KuCoin Ventures Weekly Report 20250512-0518

2025/05/20 02:15:19

KuCoin Ventures Weekly Report: Believe's One-Click Launch & Meme Market Shifts; Macro & Institutions Drive BTC Near ATH; Stablecoin Infrastructure Rising

1. Weekly Market Highlights

Believe Reborn: A Comeback in an Overcrowded On-Chain Token Launch Landscape

As meme token launch platforms become increasingly homogenous and saturated, Believe, founded by Australian entrepreneur Ben Pasternak, officially relaunched at the end of April 2025, aiming to redefine the on-chain token issuance model with lower entry barriers, stronger incentives, and a market-driven consensus mechanism. The project originally began as Clout, which focused on celebrity-backed social tokens but quickly faded due to overreliance on influencer hype.

With its reboot, Believe has pivoted away from celebrity-driven “clout coins” and now focuses on creating a permissionless, meme-based token launch platform with built-in community validation. Users can now issue tokens by simply posting on X (formerly Twitter) and tagging @LaunchACoin with a token name—no need to log into a DApp, fill out forms, or write smart contracts. Once a tweet reaches a threshold of social engagement (e.g., enough likes or reposts), the system automatically creates the token and injects initial liquidity via a bonding curve, letting market consensus determine the token’s viability.

On the protocol level, Believe has introduced a dynamic fee model to deter sniping and manipulation. Newly launched tokens are subject to very high trading fees, which gradually decrease to the standard 2% as the market stabilizes. Initial liquidity is automatically injected by the platform, eliminating the possibility of preloading large positions or manual liquidity provisioning. Once a token surpasses a market cap of around $100,000, Believe will escalate it to more advanced trading venues (such as Meteora), providing deeper liquidity and better execution.

Believe also breaks away from the traditional binary model of “platform vs. creator” by introducing “scout incentives.” In each transaction, 1% of the fees go to the token’s creator, 0.1% is rewarded to the scout who first promoted or discovered the token, and the remaining 0.9% goes to platform operations. This structure ensures creator compensation while also encouraging the community to actively identify and promote promising ideas.

