The Prediction Market Playbook: Uncovering Alpha, Top Players, Core Risks, and the Infrastructure Landscape

2025/11/10 08:36:02

Authors: KuCoin Ventures ( Claude, Mia, Oasis )

A hundred-billion-dollar information war has begun. When Polymarket, with its collective intelligence forged from billions of dollars, predicted the US election results more accurately than all major polls; when Kalshi turned the question "Will the Fed cut interest rates?" into a contract that ordinary people can trade like stocks; a brand-new track has burst from the fringes of Web3 to the center of the information and financial worlds. This is the world of prediction markets, an emerging info-financial infrastructure that is reshaping how we discover truth, price risk, and ultimately, make decisions.

However, beneath this prosperity lies equally massive chaos and risk. Deficiencies in oracle governance, unclear regulatory paths, and fragmented liquidity are plaguing today's entrepreneurs. So, for the decision-makers, entrepreneurs, and investors riding the Web3 wave, are prediction markets a bubble or a gold mine?

We hope to provide you with a detailed guide to the prediction market landscape. After reading this article, you will have a clear understanding of:

-

Prediction Market Sector Analysis: What is the core value proposition of prediction markets? What is the fundamental difference between them and gambling?

-

Secrets to Top Projects' Success: What did the two giants, Polymarket and Kalshi, do right to stand out? What can we learn from their starkly different GTM strategies and product philosophies?

-

Current Risks and Challenges: What are the root causes of the three core bottlenecks facing the sector—regulation, governance, and liquidity? What warnings do the "Zelenskyy Suit Case" and the "

Crypto.comCase" hold for us? -

Future Opportunities: Beyond building another platform, where is the real blue ocean for entrepreneurs? Next-generation oracles, liquidity protocols, social distribution tools, and compliance tech—which is the golden "picks and shovels" play?

Now, let's start from the moment that catapulted prediction markets into the spotlight...

1. What Are Prediction Markets? How Do They Differ from Gambling?

1.1 Prediction Markets Use Market Prices to Discover Collective Intelligence and True Probabilities

From ancient times to the present, "predicting the unknown" has been one of humanity's deepest desires. From tying knots for divination and stargazing in antiquity to more systematic methods like the I Ching, astrology, and tarot cards, we have never ceased our exploration of the future. This desire has become particularly urgent in today's world of information overload, where truth and falsehood are difficult to distinguish.

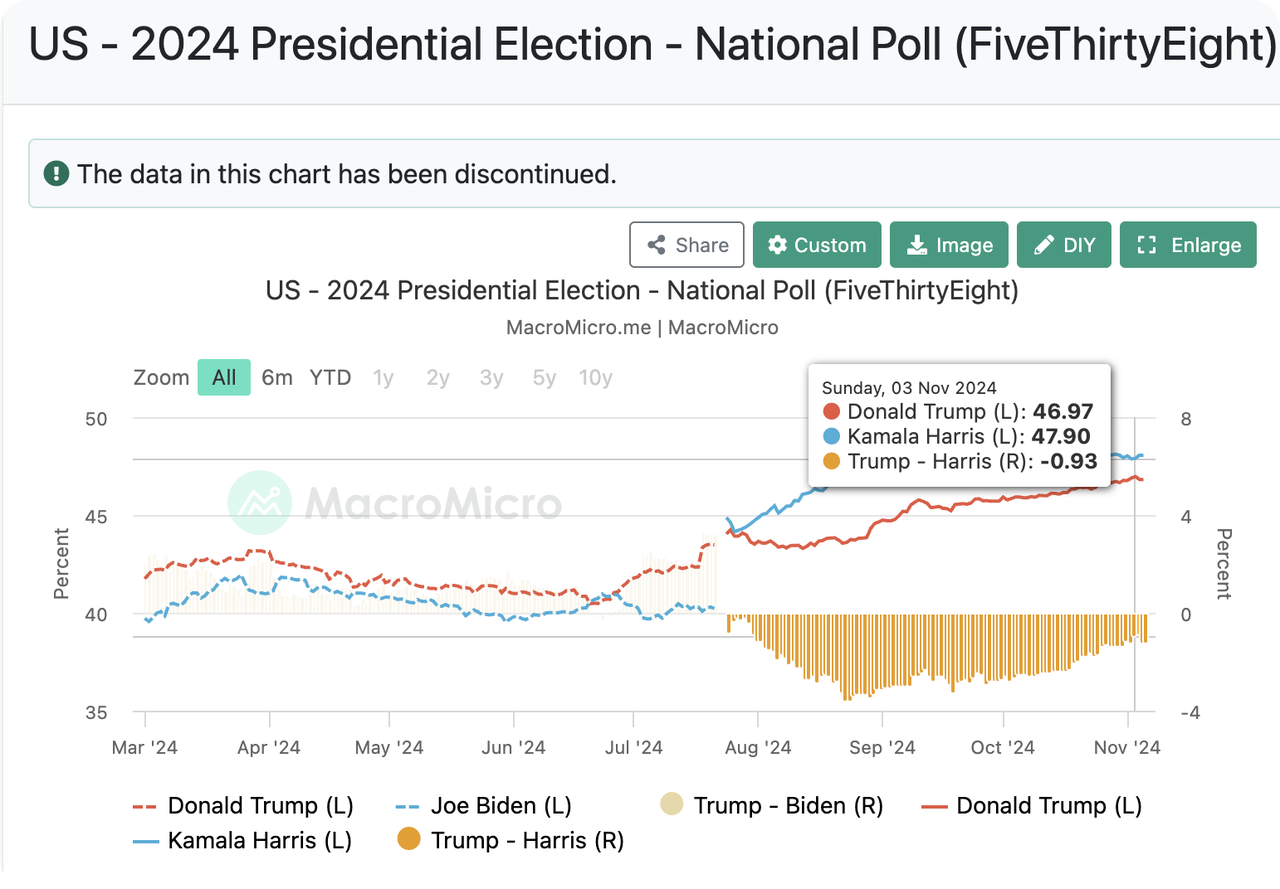

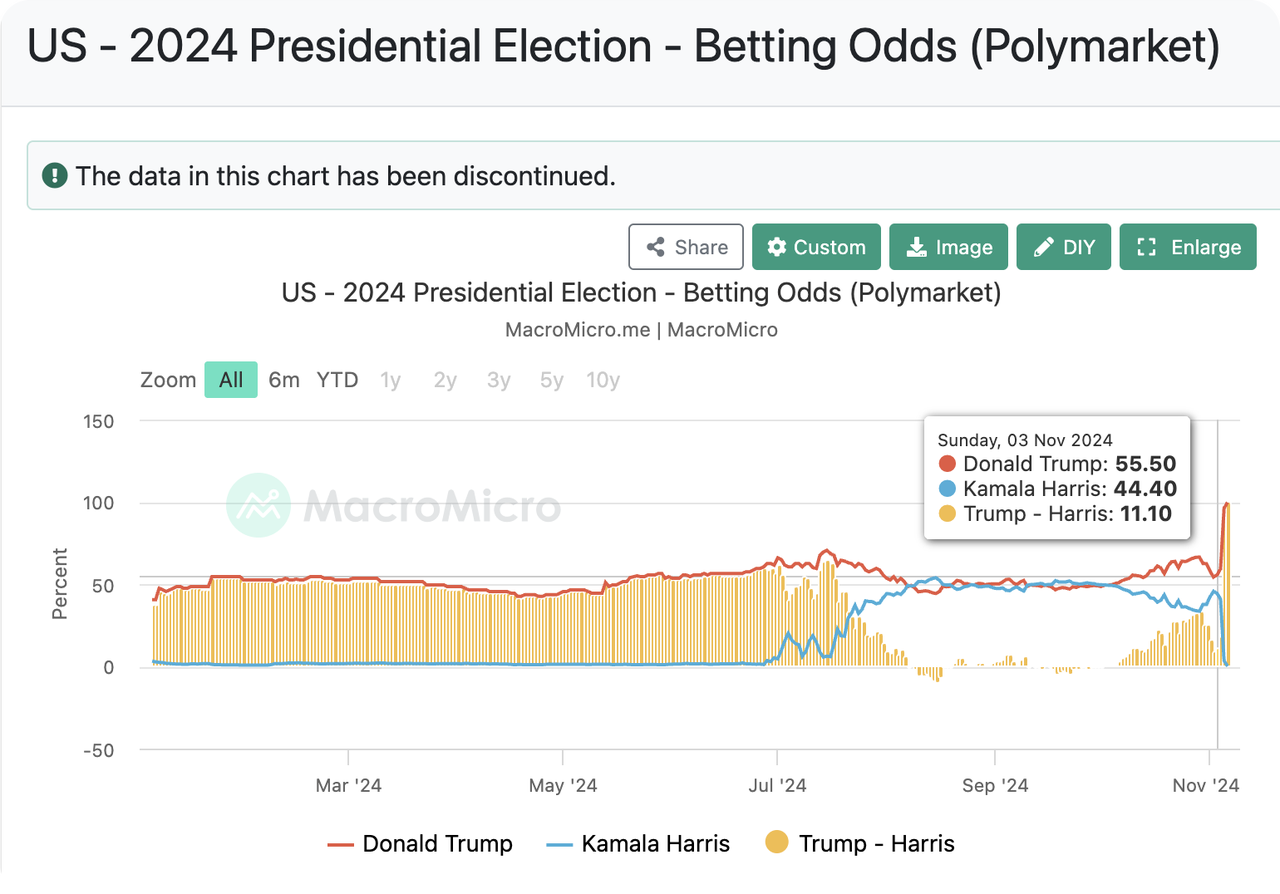

In early November 2024, the U.S. presidential election was fiercely contested. According to the renowned poll aggregation site FiveThirtyEight, as of the eve of the election, Donald Trump's support stood at 46.8%, slightly lower than Kamala Harris's 48.0%. However, on a decentralized application called Polymarket, a completely different expectation was unfolding: Trump's probability of winning climbed to around 59%, indicating a much greater chance of victory. Behind Polymarket's data was the collective judgment of global users, backed by over $3 billion in real money. In the end, when the dust settled, traditional polls proved to be inaccurate once again, while the probability given by Polymarket was astonishingly close to the truth. Donald Trump was elected the new President of the United States, and overnight, the powerful mechanism behind Polymarket—the prediction market—shot to fame.

However, the concept of prediction markets didn't just appear in 2024. It is a science with a long history of continuous evolution, core to which is the belief that under a well-designed incentive mechanism, the collective intelligence contributed by a crowd bound by interests far surpasses that of experts.

Looking back at the history of prediction markets, they have been inseparable from "elections" since their inception. Their prototype can be traced back to the 16th century. As early as 1503, historical records show people betting on the outcome of the next papal election. By the late 19th century on Wall Street, betting on the U.S. presidential election was rampant, with its trading volume and public attention even surpassing the stock market at the time. In the 20th century, with the rise of modern scientific polling methods like Gallup and tightening regulations on gambling, the election betting market gradually declined.

In 1988, a group of professors at the University of Iowa created the first modern prediction market with the explicit purpose of "producing accurate forecasts"—the Iowa Electronic Market (IEM). Its mechanism allowed users to use small amounts of money (usually no more than $500) to buy "stock contracts" representing a political candidate's future vote share. For example, the final value of a "Republican Candidate Contract" would be tied to their actual vote share in the general election. If the candidate ultimately received 55% of the vote, each contract would be worth $0.55 at settlement. Therefore, the real-time trading price of this contract before the election—say, $0.52—directly reflected the market's collective forecast of the candidate's final vote share.

In fact, over the subsequent decades, the IEM consistently outperformed traditional polls in forecasting U.S. presidential elections, proving the power of this model with irrefutable data. Today, prediction markets are gradually moving from academic experiments to commercial applications, from centralized platforms (like Kalshi, PredictIt, IBKR ForecastTrader) to the fully blockchain-based decentralized prediction market protocol we see today, Polymarket—which tokenizes every future event and records and trades them purely on-chain. Although the product form is constantly evolving, its core pursuit of "collective intelligence" has never changed.

