Mastering Volatility: Advanced Strategies and Risk Management for BTC Futures Trading

For the experienced trader, the world of BTC futures trading represents both a thrilling challenge and a profound opportunity. Beyond simple directional bets, the cryptocurrency futures market offers a suite of advanced tools and strategies to navigate its notorious volatility. This article delves into sophisticated techniques, from hedging and arbitrage to disciplined risk management, designed for those who have already built a foundation in trading and are now seeking a competitive edge.

Hedging & Arbitrage Strategies Using Futures

While betting on price direction is the most common form of BTC futures trading, seasoned traders know that the market's complexity allows for a variety of more nuanced strategies. These techniques are designed to exploit market inefficiencies, manage risk, or generate returns in different market conditions.

Understanding Hedging with Futures

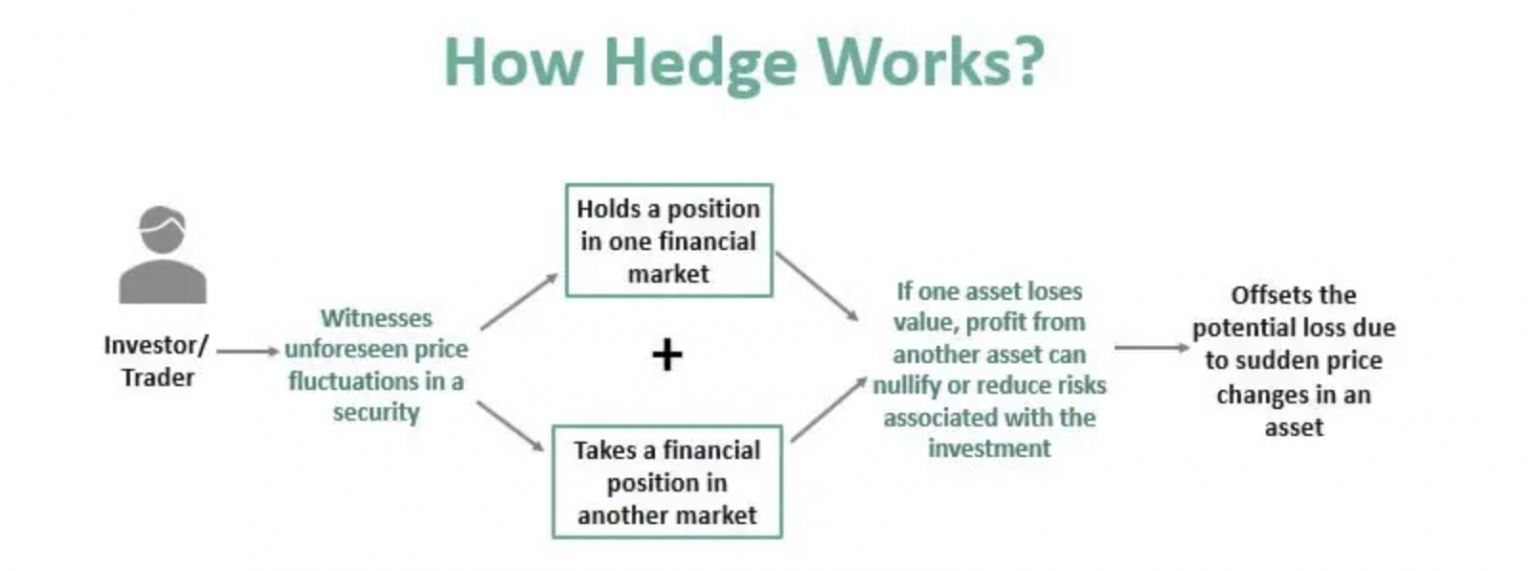

At its core, hedging is a risk management technique used to offset potential losses in one position by taking an opposite position in a related instrument. In the context of cryptocurrency, this means using a BTC futures contract to mitigate the risk of adverse price movements on a spot Bitcoin position. By creating this counterbalance, a trader can protect the value of their holdings without having to liquidate the underlying asset, which is particularly useful for long-term investors or those awaiting a better selling opportunity.

A primary use case is the short hedge, where a trader who holds a spot position in BTC opens a short position of equivalent size in a BTC perpetual futures contract. Should the market experience a downturn, the losses incurred on the spot position will be largely offset by the profits from the futures position. This strategy effectively "locks in" the current portfolio value, shielding it from short-term price drops.