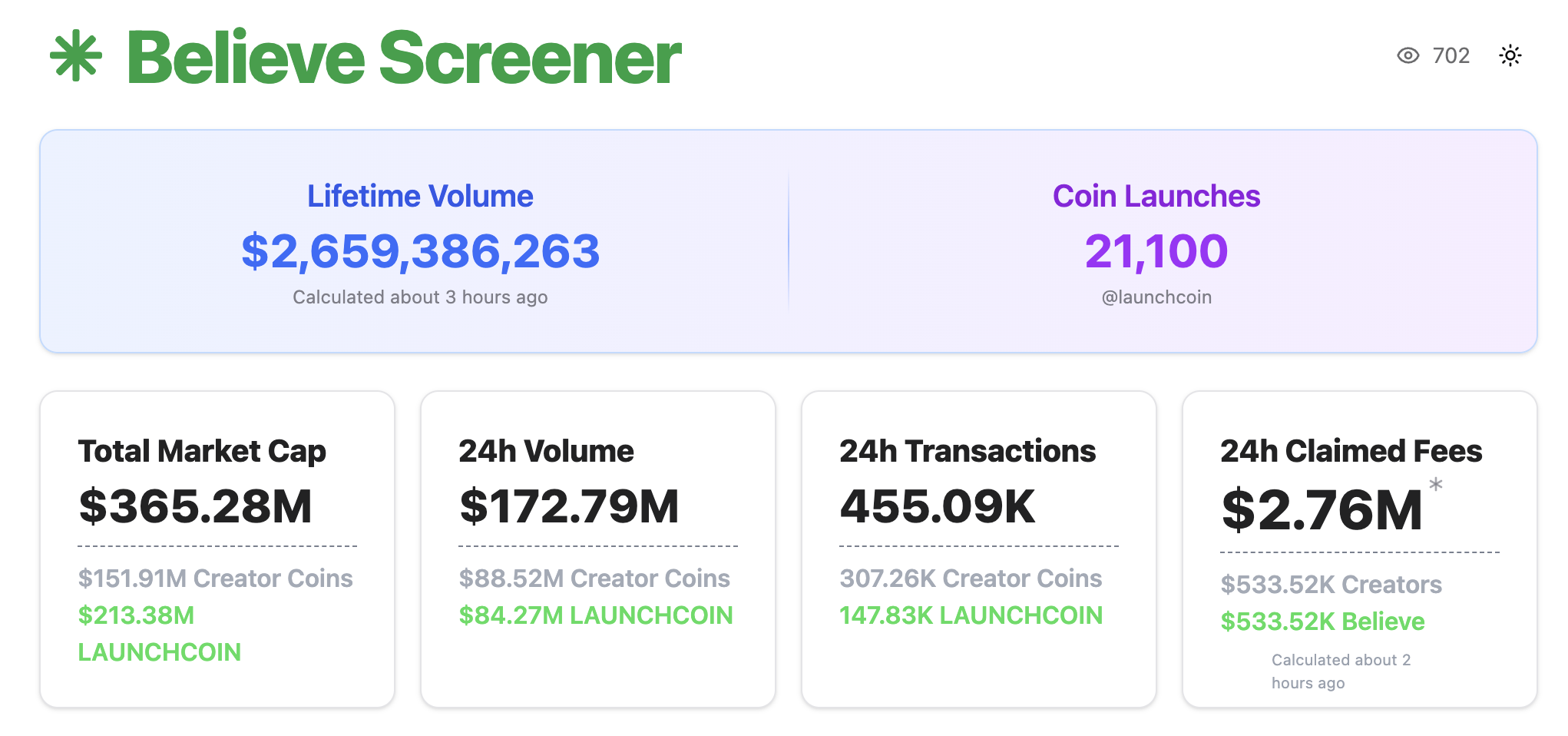

Data Source: https://www.believescreener.com/

According to official data, Believe has facilitated the launch of 21,100 tokens, with a total trading volume of $2.6 billion and 1,133 tokens having “graduated” (i.e., reached significant milestones). Among them, $LaunchCoin—originally released by Ben himself under the name $PASTERNAK—was rebranded and repurposed into the platform's flagship token. On the day of its relaunch, LaunchCoin surged 200x, reaching a market cap of $200 million and sparking heated discussions across the crypto community.