1.2 The Core Differences Between Prediction Markets, Gambling, and Binary Options

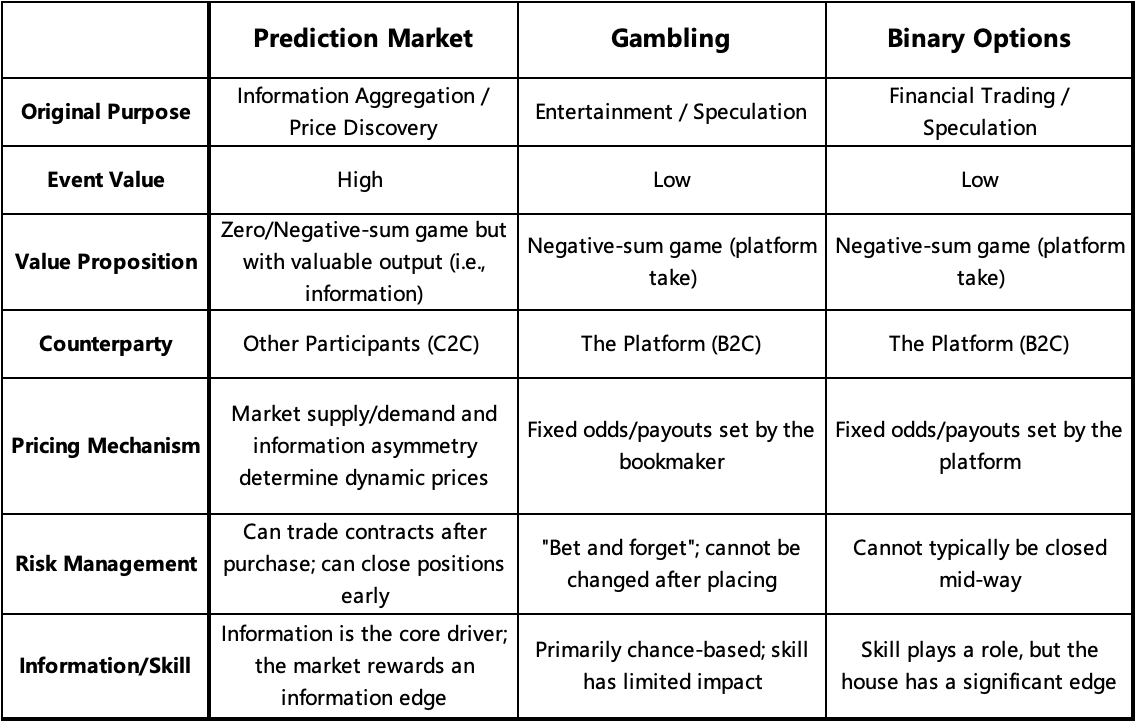

Although they all superficially involve betting on future events, and in many countries, prediction markets are considered a form of gambling, they are fundamentally different from gambling and binary options in purpose, mechanism, and value. Without a proper understanding of these differences, one cannot grasp their true investment value.

In simple terms, the core differences are:

Purpose: "Negative-Sum Entertainment" vs. "Positive-Sum Information." Traditional gambling and binary options are value-consuming negative-sum games due to the "house take" mechanism. Their primary output is entertainment and excitement. In contrast, the core output of a prediction market is an "informational public good"—an accurate probability forecast—that provides external value to society, generating a positive impact.

Mechanism: "Locked Bets" vs. "Dynamic Trading." In gambling or binary options, your bet is typically a one-time event. Once confirmed, it cannot be changed, and you can only wait for the outcome. In a prediction market, you buy a "contract" that can be traded at any time. You can sell it at any moment before the market settles to take profit or cut losses. This dynamic risk management capability makes it structurally closer to a financial trading market.

Counterparty: In gambling or binary options, you are always betting against a "house" or platform that sets the rules and has an information advantage. In a prediction market, you are engaging in a peer-to-peer contest with other traders who hold different opinions. Theoretically, this is a fairer and more efficient arena where a user's own skill, knowledge, and information channels are often the decisive factors.

2. Why Do We Need Prediction Markets? Why Decentralize Them?

2.1 The Value of Our Times: Why Prediction Markets Are Becoming a "Source of Truth" Amidst Declining Trust in U.S. Mainstream Media

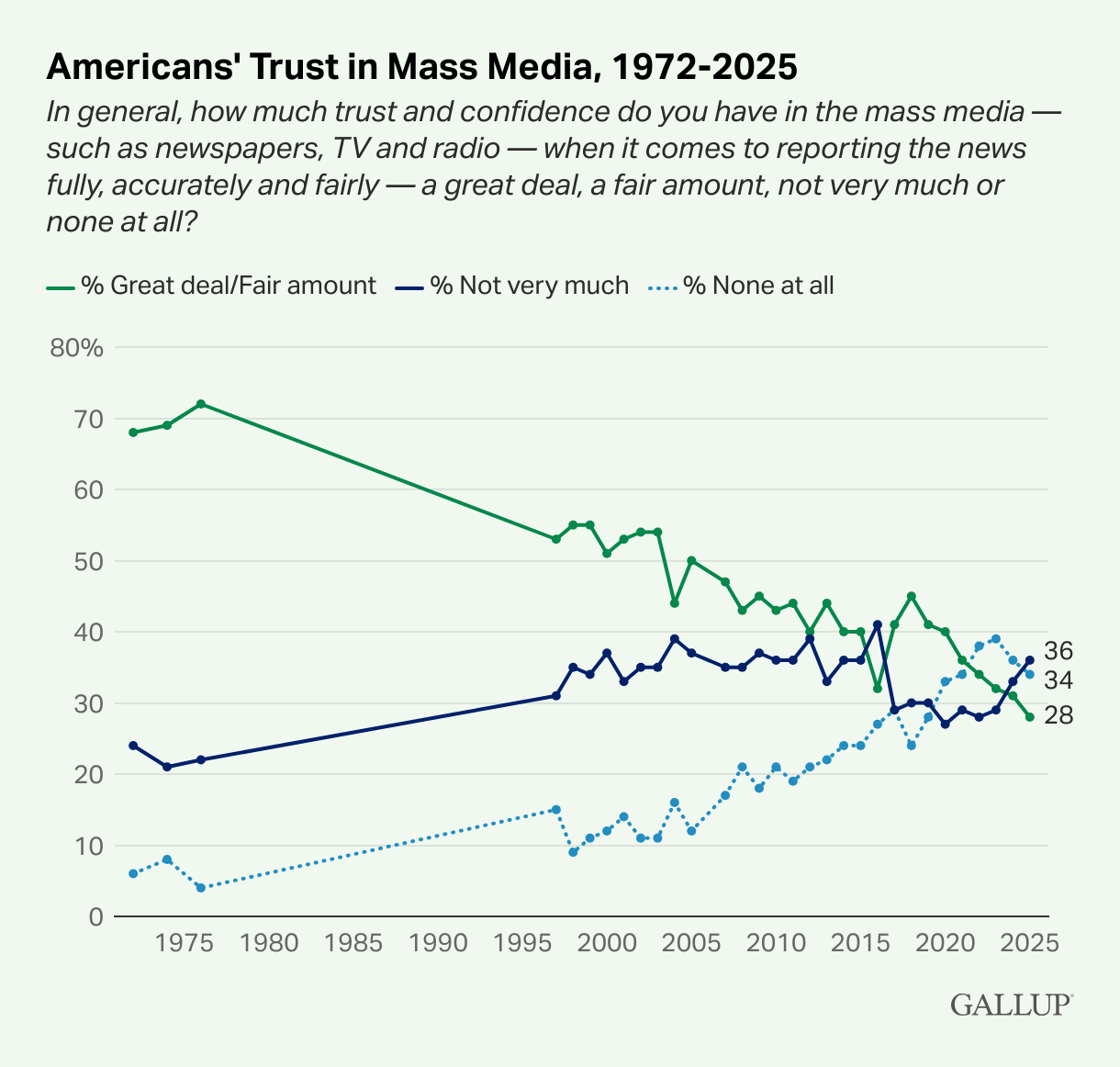

When narratives are amplified by algorithms, price-implied probabilities with capital at stake become a more verifiable public signal. According to Gallup’s annual polling, public trust that “newspapers, television and radio report the news fully, accurately and fairly” has trended down over the past decade—31% in 2024, falling further to 28% in 2025—deepening polarization in the information environment. Compared with stance- and emotion-driven commentary, prediction markets force participants to pay for being wrong, compressing noisy, dispersed information into a quantifiable, testable probability price that offers a transparent, auditable reference point for the public and decision-makers alike.

Turning “telling the truth” into a rewarded behavior is the institutional core of prediction markets. Vitalik frames this as broader “info finance” : a three-sided market—wagerers place bets and generate predictions, readers consume those predictions as news, and the market itself outputs reusable probabilities and conclusions as a public good for journalism, scientific review, and governance. In other words, mechanism design aligns payoffs with providing valid information and correct expectations while raising the cost of misinformation; as topics cycle through “screenshot → spread → re-bet” on social platforms, surprising odds attract attention and liquidity, creating an information → trading → distribution flywheel.

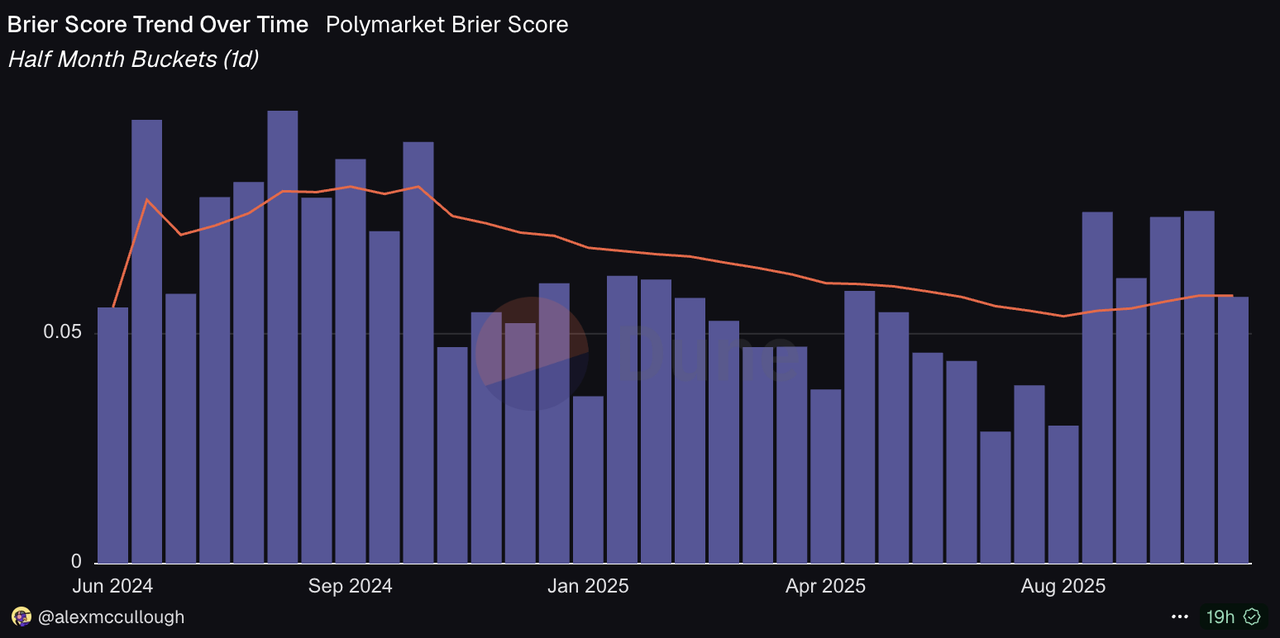

Calibration and accountability make probability prices superior to rhetorical slogans. Unlike unbenchmarked social-media opinions, prediction-market price paths and final settlements are naturally amenable to ex-post scoring (e.g., Brier or logarithmic scores). A growing body of work shows that betting/prediction markets (e.g., Polymarket) can quantify large political events more promptly and testably, forming a scorable, auditable ledger of public accountability.

The 2024 U.S. presidential election is a straightforward example: amid heat and controversy, prediction markets became a real-time quantitative complement for media and traders. Around the sequence of “Biden’s withdrawal” and shifts in candidate win probabilities, market prices were widely cited to depict the instantaneous direction and magnitude of shocks. Meanwhile, concentrated “whale” positions sparked debates on manipulation and bias (e.g., reports of a French high-roller heavily backing Trump on Polymarket). Overall, despite controversy and regulatory boundaries, the speed of reaction and calibration at key inflection points provided a measurable cross-check to polls and punditry, prompting further academic assessment of relative predictive power and application limits.

