KuCoin Ventures Weekly Report: Asset Recovery & Strategic Gaming Amid Geopolitical Shocks — From Lighter’s Sector Disruption to BROCCOLI’s Liquidity Hunt

2026/01/06 03:03:02

1. Weekly Market Highlights

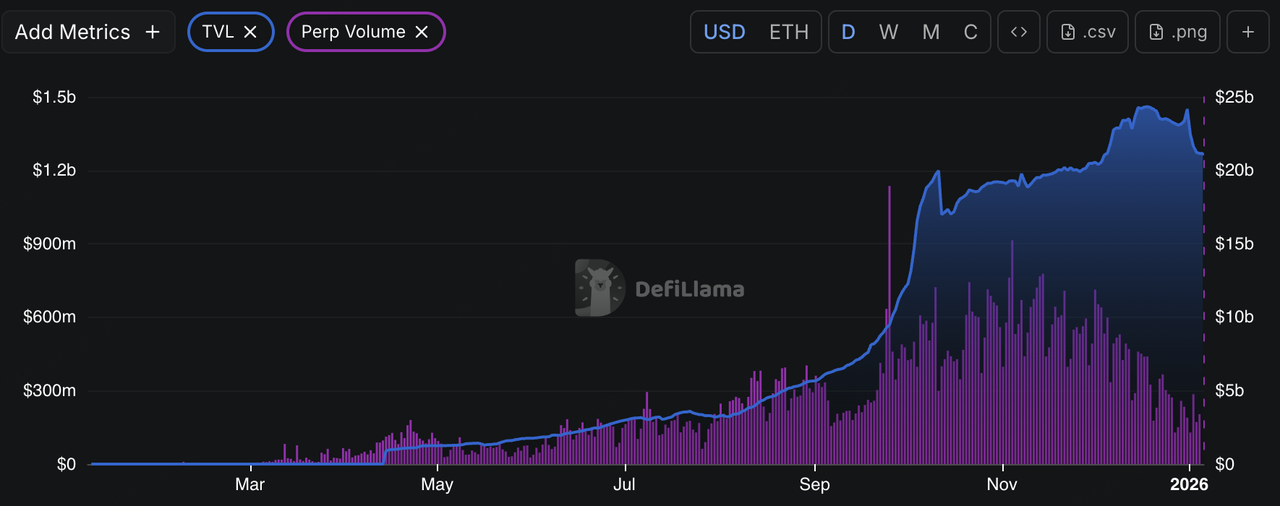

Lighter Post-TGE: Disruptor and Litmus Test in the Perp DEX Race

On December 30, 2025, Lighter—the breakout star of the Decentralized Perpetual Exchange (Perp DEX) space—officially held its TGE. The project launched its $LIT token with a total supply of 1 billion, a staggering 25% of which was airdropped directly to the community. With a total value of approximately $675 million, this marks one of the largest token distributions of 2025. Market reaction was immediate, with discussions quickly centering on volume authenticity, incentive sustainability, and whether Lighter poses a legitimate threat to established Perp DEX leaders. This event has pushed rivalry within the sector into a fever pitch.

Built on Ethereum, Lighter focuses on providing high-efficiency, non-custodial trading infrastructure. Utilizing Zero-Knowledge (ZK) proof technology to achieve high throughput and low latency, it supports cryptocurrencies, commodities, and potentially RWAs. Unlike many "grassroots" projects, Lighter is backed by Tier-1 venture capital firms including a16z and Founders Fund. Through an aggressive expansion strategy in the second half of 2025, Lighter evolved from an emerging protocol into a giant with over $1.2 billion in TVL. It has become a pivotal force for the Ethereum ecosystem as it challenges high-performance Perp-native Layer 1s. By the end of 2025, the platform captured a 20% share of the DEX Perp market.

Lighter TVL and trading volume growth.

Data source: DeFiLlama

Prior to TGE, Lighter incentivized participation through a points-based system split into Season 1 (private testnet) and Season 2 (public phase). Users earned points by trading, providing liquidity, and referring others. The system was humorously dubbed "farming points" by the community, as users often needed to engage in frequent small leveraged trades or place orders continuously to maximize rewards. Average users accumulated 50–150 points, translating to an airdrop value of approximately $5,000–$15,000. The airdrop totaled 25% of supply (250 million $LIT), with a conversion rate of roughly 1 point ≈ 20 $LIT, fully unlocked at launch with no vesting. Community feedback suggests an estimated 75% retention rate, though short-term sell pressure was clearly visible.

