KuCoin Ventures Weekly Report: The Triple Stress Test: A Simultaneous Deleveraging of DeFi, Macro, and Narrative Assets

2025/11/10 08:36:02

1. Weekly Market Highlights

Single-Point Failure, Systemic Amplification: The Balancer Attack Triggered Runs on DeFi Yield Products and Stablecoin Depegs

This week, the DeFi market again witnessed a chain reaction set off by a single security incident. The shock began with a major exploit of Balancer’s V2 contracts, with media and security firms estimating losses at roughly $128 million. Technically, the attacker exploited a flaw in how the contracts handled decimal precision and rounding, using micro-sized, batched swaps to accumulate small errors, gradually distorting pool pricing and, within the contract’s allowed interaction pathways, draining assets at very low cost.

Soon after, on-chain yield platform Stream Finance disclosed about $93 million in losses tied to an external asset manager and suspended deposits/withdrawals. To be clear, Stream’s blow-up is not a strict, direct causal consequence of the Balancer exploit and was also affected by the earlier “10/11” mass liquidation event, but it acted as a risk amplifier at the market-structure and sentiment levels: damage to upstream infrastructure sparked fear, LPs withdrew, and market-making depth thinned. Against that backdrop, any deviation in a platform’s own strategies or those of external managers can rapidly turn manageable redemptions into a run, triggering a self-reinforcing “redemption → sell pressure → price decline → more redemptions” loop.

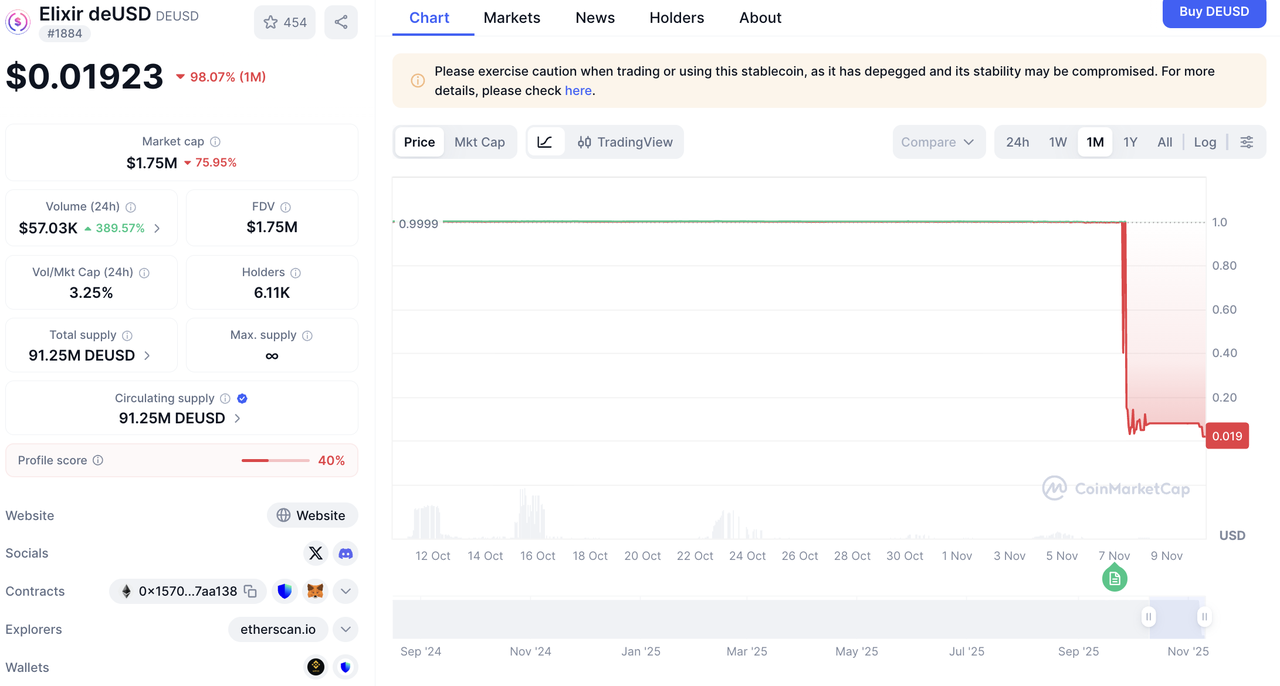

Once upstream liquidity and mid-tier yield products came under stress, pressure quickly propagated downstream to lending and stablecoins. deUSD, with exposure related to Stream, saw its collateral and redemption pathways impaired and the project was forced to wind it down. USDX, hit by the combination of a liquidity vacuum and market-making imbalance, depegged deeply, at one point trading in the $0.30–$0.40 range and has since fallen below $0.01. Both cases highlight the fragile boundary of “stability”: when redemption windows clog, market-maker inventory is insufficient, and collateral values drop simultaneously, the peg can fail non-linearly over short intervals, producing a “price drop → redemption panic → liquidity air-pocket → further price drop” death spiral.