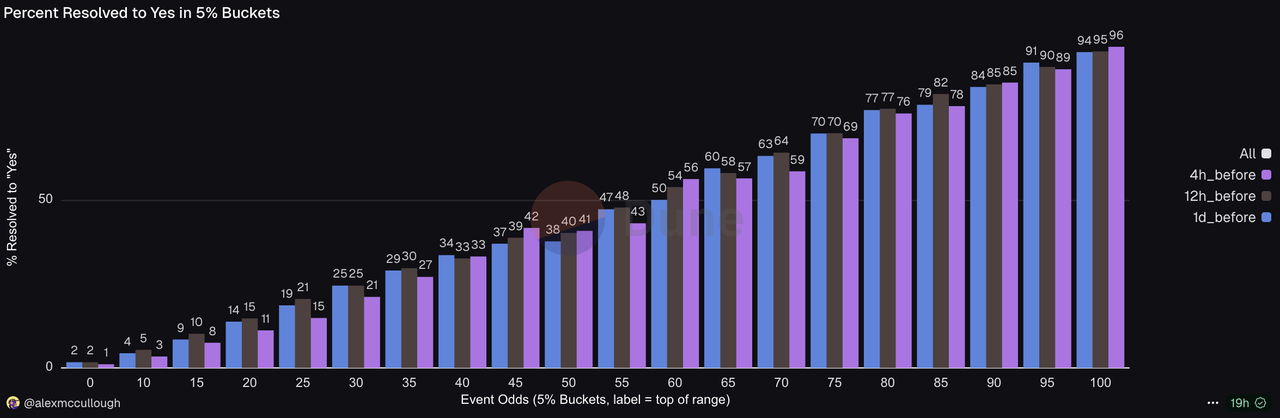

By comparing forecast probabilities with realized outcomes, prediction markets represented by Polymarket are accurate in most cases; its Brier-score and time-window analyses show clear advantages in probability forecasts—especially as resolution nears. The closer a Brier score is to 0, the more accurate the forecast. Polymarket’s Brier score is 0.05–0.06 within one day of settlement; by contrast, typical binary sports-betting models are around 0.21–0.22. Based on pre-season betting odds as forecast probabilities versus realized three-way (win/draw/loss) outcomes, the 2024/25 English Premier League Brier score is 0.2378. In addition, at high-confidence prediction bins, the three bars for Polymarket markets near resolution (4h / 12h / 1d) almost overlap, indicating stable calibration as settlement approaches. In other words, pre-resolution prices have absorbed nearly all available information, evidencing high informational efficiency.

2.2 Why Decentralized Prediction Markets?

Easier access, global availability, lower switching costs: the permissionless nature of the contract layer removes reliance on a single platform’s account system or geographic access policy for market creation and participation. Users interact directly with a wallet; front-ends are replaceable and contracts persist, so participation and settlement remain reachable and continuous even under differing real-world compliance regimes. For example, in Omen (built on Gnosis Conditional Tokens) and Augur, market creation, market making, and trading logic are implemented by smart contracts, allowing users to participate and exit without depositing assets into a custodial platform account.

Self-custody and end-to-end auditability reduce black boxes and rent-seeking: funds are self-custodied, and every step of trading and settlement is recorded on-chain and publicly verifiable—shifting from “trust the platform” to “verify the code.” From order placement and matching to settlement and fee distribution, each critical step is traceable. For external consumers, publicly available event prices and resolution data form a reusable data layer. With Gnosis Conditional Tokens, event outcomes can be encoded and then composed into more complex conditional structures, creating a direct interface for downstream reuse and automation.

Natively composable as an “information oracle” for DeFi: decentralized prediction markets output not only prices but also an information state that smart contracts can consume directly. Applications can feed event probabilities or resolutions into insurance, derivatives, treasury management, or governance workflows (e.g., automatically hedge, adjust fees, or trigger governance rules when a probability threshold is crossed), turning information into executable financial conditions.

3. Sector Landscape and the Success Playbook of Leading Players

3.1 Current Market Status and Key Data Analysis

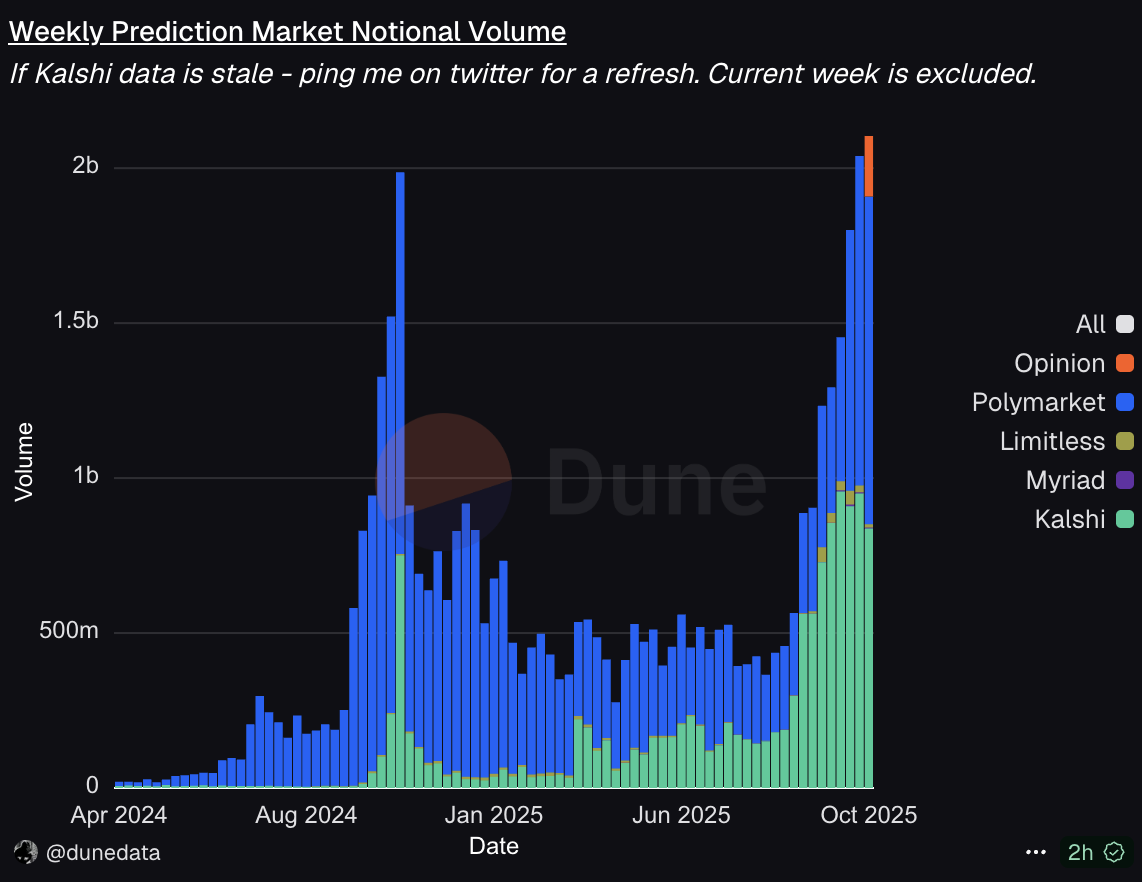

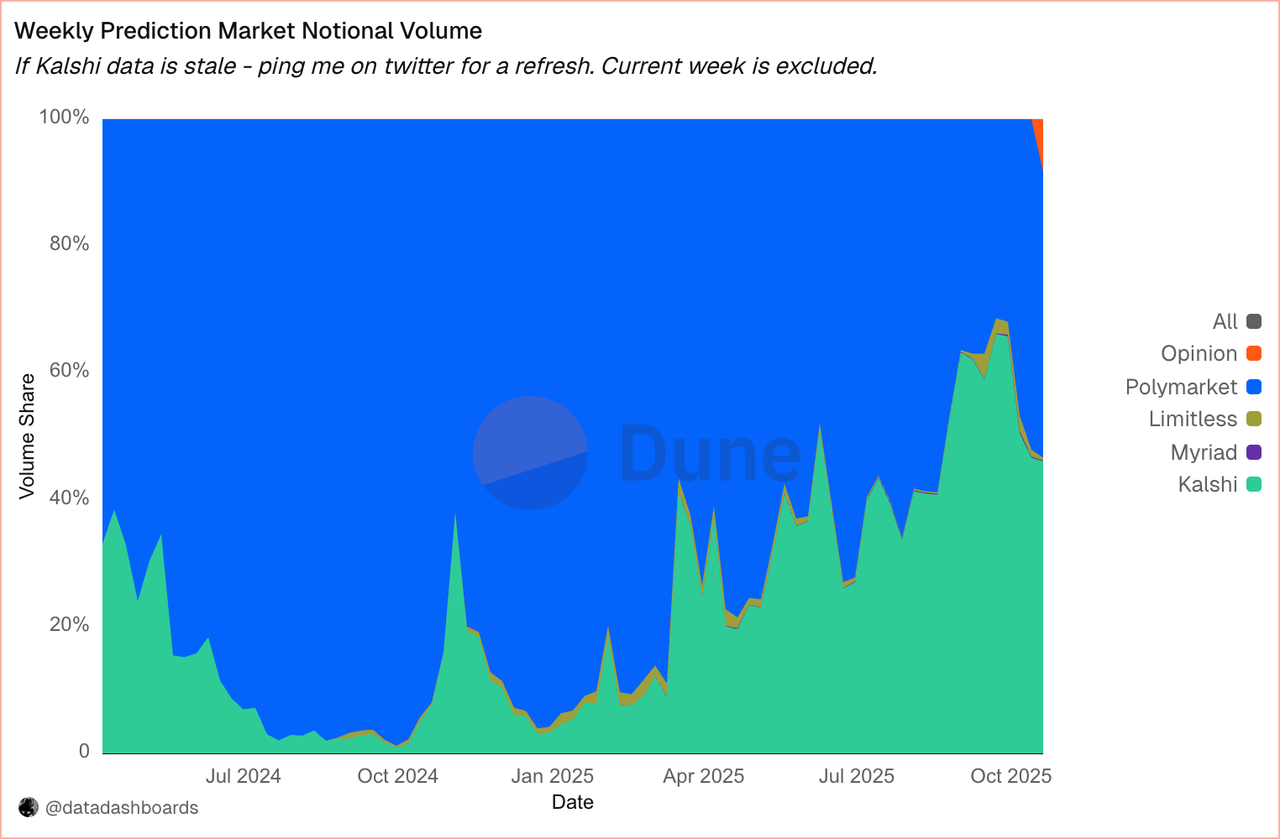

After more than a year of development, prediction markets have shifted from a niche, entertainment-oriented tool to an emerging layer of information finance. The market is no longer driven by a single platform; instead, a duopoly of Polymarket and Kalshi has formed, with multiple new entrants competing alongside them.

Data Source: https://dune.com/dunedata/prediction-markets

Based on trading-volume data, the evolution of the sector can be divided into four phases:

-

Entertainment-led nascent phase: primarily in Q4 2024 and earlier, when prediction markets remained a niche, curiosity-driven betting playground.

-

Q4 2024 U.S. election peak: the first major peak emerged in November 2024 during the U.S. election. Demand for political and macro forecasting surged. Polymarket drew real-world attention with markets spanning from the presidency down to local offices, and—around the sequence “Biden exits → Harris steps in → Trump odds rise”—frequently appeared in mainstream TV coverage.

-

Post-election lull and demand vacuum: once the mega political event ended, macro, on-chain, and entertainment topics did not immediately fill the gap; trading volumes fell sharply, and the sector needed new supply-side growth drivers.

-

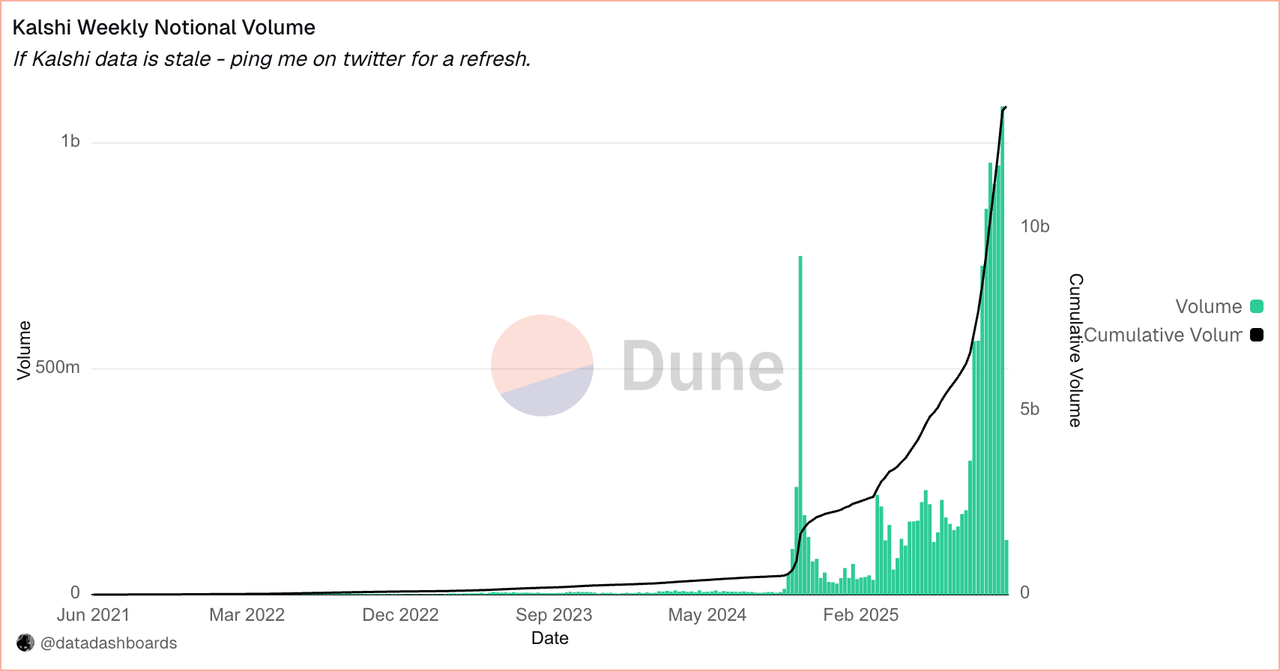

Repricing and institutionalization: after summer 2025, as primary-market valuations for Polymarket and Kalshi climbed and crypto industry leaders pushed the category, supply-side activity revived. Speculators and retail users refocused on the space, and the demand side increasingly viewed prediction markets as an important bridge between crypto and the real world. Following this repricing, weekly trading volumes recovered—from under $500 million earlier this year to a new historical high of over $2 billion amid a more diverse, multi-platform landscape.