Image: WallstreetMojo

Image: WallstreetMojo

Understanding Arbitrage with Futures

Arbitrage is a market-neutral strategy that aims to profit from the temporary price discrepancies of the same asset across different markets or instruments. In the context of BTC perpetual futures, arbitrage is a key advanced strategy. A classic example is cash-and-carry arbitrage, where a trader buys Bitcoin on a spot exchange and simultaneously sells a futures contract at a higher price. The difference between the futures price and the spot price, known as the basis, is the theoretical profit. The trader holds the spot BTC until the futures contract's expiration, at which point the basis converges to zero and the profit is realized. For BTC perpetual futures, this strategy is adapted based on the funding rate. When the funding rate is significantly positive, a trader can short the perpetual contract while holding spot BTC. This allows them to collect the funding payments from long positions, effectively creating a yield on their spot holdings with minimal directional risk. This strategy is an elegant way to exploit a market inefficiency rather than speculating on price direction.

The Art of Execution: Trading Strategies and Technical Analysis

Rather than approaching trading strategies as a collection of disjointed tactics, experienced traders integrate them into a cohesive framework. Let's walk through an example to illustrate how different strategies and tools are applied in a single, well-defined trading scenario.

Imagine a trader, Alex, believes that after a strong rally, Bitcoin is likely to consolidate in a range before making its next move. He identifies key support at $65,000 and resistance at $70,000.

Range-Bound Trading with Volume and Volatility Confirmation

STEP 1: Initial Analysis & Position

Alex's primary strategy is to trade the range. He sets a plan to buy near support and sell near resistance. As BTC approaches the $65,000 support, he initiates a long position using BTC futures. He sets his stop-loss just below the $65,000 level at $64,800, invalidating his thesis if the range breaks. His take-profit is set near the $70,000 resistance.

STEP 2: Risk Management in Practice

Alex understands the power of leverage but uses it conservatively. He decides to use 5x leverage on his position, which gives him enough margin to withstand minor fluctuations within the range without facing immediate liquidation. This measured approach to leverage, coupled with a defined stop-loss, is a cornerstone of his risk management.

STEP 3: Volume Confirmation

As the price bounces off the $65,000 support, Alex observes a significant spike in trading volume. This volume confirmation reinforces his belief that there is strong buying interest at this level, increasing the probability of his long trade succeeding. He knows that if the bounce had occurred on low volume, he would have been more cautious or even avoided the trade entirely.

STEP 4: Adapting to a Breakout

A few days later, BTC convincingly breaks above the $70,000 resistance with a substantial surge in volume. This event invalidates his range-bound strategy. Instead of sticking to his original plan of selling at resistance, Alex recognizes the shift in market dynamics. He closes his range-bound trade for a profit and now considers a new trend-following strategy, potentially waiting for a retest of the $70,000 level (which now acts as new support) to enter a long position. This seamless transition from one strategy to another based on real-time market data is a hallmark of an advanced trader.

All in All, Trading is not a single action but a continuous process of analysis, strategy, execution, and adaptation. By treating each trade as part of a larger framework, a trader can manage risk and improve their probability of success.