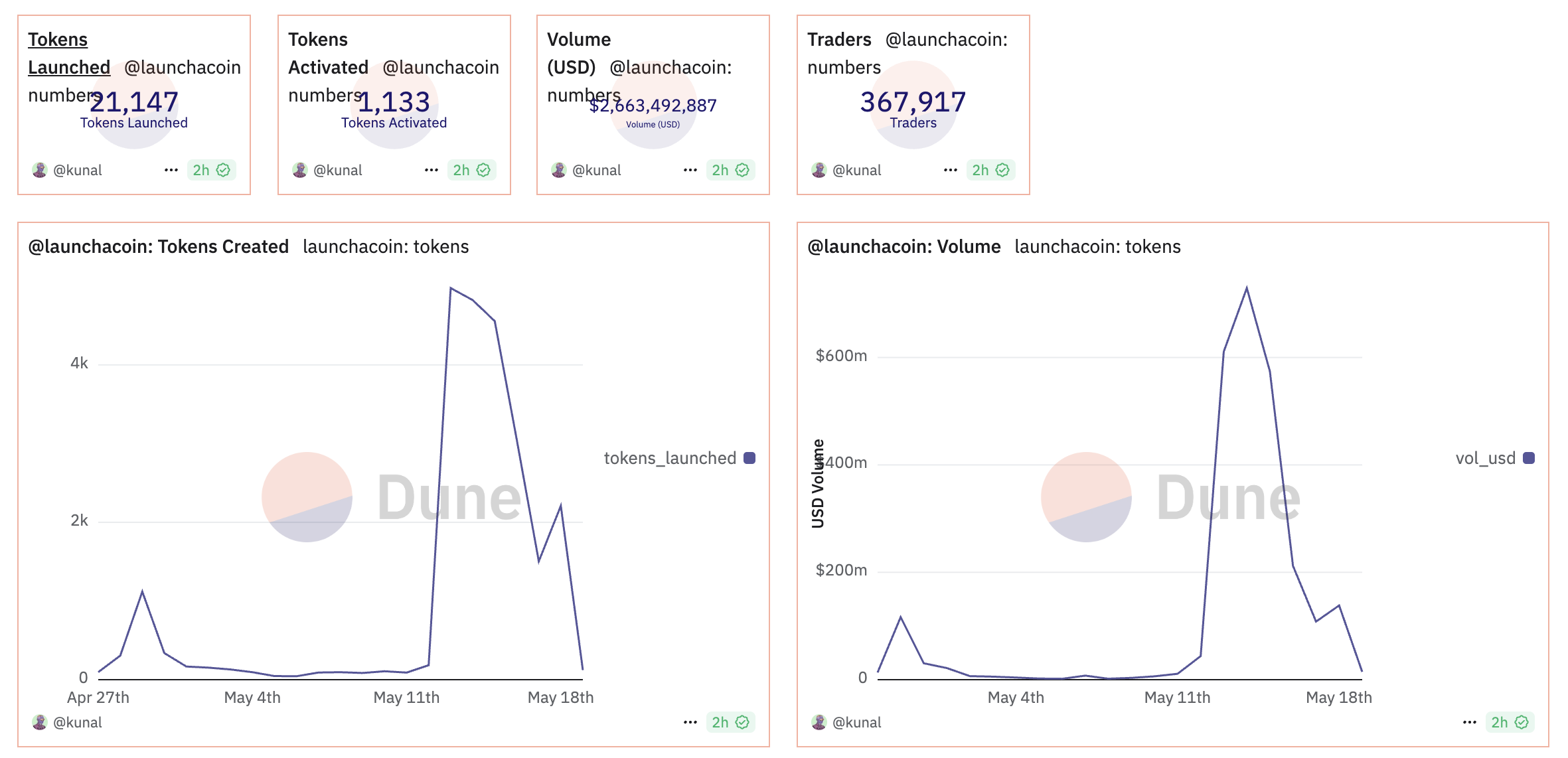

However, aside from LaunchCoin, the combined market cap of all other tokens is only $152 million. Platform activity peaked on May 13–14, but has since cooled, with both the number of daily launches and overall trading volumes showing a notable decline. The explosive “get-rich-quick” narrative is proving hard to replicate, and the era of wild growth may be coming to a close.

Going forward, competition among on-chain launch platforms will increasingly shift toward refined operations—those who can consistently launch viral hits, improve creator revenue models, and enhance user trading experiences are best positioned to dominate in the next market cycle.

Data Source: https://dune.com/kunal/launchacoin

2. Weekly Selected Market Signals

BTC hit $107,000 on Sunday night, just shy of a new all-time high

On the tariff front, the U.S. and Saudi Arabia sealed a $600 billion trade deal on Wednesday, initiating tariff rollbacks. The S&P 500 surged, recouping last month’s 17% decline. Last week’s U.S. Inflation data, with CPI and PPI both below expectations, is likely to bolster market bets on rate cuts. Markets currently see a higher probability of the federal funds rate staying at 4.25%-4.5% for the June and July FOMC meetings. Expectations for 2025 point to two rate cuts, with the likelihood of cuts rising significantly after September.

Another key driver is the growing trend of global listed companies and governments buying and holding BTC. Last week, Addentax Group Corp, a Nasdaq-listed Chinese textile and apparel firm, announced plans to acquire roughly 8,000 BTC through a common stock offering. Ukraine’s government is also considering establishing a strategic Bitcoin reserve.

BTC’s rally shows a relative lag compared to U.S. stocks. Its sharp climb on Sunday, when U.S. markets are closed, may reflect institutional portfolio rebalancing. Adjusting positions on Sunday avoids interference from U.S. stock trading and reduces competition for orders, making it an opportune time for price manipulation.