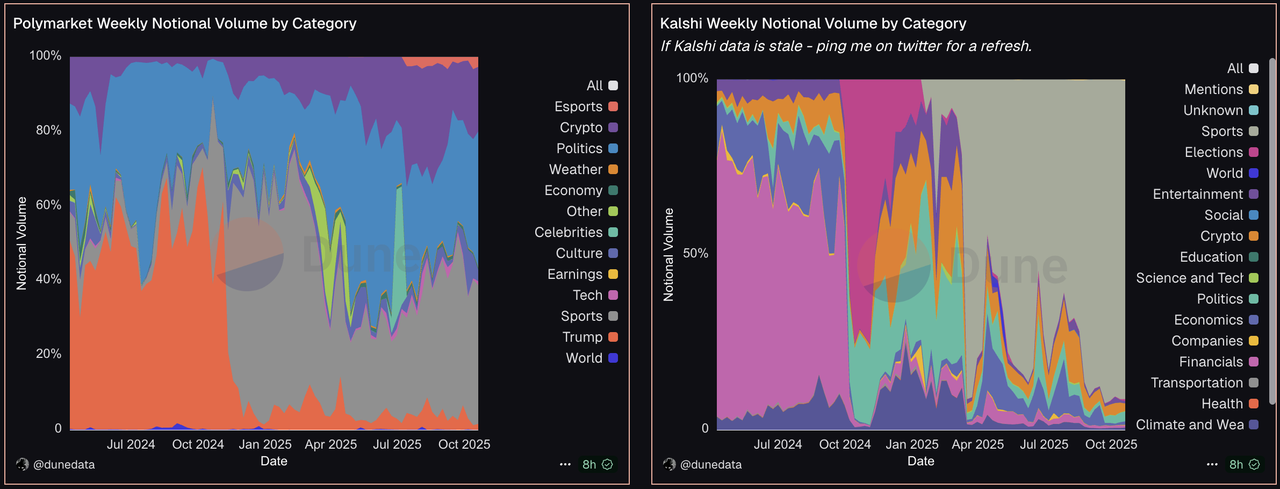

Data Source: https://dune.com/dunedata/prediction-markets

User behavior has also shifted. Across topics, wagers on sports and politics exceed those within crypto itself. Different platforms have developed distinct profiles around these behaviors. Polymarket is relatively balanced, anchored by politics and sports while steadily expanding short-horizon crypto price markets to strengthen diversification. Kalshi, by contrast, is notably concentrated in sports, with the category accounting for more than 85% of its volume.

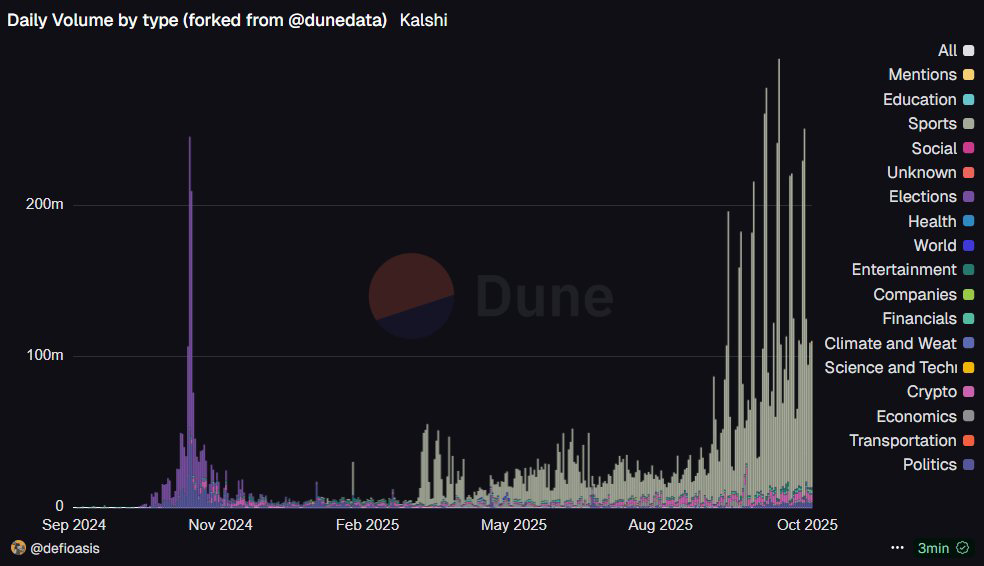

Data Source: https://dune.com/dunedata/kalshi-overview

Kalshi’s trading has migrated from politics and elections toward sports. Roughly 90% of platform volume now concentrates in sporting events, which creates a pronounced weekend effect because major leagues schedule to maximize weekend audiences. Leveraging NFL and other sports markets, Kalshi rapidly captured substantial traffic; at times, its weekly trading volumes have surpassed Polymarket’s, producing a head-to-head competitive pattern.

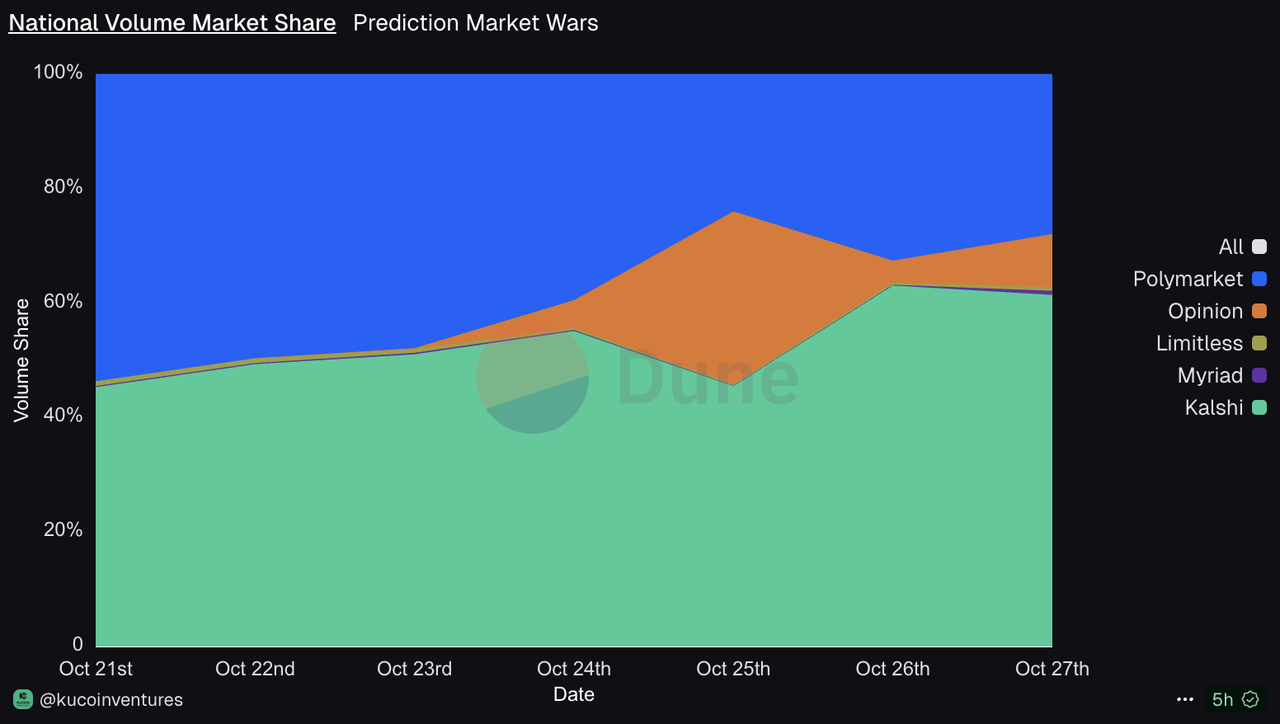

In addition, “incentive-driven + high-frequency” platforms such as Opinion Labs, Limitless, and Myriad have, on certain days, recorded on-chain trading volumes exceeding Polymarket’s (for example, on October 25, Opinion’s single-day volume reached $169 million, slightly above Polymarket on the same day). This indicates that the long tail can create short-term disruptions for the leaders, and the sector can no longer be reduced to “just two players.”

3.2 Polymarket vs. Kalshi — Technology and Product Breakdown

In October 2025, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, announced an investment of up to $2 billion in Polymarket, implying a post-money valuation of approximately $8 billion. A few days later, the U.S. regulated prediction-market venue Kalshi announced a $300 million financing round, lifting its valuation to $5 billion. The two platforms now account for the dominant share of sector trading volumes, with weekly leadership alternating between them.

Data Source: https://dune.com/datadashboards/prediction-markets

3.2.1 Polymarket as the Web3-Integrated Representative

Polymarket is a leading prediction market built on Polygon. It allows users to purchase USDC via MoonPay using traditional payment methods or to deposit USDC from a self-custodied wallet to place trades. There is no need to bind a new wallet or handle concepts such as gas or signatures during use, which makes the product friendlier for non-Web3 users.

Market resolution relies on UMA’s Optimistic Oracle. A proposer first submits an outcome; if unchallenged during the dispute window, the outcome stands. If challenged, the dispute escalates to UMA’s Data Verification Mechanism (DVM) for arbitration, enabling subjective or unstructured events to be resolved under economic constraints. Polymarket currently charges no trading fees; instead, it levies a 2% performance fee on net profits at market resolution (used in part to subsidize liquidity providers). It has also been noted that the platform may generate indirect revenue through providing its own liquidity and managing spreads, and it may introduce trading fees in the future.

Although Polymarket initially adopted an AMM model to address cold-start liquidity, it shifted to a CLOB (central limit order book) in late 2022 to expand market-making strategies and deliver a more professional trading experience. This technical and product trajectory underpins a systematic moat across verifiable settlement, a composable data layer, and professional execution. To encourage users to provide order-book liquidity, Polymarket launched a limit-order liquidity rewards program: if users post bids or asks near the mid-price (effectively acting as market makers), they can earn daily rewards.

Data Source: Polymarket Official Website

Beyond liquidity incentives, Polymarket also offers a long-term holding yield designed to stabilize prices in long-dated markets. For selected markets, the platform provides an annualized 4% “Holding Rewards.” For users holding positions in these markets, the platform samples balances hourly and pays interest daily. In addition, in response to regulatory pressures, Polymarket in 2025 acquired derivatives exchange QCEX, which holds a CFTC license, for $112 million to obtain a legal operating path in the United States, and announced plans to return to the U.S. market.

3.2.2 Kalshi as the Compliance-First Representative

Unlike Polymarket’s blockchain-native approach, Kalshi follows a compliance-centric platform path. It obtained CFTC Designated Contract Market (DCM) status in 2020, secured Derivatives Clearing Organization (DCO) registration in August 2024, and in January 2025 received an amended designation order allowing it to offer event contracts—completing the compliance loop of matching, clearing, custody, and audit. This makes Kalshi the first federally regulated prediction-market exchange in the United States. Event contracts are economically equivalent to binary futures: if the event occurs, the contract settles at $1; otherwise, at $0.

On the technology and product side, Kalshi uses centralized matching and account custody, supports fiat (USD deposits) and USDC funding, and emphasizes user experience. Its regulated status and auditability constitute the certainty premium most valued by institutions and mainstream users, helping Kalshi stand out amid regulatory scrutiny. In 2025, partnerships with major brokerages such as Robinhood and Webull embedded event-contract trading as a “prediction-market hub” within retail brokerage front-ends, significantly improving accessibility for ordinary investors. While sports contracts have faced federal and state-level friction (e.g., temporary removal of Super Bowl markets at the CFTC’s request and certain state restrictions on NCAA events), the overall picture reflects a dynamic balance between compliance expansion and product scope.

