Trump–Zelensky meeting advances Russia–Ukraine agreement; Bitcoin fails to break above 90k

Summary

-

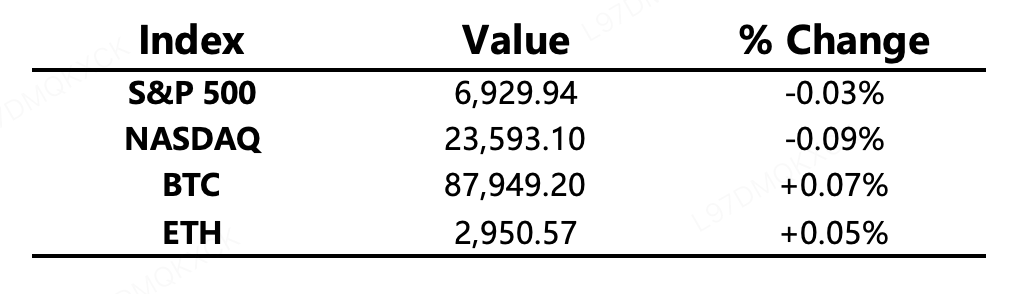

Macro environment: Following a weekend meeting between Trump and Zelensky, Trump stated that both Russia and Ukraine are willing to push toward ending the conflict, with the relevant agreement now in its “final stage.” Last Friday, the three major U.S. equity indices edged lower on lighter volume, but still posted weekly gains of more than 1% amid the Christmas rally. Precious metals continued to heat up, with gold, silver, copper, and platinum all reaching record highs.

-

Crypto market: Bitcoin failed to break above the 90k level last Friday. As U.S. equities pulled back, BTC briefly dipped to 86.7k before rebounding, and remained range-bound over the weekend. Amid relatively thin weekend trading, both altcoin market-cap share and trading-volume share rebounded. Market sentiment improved only marginally, with risk appetite still in the extreme fear zone.

-

Project developments

-

Trending tokens: XAUT, CC, UNI

-

XAUT: Gold surged to USD 4,550, setting a new all-time high

-

CC: Canton Network released the CIP-56 privacy token standard; CC rose 22%

-

UNI: 100 million UNI tokens were successfully burned, valued at approximately USD 596 million

-

LIT: The founder of Lighter stated that previous large LIT token transfers were unrelated to the airdrop; the app may launch in the coming weeks

-

HYPE: Hyperliquid recorded net inflows of USD 3.87 billion in 2025, with trading volume nearing USD 3 trillion

-

ZRO: The LayerZero community vote to “activate the protocol fee mechanism” did not pass

-

Major asset movements

Crypto Fear & Greed Index: 24 (24 hours ago: 24), classified as Extreme Fear

Today’s agenda

-

Hyperliquid (HYPE): Approximately 9.92 million tokens to be unlocked, valued at about USD 256 million

Macroeconomy

-

The U.S. side was reported to have proposed deploying cryptocurrency mining in disputed Russia–Ukraine regions as a bargaining chip in negotiations

-

Bank of Japan meeting summary: A steady pace of rate hikes, roughly once every few months, may be required going forward

Policy direction

-

Russian crypto-finance pilot: Russia’s largest bank issued pilot loans collateralized by crypto assets

-

Pakistan: Police dismantled a crypto investment fraud ring involving approximately USD 60 million

-

Japan: Announced a cryptocurrency tax reform proposal, planning to introduce a separate taxation regime

-

Lithuania: To crack down strictly on unlicensed crypto companies starting in 2026

-

JPMorgan: Froze accounts of multiple stablecoin startups linked to high-risk markets such as Venezuela

-

Coinbase: First arrest made in an internal data leak case; Indian police arrested a former Coinbase customer service employee

Industry highlights

-

Bloomberg: Investors are selling BTC and using the losses to offset capital gains, thereby reducing taxable income

-

During Christmas week, U.S.-listed spot Bitcoin ETFs saw large-scale outflows, with cumulative net outflows of approximately USD 782 million

-

ABN AMRO: Received MiCAR approval and launched blockchain-based derivatives

-

UNI: 100 million tokens were burned, valued at approximately USD 596 million

-

Michael Saylor: Released Bitcoin Tracker information again, potentially signaling another BTC accumulation

-

Hyperliquid: Net inflows reached USD 3.87 billion in 2025, with trading volume nearing USD 3 trillion

-

Strategy: Established a USD 2.2 billion cash reserve, shifting toward a defensive strategy

-

KLab (Japan-listed): Initiated a “dual gold financial strategy,” beginning allocations to both Bitcoin and gold

-

LayerZero: Community vote to activate the protocol fee mechanism did not pass

-

Bitmine: Cumulatively staked 154,176 ETH today, valued at approximately USD 451 million

Industry Highlights Extended Analysis

Bloomberg: Tax-Loss Harvesting Triggers Massive Bitcoin ETF Outflows in Christmas Week

During Christmas week, U.S.-listed spot Bitcoin ETFs experienced a cumulative net outflow of approximately $782 million, primarily driven by "tax-loss harvesting" strategies. With Bitcoin's price retracing roughly 30% from its October peak, investors are selling their underwater ETF positions to realize losses that can offset capital gains from other successful investments (such as U.S. equities), thereby reducing their total taxable income for the year. This seasonal selling pressure is generally considered a temporary, tax-compliant maneuver by institutional players rather than a shift in long-term market fundamentals.