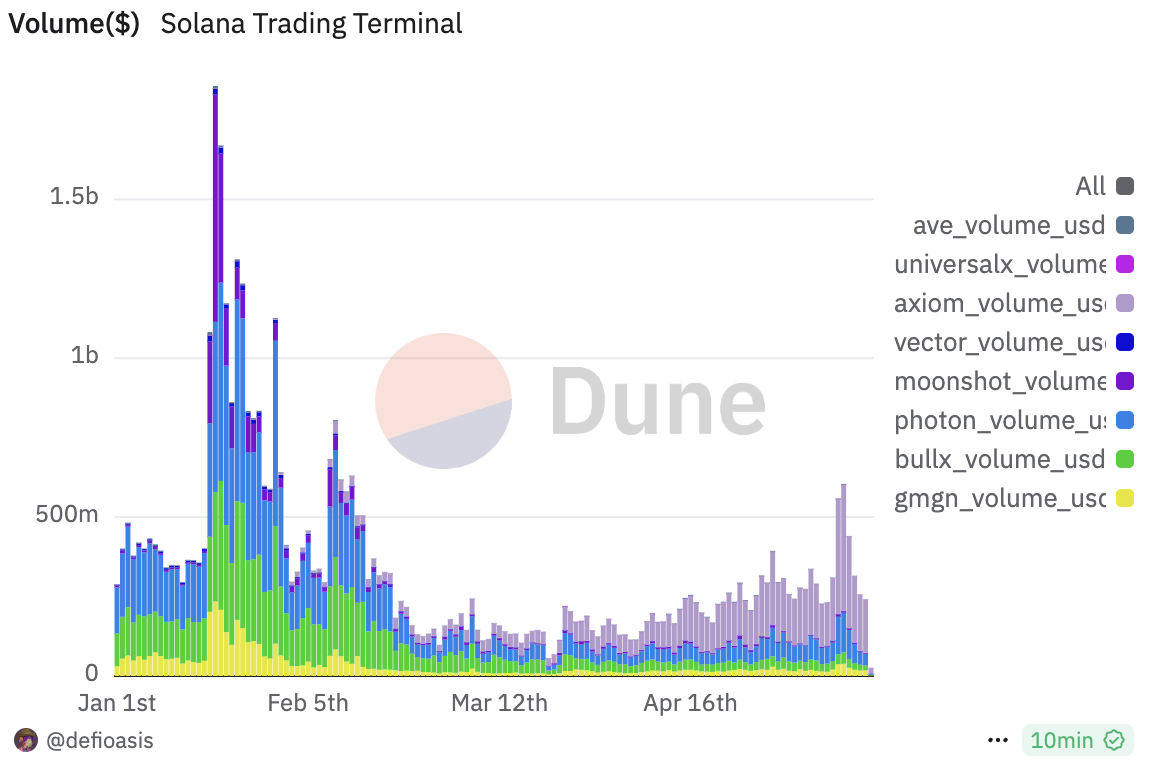

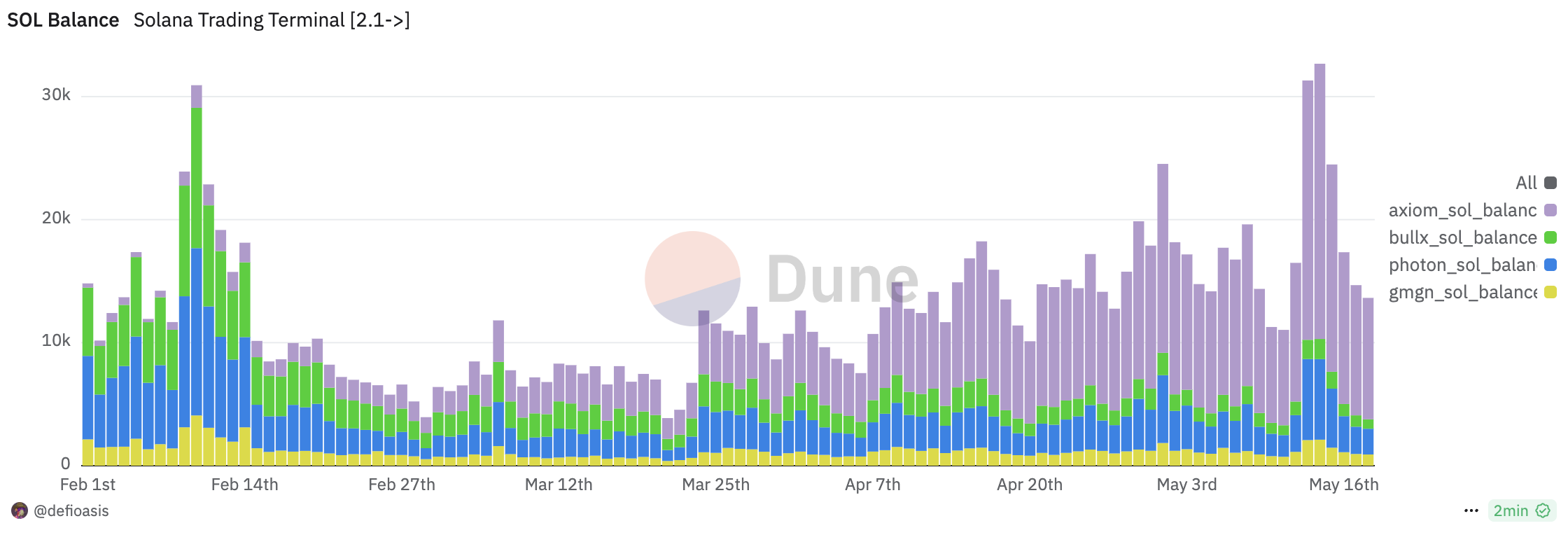

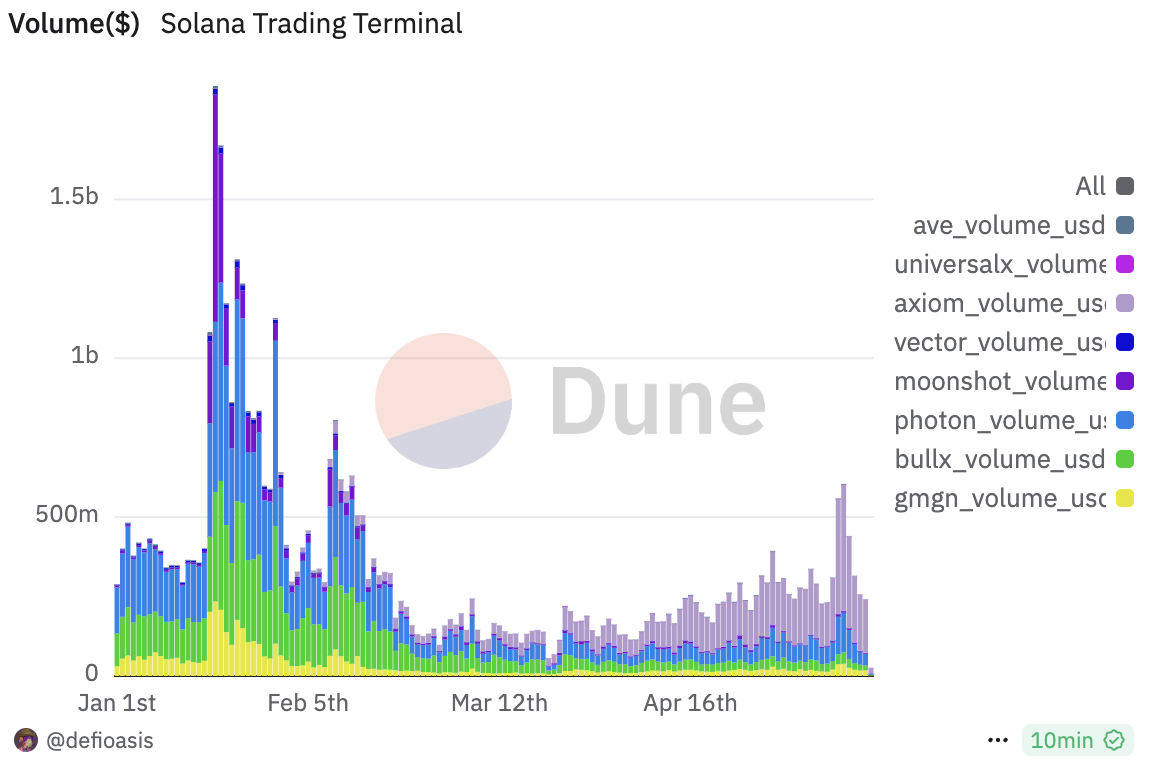

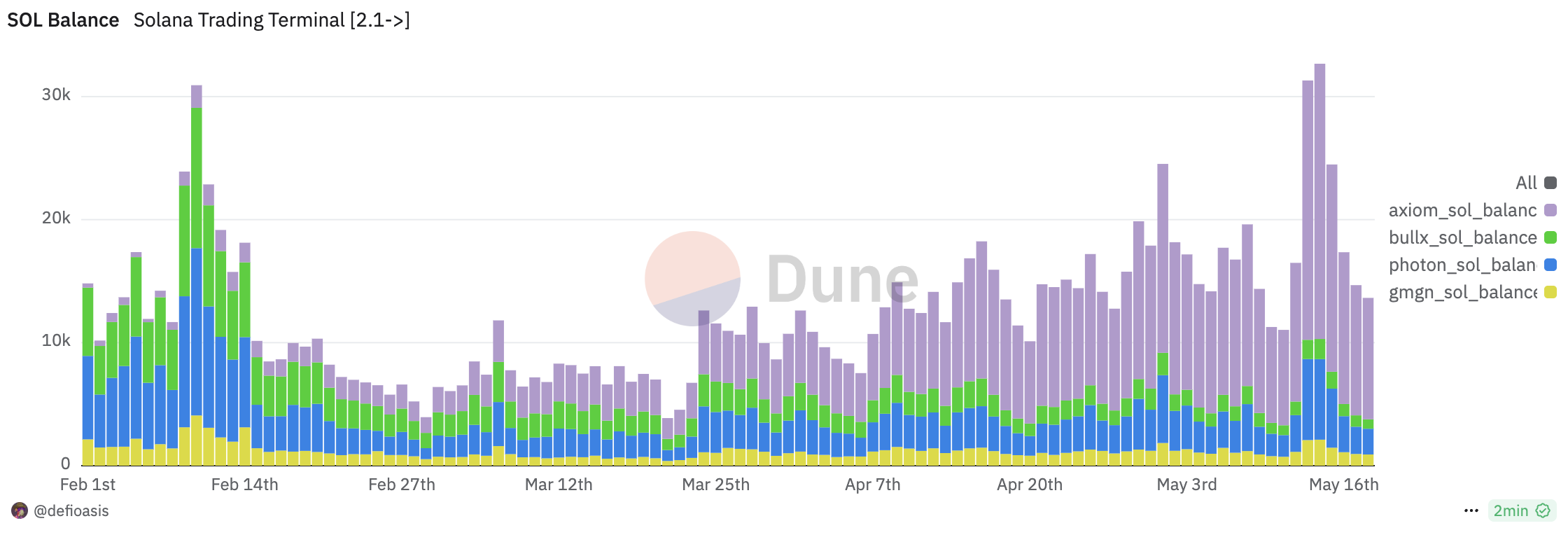

The recovery of on-chain potential purchasing power has gradually translated into trading volume

In April, the potential purchasing power of monthly traders on major meme trading platforms reached 410k SOL, nearing last November’s levels. However, at the start of May, this gradual recovery in purchasing power had yet to drive an increase in trading volume. With intensifying competition among meme launch platforms and the rising narrative around ICM Tokens, trading volume on major meme platforms surpassed $600 million on May 14, marking a high not seen since mid-February. Of this, Axiom accounted for nearly $400 