Kalshi’s revenue model is more broker-like: it charges approximately 0.7%–3.5% of notional per fill (varying by price) and does not participate directly in user P&L. Resting limit orders incur no fees, and executed maker orders are typically fee-free—maker incentives that help sustain deep order books. Under this fee policy, users can reduce their trading costs by placing passive orders, which can, in turn, amplify reported volumes with relatively modest capital. As a result, Kalshi’s market depth is a core performance pillar, with average slippage of less than 0.1%, materially below the sector average.

In addition, outcomes on Kalshi are adjudicated using pre-specified authoritative data sources (such as government releases or official sports results), leaving little room for dispute at settlement. Given the current U.S. federal regulatory environment, sports contracts are also the easiest to explain and distribute, which may reinforce Kalshi’s business concentration in sports.

3.3 Polymarket vs. Kalshi — Success Playbook of the Leading Platforms

The two follow orthogonal paths—“on-chain verifiability + composability” versus “regulatory certainty + distribution channels”—but share the same goal: achieving higher-quality price discovery and outcome resolution with lower friction. Historical data suggest that three variables drive peaks and share rotation: supply-side expansion (new markets created), major event cycles (core category expansion), and distribution breakthroughs (licensing/partnerships).

3.3.1 Polymarket’s First-Mover Growth Flywheel

Polymarket’s trajectory can be summarized as “hot-topic ignition → product-led → social embedding.”

First, it captures sustained organic flow through highly watched themes (U.S. elections, macro policy, sports/entertainment) riding news cycles and social distribution.

Second, the AMM→CLOB product shift materially improved depth and matching efficiency; combined with USDC onboarding and transparent on-chain settlement, it reduced learning and trust costs for non-crypto users.

Third, the “bet-as-statement” social property creates a loop of view → position → distribution; paired with Substack, X, and other media, this pulls long-tail market creation on the supply side and drives broader reach.

In October 2025, the platform recorded 35,500 newly created markets (a historical high), up roughly 2,000 from September—evidence of a clear supply-side expansion. This “supply expansion + event cycle” dual engine explains why activity remained high even amid strong competition.

Data Source: https://www.theblock.co/data/decentralized-finance/prediction-markets-and-betting/polymarket-new-markets-monthly

3.3.2 Kalshi’s Late-Mover Growth Path

Kalshi’s path is best described as “compliance first + B2B2C distribution.”

First, DCM + DCO status establishes usability and regulatory certainty in the U.S., creating a standardized venue that is accessible, auditable, and clearable for institutions and retail—building a trust moat.

Second, integrations with entry-point brokers such as Robinhood bring direct access to large non-crypto user bases, shortening education cycles and improving retention and turnover.

Data show that in the second week of September, Kalshi’s weekly volume exceeded $500 million with an estimated 62% market share, temporarily overtaking Polymarket. In the third week of October, the sector’s weekly volume surpassed $2 billion—lifted by both platforms—cementing a de-facto duopoly at the top.

Data Source: https://dune.com/datadashboards/kalshi-overview

4. Detailed Strategies of Incumbents and Emerging Forces

4.1 Incumbent Strategies: Coinbase, Kraken, Binance, and Robinhood

Beyond native prediction-market platforms, crypto exchanges are actively positioning for this vertical. The entry of major players validates prediction markets as a standalone category and introduces new variables into platform competition.

The U.S.-regulated exchange Coinbase is building toward an “everything exchange,” spanning tokenized equities, prediction markets, and on-chain assets. Given the CFTC’s regulatory remit over prediction markets in the United States, Coinbase is unlikely to launch a fully new, standalone venue; rather, prediction markets will likely be integrated as a branch within the “everything exchange” push to full on-chain coverage. For now, Coinbase has not announced a specific partner. Both Kalshi—known for its U.S. compliance posture—and Polymarket—which is preparing to re-enter the U.S. through an acquisition of a licensed venue—are plausible candidates. Notably, Coinbase Ventures participated in Polymarket’s $150 million round announced in January 2025 at a $12 billion valuation; with Polymarket’s current valuation around $9 billion, that investment is already strongly in the money on paper. In a lighter moment, at the end of its Q3 earnings call, Coinbase CEO Brian Armstrong opened a prediction market and read out the words users had bet he would say.

Another U.S.-regulated exchange, Kraken, acquired the CFTC-regulated Designated Contract Market Small Exchange for $100 million in October. The deal advances Kraken’s effort to build a more complete U.S. derivatives stack; earlier this year Kraken also acquired NinjaTrader to expand offerings around CME-listed crypto futures. Acquiring Small Exchange also provides the regulatory architecture for Kraken to launch event contracts/prediction markets in the future.

Data Source: https://x.com/heyibinance/status/1977571496022479136

The world’s largest offshore exchange, Binance, is investing via native projects on BNB Chain. YZi Labs launched a $1 billion BNB Builder Fund to support projects through investment, incubation, and hackathons. The first frontier theme listed is “Prediction & Futarchy.” Binance co-founder Yi He also publicly invited “the right builders” to launch prediction markets on BNB Chain, with potential YZi Labs backing. Spurred by Binance’s push, the YZi-backed Opinion drew strong retail FOMO during its invite phase, with first-day trading topping $100 million.

Robinhood’s approach is another archetype: instead of investing in, acquiring, or creating a new platform, Robinhood partnered with Kalshi. It rolled out election-related event contracts in October last year and, in March this year, launched a Prediction Market Hub—an in-app section for trading future events. The Hub itself does not operate a full prediction market; it relies on Kalshi’s compliant infrastructure to provide contracts, user management, and UI, while taking a commission. On its Q2 earnings call, Robinhood’s CFO said customers traded about $1 billion (face value $1 per contract) on Kalshi in Q2, generating roughly $10 million in revenue—i.e., about $0.01 per contract in commission. As a rough inference, this implies Kalshi’s weekly nominal volume around $1 billion and an annualized nominal volume near $52 billion. If Robinhood accounts for 10% of that, prediction markets could contribute roughly $52 million in annual revenue to Robinhood. The exact share will depend on future disclosures.

The Trump family, which reportedly generated more than $1 billion in crypto-related revenue this year, is also eyeing the space. On October 28, Trump Media & Technology Group (TMTG) announced a move into prediction markets via the Truth Social platform, launching “Truth Predict.” Users will bet on binary contracts across politics, sports, and entertainment. TMTG is partnering with the U.S. derivatives arm of Crypto.com to ensure CFTC oversight, enabling users to trade prediction contracts directly within Truth Social without leaving the app.

4.2 New Challengers and the Prediction-Market Ecosystem

Other participants are evolving along two lines: (1) launching new markets across multiple chains and scaling with support from L1 ecosystems and funds to challenge incumbents; and (2) building around mature markets—front ends, TG bots, and aggregators.

4.2.1 BNB Chain Representative: Opinion Labs

Data Source: https://dune.com/kucoinventures/opinion

Since its invite-only mainnet launch on October 24, Opinion has quickly become the third-largest prediction market. As of October 31, cumulative volume exceeded $500 million, with more than $30 million in open interest. Opinion is emerging as the strongest challenger outside Polymarket and Kalshi. Its rapid share gains are not accidental but the result of aligned narrative timing, go-to-market strategy, capital backing, user incentives, and product choices:

-

The sector-wide boom provided fertile ground. Launch timing coincided with record volumes at Polymarket and Kalshi, concentrating user attention.

-

It capitalized on a window in which neither Polymarket nor Kalshi was imminently tokenizing; with few “bet-on” assets despite rising interest, Opinion’s airdrop-style points system was especially effective.

-

Strong capital backing: Opinion is funded by YZi Labs. Throughout the month, YZi Labs and Binance co-founder Yi He openly promoted prediction markets, directing traffic and encouraging users to view Opinion as the “prediction-market version of Aster.”

-

Points-driven posting and trading incentives, KOL referral programs, founders engaging directly with users, a viral “intern incident” on the official account, plus time-boxed new-user admissions—all contributed to organic FOMO.

-

Product-side highlights include using an AI Oracle for resolutions to reduce reliance on manual decisions and mitigate third-party oracle capture by large holders. A dynamic 0–2% fee model gives the team cash flow from day one; based on total notional and fees, Opinion’s effective take rate is around 0.14%.

Opinion’s trajectory shows a deep understanding of Web3 market dynamics. With timing, capital, attention, product, and liquidity aligned, it spun up a flywheel that drove rapid breakout post-mainnet.

4.2.2 Base Network Representatives: Limitless and PredictBase

Before Opinion, Limitless was viewed as the most likely challenger to the Polymarket–Kalshi duopoly.

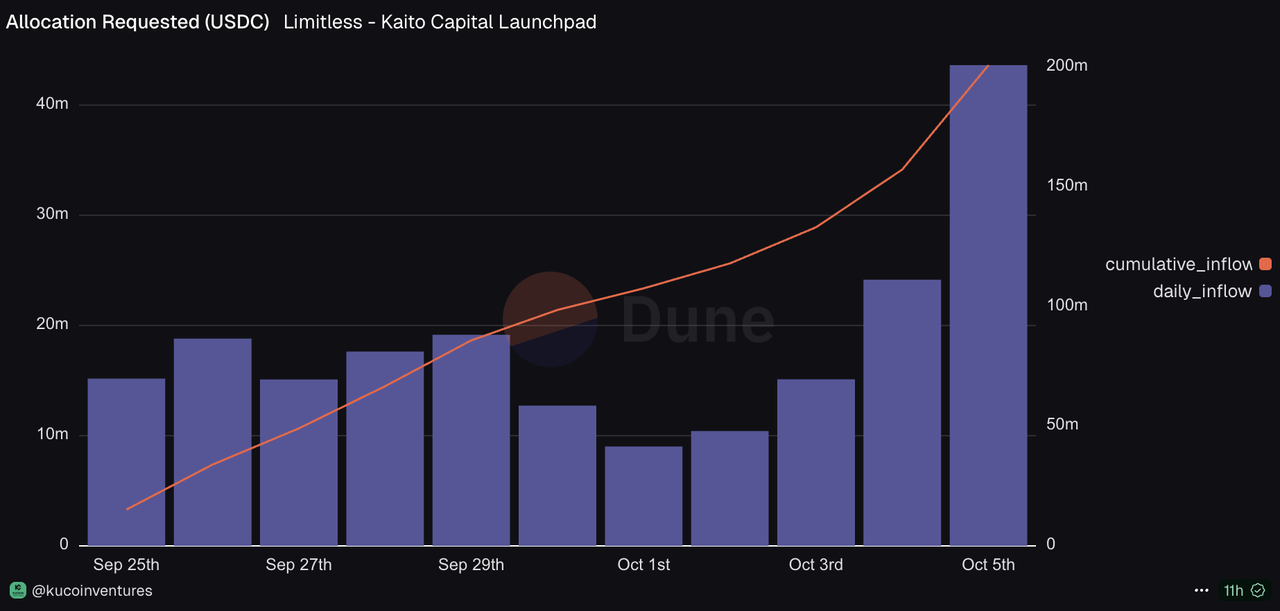

Compared with mature platforms, Limitless leans into a crypto-native experience focused on short-horizon price prediction for mainstream crypto assets. It offers 24/7 markets that settle every four hours across multiple assets, appealing to speculative, derivatives-oriented users. Powered by points incentives and a Kaito token sale, Limitless won strong market recognition for a time. From mid-September to the end of the S1 points period, thousands of new users placed daily bets on Limitless; during the subsequent LMTS public sale run with Kaito, more than 32,000 depositors committed $200 million, oversubscribed by 200×.

Data Source: https://dune.com/limitless_exchange/limitless

As the Base “ecosystem singleton” with backing from Coinbase Ventures and the Base Eco Fund, Limitless had strong tailwinds on paper. However, a string of missteps in market strategy and post-TGE execution undermined these advantages. First, the founder publicly leaked private-group messages to allege listing fees, sparking an open dispute with Binance and escalating into perceived Coinbase-versus-Binance platform tensions. Coinbase later defused the optics by listing Binance’s BNB, but Limitless suffered lasting brand damage. LMTS launched directly on DEXs without mainstream CEX support. Post-launch, the team’s “on-chain MM strategy” drew community criticism as high-sell/low-buy behavior. After these controversies, daily volume fell from $5–10 million to just above $1 million.

PredictBase is a “small but sharp” venue on Base. It was among the earliest teams exploring prediction on Base, launching in May. Its hallmarks include an LMSR AMM, permissionless market creation with seed liquidity (minimum $10, refundable at market end), and a fee split where creators capture 1% of volume while the protocol takes 1% for buybacks of PREDI. For resolution, it employs a hybrid approach—PredictBot AI agents prioritized, with human review as needed. PredictBot launched the PREDI token via Virtuals Genesis in early July. Without VC funding, PredictBase nonetheless excels at leveraging Base ecosystem distribution: it was among the first to integrate Base app as a channel and even briefly topped its trending list. As of October 28, PredictBase recorded about $1.3 million in cumulative volume, over 3,600 user-created markets, and more than $12,600 paid to creators.

