KuCoin RWA Investment Guide: How to Earn Passive Income from Tokenized Assets

2025/08/13 09:54:01

As the cryptocurrency market enters a new phase of development, RWA (Real-World Assets) is becoming the next major investment trend. It not only injects real-world value into the crypto space but also offers unprecedented opportunities for everyday investors. This article will delve into the investment value of RWA and provide a practical guide on how to navigate this new trend on a leading platform like KuCoin, and earn passive income from tokenized assets.

What is RWA and Why Can It Generate Passive Income?

RWA, or Real-World Assets, refers to assets with real-world value that have traditionally been difficult to invest in, such as real estate, private credit, government bonds, and money market funds. Through tokenization, the ownership of these assets is fractionalized into digital tokens that can be traded on the blockchain.

RWA generates passive income because these tokens typically represent the right to the yields produced by their underlying assets. For example:

-

Tokenized Real Estate: The tokens you hold can entitle you to a proportional share of rental income.

-

Tokenized Bonds or Funds: The tokens you hold can entitle you to regular interest payments or dividends.

RWA tokenization bridges the gap between traditional finance and cryptocurrency, allowing everyday investors to participate in high-value asset investments with extremely low barriers, truly enabling financial inclusion.

Analysis of RWA Investment Advantages: Why It's Worth Paying Attention

The core advantages of RWA tokenization make it a highly attractive investment vehicle.

-

Fractional Ownership: Lowering Investment Barriers

In the past, investing in commercial real estate or a high-net-worth fund required a substantial amount of capital. Through tokenization, these assets are divided into countless small portions, allowing you to purchase a fraction of the ownership with very little money. This significantly lowers the barrier to entry, enabling more people to participate.

-

Increased Liquidity: Trade Anytime

The process of buying and selling traditional assets (like real estate) is complex, time-consuming, and costly. RWA tokenization gives these assets the liquidity of cryptocurrencies, allowing you to buy and sell your tokenized assets on platforms like KuCoin 24/7, just like trading Bitcoin, which enhances asset convertibility.

-

Real Value Anchor: Lower Volatility

Unlike purely crypto-native tokens, the value of RWA tokens is derived from real-world, physical assets. Their returns and value fluctuations are typically correlated with the performance of the underlying assets, making their prices relatively more stable and serving as an effective tool for risk diversification within a crypto portfolio.

KuCoin RWA Practical Investment Guide

To invest in RWA on the KuCoin platform, you can follow these steps to better seize opportunities.

Step 1: Find RWA Projects

-

Follow Official Announcements: KuCoin regularly releases announcements for new project listings, which will include RWA-related tokens.

-

Use the Search Function: On KuCoin's trading page, search for RWA-related tokens, such as the recently highlighted RYT token.

-

Review Project Details: Click on a token and carefully read the project description to understand its underlying assets, compliance framework, and yield mechanisms. For example, the underlying asset of the RYT token is a money market fund from China Asset Management (Hong Kong).

Step 2: Evaluate Core Elements of an RWA Project

A qualified RWA project should possess the following core elements:

-

Authenticity of the Underlying Asset: Is the project issued by a reputable, regulated traditional institution? For instance, the RYT token's underlying asset is issued by China Asset Management (Hong Kong) and managed by Standard Chartered Bank (Hong Kong), which provides a high degree of credibility.

-

Compliance: Does the project adhere to a strict regulatory framework? Compliance is key to ensuring asset security and long-term value.

-

Transparency: Does the project publicly disclose information about its underlying assets, such as their value, yield performance, and audit reports?

Step 3: Develop Your Investment Strategy

-

Invest Small, Diversify Broadly: RWA is a new field, so it's advisable to adopt a strategy of small, diversified investments. Avoid concentrating all your funds on a single project.

-

Long-Term Holding: RWA returns typically come from the long-term performance of the underlying assets. It is better suited for a long-term allocation to achieve stable passive income.