Data Source: CoinMarketCap

At a higher level, this shock reveals structural fragilities in DeFi rather than an isolated accident. First, multi-layered counterparties and strategy chains turn “composability” into a double-edged sword: any mismatch in one link can be amplified along the redemption path. Second, redemption mechanisms and pegs depend heavily on AMM depth and oracle robustness—dependencies that are inherently fragile in stressed markets. Third, limited disclosure and poor timing alignment exacerbate pessimistic pricing: the less transparent the asset mix, the deeper the panic-driven discount.

Accordingly, assessing current and forward risk should look beyond single-asset price moves and focus on structural signals: whether net redemptions in core pools are persistently diverging from market-making depth; whether counterparty/custody concentration at key protocols is rising; and whether the re-pegging lag after a stablecoin depeg is lengthening. Compared with point-in-time price action, these indicators are better at flagging early the self-reinforcing loop among prices, flows, and trust, and at distinguishing short-lived, self-healing disturbances from pressures that may spill over system-wide.

2. Weekly Selected Market Signals

Macro Liquidity Drain and On-Chain Risks Resonate, Awaiting a Breakthrough from Washington and the Fed

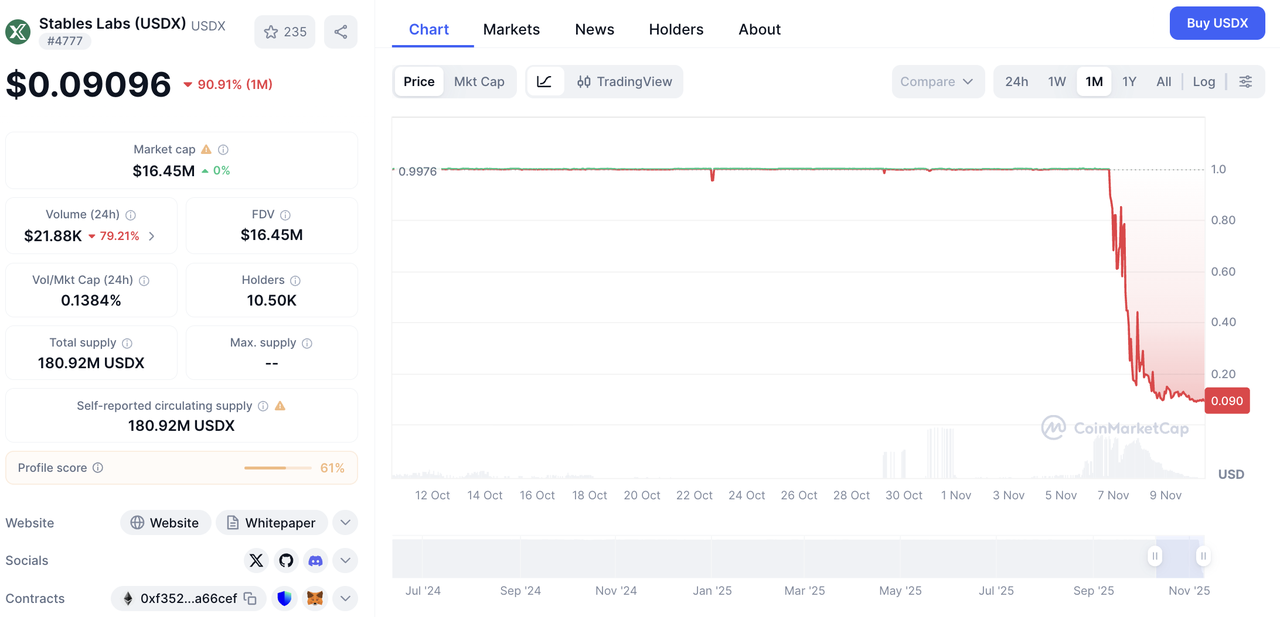

Global capital markets, particularly in the United States, were hit by a sudden liquidity storm last week. The epicenter of this storm was the rapidly swelling Treasury General Account (TGA), a direct consequence of the prolonged U.S. government shutdown. The mechanism is straightforward: during the shutdown, the Treasury continues to raise funds from the market by issuing bonds (inflows to the TGA), while the majority of government spending is halted (outflows from the TGA are blocked). This one-way flow of funds has trapped capital within the TGA, preventing it from circulating in the market. As a result, the TGA balance has surged from $300 billion to approximately $1 trillion over the past three months, effectively siphoning a massive amount of liquidity from the financial system. Compounding this issue, the Federal Reserve's quantitative tightening (QT) over the past three years had already drained liquidity, making the Treasury's actions an exacerbating factor that has left bank reserves dwindling and the financial system's capital buffer nearly depleted.