The core of the buzz surrounding Lighter is its direct challenge to the current market leader, Hyperliquid. In December 2025, Lighter’s 24-hour trading volume surpassed Hyperliquid’s on multiple occasions, with its 30-day volume briefly crossing the $200 billion mark. This "data peak" is not just a testament to its technical stack, but a direct reflection of its aggressive user acquisition strategy.

However, from a professional research perspective, there is a clear "metric misalignment." While Lighter leads in 30-day volume, its Open Interest (OI) sits at approximately $1.4 billion—far below Hyperliquid’s $8 billion. Lighter’s Volume/OI ratio is consistently higher than its peers, suggesting that platform activity is driven primarily by high-frequency, short-term "wash trading" (to farm incentives) rather than long-term position holding. This reveals that the project is still in a heavy incentive-driven phase and has yet to transition from "acquiring traffic" to "retaining deep liquidity."

Data Source: Table compiled by KuCoin Ventures. Original data sourced from DeFiLlama.

Lighter’s most aggressive product move was announcing a 0% Taker fee for retail users—essentially a price war targeting the existing market. By forgoing Taker fees, Lighter’s estimated annualized revenue is only about $105 million, whereas Hyperliquid generates over $800 million on similar volumes. Under this zero-fee model, Lighter must prove that its ecosystem can generate enough internal momentum (via API service fees, $LIT staking/validation, or asset buyback mechanisms) to support its $3 billion FDV.

2. Weekly Selected Market Signals

Geopolitical Shock Meets Capital Rebalancing: Risk Assets Oscillate Between a “Rebound” and “Fragility”