4.2.3 Solana Representative: PMX Trade

PMX Trade evolved from Polycule, Polymarket’s largest TG bot, and later launched its own prediction market on Solana. Polycule had been backed by AllianceDAO, the accelerator that invested in projects such as Pump.fun and Believe. PMX Trade runs an AMM-style market and borrows from Pump.fun’s token-launch mechanics, adding a “Presales” internal pool to validate community interest and feasibility. Creators and users can contribute base liquidity in tiers of $10,000–$50,000 or $50,000–$100,000. Once a tier’s hard cap is reached, PMX migrates liquidity to Meteora and lists two tokens—Yes and No. For a $50,000 pool, combined Yes+No fully diluted value is $1 million; for a $100,000 pool, Yes+No FDV is $10 million. These tokens are freely tradable across Solana DEXs. Presale participants act as LPs, earning 1% of each trade as fees after launch, with 60% of fees distributed to LPs. An embedded automated-arbitrage system manages roughly 99% of Yes/No supply via “Option Wallets,” functioning as an automated market maker to maintain target market caps ($5 million or $10 million).

Resolution is manual: the team determines the outcome based on the real-world event, rather than via an oracle. When a market expires, Yes/No liquidity is withdrawn and trading halts; after the outcome is decided, fixed payouts are airdropped to winning token holders—$0.001 USDC per token for the $10–50k tier and $0.01 USDC for the $50–100k tier (e.g., holding 1,000 Yes tokens yields 1 or 10 USDC if YES wins). LPs can withdraw principal and fee share only after expiry and resolution. In special cases (e.g., insufficient counterparties or abnormal market conditions), PMX allocates compensation to LPs pro rata based on pool terms to maintain fairness.

4.2.4 The Prediction-Market Ecosystem: Trading Bots

Prediction markets are both information aggregators and liquidity engines. Competing alone is difficult; only by drawing in developers, traders, capital, AI, data, and off-chain influence can platforms build defensible moats at scale. Both Polymarket and Kalshi have rolled out affiliate programs to support trader outreach and early ecosystem apps. Ecosystem components cluster into three groups: Trading Bots (trading front ends and TG bots), AI agents, and data dashboards for market analytics, arbitrage, and trade tracking.

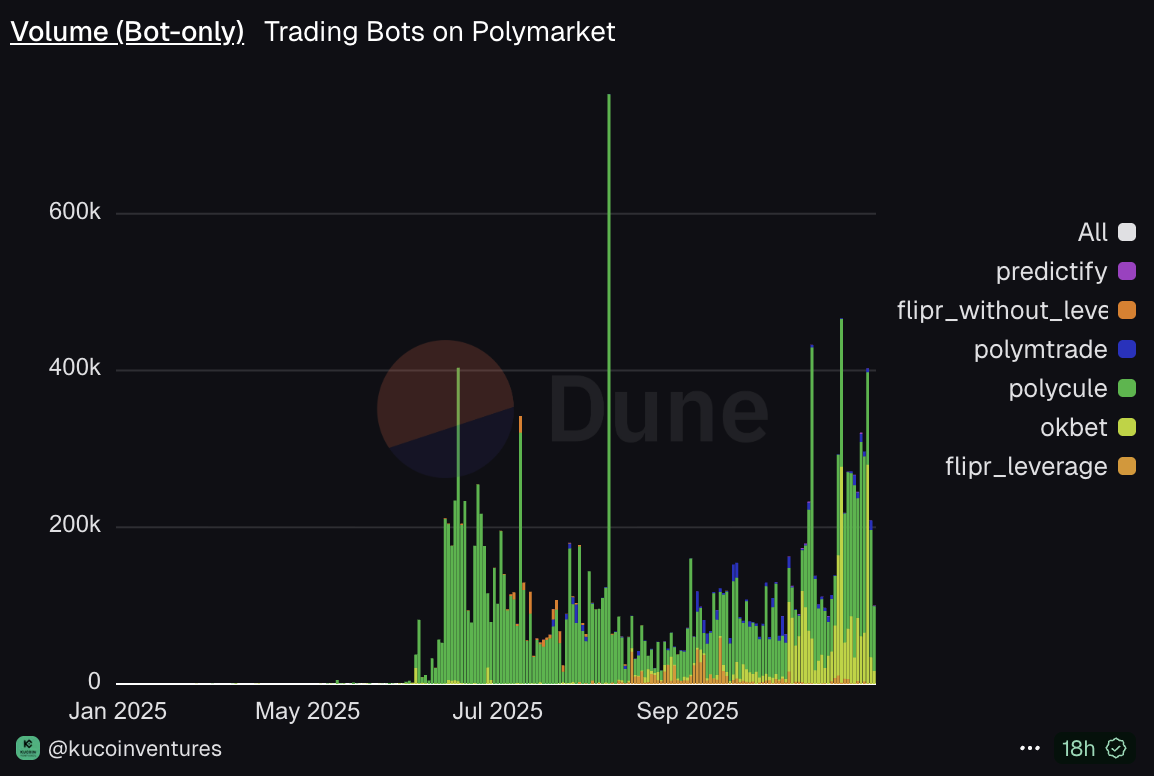

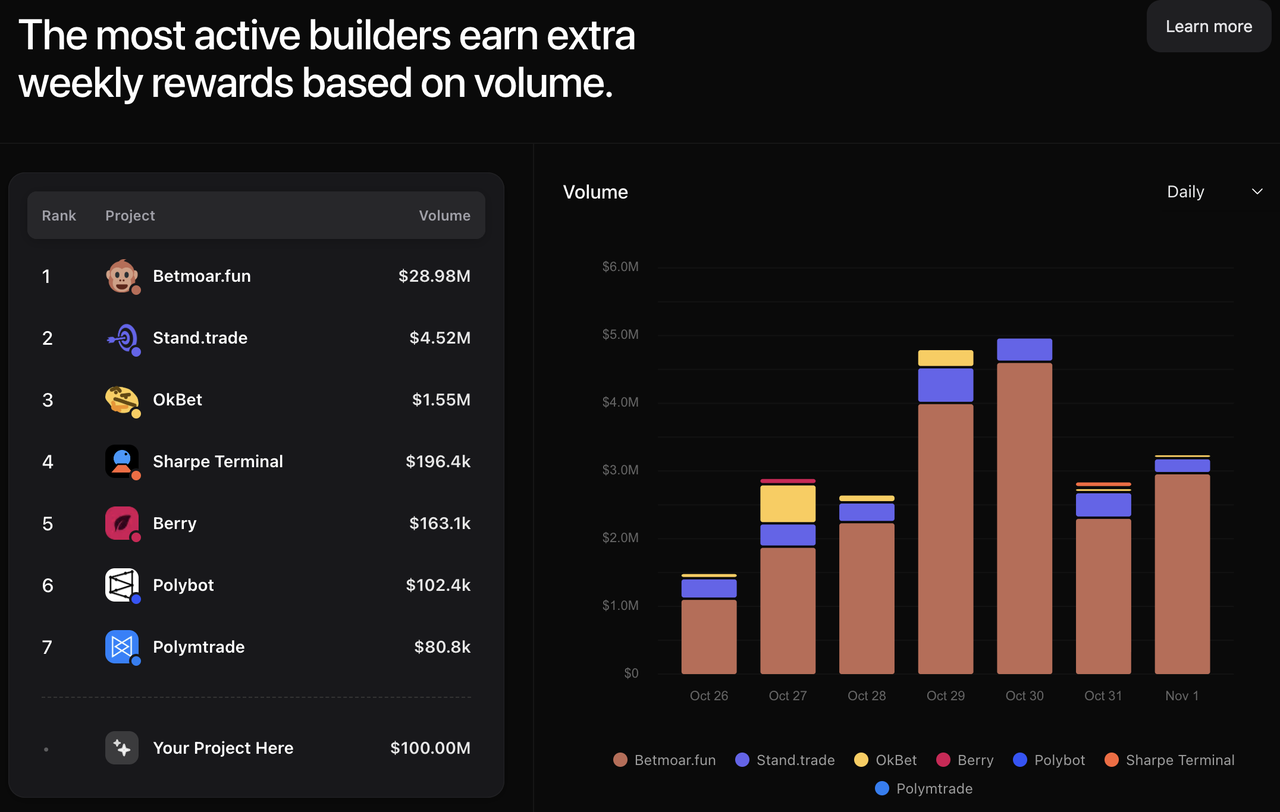

At present, Polymarket’s ecosystem looks most active—especially around Trading Bots. Third-party developers are building diverse toolchains on the Polymarket API and Polygon. Polymarket recently launched the Polymarket Builders Program to support front-end tools, awarding active developers on a weekly cadence. Seven projects are currently listed in the grants roster; among them, Betmoar.fun has posted the highest daily volume, at times approaching $5 million. That said, most Polymarket Trading Bots have daily volumes below $200,000, accounting for less than 1% of Polymarket’s daily turnover. Many tools advertise zero fees and potential airdrops to win share; real traction remains to be seen.

Data Source: https://builders.polymarket.com/

Unlike meme-trading bots that compete on raw execution speed, prediction markets are relatively low-frequency. If a Trading Bot merely “relocates the trade button,” it will be outpaced quickly—especially as mature meme terminals/bots can aggregate prediction venues at any time (just as Axiom aggregates Hyperliquid Perp). Prediction-market bots will need to move toward precision operations, including:

-

Social alpha: track and mirror whales/smart money. With on-chain matching on Polymarket, trades are transparent; bots can monitor large orders, follow, and close on probability convergence. Polycule was among the earliest TG bots enabling auto-copy trading and has been integrated and promoted by Polymarket Analytics.

-

Cross-venue arbitrage: as more venues launch, bots need multi-market capabilities. For the same event, probabilities on Polymarket, Kalshi, or others can differ by 3–5%. Bots should detect and act on these gaps. Today, okbet is among the few TG bots integrating Polymarket, Kalshi, and Limitless.

-

New-market market-making: monitor new listings, integrate fresh events quickly, and provide two-sided Yes/No quotes to earn spreads and potential platform subsidies.

-

Event-driven automation: akin to contract-address “snipers” in the meme world, bots should scrape news, X posts, and on-chain signals to generate real-time probability shifts and execute orders based on defined triggers.

Meme-trading bots win on speed; Polymarket-style trading bots win on information edge—covering more venues and helping users capture information-driven alpha. Ideally, prediction-market bots will evolve into new traffic and distribution gateways, much like Axiom and other meme-trading terminals.

5. Current Core Challenges: Bottlenecks Awaiting Solutions

As prediction markets move into the mainstream, the internal risks they face are no longer just the common on-chain issues like code bugs or hacks. They now extend to a level that touches upon law, sociology, and governance philosophy.

5.1 Internal Risks: From "Technical Issues" to "Governance Dilemmas"

The greatest strength of prediction markets is their diversity—anything can be predicted. On a permissionless platform like Polymarket, market creation activity exploded in 2025. From a stable state of a few hundred to a thousand new markets per month in 2024, it surged to a fever pitch of over 10,000 new markets created per month in the latter half of 2025. This demonstrates extremely high platform activity and community engagement, with users converting real-world events into tradable markets at an unprecedented rate.

But this very strength brings about its greatest challenge: extreme liquidity fragmentation. A presidential election can attract billions of dollars in capital, but a market on "next quarter's iPhone sales" or "whether a certain company will continue to buy BTC next week" might only have a trading volume of a few tens of thousands of dollars. The "head market" siphon effect is pronounced. In these top markets, liquidity is excellent, price discovery is efficient, and the trading experience is smooth. However, thousands of more niche, vertical markets face a severe lack of liquidity.

Data Source: https://dune.com/filarm/polymarket-activity

Low liquidity has two fatal consequences. First, since a large order from a few individuals can easily manipulate the price, the prices in long-tail markets can hardly represent "collective intelligence," and their core value as a "truth engine" vanishes. Second, the user experience is extremely poor. High slippage and thin order books prevent traders from entering and exiting smoothly, causing the market to lose its appeal for trading. How to effectively guide and aggregate liquidity to provide sufficient depth for thousands of long-tail event markets is a persistent challenge for all platforms.

Oracle and Rule Ambiguity Issues

Of course. This is a critical section of the report that delves into the nuanced and complex issues of oracle governance. The translation needs to be precise and clear to convey the full weight of these case studies. Here is the revised translation: If smart contracts are the "executors" of prediction markets, then oracles are their "final arbiters," holding a position of paramount importance in the system's operation. However, when the subject of an oracle's judgment is no longer clear-cut on-chain data (like BTC/ETH prices or wallet counts) but ambiguous real-world events, the risk of resolution escalates from a matter of technical security to a governance conflict over the right to define truth.