This acute liquidity shortage has directly led to a stronger U.S. dollar and placed significant pressure on risk assets like equities, with the S&P 500 trending downward amid rising risk-off sentiment. The U.S. stock market experienced a "Black Tuesday" last week, with all three major indices falling sharply. Tech stocks were the hardest-hit, with the Nasdaq Composite plunging over 2% and the semiconductor index dropping by 4%. Although the market saw a rebound from its lows on Friday, it was not enough to prevent the end of its three-week winning streak.

Data Source: SoSoValue

The chill spread to the crypto markets, with capital outflows becoming particularly pronounced. ETF fund flow data shows a net outflow of $1.22 billion from BTC ETFs and $507 million from ETH ETFs in a single week. Notably, however, two SOL ETFs bucked the trend, recording a net inflow of $136 million, indicating that some capital is actively seeking new havens or speculative opportunities.

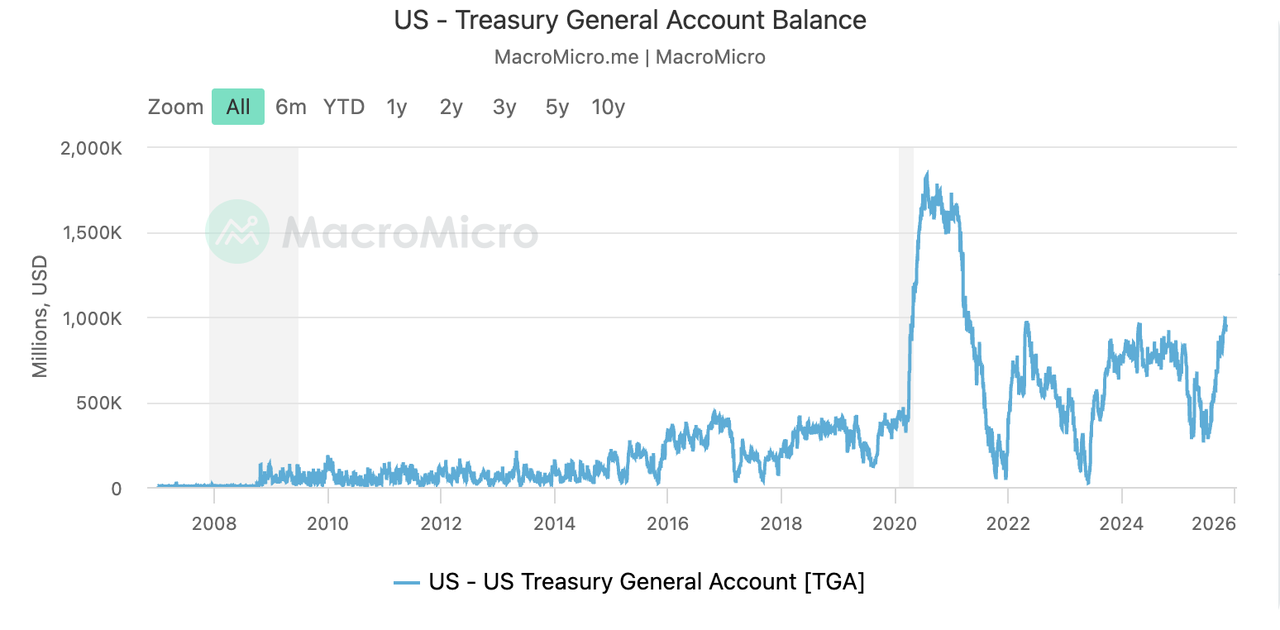

Data Source: DeFiLlama

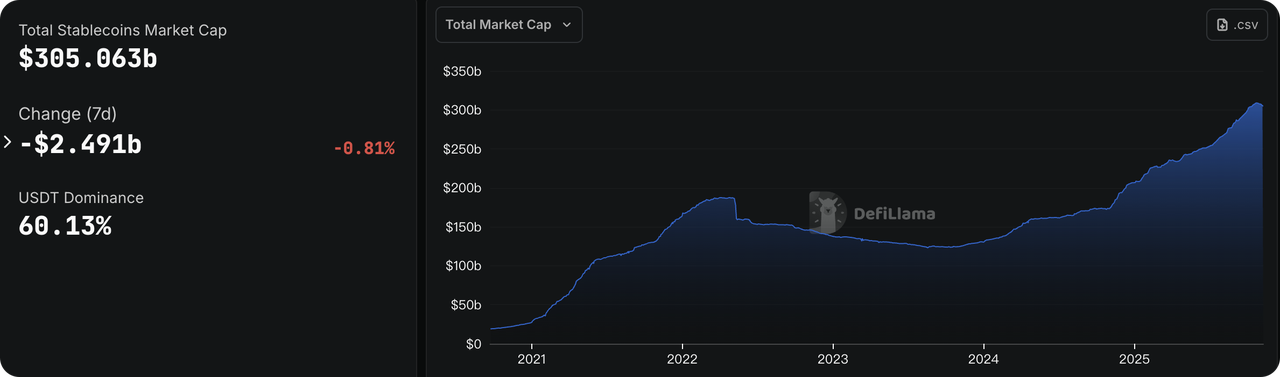

To make matters worse, risk events within the crypto ecosystem have amplified fear and concern among large capital holders. The exploit of a smart contract vulnerability on Balancer last week triggered a massive withdrawal of funds from the DeFi sector. According to DeFiLlama data, the total value locked (TVL) in crypto DeFi plummeted from nearly $150 billion to a low of $130 billion, an evaporation of about $20 billion in one week. More alarmingly, the total supply of stablecoins has also begun to retract, showing signs of growth stagnation reminiscent of the period before the UST collapse in 2022. The supply of USDe has been nearly halved from its peak, while leading stablecoins like USDT and USDC have also recorded modest negative growth.

