore DApps: With a decentralized wallet, the real power of Ethereum is unlocked. You can connect your wallet to thousands of DApps. For example, you can connect to a decentralized exchange (DEX) like Uniswap to swap one type of token for another, or you can connect to an NFT marketplace like OpenSea to buy or sell digital art.

4.Recent ETH Price Movements

In recent months, the price of ETH has experienced significant volatility, driven by macroeconomic trends and major developments within the Ethereum network itself.

-

Recent Gains: ETH saw a strong rally over the past quarter, largely fueled by improving market sentiment and the anticipated approval of a spot ETH ETF in the United States. Many analysts believe that if the ETF is eventually approved, it could bring a massive influx of new institutional capital into the Ethereum market, potentially driving prices even higher.

-

Market Outlook: Despite recent fluctuations, the market remains generally optimistic about Ethereum's long-term prospects. This optimism is fueled by the network’s ongoing evolution. Key upgrades, such as the Dencun Upgrade, have successfully lowered transaction costs on Layer 2 solutions, making the ecosystem more scalable and accessible for users. These technical advancements, combined with its established position as the leading smart contract platform, continue to solidify Ethereum's role as a foundational piece of Web3 infrastructure.

Click https://www.kucoin.com/price/ETH to know the latest eth price.

In summary, Ethereum's market performance is influenced by both external macroeconomic factors and the ongoing evolution of its robust ecosystem.

Related Links:

-

https://www.kucoin.com/futures/trade/ETHUSDTM

-

https://www.kucoin.com/otc/buy/ETH-USD

-

https://www.kucoin.com/markets/spot/ETH

-

https://www.kucoin.com/trade/ETH-BTC