KuCoin Ventures Weekly Report: The Epic Rally in Precious Metals, The Evolution of Stablecoin Payments, and The Return of Value to DeFi Protocols

2025/12/29 10:00:03

1. Weekly Market Highlights

Stablecoin Payments Are Accelerating Toward “Productization”: Transfer Scale, Merchant On-ramps, and Compliance Path Must Advance in Parallel

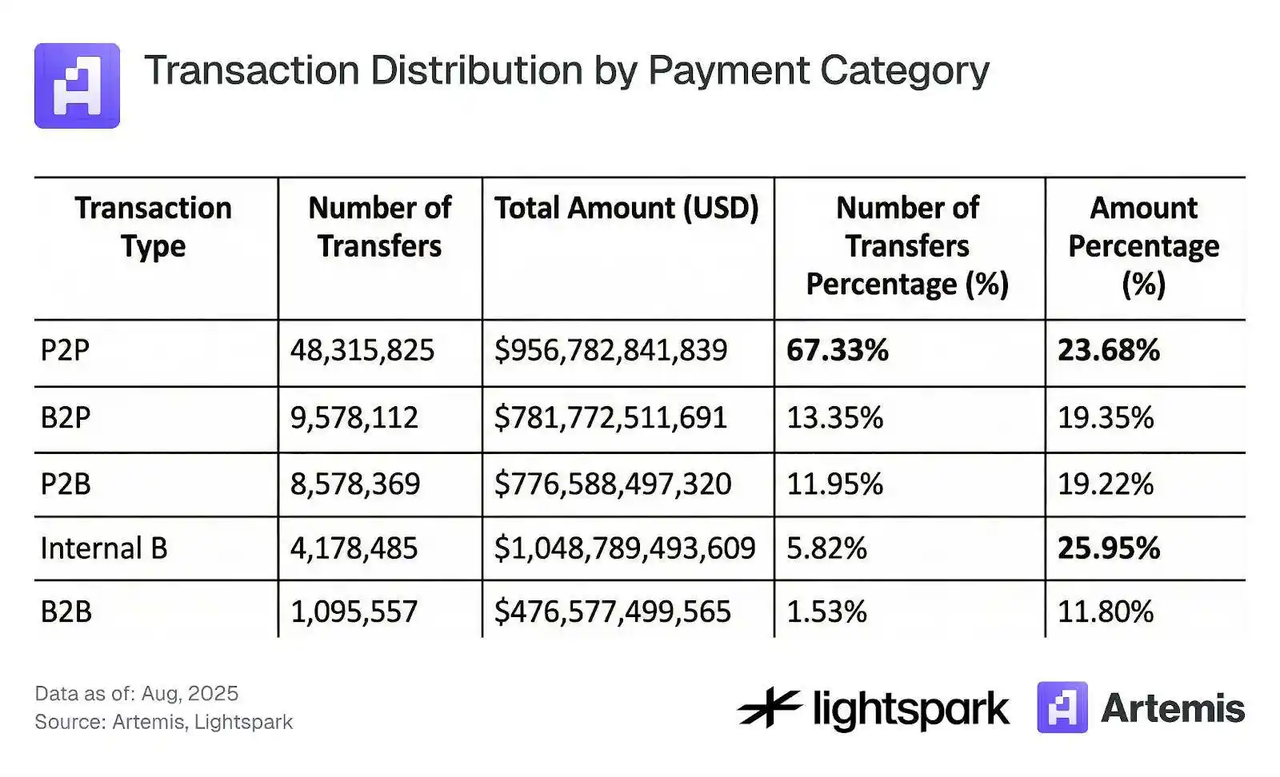

Stablecoin payments remain a highly discussed topic. In Stablecoin Payments from the Ground Up, Artemis offers a lens that is closer to “real operating structure”: stablecoin “payment/transfer” activity has approached roughly half of total stablecoin transaction volume, yet the organization of these flows still relies heavily on a small number of hub institutions. The report shows that the top 1,000 addresses account for about 84%–85% of total transfer value; while P2P transfers represent a higher share by transaction count (around 67%), they contribute only about 24% by value.

Data Source: Artemis, Lightspark

This “hub-concentrated payment structure” does not negate adoption progress—if anything, it aligns with the typical path of early infrastructure expansion. Large-ticket flows and high-frequency settlement often concentrate first in a limited set of hubs (exchanges, payment aggregators, institutional treasury and settlement wallets) before diffusing toward a more distributed retail layer. As a result, assessing stablecoin payments should not hinge on transaction counts alone; it should also track counterparty structure, average transfer size distribution, and whether merchant-side usage is showing sustainable repeat purchase and settlement retention.