ABN AMRO: MiCAR Approval and Launch of Blockchain Derivatives Accelerate EU Compliance

ABN AMRO’s German subsidiary has successfully obtained authorization under the EU’s Markets in Crypto-Assets Regulation (MiCAR), making it one of the first major traditional banks to operate under this new unified compliance framework. Simultaneously, the bank completed its first cross-border OTC "Smart Derivatives Contract" (SDC) with DZ BANK using blockchain technology. The implementation of MiCAR clears regulatory hurdles for traditional European financial institutions, while blockchain integration automates clearing and collateral management, signaling the beginning of a major shift for traditional derivatives onto the chain.

Uniswap (UNI): Massive Token Burn Enhances Scarcity of Governance Asset

The Uniswap treasury recently executed a historic burn of 100 million UNI tokens, valued at approximately $596 million, following the community’s approval of the "UNIfication" proposal. For years, UNI has faced criticism for being a "pure governance" token with no direct value capture. This burn not only slashes the circulating supply by about 16% but also marks Uniswap’s transition toward a "fee-driven" model with deflationary mechanisms, significantly bolstering long-term investor confidence.

Michael Saylor: Renewed "Tracker" Signals Hint at Continued Bitcoin Accumulation

Michael Saylor, founder of Strategy (formerly MicroStrategy), has once again released Bitcoin Tracker data, suggesting the company may be utilizing year-end price volatility to quietly increase its holdings. As of mid-December, its total holdings have exceeded 670,000 BTC. While the company recently established a $2.2 billion cash reserve, Saylor’s continued "buy the dip" signals reinforce Strategy’s role as the primary institutional proxy for Bitcoin, with his posts often serving as a psychological floor for the market.

Hyperliquid: 2025 Net Inflows Near $4 Billion, Solidifying Dominance in DeFi Derivatives

The decentralized perpetual exchange Hyperliquid has delivered a stellar performance in 2025, reaching an annual trading volume of nearly $3 trillion with net inflows of $3.87 billion. With its Total Value Locked (TVL) stabilizing above $4 billion, the platform reflects a broader trend of traders migrating from centralized exchanges (CEXs) to high-performance DEXs. Hyperliquid’s success proves the superiority of application-specific chains (AppChains) in handling high-frequency derivatives trading, establishing it as a critical liquidity hub in the DeFi sector.

Strategy’s Tactical Shift: $2.2 Billion Cash Reserve Signals a Defensive Posture

In a notable departure from its previous "all-in" approach, Strategy has built a massive $2.2 billion cash reserve as of late 2025. This shift suggests that while the company remains aggressive in accumulating BTC, it is also preparing for potential macro-economic uncertainty. This "defensive strategy" provides the firm with significant "dry powder" to capitalize on future market corrections while ensuring operational liquidity in a potentially tightening credit environment, demonstrating a more mature level of capital management.

KLab (Japan): "Dual Gold" Strategy Normalizes Digital Asset Allocation for Listed Firms

Following in the footsteps of Metaplanet, the Japanese-listed company KLab has launched a "Dual Gold Financial Strategy," allocating 3.6 billion yen (approx. $24 million) between Bitcoin and Gold at a 6:4 ratio. KLab explicitly stated that this move is a response to the "silent collapse" of the yen's purchasing power. This action signifies that Japanese corporations are increasingly viewing Bitcoin as a safe-haven asset on par with gold, creating a blueprint for other non-US listed companies to hedge against inflation.

LayerZero: Community Vote Fails to Activate Protocol Fees, Showing Governance Checks and Balances

A community proposal to activate the LayerZero protocol fee mechanism failed to pass on December 27 due to insufficient voter participation (failure to reach a quorum). The proposal intended to convert protocol fees into ZRO tokens for burning. The failure of this vote reflects community concerns that premature fee implementation might stifle the protocol’s competitive edge. It also demonstrates the sobriety of decentralized governance when making significant adjustments to a protocol's economic model.

Bitmine: Cumulative Staking Reaches 154,176 ETH, Securing $451 Million in Value

Mining giant Bitmine reached a milestone today with its cumulative staking volume hitting 154,176 ETH, valued at approximately $451 million. As Ethereum deepens its evolution into a PoS-based ecosystem, large-scale mining operations and hash-power providers are shifting their focus from traditional hardware mining to Liquid Staking Tokens (LSTs). This institutional-scale staking not only provides Bitmine with stable on-chain yields but also further enhances the security and decentralization of the Ethereum network.