million. Beyond trading volume, Axiom’s trader balance (i.e., potential purchasing power) hit 22.4k SOL that day, with an average transaction amount per user reaching $8.3k, reflecting robust purchasing power. These figures rival Photon’s performance during the TRUMP MELANIA token launch.

Data Source: https://dune.com/defioasis/solana-trading-terminal

Primary Market Financing Observations: YZi Launches Incubation Program for Web3, AI, and Healthcare; Sonic Ecosystem Sees Strong Rise

YZi Launches Incubation Program Targeting AI and Healthcare

YZi Labs has introduced the investment terms for its global incubation program, EASY Residence, focused on Web3, AI, and healthcare. The program invests $500,000 in selected startups, split into two parts:

-

$150,000 (for 5% equity, in SAFE format) - $3m FDV

-

$350,000 in the next financing round (uncapped SAFE)

SAFE (Simple Agreement for Future Equity): No maturity date, no interest, reducing repayment pressure on founders. It typically converts to equity in the next financing round (e.g., Series A) and includes terms like valuation caps and discount rates. Notably, the uncapped SAFE means this portion has no preset valuation cap, allowing investors to convert to equity at the valuation of the future round. This structure benefits founders by avoiding early-stage equity dilution at low valuations but carries higher risk for investors, who may enter at a higher valuation. YZi Labs aims to secure early-stage entry into high-potential startups at lower costs while providing founders with sufficient funding support.