Data Source: CME FedWatch Tool

According to the CME FedWatch Tool, the interest rate futures market is pricing in a 66.8% probability of a 25-basis-point rate cut by the Federal Reserve in December. This market expectation stems primarily from concerns over financial stability: the liquidity crisis sparked by the government shutdown has caused key interest rates to spike, and combined with the significant pullback in risk assets, the market believes the Fed will be forced to intervene to stabilize the system.

However, this market pricing is in stark contrast to the dilemma facing the Fed. The very government shutdown that caused the liquidity crisis has also created a data vacuum for key economic indicators like the non-farm payrolls and CPI reports. This leaves the data-dependent Fed "flying blind." The absence of hard data provides hawkish officials, who are concerned about a resurgence of inflation, with a strong rationale to hold rates steady in December, injecting a high degree of uncertainty into the upcoming FOMC meeting.

Data Source: https://polymarket.com/event/when-will-the-government-shutdown-end-545?tid=1762742554499

-

A Glimmer of Hope for a Government Reopening: The prediction market on Polymarket shows the probability of the U.S. government reopening this week (Nov 12-15) soaring. This follows reports that the Senate has reached an agreement to end the shutdown, suggesting a potential breakthrough in what has become the longest government shutdown in U.S. history.

-

Fed Officials in the Spotlight: A number of Federal Reserve officials, including several FOMC voting members, and Treasury Secretary Bentsen are scheduled to speak this week. With official data unavailable, their comments will be scrutinized by the market for any clues regarding the future policy path.

Primary Market Observations:

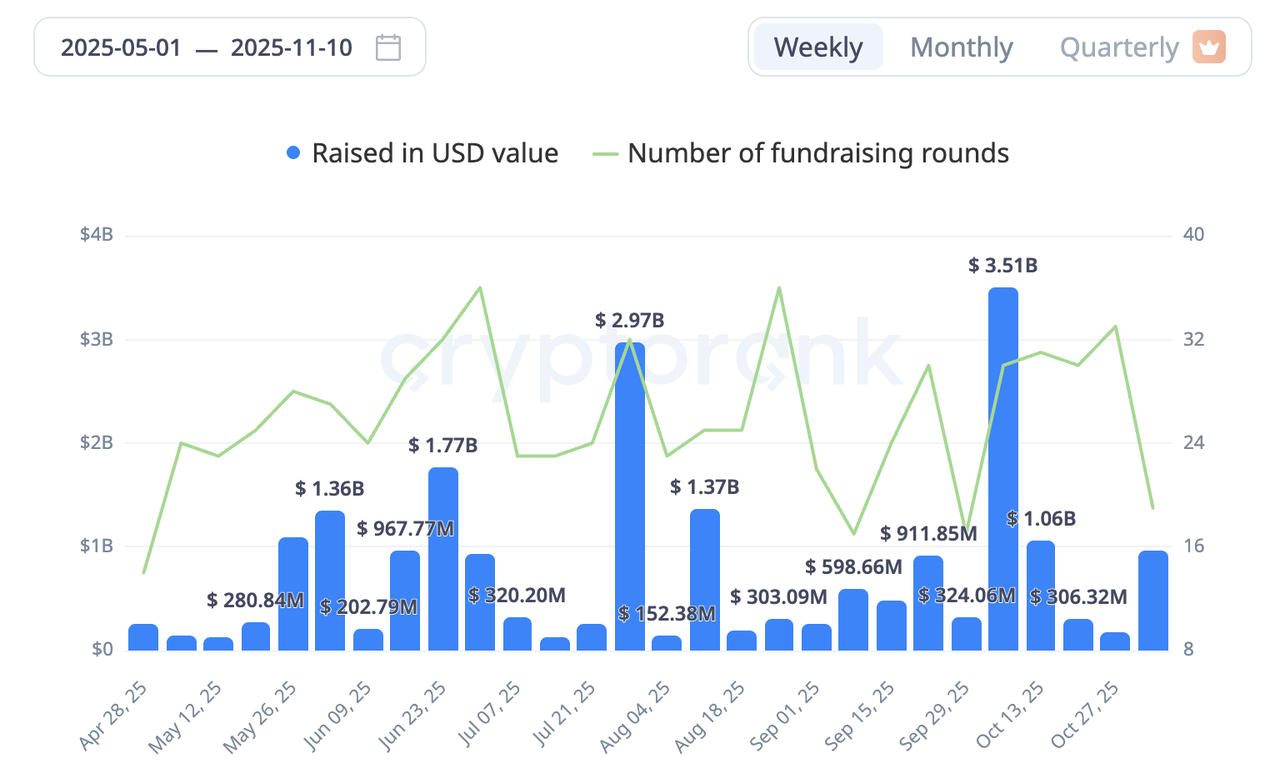

Crypto primary market fundraising saw a rebound last week. Notable rounds included Ripple's first external fundraise in nearly six years, a strategic round amounting to $500 million. Additionally, biotech public company Tharimmune (THAR) successfully raised $540 million to pivot and become the treasury for the DAT-concept Canton Coin (CC).

Data Source: CryptoRank

A Mix of Chaos and Vigor: Stable's Mid-Stream Rule Change Still Leads to Massive Oversubscription

The focal point of the primary market last week was undoubtedly the second phase of the pre-deposit event for the stablecoin-focused L1 blockchain, Stable. This phase was designed to address community criticism of "whale domination" during the first round by introducing a more "equitable" mechanism. However, the process was fraught with complications.

Upon launch, immense market enthusiasm quickly devolved into a chaotic fundraising scene. The official front-end interface was congested due to overwhelming traffic, and some eager participants who tried to bypass it by interacting directly with the smart contract ended up sending funds to the wrong address by mistake. In response, the project team adjusted the rules mid-stream, not only reopening the deposit window for 24 hours but also increasing the per-wallet cap to $1 million. While this solved the congestion issue, it sparked fresh controversy in the community, with critics arguing it deviated from the original principle of fair participation.

Despite the initial chaos and subsequent controversy, the event ultimately attracted nearly $1.8 billion in deposits, far exceeding the $500 million hard cap. On the very same day the event launched, Binance listed a STABLEUSDT perpetual contract for pre-market trading. Based on the total supply of 100 billion tokens and its trading price (approx. $0.056 at the time of writing), the market assigned Stable a Fully Diluted Valuation (FDV) of $5.6 billion.

The underlying reason for this chaotic yet wildly successful outcome is that, in the wake of recent implosions in DeFi stablecoin yield protocols, a large amount of capital seeking both safety and high potential returns viewed Stable's pre-deposit event as an ideal destination. Therefore, the turbulent process, the massive oversubscription, and the high early-stage valuation from the secondary market collectively reflect the market's intense interest and complex expectations for the project.