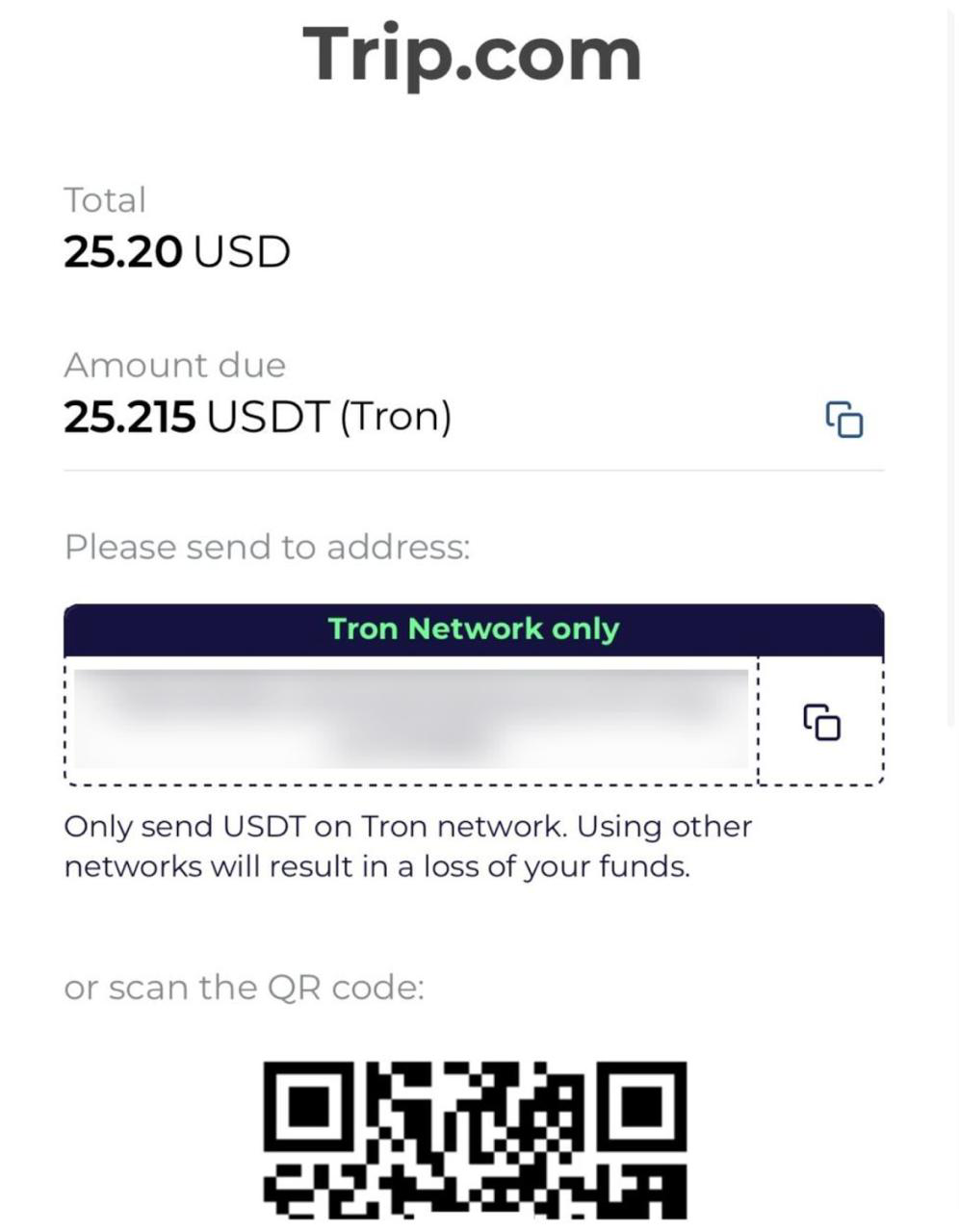

From a “merchant entry-point” perspective, travel and cross-border services are among the most straightforward categories for stablecoin payments to land. Recently, multiple industry media outlets reported that Trip.com has introduced stablecoin payment options such as USDT and USDC, with payment processing supported by a licensed crypto payments provider. The significance of such partnerships is moving stablecoins from “on-chain settlement” into “an optional payment method in consumer scenarios,” particularly for cross-border users facing card-network coverage differences, FX friction, and settlement speed constraints. For stablecoin payments, macro cycles and market sentiment shape “why to use it now,” while merchant coverage, payment success rates, refund/chargeback handling, and cost structure determine “whether it can be used sustainably over time.”