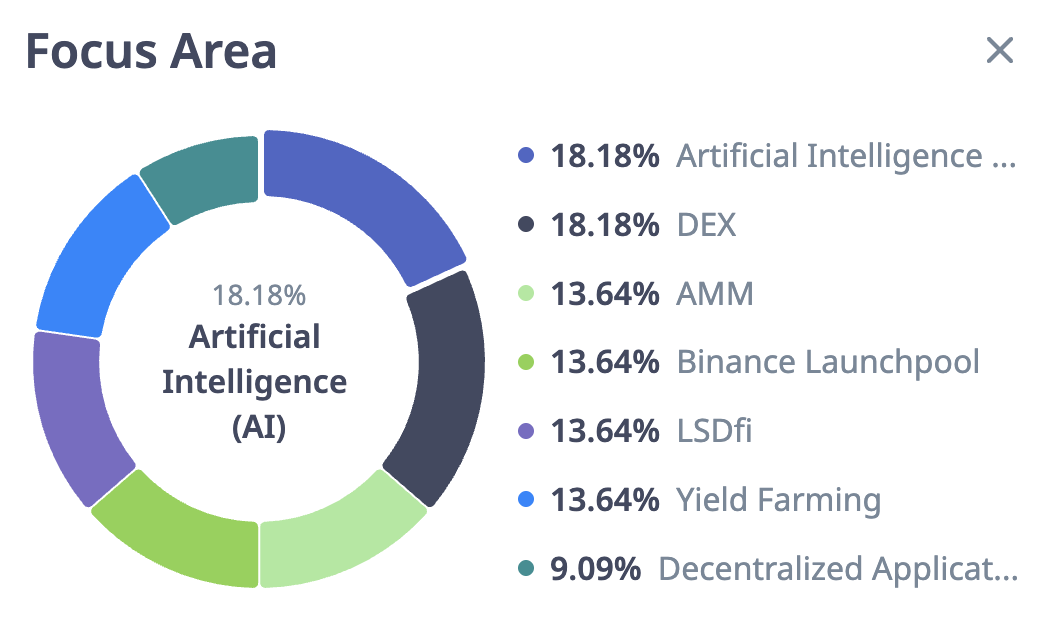

The AI sector has surpassed DEX to become YZi Labs’ top investment category.

Data Source: https://cryptorank.io/funds/binance-labs/rounds

Emerging Ecosystem on the Rise: Sonic Labs Completes $10M Strategic Financing for S Token, Bolstering Ecosystem Partnerships

Sonic, a Layer 1 blockchain launched by DeFi veteran AC, represents a technical and brand overhaul of Fantom. Sonic has been highly active recently, beyond its token financing. Sonic’s TVL recently hit $1 billion, and Circle’s native USDC has launched on Sonic, with a swap upgrade from the cross-chain to the native version set to complete this month. Over 92% of stablecoins on the chain are USDC. Additionally, Sonic is the first network after Ethereum, BNB Chain, Solana, and Base to launch on Binance Alpha 2.0, enabling Binance users to directly purchase Sonic chain assets like SHADOW, Anon, and BEETS using S and USDC assets on the platform. Notably, Sonic is the second network after BNB Chain to introduce an Alpha trading competition. Beyond driving the flywheel of DeFi protocols, AC-led Sonic exhibits a distinct style compared to its Fantom era, focusing not only on DeFi composability but also on strengthening network ecosystem collaborations with external partners.

3. Project Spotlight

Exploring M0 Protocol: The "Middleware" Powerhouse Behind Stablecoin Issuers

Beyond MEME coins and AI, stablecoins are highly likely to capture the spotlight in today's heated crypto discussions. Last week, the U.S. Senate did not pass the "Guiding and Establishing National Innovation in Stablecoins Act" (GENIUS Act), but further discussions and debates on amendments this week will undoubtedly continue to draw market attention. Against this backdrop, we have observed that a common partner, M0 Protocol, appears to be behind a series of emerging stablecoin projects.

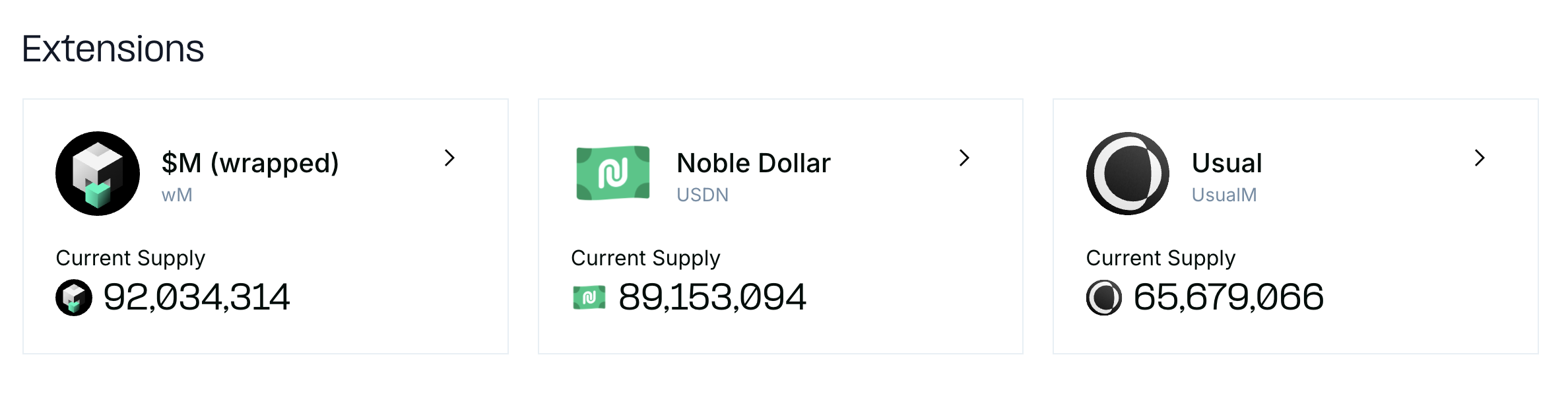

Data Source: https://dashboard.m0.org/

M0 Protocol has been noted as a collaborator in several stablecoin initiatives. For instance, M0 Protocol, in conjunction with Noble (Circle's official CCTP partner in Cosmos), launched USDN, a stablecoin with a circulating supply of $89 million USD. The project also partnered with Usual to introduce UsualM, which currently has an issuance of $65 million USD. Furthermore, it has collaborated with neobank KAST to issue stablecoins on Solana, enabling deposit tokenization, payments, savings, and other services.