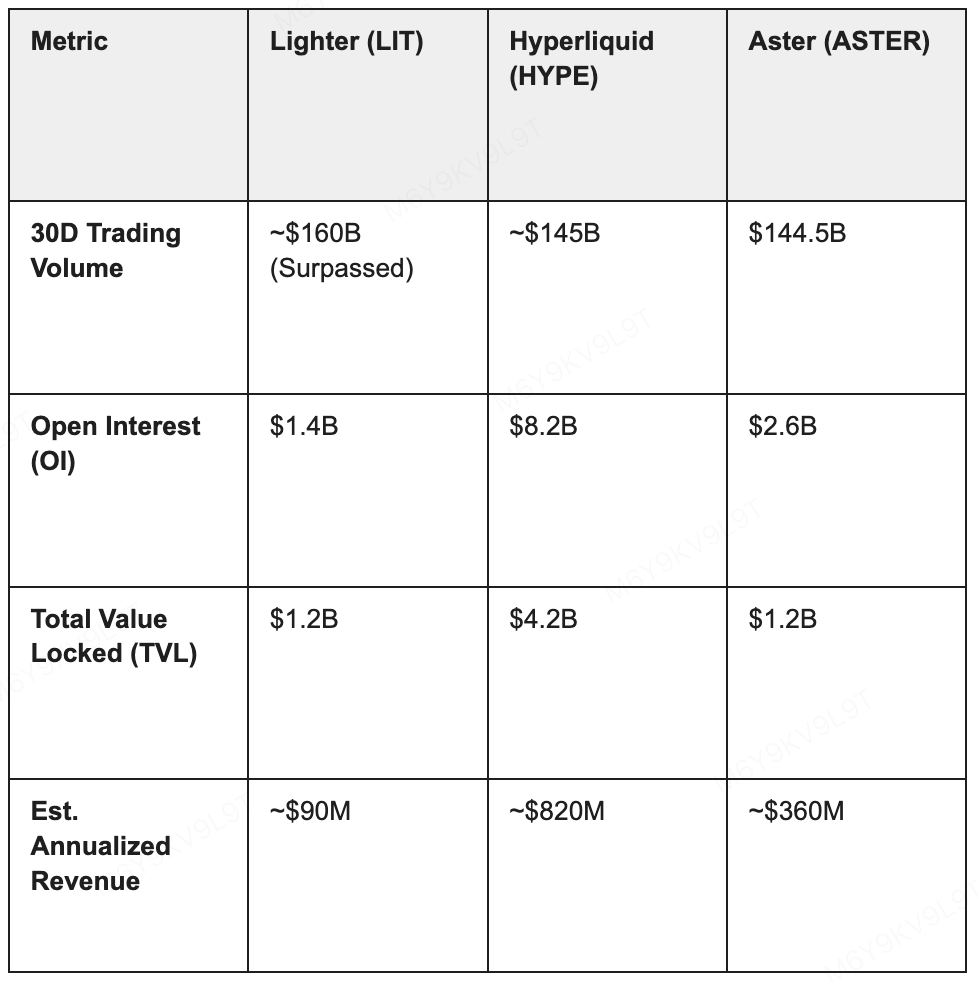

On the geopolitical front, following reports that the United States launched a military operation in Venezuela and removed President Nicolás Maduro, global assets moved into a classic “geopolitical shock → asset-by-asset repricing” pattern. Precious metals were the first to attract incremental safe-haven flows: both gold and silver rebounded quickly after a brief pullback, reflecting that the market’s initial response to tail risk still prioritizes “cash-equivalent hedges” and uncertainty protection. By contrast, crude oil priced the event with notable restraint.

Data Source: https://www.investing.com/commodities/metals

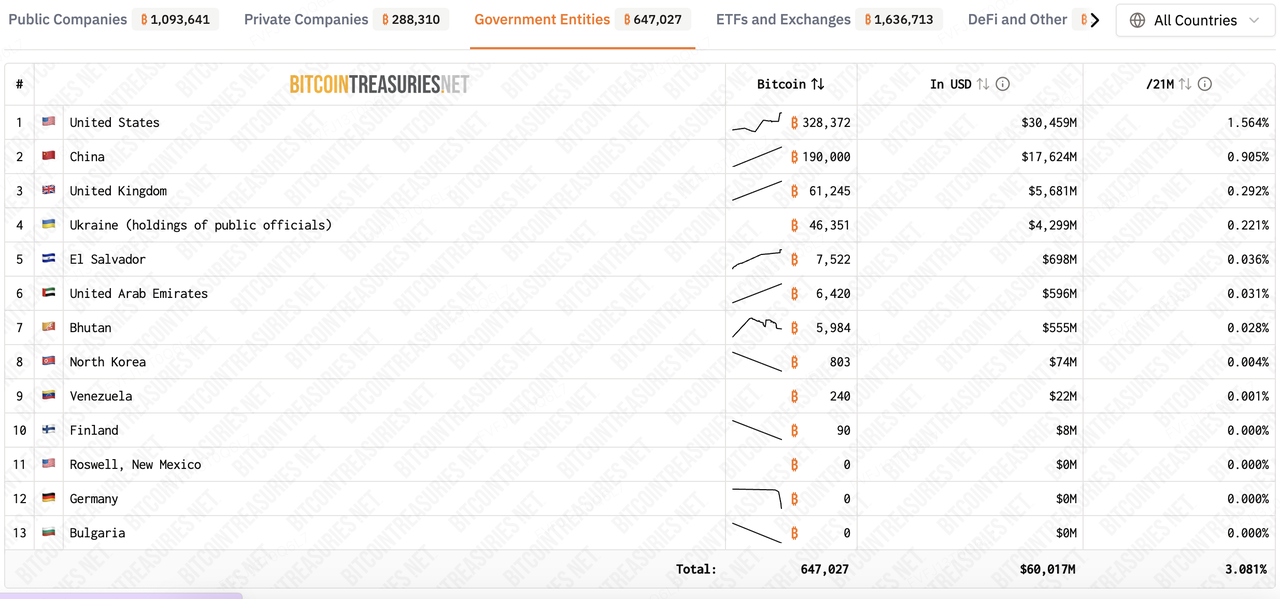

A tail variable that intersects more directly with crypto is the surge in discussion around Venezuela’s alleged “Bitcoin reserve used to evade sanctions” after the swift regime disruption—most notably the widely circulated claim of "tens of billions" scale, often linked to figures such as Alex Saab and a purported “shadow reserve.” If that estimate were accurate, the position would be large enough to rival MicroStrategy’s holdings and even exceed El Salvador’s national reserves.

Data Source: https://bitcointreasuries.net/governments

That said, it is important to emphasize: as of now, the claimed scale and fund trail lack address-level evidence and a traceable flow map that leading on-chain research institutions can consistently validate. It currently reads more like a composite of “political narrative + asset imagination” than a verified on-chain fact pattern. The variable worth tracking is not the rumored size per se, but control and disposition pathways: even if relevant crypto assets do exist, the market impact depends on specific form of disposal, rather than an immediate, linear supply overhang for spot markets.