Data Source: Foresight News

Another stablecoin payment scenario drawing increasing attention is the crypto debit card. Its core value is converting “stablecoin balances” into payment capability that works across everyday acceptance networks, with advantages typically reflected in cross-border payment experience, FX friction, and acceptance compatibility. At the same time, discussions around “U-cards” highlight a key reality: sustained expansion ultimately depends on a clear compliance pathway, the compliance boundaries of card issuance and clearing networks, and regulatory requirements across jurisdictions regarding fund attributes and fiat on/off-ramp rails. The widespread re-circulation of recent Caixin coverage also underscores that the market is rapidly increasing the weight it assigns to a second-order variable beyond “product usability”: compliance sustainability.

More broadly, traditional payment networks and banking systems are also bringing stablecoins into the framing of “settlement infrastructure.” For example, Visa’s progress on stablecoin settlement has been interpreted by some media as accelerating banks’ product imagination around 7×24 settlement and cross-border liquidity orchestration. The value of these signals is not near-term sentiment uplift, but rather a clearer picture of “who participates compliantly”: banks and licensed institutions handle accounts and compliance; payment networks provide acceptance and clearing rules; on-chain stablecoins serve as the programmable settlement layer.

Ultimately, for stablecoin payments to evolve from “hub-driven scale” to “broader distributed adoption,” three tracks must advance together: (1) gradual de-concentration of flow structure (more genuine merchant and individual receive/send activity, rather than internal circulation within a handful of institutional wallets), (2) sustained expansion of merchant and product on-ramps (more high-frequency consumption and cross-border service scenarios), and (3) clearer compliance pathways (licensing, risk controls, on/off-ramp rails, and dispute-handling mechanisms that the mainstream system can accept). When these three lines reinforce one another, stablecoin payments are more likely to move beyond a phase-like “scale phenomenon” and become durable payment infrastructure.

2. Weekly Selected Market Signals

The Frenzy of Real Assets and the Liquidity Expectation Gap in 2026

As 2025 draws to a close, global markets are exhibiting a distinct "shift from virtual to real." The frenzy in the precious metals sector stands in stark contrast to the relative sluggishness of the crypto market. Driven by escalating geopolitical tensions and a weakening US dollar, precious metals have staged an epic "short squeeze" rally. Spot gold breached the $4,500/oz mark, while silver recorded an astonishing 167% year-to-date gain, touching a historic peak of $79/oz during intraday trading. Looking past the surface, this reflects a pessimistic market pricing of the long-term creditworthiness of fiat currencies, led by the US dollar, driving a revaluation of real assets. However, the current momentum is overly aggressive; market FOMO combined with clear signs of being short-term overbought suggests risks, as evidenced by the sharp dive in spot silver on December 29, which served as a prelude to potential volatility.

Data Source: Yahoo.com

In equity markets, Japanese stocks have become a counter-intuitive highlight against a backdrop of rate hikes. Despite the Bank of Japan raising interest rates to 0.75%—a 30-year high—the Nikkei 225 has still recorded a year-to-date gain of approximately 26%. The market logic has shifted to viewing "rate hikes" as a positive signal that the economy is exiting deflation. This, superimposed on Japan's strong ecological niche in the AI supply chain, has attracted significant capital seeking to hedge against USD risks. US stocks remain high on "Santa Rally" expectations, but the tech sector presents a complex duality: In the primary market, Nvidia is rising against the trend, keeping the AI narrative robust; yet on the macro level, Fed Governor Waller's comments that "AI is suppressing hiring" have triggered concerns. The substitution effect of AI on the service sector and white-collar jobs is exacerbating K-shaped differentiation in the labor market, making the AI topic more complex and severe.