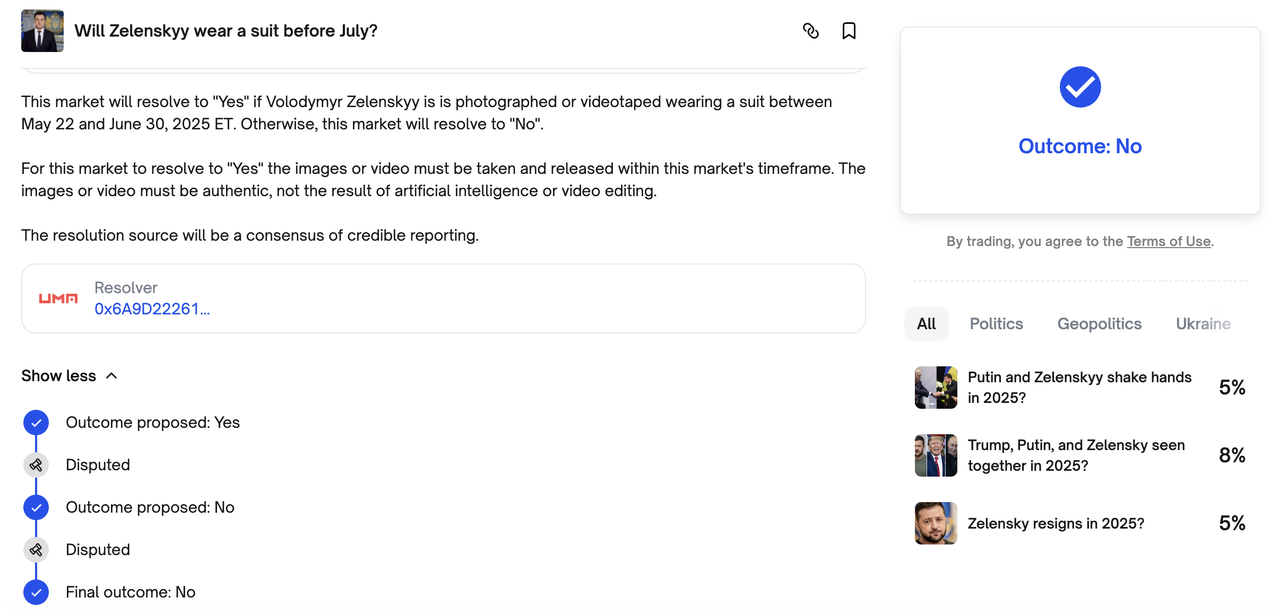

Case Study 1: The "Zelenskyy Suit Case" of June 2025

A popular market on Polymarket asking, "Will Zelenskyy wear a suit before July?" attracted up to $240 million in trading volume. The final resolution of this event sparked immense controversy, exposing the vulnerability of current oracle governance systems when faced with rule ambiguity.

-

The Event: On June 25, 2025, Ukrainian President Volodymyr Zelenskyy appeared at a NATO summit in a black formal outfit.

-

One Side's Argument: Some international and local mainstream media, including the BBC and the Kyiv Post, described it as a "suit." According to the market rule—which references a "consensus of credible reporting"—users who bet "Yes" believed the outcome was settled.

-

The Counterargument: Other media outlets and community members argued that he was wearing a "suit-style jacket," not a traditional full suit that includes a tie, dress shirt, trousers, and jacket, and therefore did not meet the market's expectation.

-

The Oracle's Ruling: The UMA optimistic oracle responsible for settlement, after an initial proposal of "Yes," was challenged by a massive stake of UMA tokens (worth approximately $25 million). Following a vote, the final resolution was determined to be "No," causing the value of positions betting on "Yes" to instantly drop to zero.

Data Source: https://www.kyivpost.com/post/55194

Data Source: https://www.president.gov.ua/en/news/u-gaazi-volodimir-zelenskij-proviv-zustrich-iz-donaldom-tram-98653

The core of this dispute lies in how a governance mechanism with potential conflicts of interest should rule when the real-world definition of a concept like "suit" is itself ambiguous. In a case like this, the resolution from an oracle with such conflicts will inevitably lean toward the interpretation that benefits the more powerful actors. In other words, the ambiguity of the rule provided UMA whales holding large "No" positions with "reasonable doubt," allowing them to leverage their voting power to steer the dispute in their favor. Imprecise rule definition creates a significant hidden risk to the integrity of governance.

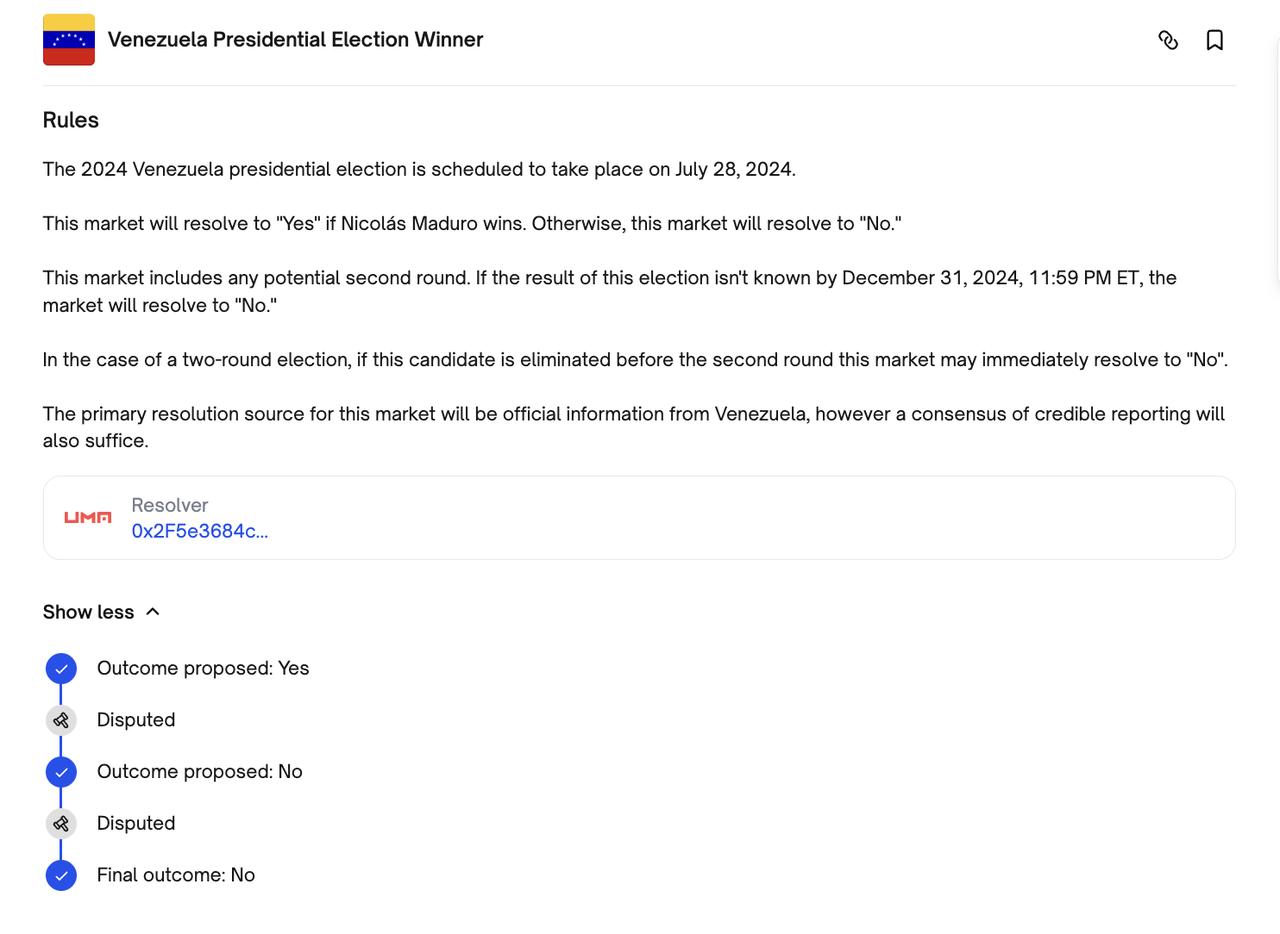

Case Study 2: The "Venezuela Election Case" of July 2024

If the "Zelenskyy Suit Case" was about the ambiguity of rules, this $6.1 million "Venezuela Election Case" poses a more profound question: When an oracle's "community consensus" conflicts with the market's explicitly written "objective rules," which should take precedence?

-

Market Rules and The Event: The rules for the Polymarket market on the "2024 Venezuelan Presidential Election Result" clearly stated: "The primary source of information for this market will be the official announcement from Venezuela, but a consensus formed by credible reporting is also valid." On election day, although exit polls showed the opposition candidate in the lead, the market price consistently favored the incumbent president, Nicolás Maduro, with his win probability hovering between 75-80%. After the election, Venezuela's National Electoral Council (CNE) officially announced that the incumbent Maduro had won with 51.2% of the vote. As soon as the news broke, Maduro's win probability on Polymarket soared to 95%, and Polymarket even tweeted to celebrate the platform's provision of accurate, real-time election information. For traders who had bet on Maduro, victory seemed certain.

-

One Side's Argument: Users who bet on Maduro argued that the oracle should strictly adhere to the rule of using the "official announcement as the primary source" and resolve the market in Maduro's favor based on the CNE's results.

-

The Counterargument: UMA token holders who voted in favor of González contended that "a 'credible consensus' had already formed based on data released by the opposition and questions raised by international media," and that this consensus was "more trustworthy than a 'manipulated official result,' therefore overriding the primary source." They argued that the opposition candidate, Edmundo González, should be declared the winner.

-

The Oracle's Ruling: After intense community debate and voting, the UMA community's final resolution was a complete reversal of Venezuela's official election results, declaring the opposition candidate González the winner. The price of tokens tied to a Maduro victory plummeted from nearly $1.00 to zero.

The central question in this dispute is whether the UMA community was interpreting the rules or rewriting them. By voting, UMA token holders chose the "credible consensus" interpretation, arguing that a consensus based on opposition data and international media scrutiny was more trustworthy than a "manipulated official result" and could therefore override the primary source. Here, the UMA oracle played the triple role of judge, jury, and executioner, transforming itself from a neutral arbiter into a decider based on the subjective judgment of its community.

These cases profoundly expose the structural flaws in current prediction market infrastructure. They clearly point to the two weakest—and therefore most valuable—links in the current landscape: truth resolution and rule definition. For investors and entrepreneurs, this might mean the most fertile ground lies not in competing head-on with Polymarket and Kalshi, but in empowering the entire ecosystem by providing "picks and shovels." Every improvement and innovation needed to address the weak points of prediction markets represents a massive market opportunity.

5.2 External Risks: Global Regulatory Uncertainty

For any emerging technology sector, navigating the existing regulatory framework is both its greatest challenge and a necessary rite of passage to maturity. For prediction market entrepreneurs, a clear regulatory environment is not a hindrance to innovation but a prerequisite for mass adoption and earning mainstream user trust. The current global regulatory landscape is highly fragmented: some jurisdictions are tightening their grip, while others remain relatively open and defined. The core consideration for regulators centers on a fundamental qualitative question: are decentralized prediction markets a form of on-chain financial innovation, or are they unlicensed gambling? Understanding and adhering to local laws and regulations is the foremost duty for all practitioners in the space.

As the world's largest capital market and foremost innovation hub, the regulatory stance of the United States has a decisive influence on the entire sector. However, the U.S. regulatory system is not monolithic; rather, it is characterized by a dual-track system of parallel exploration and contention between federal and state authorities, as well as among different agencies.

Federal Level: The CFTC's "Financial Instrument" Classification

The U.S. Commodity Futures Trading Commission (CFTC) is the primary federal regulator. It tends to view the "event contracts" of prediction markets as a broad category of financial derivatives and seeks to bring them under its regulatory framework. Its legal basis is the Commodity Exchange Act (CEA), which has an extremely broad definition of a "commodity."

-

Compliance Path: The CFTC offers a "front door" for prediction markets: applying to become a regulated Designated Contract Market (DCM). Kalshi followed this path to gain legal status to operate in the U.S., allowing it to offer services to American users in a regulated environment.

-

Enforcement Action: For unlicensed platforms, the CFTC has been unforgiving. In its enforcement action against Polymarket, the CFTC explicitly defined its contracts as "unregistered swaps" and "binary options," imposing a fine. In response, Polymarket made a move in 2025 by acquiring QCEX, a newly licensed DCM, in an effort to re-enter the U.S. market.