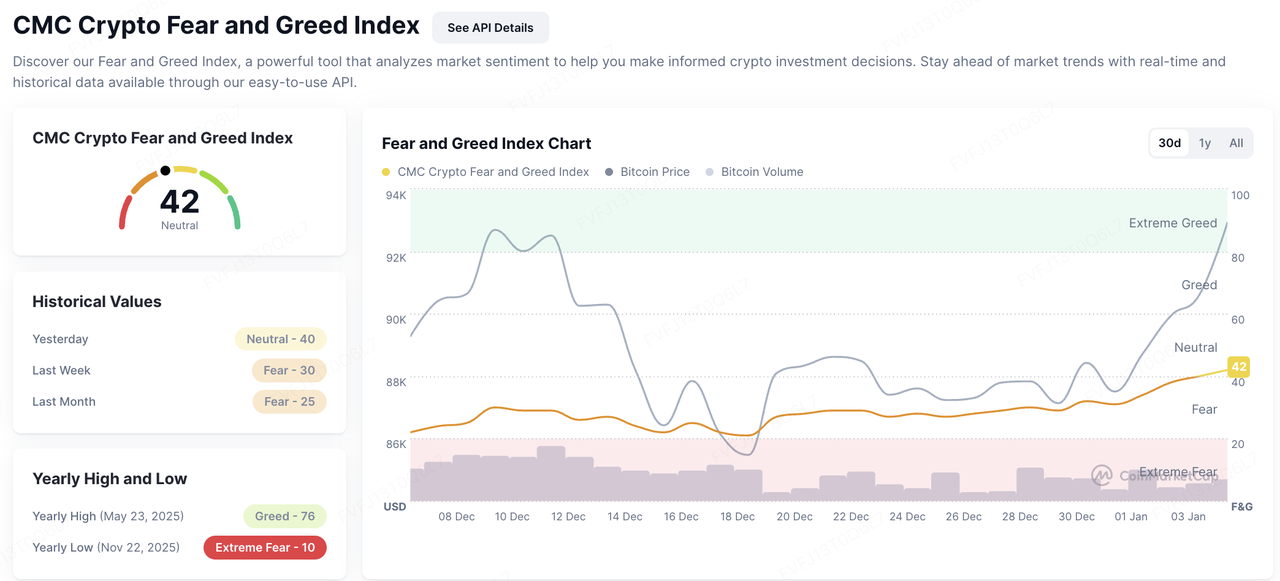

On the risk-asset side, after weeks of lethargy, crypto in early 2026 saw a phase of synchronized rebound: Asian equities strengthened, U.S. equity futures recovered, and crypto rose in tandem, with the CMC Fear & Greed Index moving back toward a more “neutral” zone. On the tape, Bitcoin briefly pushed above $93,000, Ethereum gravitated toward the $3,200, and altcoins—along with several legacy meme tokens—led the advance, consistent with the standard transmission from “risk appetite repair + liquidity spillover” into high-beta assets.

A key caveat is that this type of “broad rebound” is typically more sensitive to macro shocks. If rate expectations, geopolitical risk, or liquidity conditions reverse, highly correlated assets can still trigger a chain reaction of pullbacks. The current rally in high-beta themes such as memes is better characterized as a function of liquidity spillover and risk appetite normalization, and is not yet sufficient evidence of a fundamentals-driven, structural uptrend.

On the flow side, U.S. spot BTC ETFs staged a clear repair last week. Net inflows spiked to roughly $471 million on Friday, while weekly net inflows totaled about $459 million—arguably a stronger signal of “marginal risk appetite returning.” Spot ETH ETFs showed a similar pattern, posting around $160 million of weekly net inflows (also notably stronger on Friday), suggesting that traditional investors’ incremental, trial re-risking into crypto beta is still in progress.