Mastering Risk: The Ultimate Edge in BTC Futures Trading

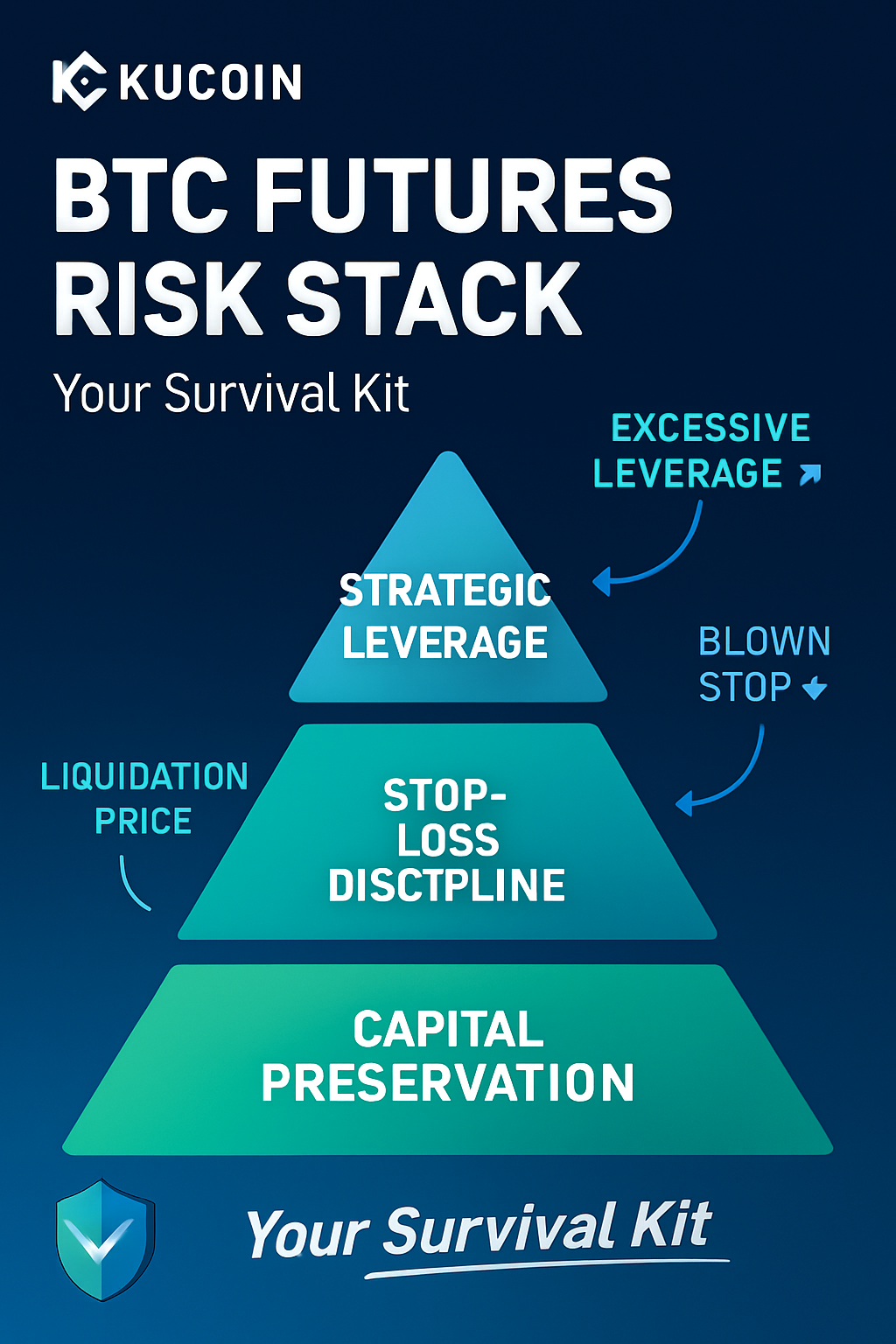

In the world of BTC perpetual futures, where leverage can amplify both gains and losses, risk management is not a secondary concern—it's the foundation of a sustainable career. An experienced trader knows that survival in the market depends on managing drawdowns and preserving capital.

- Strategic Leverage and Position Sizing

High leverage (e.g., 50x or 100x) is often tempting but is a direct path to liquidation for most traders. A seasoned approach involves using leverage strategically, not aggressively.

- Controlled Leverage: Instead of using maximum leverage, use a moderate amount (e.g., 5x-10x) that allows your position to withstand minor market fluctuations without getting liquidated.

- Position Sizing: The golden rule of risk management is never to risk more than a small percentage (e.g., 1-2%) of your total trading capital on any single trade. Your position size should be calculated based on your stop-loss and risk tolerance, not on the amount of margin you have available.

-

The Non-Negotiable Stop-Loss

Every trade must have an exit plan. A stop-loss order is your fail-safe, automatically closing your position when the price hits a predetermined level. For experienced traders, a stop-loss isn't just an order; it’s a crucial component of the trade setup, placed at the point where the initial trade hypothesis is invalidated. Sticking to your stop-loss without moving it is a hallmark of disciplined trading.

-

Managing Margin and Liquidation Risk

Understanding your margin and liquidation price is non-negotiable. Platforms like KuCoin provide a clear overview of your liquidation price in real-time. Actively monitoring your margin ratio allows you to make informed decisions about adding margin to a position to lower the liquidation price or reducing your position size to decrease risk.

Choosing the Right Tools and Platform

A trader is only as good as their tools. For BTC futures trading, choosing a reliable platform is essential for executing complex strategies. Look for platforms that offer:

- Deep Liquidity and a Robust Matching Engine: Crucial for minimizing slippage during high-volatility events.

- Advanced Order Types: The ability to use various order types like trailing stops and conditional orders is key for sophisticated strategies.

- A User-Friendly yet Powerful Interface: A clean interface that provides real-time data on funding rates, liquidation prices, and market depth is invaluable.

For those ready to put these advanced strategies into practice, you can find a comprehensive and powerful trading interface here: https://www.kucoin.com/futures/trade/XBTUSDCM

Discipline, Strategy, and Continuous Learning

The path to success in BTC futures trading is not defined by a single winning trade but by the consistent application of sound strategy and impeccable risk management. For the experienced trader, the goal is to move beyond mere speculation and use the advanced tools of the market to build a more robust and resilient trading system. By mastering strategies like hedging and arbitrage, combining technical analysis with a disciplined approach to risk, and continuously learning, you can truly master the volatility of the crypto market and secure your place as a formidable trader.