Mastering Crypto Alpha: What Is Alpha in Crypto & Practical Strategies for Investors

2025/08/21 09:30:02

In the high-stakes world of cryptocurrency, a term once confined to traditional hedge funds has found a powerful new meaning: alpha. This guide will decode what crypto alpha is and, more importantly, how it is systematically generated.

Alpha vs. Beta in Finance and Crypto World

To fully grasp the concept of alpha, it's essential to understand its counterpart, beta, and how both apply across different financial landscapes.

In traditional finance, like the stock market, beta is the measure of volatility, also known as risk, of a stock or portfolio relative to the overall market (e.g., the S&P 500 index). Alpha, in this context, measures the excess return above a benchmark for an investment, signifying the value added by a fund manager or investor through superior stock selection, market timing, or other active strategies.

In the crypto world, the core definitions of alpha and beta remain the same, but their application takes on unique characteristics due to the market's distinct dynamics. Here, beta often refers to the broad market movement, typically tracked by major cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH). An investor whose portfolio simply tracks the price movements of these top cryptocurrencies has a high beta. In a bull market, they will see substantial gains, but in a downturn, their losses will largely mirror the market's decline. Their returns are a result of pure market exposure, not active management.

Alpha, conversely, is the return on an investment that is completely independent of the crypto market's general performance. It is the excess profit you generate through a deliberate strategy, unique insight, or active management specific to the crypto ecosystem. The purpose of understanding alpha is to distinguish between a truly effective investment strategy and a return that is simply the result of getting lucky during a market surge. For instance, if the broader crypto market, as represented by BTC, surges by 50% and your specific altcoin investment gains 80%, your portfolio’s 30% excess return is your alpha. It's the tangible proof of your unique skill and decision-making in a market full of noise and volatility. The fragmented nature and relative inefficiency of the crypto market compared to traditional equities often present more opportunities for skilled investors to find and exploit these price disparities or emerging trends, thus generating alpha.

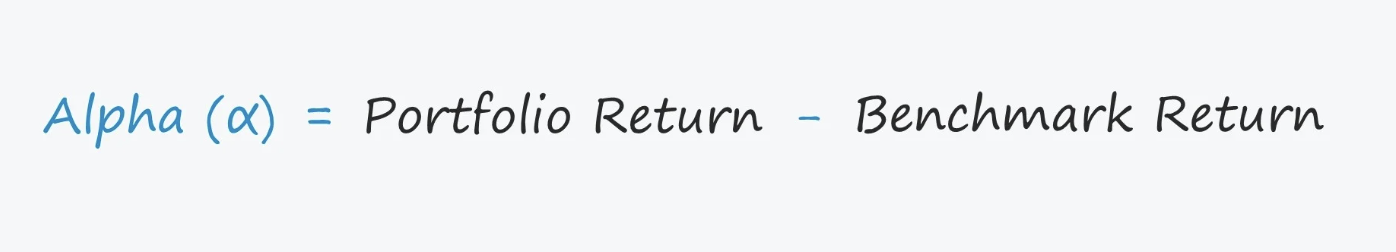

Defining Alpha in a Quantitative Context

To understand alpha, we must first define it quantitatively. Alpha is the return on an investment in excess of what would be predicted by a benchmark index and the investment's beta. In a simplified model, you can think of the formula as:

Image: wallstreetprep

The "Benchmark Return" is calculated based on the market's return and the asset's beta. For crypto, the market benchmark might be a top-10 index of cryptocurrencies. If a portfolio has a beta of 1.2 (meaning it is 20% more volatile than the market), and the market returns 50%, a 60% return for the portfolio is simply a reflection of its beta. But if that portfolio returns 70%, the additional 10% is true alpha—a testament to the investor’s ability to find undervalued assets or execute superior strategies.

True alpha is systematic; it is a repeatable process. It is not the one-off profit from a meme coin, but a consistent ability to identify and exploit market inefficiencies and opportunities that others miss.

Strategies for Alpha Generation

Generating alpha in crypto requires a tactical approach that goes far beyond simple market timing. The most successful strategies are born from a combination of in-depth analysis and precise execution.

Arbitrage: One of the most classic forms of alpha is generated through arbitrage, which exploits price differences for the same asset across different venues.

-

Centralized vs. Decentralized Exchange (CEX vs. DEX) Arbitrage: This involves capitalizing on price disparities that exist between centralized exchanges and on-chain decentralized exchanges. A trader might use an automated bot to buy a token on a CEX where it is priced lower and simultaneously sell it on a DEX where it is priced higher, capturing the difference.

-

Triangular Arbitrage: This complex strategy involves exploiting price inconsistencies among three different crypto assets on the same exchange. For example, a trader might convert BTC to ETH, then ETH to a stablecoin, and finally the stablecoin back to BTC, all in a fraction of a second, to profit from a slight imbalance in the exchange rates.

-

Yield Farming & Liquidity Provision: For investors in the DeFi space, alpha is generated by putting assets to work to earn additional returns. By providing liquidity to a decentralized exchange, investors earn a share of the transaction fees, which is a form of alpha on top of the asset’s price movement. The key is to find protocols with sustainable, long-term yield rather than just chasing the highest Annual Percentage Yield (APY), which often comes with unsustainably high rewards and the risk of impermanent loss—a decline in value due to volatility between the paired assets.

-

Structured Products & Derivatives: Advanced investors use derivatives such as futures and options not just for speculation but to generate alpha through hedged positions or complex strategies. For instance, a trader holding a spot position in a token may use a perpetual futures contract to hedge their risk, effectively "locking in" a profit. They can also create more sophisticated structured products—for example, a strategy that earns from small price fluctuations while being hedged against a major market crash. This level of risk management is a direct source of alpha.

The Tools of the Trade

Executing these strategies requires more than just capital; it demands access to sophisticated data and analytical tools. The modern alpha hunter’s arsenal includes:

-

On-Chain Analytics Platforms: Platforms like Nansen and Dune Analytics provide deep insights into blockchain activity. An investor can track "smart money" wallet movements, monitor inflows into specific DeFi protocols, and analyze smart contract usage to gain a competitive edge.

-

Technical Analysis Software: Tools like TradingView are essential for performing advanced technical analysis on market trends, identifying key support and resistance levels, and building algorithmic trading strategies.

-

Project Whitepapers & Audits: For fundamental alpha, there is no substitute for rigorous research. An investor must study a project's whitepaper, tokenomics, and third-party security audits to assess its long-term viability and potential.

This analytical work is only half the battle; the other half is having a platform that can handle the complexity and speed required for execution. A robust and secure platform like KuCoin becomes an essential partner for the sophisticated investor. With its wide range of listed assets, advanced trading terminals, and access to both spot and derivatives markets, it provides the necessary infrastructure for implementing a diverse set of alpha-generating strategies.