Data Source: SoSoValue

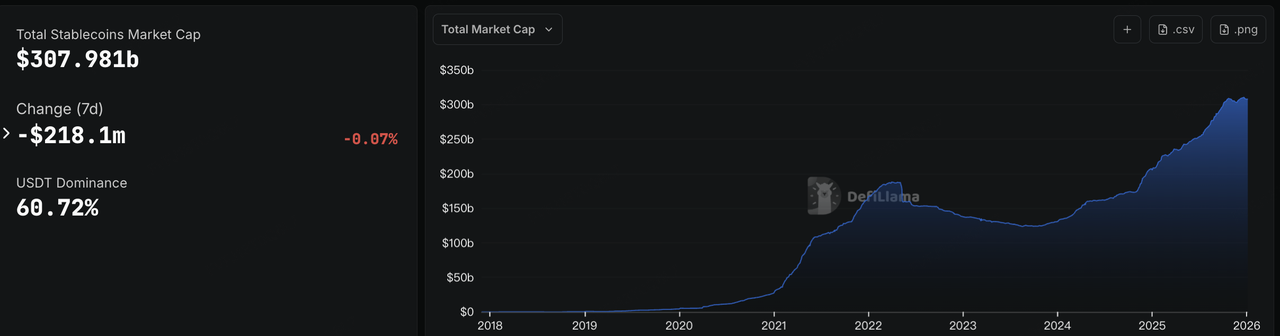

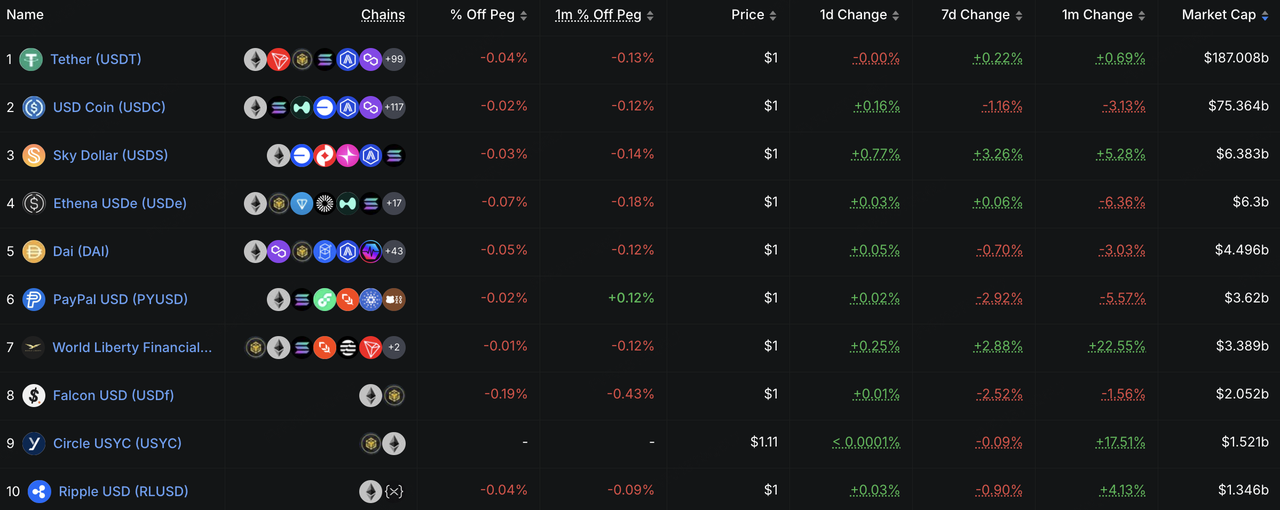

In contrast, on-chain liquidity did not strengthen in tandem. Total stablecoin supply declined from the prior peak to around $308 billion, and USDC saw a more pronounced net outflow of roughly $929 million. Additionally, on-chain tracking (e.g., Arkham) indicates that wallets associated with the “Official Trump Meme” cluster transferred out approximately $94 million USDC on December 31, 2025. If altcoins and other high-beta sentiment are to evolve from a “trading rebound” into a more durable trend, markets typically need stablecoin supply growth and rising exchange-available stablecoin balances; absent that, the rally is more likely to remain in a “fixed-sum positioning game + leverage-driven volatility” regime.