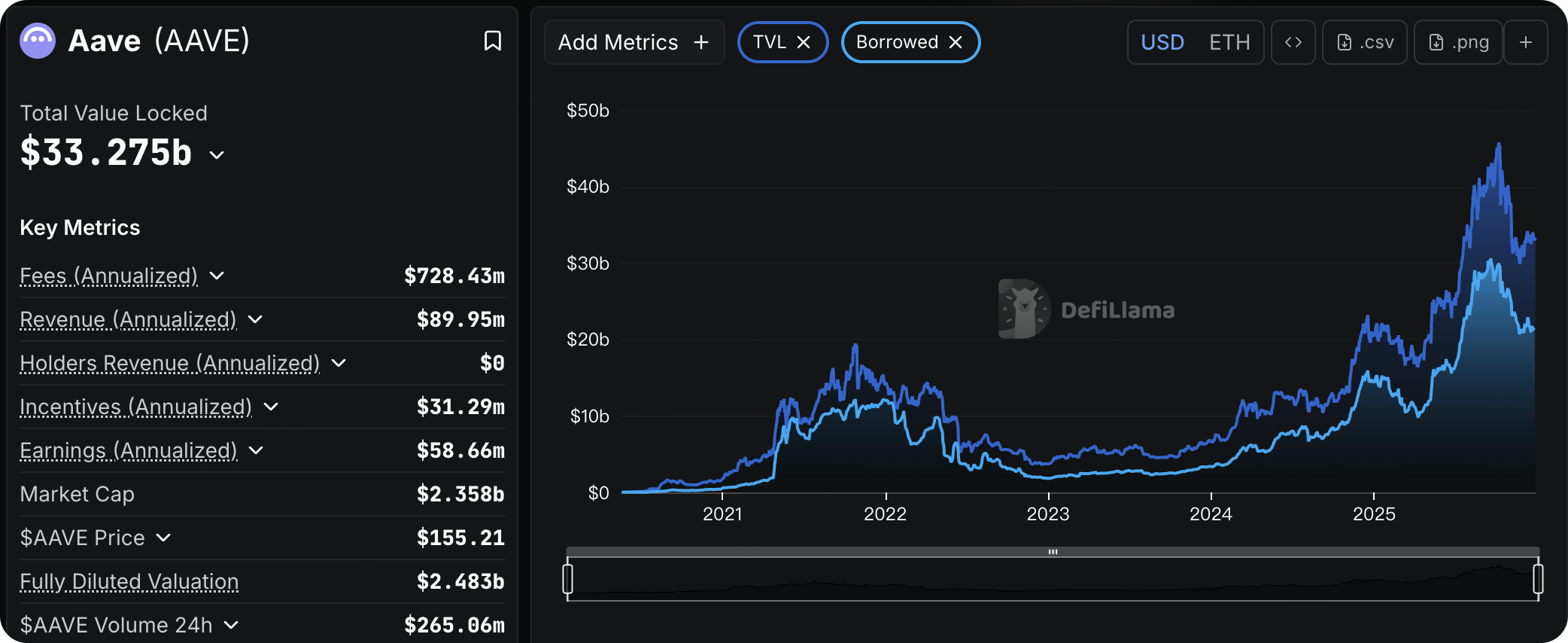

Data Source: defillama.com

In stark contrast to the heat in traditional markets, the crypto market is experiencing a bleak winter. Market sentiment remains in the "Fear" zone this week, spot liquidity is extremely dried up, and global crypto trading volume has declined for the fifth consecutive week. One reason is that, as crypto assets have severely underperformed traditional indices (like the S&P 500) this year, and BTC prices remain persistently below the cost basis for short-term holders, massive amounts of floating-loss capital have chosen to sell before year-end for tax-loss harvesting, creating sustained selling pressure. Deleveraging in the DeFi market is also evident, with Aave borrowing volumes shrinking by about 30% since their September highs.

Despite the weakness in spot markets, the derivatives market is brewing a turnaround. On December 26, the market saw the largest options expiry in history, totaling $28 billion. While bulls suffered heavy losses, the post-expiry open interest structure has fundamentally changed: Call options expiring in March 2026 have become the largest position. Furthermore, the resistance for BTC to reclaim $100k may have significantly lightened. Options data shows that the BTC "max pain" point is moving upward. Moreover, if prices rise over the next 30 days, the liquidation intensity for short positions will be significantly greater than for longs. This implies that after the year-end tax selling pressure passes, the market is highly prone to a "short squeeze" rebound in January driven by returning liquidity.

Data Source: SoSoValue

US BTC Spot ETFs saw sustained outflows last week, with a cumulative net outflow of approximately $782 million. Friday alone saw a net outflow of $276 million, the peak for the holiday period. Fortunately, despite the outflows, Bitcoin's price maintained the $87,000 level, suggesting that this capital withdrawal stems more from year-end asset rebalancing and reduced holiday liquidity rather than market panic.