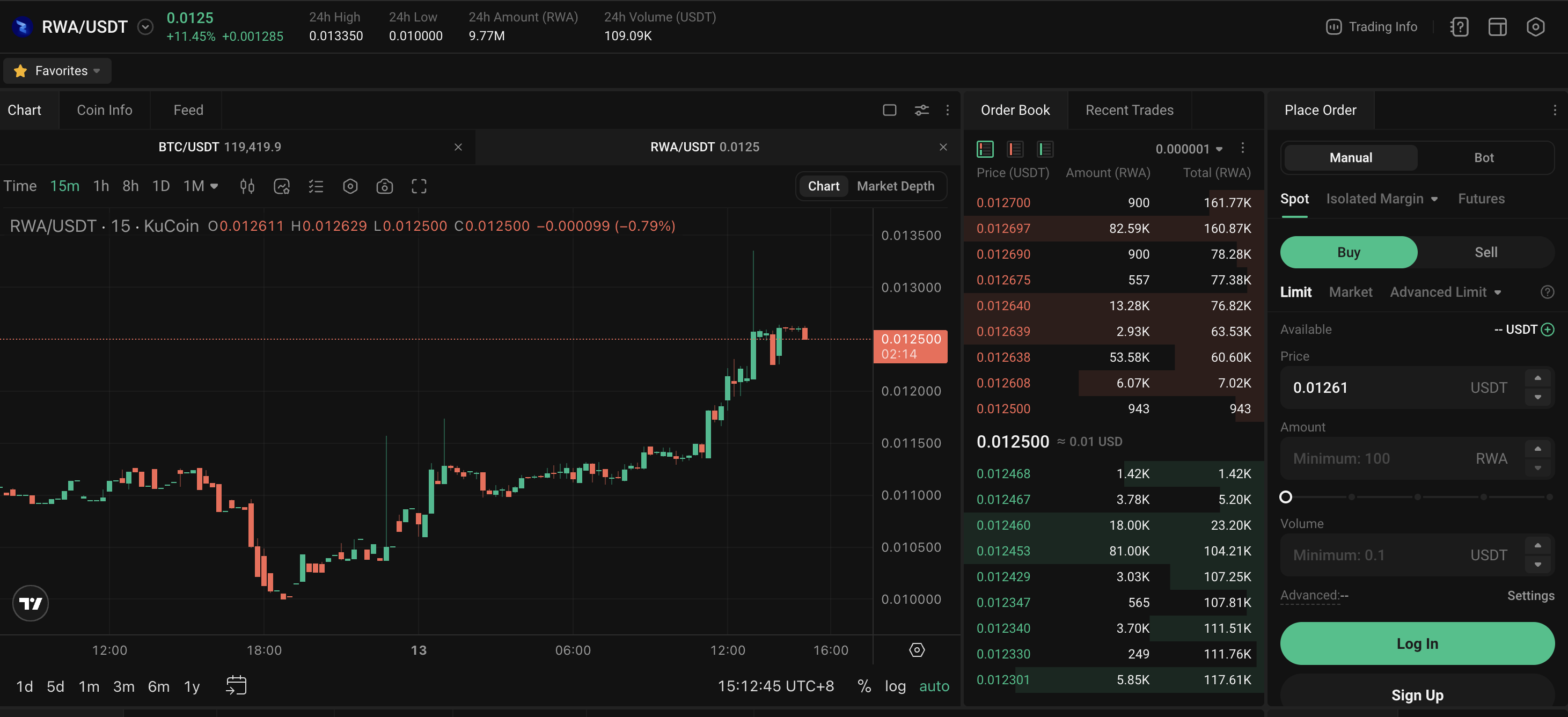

Below is the RWA token trading interface on the KuCoin platform.

Risk Warning: A Rational View of RWA Investment

-

Liquidity Risk: Although RWA has higher liquidity than traditional assets, token prices can still fluctuate significantly during market panic or low trading volume, making it difficult to sell quickly.

-

Compliance Risk: The development of RWA is dependent on the regulatory environment. If policies change, it could impact a project's legality and value.

-

Smart Contract Risk: All on-chain assets face the risk of smart contract vulnerabilities. When selecting a project, prioritize those that have undergone professional audits.

In conclusion, RWA tokenization opens the door to high-value asset investment for the average person. By following a rigorous investment strategy and maintaining risk awareness on a compliant platform like KuCoin, you'll be better equipped to navigate this new wave, diversify your asset portfolio, and achieve steady passive income.