Data Source: DeFiLlama

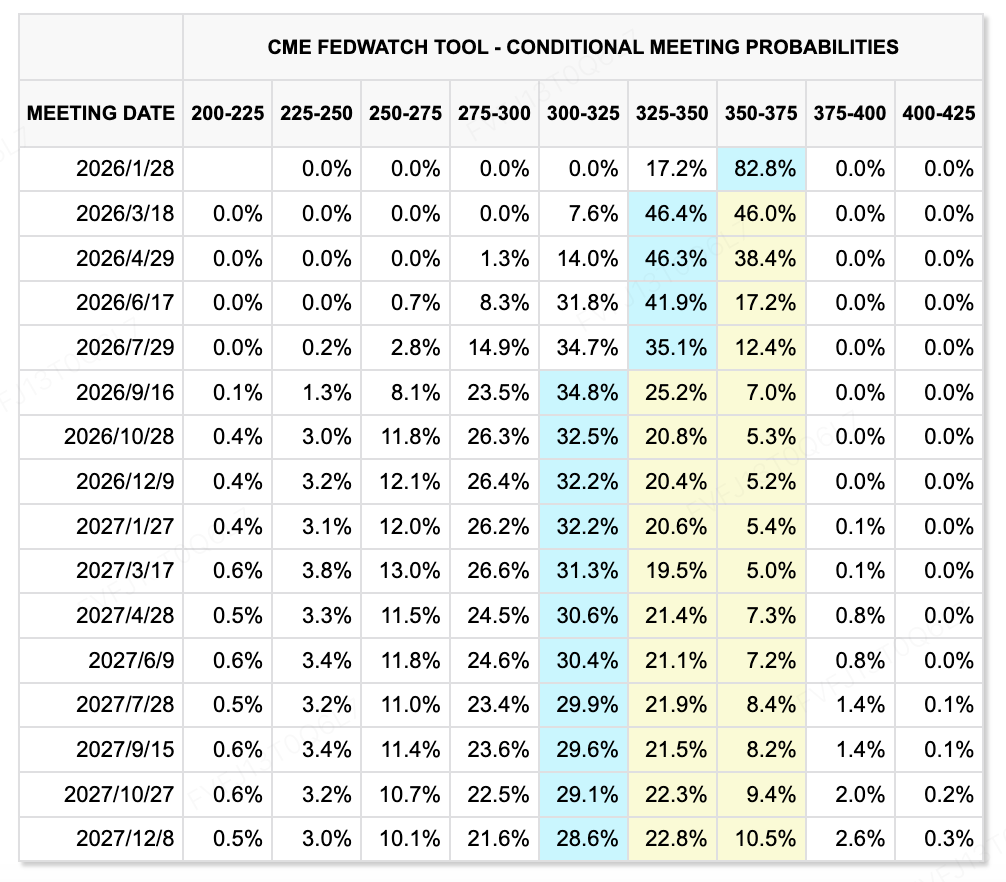

On rates and macro anchors, market pricing for early-2026 easing remains relatively restrained, leaning toward a “hold / small-step adjustment” baseline. It is worth underscoring that FedWatch reflects a probability distribution implied by market pricing—not a policy commitment. When inflation and employment dynamics re-accelerate or soften in new combinations, the distribution can reprice rapidly. Accordingly, this week’s key focus remains U.S. nonfarm payrolls and how Fed officials recalibrate the weight they place on “jobs vs. inflation vs. financial conditions.”

Data Source: CME FedWatch Tool

Key Events to Watch This Week (GMT+8):

-

Jan 6: Geopolitics — U.S. court confirms Maduro will appear in New York (watch potential spillovers into sanctions, asset disposition, and regional stability)

-

Jan 4–9: CES 2026 (Las Vegas) — focus on AI chips, compute infrastructure, and corporate capex guidance and how they shape tech-sector risk appetite

-

Jan 9: U.S. Dec nonfarm payrolls — key tension remains job growth alongside elevated unemployment; multiple Fed officials are also scheduled to speak this week

-

Jan 9: China Dec CPI and PPI

Primary Market Financing Observations:

With the Christmas and New Year holiday window, disclosed primary-market fundraising cooled sharply, leaving almost no new, statistically meaningful samples. The few publicly disclosed items skewed toward “existing business expansion + explainable cash flows.” For example, NYSE-listed Bitcoin miner Cango raised approximately $10.5 million by issuing Class B shares to expand global mining operations and extend into energy and AI compute infrastructure. Overall, the market still appears to be in a phase of “risk appetite repairing, but primary deployment cautious,” with capital more willing to pay for verifiable capacity and cash flows than to underwrite long-dated narratives at a premium.