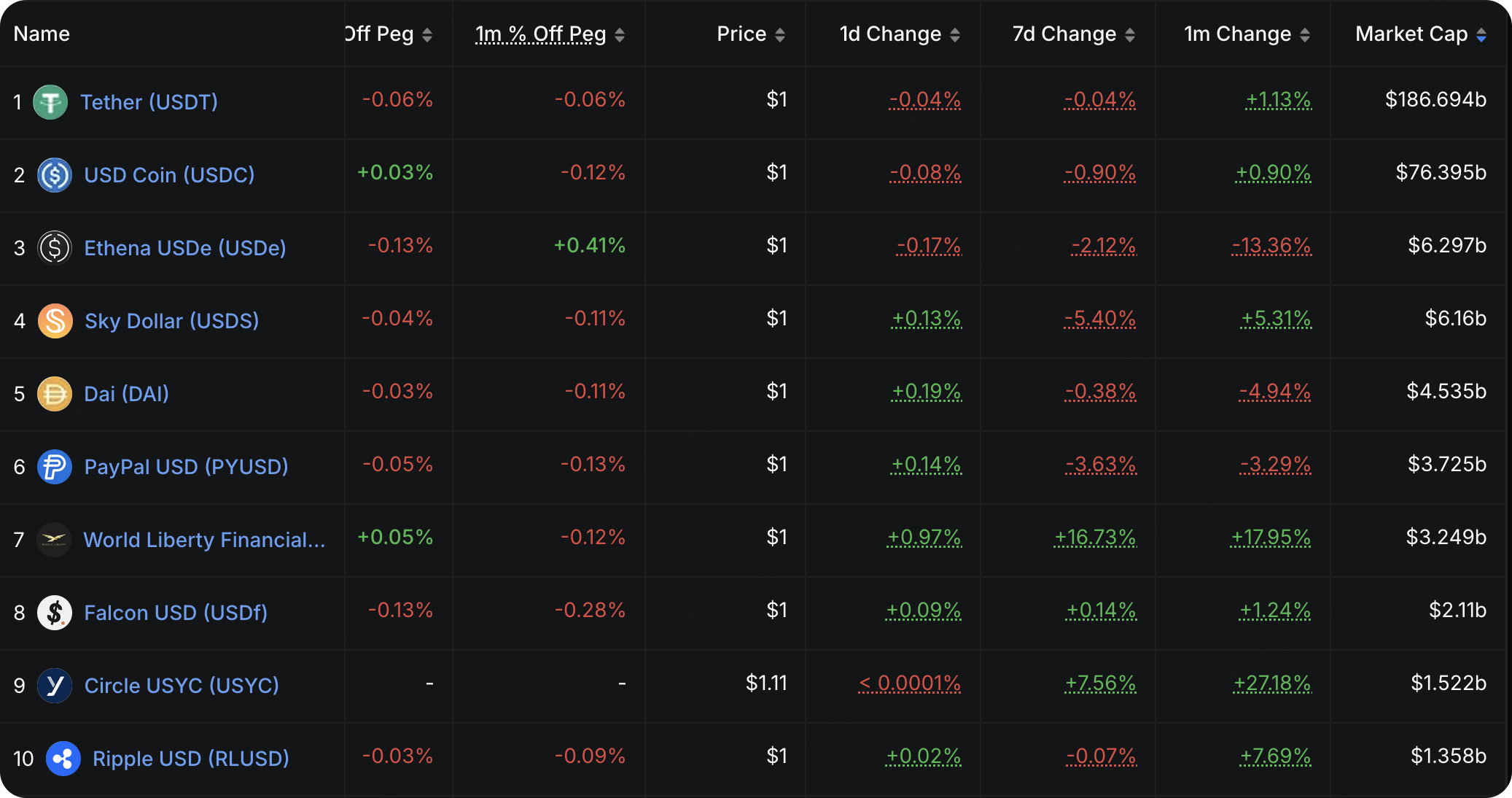

Data Source: DeFiLlama

On-chain liquidity data further confirms the market's defensive mindset. The total issuance of stablecoins remains hovering near previous highs of $310 billion, with no significant incremental growth. While USDe redemptions have slowed and USD1 issuance has seen impressive growth driven by high-yield campaigns, the overall flow shows no net increase in stablecoins used for trading purposes. Instead, funds flowing into the crypto market are prioritizing yield farming and arbitrage (represented by USD1 and USYC), indicating a preference for conservative yield generation over risk-taking.