State Level: The "Online Gambling" Definition and Its Underlying Reasons

Unlike the federal financial perspective, U.S. states hold independent legislative power over gambling. From the standpoints of consumer protection and state-level financial interests (e.g., tax revenue), state gaming commissions are inclined to view prediction markets as a form of online gambling.

-

Core Logic: State gaming commissions are not unaware of the differences between prediction markets and traditional casinos. However, they opt to define it as online gambling based on the most fundamental user behavior, as its core model perfectly fits the definition of "risking something of value (money) on an outcome that is largely determined by chance and is outside of one's control."

-

Judicial Actions: Several states, led by Nevada, New Jersey, and Maryland, are actively challenging the legality of prediction markets through lawsuits—even targeting federally licensed platforms like Kalshi. An October 8th ruling by a federal judge in Nevada showcased the micro-semantic interpretation of legal text at the state level. The judge ruled that although Crypto.com had acquired Nadex, a DCM-licensed entity, its sports contracts were based on the "outcome" of a game, not an "occurrence" (a yes/no event) that could constitute a "swap" under the Commodity Exchange Act. Therefore, the judge deemed it outside the CFTC's jurisdiction. The implications of this precedent are profound, demonstrating that a CFTC DCM license is not a silver bullet; the determination remains contested within the U.S. system. State-level courts can still challenge federal law from a highly technical angle.

The regulatory conflict in the U.S. is not an isolated case but a microcosm of a common dilemma faced by developed economies worldwide. Looking globally, we find that the vast majority of countries and regions tend to classify prediction markets directly as "online gambling," requiring them to comply with strict and independent national gaming laws. This presents challenges for global operations but also offers guidance and opportunities for teams that deeply understand and adapt to local markets. The table below, using Polymarket as an example, clearly illustrates the differences in regulatory attitudes across major global regions:

Polymarket's initial compliance strategy was designed to leverage its technical architecture to evade regulatory scrutiny. The core idea was to legally separate the centralized "operating company" from the decentralized "technical protocol." This involved splitting into two separate legal entities domiciled in offshore jurisdictions, strictly prohibiting users from high-risk regions through technical measures like IP blocking, and insisting that user funds remain self-custodied in personal wallets. Through this series of measures, Polymarket attempted to position itself as purely a technology provider, arguing that the company itself did not directly offer regulated financial services, and that its front-end was merely a convenient "browser" for users to access the underlying protocol.

However, in its settlement order with Polymarket, the U.S. CFTC advanced a view potent enough to pierce this legal firewall, serving as a profound warning to the entire DeFi industry. The CFTC argued that even if the underlying protocol is decentralized, as long as a project team operates a web interface to facilitate user access and trading, that team is engaging in regulated activity for which it is responsible. This enforcement logic means that a simple "technological neutrality" defense may not hold up against regulators, thrusting the operators of the front-end interface directly into the regulatory spotlight.

As it stands, there are three primary paths, each with clear trade-offs: embracing regulation (the Kalshi model), technical evasion (the pre-acquisition Polymarket model), or offshore gray-area operation. Entrepreneurs must weigh the pros and cons and choose prudently, clearly recognizing that each path comes with its own set of opportunities and challenges. For any team hoping to operate a prediction market platform legally and for the long term, a compliance strategy cannot be an afterthought or a reactive measure. Instead, it must be a critical component of the top-level design, established before a project even launches. This decision will ultimately determine the project's DNA, its ceiling, and its destiny.

6. Future Opportunities: What Can Entrepreneurs Still Do?

After a deep dive into the internal governance dilemmas and external regulatory fog of prediction markets, we see not just a series of daunting challenges, but also a blue ocean of opportunities born from "imperfection." For entrepreneurs and investors, the pitfalls encountered by the leading platforms are the fertile ground for the next generation of companies. The opportunity is no longer just about "building another Polymarket," but about serving the entire ecosystem from a more practical perspective to solve the sector's core bottlenecks.

6.1 Platform-Level Differentiated Competition

To compete with giants like Polymarket and Kalshi, new platforms must find a differentiated path to survival. This means entrepreneurs need to make strategic choices that differ from the giants in three key dimensions: compliance path, target market, and technical ecosystem.

-

Ecosystem Positioning on Different Blockchains: Polymarket's success is deeply tied to the Ethereum/Polygon ecosystem. For new platforms, instead of fighting on the giants' "home turf," it's better to choose a new, high-potential blockchain ecosystem for differentiated competition. For example, Opinion Labs on BNB Chain, Limitless on Base, and Jupiter, Drift, and PMX Trade on Solana. Other emerging L1/L2 ecosystems are also undoubtedly fostering their own prediction markets.

-

Deepening Niche Markets: The strength of Polymarket and Kalshi lies in their breadth, covering popular topics like politics, sports, and macroeconomics. The opportunity for new platforms may lie in niche verticals and deep content. By cultivating a vertical, a new platform could build a moat. For example, a new platform might focus exclusively on entertainment events (awards, box office, music charts) and attract a core user base through more specialized community management and product design.

-

Innovating on Details and Product Services: For example, Limitless took a product-first approach by introducing dynamic leverage and using a pricing curve similar to perpetual contracts, making the market more suitable for high-frequency traders. Its AMM model is integrated with external yield-bearing protocols, allowing liquidity providers' capital to earn yield while market-making, aiming to improve LP capital efficiency and participation. functionSPACE aims to build a universal, unified "information market" ecosystem and underlying infrastructure, creating a unified liquidity pool to provide liquidity for long-tail markets. It also wants to create continuous probability markets that go beyond simple "Yes/No" questions, allowing users to trade on a continuous probability distribution.

6.2 Diverse Opportunities at the Infrastructure Layer

The battle between public chains and platforms is just the tip of the iceberg. Beneath the surface, an arms race around infrastructure has long been underway. Regardless of which differentiation path is chosen, all prediction market platforms face the same soul-searching questions: Who defines truth? Where does liquidity come from? How to survive in the regulatory gaps?

Instead of looking for the next challenger in the crowded platform layer, it's better to turn our attention to the enabling businesses that provide infrastructure for all platforms. We find that these opportunities can be systematically categorized into the following areas, which will have a profound impact on the long-term development of the prediction market ecosystem.

6.2.1 Truth and Rules

Oracles are the bedrock of the entire prediction market ecosystem and currently one of its most fragile links, as they determine whether the object of our prediction is clearly defined and whether the final outcome can be judged fairly. As mentioned in our report, the "Zelenskyy Suit Case" and the "Venezuela Election Case" exposed the ambiguity of rules and the conflict of interest in governance, reflecting the inherent flaws of current oracle governance. The core entrepreneurial opportunity in this segment lies in reshaping the production and arbitration mechanism of "truth."

-

Next-Generation Oracles: Current mainstream oracles like Chainlink and Pyth are better at providing objective price data, while decentralized oracles that rely on human voting, like UMA Protocol, are prone to conflicts of interest and governance flaws. Although all leading oracle projects are iterating and improving their products to meet the new demands of prediction markets, there is still a great need for new oracle networks with innovative governance specifically designed for prediction markets. For both established leaders and new entrepreneurs, whoever can make a breakthrough in oracles will capture enormous value. Currently, projects like Nubila, APRO, and XO Market are attempting to tackle these challenges. They might solve the flaws of "rule by man" through innovative economic and game-theoretic mechanisms (like jury systems or interest segregation), or they might use technical means (AI models, cryptographic proofs) to remove humans from the adjudication process, achieving "computable truth."

-

Market Creation and Arbitration Protocols: Another current product pain point is the centralization of "market creation." On both Polymarket and Kalshi, the creation of new markets depends on the platform's permission and review. Although Polymarket allows user proposals, the platform has the final say. Kalshi, on the other hand, lists markets entirely based on its own assessment of regulatory requirements. The future trend will undoubtedly be "permissionless market creation," where any user can freely create any market they want to predict. So, how can we ensure that the rules of created markets are clear and unambiguous? And how can disputes be arbitrated fairly? The creation of decentralized prediction market creation and arbitration protocols will become essential.

6.2.2 Capital and Liquidity

If "truth and rules" are the soul of prediction markets, then "capital and liquidity" are their lifeblood. Facing explosive market growth and diverse, global niche prediction needs, ensuring that every valuable long-tail market has sufficient trading depth and efficiency is the core economic problem that will determine the prosperity of the entire ecosystem. The lack of liquidity in long-tail markets not only weakens their core value of price discovery but also directly deters users. Therefore, systematically solving the liquidity problem is the sole mission of this infrastructure layer.

-

Liquidity-as-a-Service: Protocols that provide automated, sustainable liquidity for new markets. This could involve developing more capital-efficient AMM models specifically designed for prediction markets or building "meta-protocols" or "liquidity layers" that can dynamically route and share liquidity across different platforms and markets.

-

Trading Terminals / Arbitrage Bots: As mentioned earlier, there are already teams developing trading terminals that can aggregate liquidity from multiple platforms like Polymarket, Kalshi, and Drift. These can provide users with the best odds and a one-stop trading experience, as well as help arbitrage traders capture price differences across platforms and automatically lock in profits. By combining trading, data tools, social features, and traffic distribution, they aim to become the new traffic hubs of the prediction market era.

6.2.3 Traffic Aggregation and Distribution

Compared to most other obscure crypto concepts, prediction markets have the inherent potential for mass adoption. The problem the sector needs to solve now is how a broader user base can discover, access, and use prediction markets. One approach is to transform prediction markets from a "destination" that users must actively visit into a ubiquitous, instant function through technology, product, and operations. The focus should be on improving user experience and distribution channels. The following directions are worth exploring further.

-

Social Distribution Tools: Bots that deeply embed trading functions into social platforms, allowing trades to happen within conversations.

-

Gamification Services: Using leaderboards, seasons, points, and badges to transform prediction content into fun, competitive games for the general public. This can also serve niche, long-tail markets and penetrate more specialized areas.

-

Embedded SDKs/APIs: Providing "Prediction-Market-as-a-Service" development tools that allow any app (like news media, sports/lifestyle/tech communities, or content platforms) to easily generate a relevant prediction market next to their content, just like integrating a payment button.

6.2.4 Compliance and Security

As regulation tightens, compliance will shift from being an option to a necessity for the long-term, safe operation of prediction market platforms. Helping prediction market platforms survive legally in a complex global regulatory environment is a track worth thinking about and exploring.

-

Compliance Tech: Developing compliance tools specifically for the new needs of prediction markets. This could include more precise IP geo-fencing services, more affordable and automated KYC/AML solutions that protect user privacy, and tools for generating compliance reports for different jurisdictions.

6.2.5 AI Empowerment and Innovation

AI is the track with the most potential for productivity upgrades today. Combining it with prediction markets will create a powerful positive flywheel and take prediction markets to a more meaningful dimension.

-

AI as a Super Trader in Prediction Markets: Kalshi has already integrated Elon Musk's xAI Grok into its trading interface to provide users with real-time analysis of event backgrounds, probability assessments, and data trends. Projects like PolyTrader AI are also exploring having AI directly participate in prediction market trading. They will become super traders analyzing information 24/7, greatly enhancing market efficiency and depth.

-

Prediction Markets as a Training Ground for AI: Adding AI to prediction markets as an assistant is not just a simple feature addition but the beginning of a feedback loop: AI helps human traders make better predictions, and the outcomes of prediction markets, in turn, train AI in real-world games, helping AI better understand how humans predict events. Prediction markets may become the training ground for testing, selecting, and incentivizing "honest" AI models. In the future, the true value of an AI model may no longer be determined by academic metrics or user ratings, but by its ability to consistently profit in open prediction markets through real-money competition.

Looking back at the ups and downs of prediction markets, we see not just the wild growth of a nascent sector, but also a profound social experiment on information, power, and truth. From the academic ivory towers of Iowa to the global frenzy sparked by Polymarket, and to the various visions of combining AI with prediction markets, this space is using real money to show us the astonishing power of collective intelligence when interests are aligned.

We firmly believe that the winners of the future will not be single platform giants, but a prosperous and resilient ecosystem composed of infrastructure, applications, and platforms. The endgame for prediction markets may not be the birth of a platform larger than Polymarket, but for them to become a ubiquitous "information and opinion interaction layer" embedded in all aspects of digital life. It will be like the "Like" button—a fundamental function for how we interact with the information world, allowing everyone to participate in pricing the future. When AI becomes deeply integrated as a "super-participant," this interaction layer will evolve into a complex system driven by both humans and machines, from which "swarm intelligence" will emerge.

Fundamentally, the enthusiasm for prediction markets is a hope for a world that is more transparent, rational, and predictable. Yet, achieving this vision requires the sector to first tackle its foundational challenges in governance, compliance, and liquidity, making it, for the moment, a grand social experiment. Should these bottlenecks be overcome by the next wave of infrastructure innovation, we will witness its evolution from the margins of a niche community into the mainstream.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.