3. Project Spotlight

DAT: Rapid Premium Compression—Entering a “Sell Coins to Buy Back Stock” De-frothing Phase

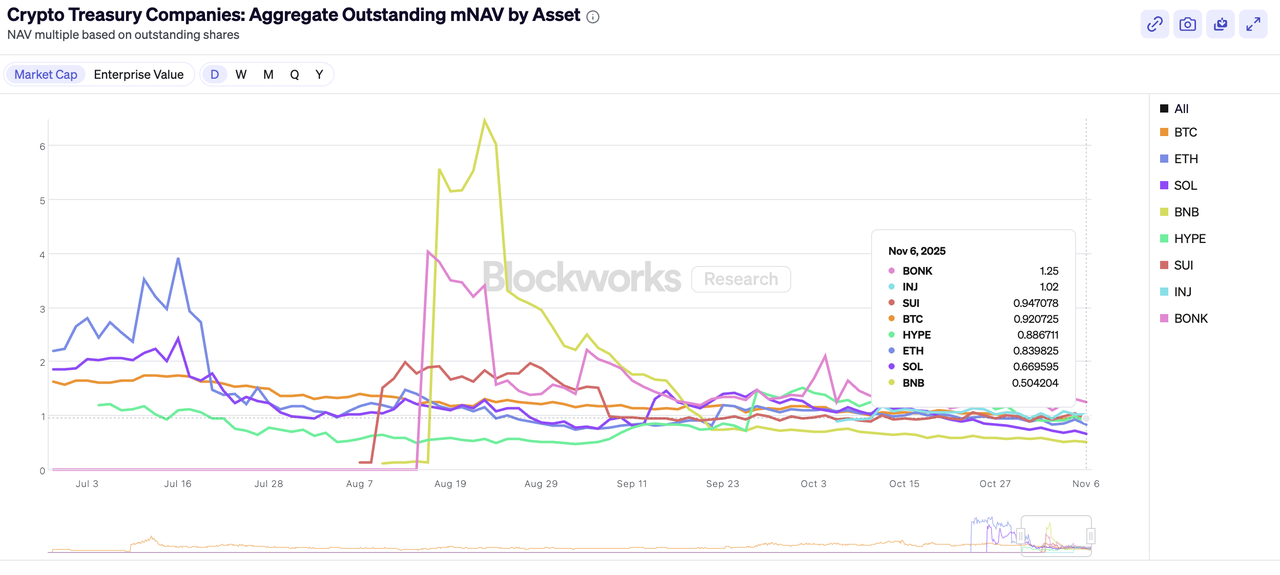

With crypto markets sliding in recent weeks, investors are increasingly questioning DAT (digital asset treasury) plays. Equity premia for treasury-driven models are compressing quickly, and the trading focus is shifting from “story-driven multiple expansion” to “using buybacks to close discounts.” MicroStrategy (MSTR) is now down more than half from its cycle peak, while many altcoin-linked DAT names have fallen over 80% from highs. The market no longer treats these stocks as “high-beta proxies” for BTC/ETH; pricing is reverting toward underlying net asset value (NAV).

DAT valuations are not anchored in recurring operating cash flows but in treasury NAV plus a narrative premium. As the narrative spread and imitators piled in, scarcity diluted and the premium base eroded. With regulatory probes tightening and short-seller reports (e.g., Kerrisdale Capital) intensifying, the weak point in a down market has been laid bare: insufficient cash generation to offset asset impairments, which amplifies pro-cyclical repricing.

Data Source: https://blockworks.com/analytics/treasury-companies/crypto-treasury-companies-crypto-holdings

On the ETH side, ETHZilla has set a clear template: sell roughly $40M equivalent in ETH to raise cash, then repurchase about 600,000 shares to narrow the stock’s discount to NAV—while stating buybacks will continue as long as a discount persists. SharpLink Gaming (SBET) is also advancing its previously approved up to $1.5B buyback authorization, emphasizing purchases when the share price trades below its crypto NAV. In the short run, these moves help repair equity discounts; system-wide, however, they normalize a “sell coins → fund buybacks” loop that, in weak markets, lifts marginal spot supply, creating tension between equity repair and underlying sell pressure.

Mechanically, this reset is visible in the decline of the mNAV/NAV (market value to NAV) multiple. As premia fade and financing windows narrow, firms lean more on disposing of treasury assets to buy back stock, de-lever, and support prices. The result: equity discounts narrow while spot markets absorb greater sell pressure—reflexivity flowing from equities back into coin prices. For now, the segment remains in a de-frothing and repricing phase; premium and buyback cadence warrant close tracking, and it is too early to assume a V-shaped recovery.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.