Data Source: CME FedWatch Tool

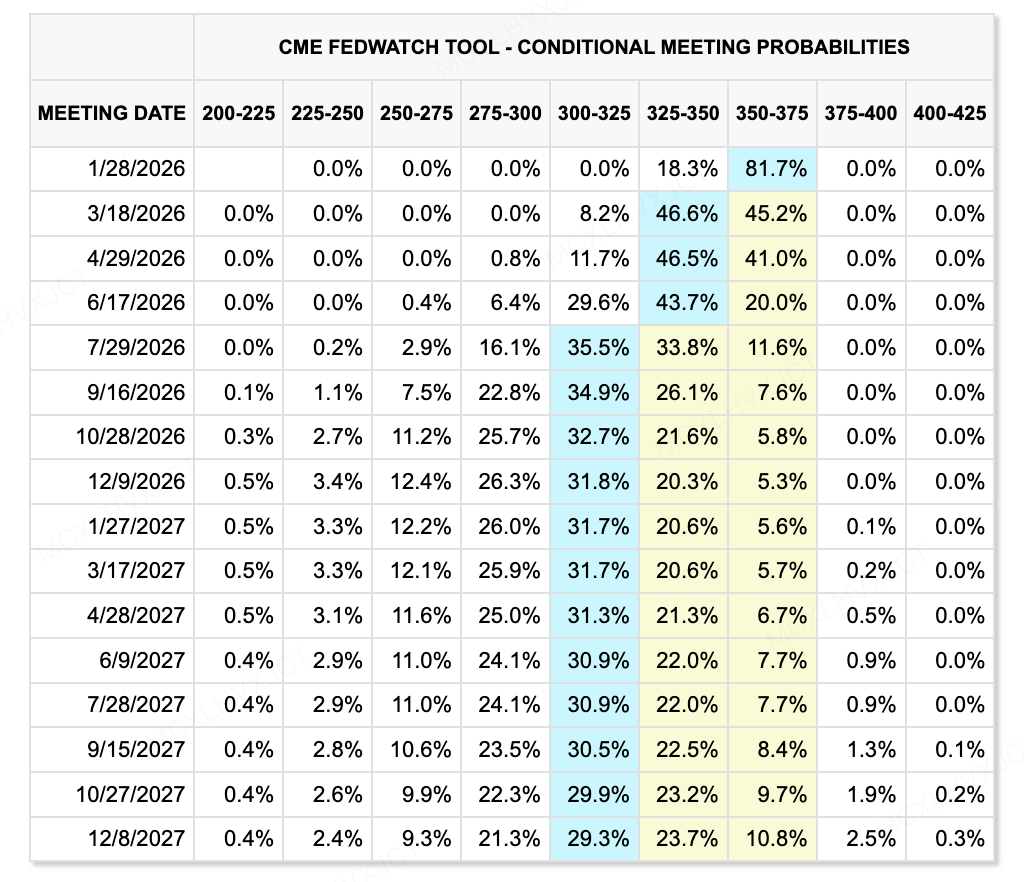

Looking ahead to 2026, the core contradiction in the liquidity environment lies in the massive expectation gap between "conservative market pricing" and "radical personnel changes." According to the latest CME FedWatch Tool data, the market is pricing in a relatively restrained rate cut path for 2026. Data indicates an 82.3% probability that rates will remain unchanged in January 2026. Market expectations for rate cuts are concentrated in the second quarter, and the path is viewed as moderate. However, the composition of the 2026 FOMC voting committee could undergo drastic changes due to proposed "residency rules." Some hawkish members face potential disqualification, which could lead to actual policy being far looser than CME predictions. If the new FOMC is dovish overall, the actual magnitude of rate cuts could expand to four or more times, providing a liquidity premium for risk assets that far exceeds expectations.

Key Events to Watch This Week:

-

December 31: US Initial Jobless Claims (week ending Dec 27); Federal Reserve FOMC Monetary Policy Meeting Minutes.

Primary Market Financing Observations:

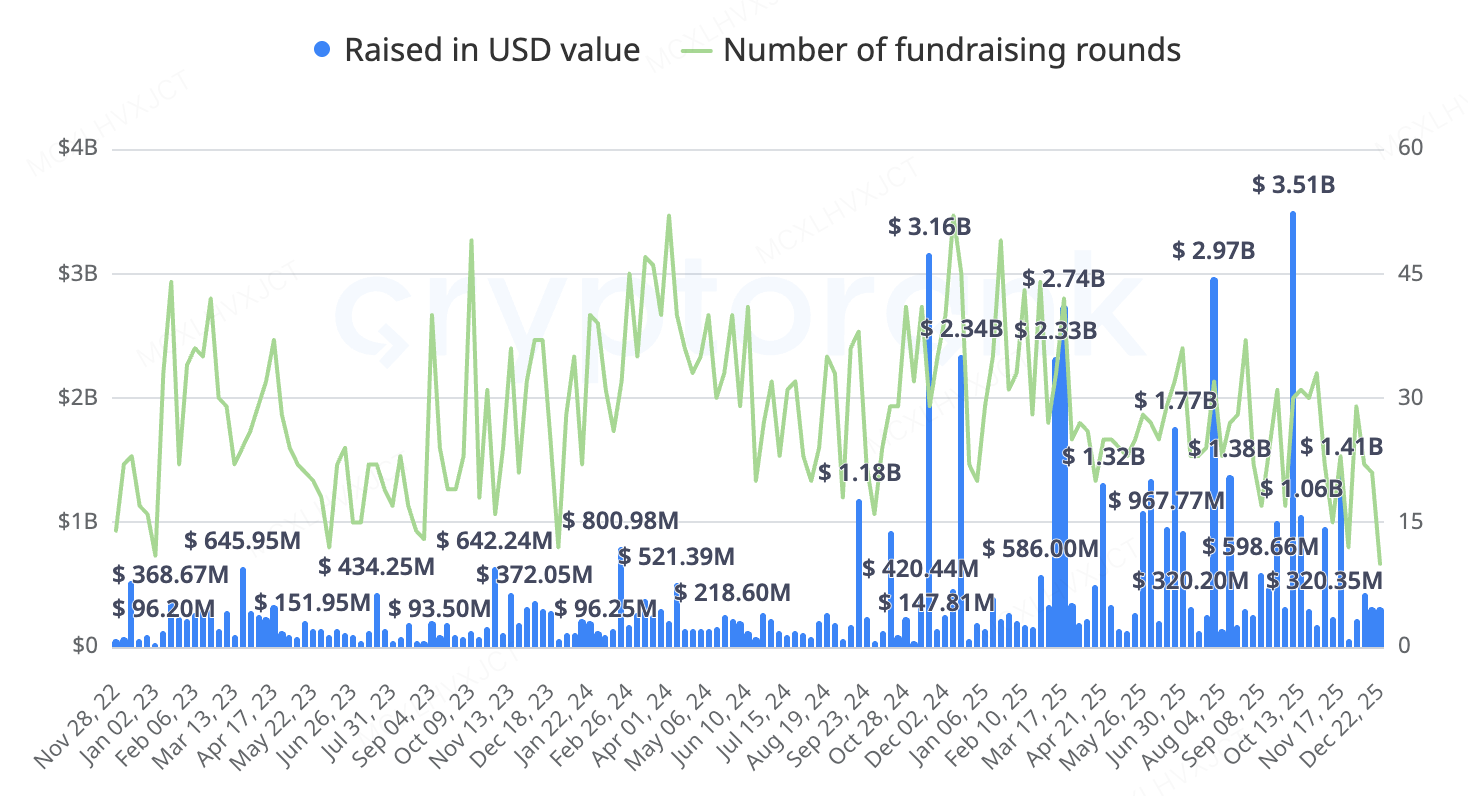

In terms of capital volume, primary market financing was decent this week. However, a clear trend this year is that the era of grassroots startups is fading. The current market has entered a stage of "insider games" involving famous enterprises and a stock game of M&A consolidation.

Data Source: CryptoRank

-

Metaverse Platform Ready Player Me: The metaverse avatar platform Ready Player Me has been acquired by streaming giant Netflix, and the original service will go offline in early 2026. The project previously secured total investment of up to $72 million from top VCs, including a16z. This marks a narrowing of exit paths for the Metaverse track; building an independent large-scale platform is exceptionally difficult, and acquisition by major tech firms as a functional component is one of the few viable exit strategies.

-

Traditional Asset Perpetual CEX Architect (AX Exchange): Architect, founded by former FTX US President Brett Harrison, announced a $35 million funding round at a valuation of $187 million. Harrison previously worked at Jane Street for many years and resigned from FTX shortly before its collapse. The project's core product, AX Exchange, allows clients to use stablecoins and fiat as collateral to trade perpetual contracts on traditional assets such as forex, interest rates, stocks, indices, metals, and energy.

-

Coinbax — The "Programmable Trust Layer" for Banks: Stablecoin infrastructure layer Coinbax completed a $4.2 million seed round. The project addresses the issue that existing banking payment rails (like ACH/FedNow) solve for "speed" but lack "programmability," while public chains (ETH/Solana) are programmable but lack "control" and "compliance" for banks. The product's core is the "Controls" module, allowing banks to execute multi-party approvals, spending limits, and condition-based fund releases on-chain. The project achieves bank-grade integration, enabling banks to use USDC/PYUSD for 24/7 settlement while retaining audit and risk controls, without needing to directly handle complex private key management or smart contract interactions. Investors include traditional banks and stablecoin-related institutions like Paxos and BankTech Ventures. The founders are veterans from fintech and banking technology service companies.

-

Coinbase Acquires The Clearing Company: The Clearing Company is a startup founded only in early 2025, which raised a seed round in August led by Union Square Ventures with participation from Coinbase Ventures. It is reported that the platform is currently applying for CFTC derivatives exchange and clearing house licenses. Founder Toni Gemayel previously worked in growth roles at two major prediction market platforms, Polymarket and Kalshi. Previously, rumors circulated that Coinbase would partner with Kalshi to launch prediction market products, but this lightning acquisition indicates Coinbase's ambition goes beyond partnership: they intend to control a licensed clearing entity to build their own fully regulated prediction market clearing and trading system.

