Trading 101: How to Short Cryptocurrencies – A KuCoin Guide

Nothing is more exciting than seeing the token you invested in skyrocket in value. However, the cryptocurrency market is very unpredictable, and it is not uncommon for prices to move down just as quickly as they went up. In such cases, hedging the risk you take is a brilliant idea.

In addition, if you wish to profit even if the cryptocurrency prices move down, you may want to consider shorting cryptocurrencies. Short selling is available on most crypto exchanges, including KuCoin, and any investor who believes that a specific coin will fall in the future can sell that coin in advance and repurchase it later at a lower price to profit.

This guide explains the intricacies of short selling and how to short crypto in detail.

What is Short Selling?

Crypto short selling (or shorting) is a form of investing that aims at profiting when the prices of the underlying asset fall. To understand how short selling works, we first must understand the two legs of a long transaction.

In a standard contract, a trader buys something at the current price, anticipating that prices will rise. The trader books a profit as long as the selling price is higher than the buying price, and this can be summarised as "buy low, sell high."

As opposed to this, in short selling, the first step of the trade is to borrow the asset (in this case, a coin or token) and sell it at the current price. Then, when a price movement drops, the trader can rebuy the asset at a lower price and close the trade.

The price difference between the selling and buying price is the profit on the trade. However, the borrowing and repaying happen on the back-end and are usually done by the crypto trading platform, so traders don't need to worry about it.

However, here is an example to help you understand:

- In this example, Bob decides to take a short position of 5 bitcoins. The current market value of one BTC is $50,000, for a total of $250,000.

- To complete this trade, Bob will need to borrow 5 bitcoins (we are not assuming any leverage or margin here) from KuCoin at the current market price.

- Now, the market moves as expected, with the price of a single bitcoin falling to $40,000, for a total of $200,000.

- As a result, Bob purchased at the price and returned the funds to the KuCoin exchange.

- Now let's do the math; Bob's profit will be:

- Selling Price ($50,000 x 5 = $250,000) - Buy Back Price (40,000 x 5 = $200,000) = Profit ($50,000). This is the profit Bob intends to book.

Step-By-Step Guide to Short Selling Bitcoin/Cryptocurrencies on KuCoin Exchange

There are various methods of shorting Bitcoin or other cryptocurrencies. Some exchanges support none of the methods, while some support all of them. Fortunately, all of the short-selling options are available on KuCoin.

- KuCoin Spot Trading

- KuCoin Margin Trading

- KuCoin Futures

- Leveraged Tokens

- KuCoin Futures Grid Trading Bot

1. How to Short Cryptocurrencies on the KuCoin Spot Trading Market

In spot trading, crypto traders attempt to profit by purchasing assets, and hoping their value will rise. When digital asset prices rise, a crypto trader can sell them on the spot for a profit.

KuCoin Spot Trading Navigation

Shorting the market is another option for spot traders; however, it's different from KuCoin futures short selling. In order to short a cryptocurrency, you need to already have it in your portfolio. So, when the price of financial assets (crypto coins) falls, it involves selling them and repurchasing more at lower prices.

For instance, suppose you have 1 BTC in your spot wallet and believe the Bitcoin price will fall from $50,000 to $40,000 in the coming days. You can sell Bitcoin now at a higher price of $50,000 and then buy back when the price falls to $40,000. Spot trading does not allow you to use leverage or margin, and you can only sell the amount of coin in your portfolio. So when you buy back 1 BTC at a price of $40,000, the difference between the Selling and Buying price will be your profit.

KuCoin Spot Trading

2. How to Short Cryptocurrencies on the KuCoin Futures Market

The cryptocurrency futures market is a derivatives market that uses leverage to magnify crypto trading volume and profit. Crypto traders can hedge against the downside risk of the spot market and arbitrage funding fees in KuCoin futures without having to hold the underlying asset.

KuCoin Futures Trading Navigation

What is KuCoin Futures?

KuCoin Futures is a sophisticated cryptocurrency trading platform that provides a variety of leveraged futures contracts that can be traded in Bitcoin and other cryptocurrencies.

Instead of fiat currencies or other cryptocurrencies, KuCoin Futures deals in USDT margined and Coin margined pairs like BTC Perpetual/USDT or ETH Perpetual/USD. Whereas all profits and losses are reported in BTC, ETH, or USDT, etc.