3. Project Spotlight

Liquidity Anomaly Post-Mortem: BROCCOLI714 Price Volatility and Arbitrage Mechanics Analysis

Around 03:00 (UTC+8) on January 1, 2026, the Binance spot trading pair BROCCOLI714/USDT experienced sudden and violent volatility. This Meme token, based on CZ's pet dog BROCCOLI, violently surged from 0.014 USDT to 0.16 USDT within an hour—a maximum increase of 1000%—before plummeting back to its starting price within just 10 minutes.

Data Source: Binance

Although Binance officially stated after their internal review that "no clear signs of hacker attacks were found," deductions based on market microstructure suggest the price surge likely stemmed from massive market buy orders caused by a whale account anomaly or a market maker program malfunction. It was almost certainly not the result of normal, organic trading. While this was an isolated incident, it exposed the pricing failure of small-cap tokens under extreme liquidity mismatches.

During the most intense phase of the rally, an extremely abnormal "buy wall" appeared on the Spot Order Book Bid side for BROCCOLI714 (which had a circulating market cap of only ~$40M), with cumulative buy orders reaching as high as 26 million USDT. According to trader post-mortems, the Spot Bid 10% depth remained above 5 million USDT, while the Perpetual Contract Bid 10% depth was only about $50,000 USDT. This means the spot-to-contract depth ratio reached an astonishing 100:1. This extreme inversion of capital structure demonstrated that the buyer completely disregarded slippage and costs, exhibiting typical characteristics of "irrational forced buying." This became the core logic for some astute traders to intervene with long positions and follow the potential upward trend.

The rapid rise in spot prices triggered risk control mechanisms in the Binance Futures market. Contract trading momentarily entered "Reduce-only" mode, causing contract prices to be forcibly suppressed. When the spot price rushed to 0.07 USDT, the contract price was capped around 0.038 USDT by the circuit breaker. This price spread created immense potential profit but also constituted an extremely high barrier to entry. Top traders (such as Vida) used API scripts to make high-frequency attempts during this sudden extreme event, quickly capturing millisecond gaps where the circuit breaker mechanism refreshed or lapsed to build long positions and follow the upward trend driven by the abnormal buy orders.

However, the BROCCOLI714 operator did not pull the price up in a single straight line. Around 04:21, the account briefly withdrawn the massive buy orders, causing the price to drop instantaneously. This move directly shattered the psychological defenses of some trend followers. Post-mortem analysis shows that Vida, judging that the "hacker" had been risk-controlled, decisively chose to sell his entire position to lock in approximately $1.5 million in profit. Yet, about a minute later, the massive buy orders were placed back, and the price surged a second time to 0.15 USDT, completing a washout of those who exited early and triggering market FOMO once again.

The signal for the endgame appeared around 04:28. As buying power for BROCCOLI714 gradually dried up, the SOL/USDT spot market suddenly saw cost-insensitive market buying, causing SOL to spike 5% in a short period. Some traders keenly captured this signal, deducing that the abnormal account related to BROCCOLI714 had been restricted by risk controls and was forced to transfer or wash out remaining funds through high-liquidity SOL. This shift in capital flow became a crucial signal for traders to judge that the buy orders for BROCCOLI714 were about to vanish completely. Subsequently, around 04:32, the Bid wall was entirely withdrawn, and the token price began a free-fall crash. Some traders decisively flipped to short positions, eating up the final segment of profit during the price regression. Although Binance later ruled out a hack, this real-time judgment based on data helped traders precisely time their exits and reversals.

Interestingly, as the event unfolded, rumors even circulated that "CZ’s dog had passed away," providing a narrative excuse of "fundamental support" for the token's speculation. However, professional traders combined capital flow with Order Book data to determine that this depth-inverted, "charity-style" buying was destined to be unsustainable. Therefore, they ignored the narrative noise and decisively chose to open short positions when the order book collapsed.

This BROCCOLI714 incident is a liquidity mismatch example full of dramatic twists worth repeated study. Through cruel price volatility and the "myth" of quick profits for a select few, it tells us: in this wild crypto world, the top hunters must possess not only millisecond-level monitoring and trading infrastructure but also the gaming intuition to decipher capital flows and market psychology. In the instant transformation between greed and fear, if one lacks the ability to distinguish between a "washout withdrawal" and a "real crash," ordinary investors blindly imitating longs or shorts are extremely likely to be liquidated during violent fluctuations. In extreme market conditions where "immortals fight," learning how to preserve oneself is the primary lesson for every market participant.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.