Most recently, M^0 partnered with Felix, Hyperliquid's lending protocol, to launch HUSD, a collateralized stablecoin intrinsically linked to Hyperliquid's interests. Its approach involves using a portion of the yield from the underlying collateral (i.e., short-term U.S. Treasuries) to buy back HYPE, and then utilizing this HYPE to incentivize order book market makers, AMM LPs, copy-trading accounts, third-party developers, and other groups within the HyperCore / HyperEVM ecosystem through low fees, rebates, and mining rewards, thereby creating a growth flywheel by fostering a cycle of stablecoin use and trading.

M0 Protocol Architecture Analysis: The Underlying Infrastructure for Stablecoin Issuance

M0 Protocol has built a system combining on-chain smart contracts and off-chain governance guidance, dedicated to serving the stablecoin business. As middleware for stablecoin issuers, M0 Protocol does not directly interface with C-end customers but rather serves stablecoin issuers/operatorscatering to different public chains and diverse objectives.

M0 Protocol provides a standardized set of rules, processes, and smart contracts to transparently map the value of real-world collateral onto the blockchain, forming digital assets. M0 Protocol handles technical details such as collateral verification (via validators), minting logic, fee mechanisms, and risk management parameters. In theory, this allows Minters (i.e., various B2C stablecoin issuers) to focus more on the higher-level design, compliance, and market promotion of their stablecoin products. Currently, M0 Protocol's collateral primarily consists of short-term U.S. Treasury bonds, with maturities generally ranging from 0 to 120 days and an annualized yield of 4.34%. The project's operations revolve around three tokens: one collateral token and two governance tokens.

Data Source: https://dashboard.m0.org/

-

M Token is a "monetary building block." Minters utilize the M0 protocol to manage eligible collateral and generate M Tokens. Subsequently, developers can use M Tokens as the underlying asset to focus on the design, compliance, operation, and distribution of their upper-layer stablecoin products to achieve custom business objectives. The current total issuance of M tokens is $231 million USD.

-

POWER Token (Execution Layer Governance Token): POWER holders are responsible for voting on most regular proposals. POWER holders who actively participate in voting receive ZERO Tokens as a reward, and their POWER supply inflates proportionally. The voting power of POWER holders who do not participate in voting will be diluted, and unclaimed inflated POWER will be auctioned. POWER Token holders are more like the management/execution layer, accumulating reputation (ZERO tokens) through work to gain higher protocol governance authority.

-

ZERO Token (Ownership Layer Governance Token): ZERO holders are responsible for voting on more significant system changes, such as "resetting" the POWER token system or setting governance thresholds. ZERO holders are among the ultimate beneficiaries of the protocol, eligible to claim a portion of the fee income generated by the protocol (e.g., from the Minter Rate, penalties, proposal fees, and POWER auction proceeds). ZERO token holders are more like board members, possessing the highest authority within the project and receiving protocol benefits.

M0 Foundation secured a total of $57.5 million USD in funding in 2023 and 2024. Pantera Capital led the initial round and continued to invest in the subsequent round, with participation from institutions such as Bain Capital Crypto, Galaxy Digital, Wintermute, GSR, Standard Crypto, and ParaFi Capital. The team hails from MakerDAO and Circle, possessing considerable experience in stablecoin business development, product, and technology.

As competition in the stablecoin market intensifies and regulatory frameworks gradually become clearer, the value of projects население actively researching and providing underlying infrastructure and innovative solutions is increasingly prominent. The long-term impact and sustainability of such projects, and whether they can secure a place in the fiercely competitive stablecoin arena, still await further market validation. We will continue to track and observe these developments.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer: This content is provided for general informational purposes only, without any representation or warranty of any kind, nor shall it be construed as financial or investment advice. KuCoin Ventures shall not be liable for any errors or omissions, or for any outcomes resulting from the use of this information. Investments in digital assets can be risky.