3. Project Spotlight

DeFi Enters a New Phase of Governance and Value Redistribution

Last week marked a series of milestone developments across DeFi, as three leading protocols—Uniswap, Aave, and Lido—each executed critical governance actions. Within a narrow time window, all three confronted fundamental questions around fee distribution, revenue ownership, protocol boundaries, and DAO authority, resulting in either decisive breakthroughs or high-profile disputes. Uniswap's activation of its fee switch effectively ushered in a new era of token-level value capture and deflation. Aave's DAO vs. Labs controversy, while temporarily resolved, exposed deep structural weaknesses in decentralized governance. Meanwhile, Lido's latest security upgrade further reinforced its dominant position in the liquid staking sector.

On December 25, one of the most significant proposals in the history of Uniswap governance, UNIfication, was passed with overwhelming support. The core of this proposal is the activation of the protocol-level fee switch, complemented by a one-time burn of 100 million UNI tokens, fundamentally reshaping its economic properties. This shift is viewed as the definitive conclusion to the industry’s long-standing "wen fee switch" debate. Previously delayed due to regulatory pressures, the plan has now been implemented following improvements in the external environment. Execution measures include activating fee switches across multiple versions on the mainnet and incorporating revenue from the new Unichain into the burn mechanism.

With over 99% of the votes in favor, the results demonstrate a high level of community consensus following years of debate over value non-capture. Uniswap can no longer operate indefinitely as a pure public good without returning protocol value to the token layer. The passing of this proposal transforms UNI from a "governance option" into an asset anchored by protocol cash flow expectations. Its valuation logic is expected to align more closely with high-performing protocols that possess mature capture mechanisms, setting a new paradigm for value return in DeFi.

In stark contrast to the consensus at Uniswap, Aave experienced a highly divisive governance storm over the past two weeks. In mid-December, the community discovered that fees from the new CoW Swap front-end integration—estimated at $8 million to $10 million annually—were being routed to the Labs team's private wallets rather than the DAO treasury, sparking intense accusations of "invisible privatization." A subsequent proposal demanded the transfer of core ownership—including brand assets, domains, and trademarks—to a DAO entity to establish an anti-capture mechanism. The Labs team pushed for an expedited snapshot vote in late December. Although the ownership transfer was ultimately rejected on December 26 with a 55% opposition rate, the founder's large-scale token accumulation during this period raised further questions regarding governance fairness.

The essence of the Aave incident is not merely the success or failure of a specific proposal, but a more pointed question: within existing legal and commercial frameworks, to what extent can a DAO truly exert control over a development team? When a protocol generates tens of millions of dollars in stable annual cash flow and its front-end and brand become core assets, the alignment of interests between the DAO and the development entity can no longer be maintained by "ideological consensus" alone. This controversy is likely to become a landmark case in DeFi history regarding the boundaries of DAO sovereignty, forcing the industry to rethink the reality of structural control in decentralized governance.

By comparison, the changes at Lido appear more incremental yet are equally profound. Last week, the Lido DAO passed the Whitehat Safe Harbor security proposal with unanimous approval, allowing whitehat hackers to intervene and rescue funds during real-time protocol attacks. The mechanism allows hackers to return recovered assets to a designated recovery address without legal repercussions, offering a reward of 10% of the recovered funds, capped at $2 million. Against the backdrop of massive industry losses to exploits this year, this move marks a shift in Lido’s security strategy from passive bug bounties to active, real-time rescue.

Significantly, this upgrade adds a layer of protection to the approximately $26 billion in assets managed by Lido, reflecting the maturity of top-tier protocols in security governance. Combined with its latest GOOSE-3 roadmap, Lido is evolving from a pure liquid staking tool into an all-encompassing DeFi ecosystem featuring yield vaults and real-world assets (RWA). The implementation of the Safe Harbor agreement not only reinforces the security of stETH but also facilitates Lido’s smooth transition into a more complex financial system while maintaining its central role in the Ethereum ecosystem.

From Uniswap's fee distribution, to Aave's governance conflict, to Lido's security governance and product boundary expansion—these three news threads collectively point to one trend: DeFi is moving from a phase driven by technology and traffic into a stage of redistribution of rights, responsibilities, revenue, and governance structures. For the secondary market, this means valuations will no longer revolve solely around TVL and market share, but will increasingly depend on three key questions:

-

Whether, and how, the protocol captures value for the token;

-

Whether the DAO possesses real control over core assets and revenue;

-

Whether expanding product boundaries brings structural growth or merely amplifies risks.

In this cycle, the true differentiation may no longer lie between "new projects vs. old projects," but within established protocols themselves—between those that successfully complete governance and economic model upgrades, and those that fail to resolve their internal contradictions.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.