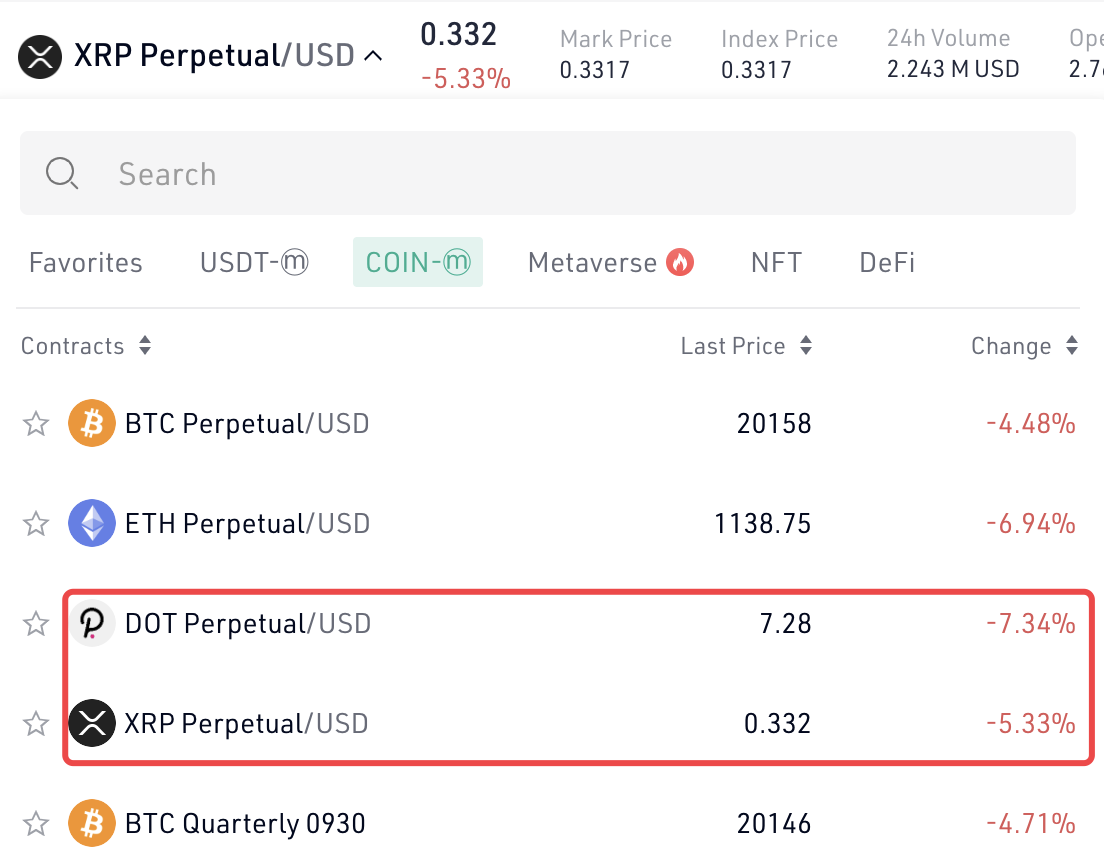

Note: KuCoin also has other coin-margined contracts except for BTC and ETH, including DOT and XRP. These can be seen in a screenshot below:

You could also short Cryptocurrencies on KuCoin Futures:

⧫ Navigate to KuCoin Futures.

⧫ You can choose from USDT Margined and Coin Margined futures contracts.

⧫ Transfer your funds from the main account to the futures account to place trades.

⧫ Read our KuCoin Futures guide to ensure you understand how the platform works.

Place an Order on KuCoin Futures

To place an order on KuCoin Futures, please select the order type, leverage, and quantity.

KuCoin Futures currently supports three orders:

⧫ Limit Orders

⧫ Market Orders

⧫ Stop Orders

Limit Order: A limit order is used to buy or sell a product at a predetermined price. To place a limit order on KuCoin Futures, enter the order price and quantity and click "Buy/Long" or "Sell/Short."

So to short a cryptocurrency, you do not necessarily have to be on the computer or a mobile phone to wait for a market to reach a certain price level. Instead, you can place a Sell/Short pending limit order, and the KuCoin Futures trading platform will automatically short a specific cryptocurrency on your behalf.

Stop Order: A stop order is an order that is triggered when the given price reaches a predetermined stop price. To place a stop order on KuCoin Futures, select the trigger type and set the stop price, order price, and order quantity.

For instance, Bob may hold 10 lots for a short position (opening leverage 5x). How does he set a stop-limit order so that when the most recent price reaches 20,000, a limit order is placed at that price?

Go to the 'Stop' tab, set the “Leverage” to 5x, Trigger Type to “Latest Price,” enter a “Stop Price” of 20,000, and Order Type to “Stop,” Lot(s) of 10, and click "Sell/Short."

Market Order: A market order is an order to buy or sell a product at the best market price. To place a market order on KuCoin Futures, enter the order quantity and click "Buy/Long" or "Sell/Short."

KuCoin Futures Trading

So if you believe that a specific cryptocurrency's price can drop after reaching a certain level, you can place a Sell/Short limit at that particular price, and the KuCoin futures trading platform will automatically execute your short trade.

Let me remind you that the main reason why crypto traders short sell crypto is to profit from a lower price tomorrow than the current price. Most trading strategies that involve short positions try to make money in both bull and bear markets.

Related Article: KuCoin Futures — 10 Principles for Beginners

3. How to Short Cryptocurrencies on KuCoin Margin Trading?

One of the most common methods used while trading is margin trading. Margin trading is an investment strategy in which a small amount of money is used to make multiple investments of the same size. Users leverage a small amount of cryptocurrency, borrow a certain amount of cryptocurrency, and then go long (buy)/short (sell) to maximize the use of their funds.

Margin trading helps experienced traders increase their exposure by borrowing money they don't have. However, KuCoin users need to determine how much margin they should be using on their KuCoin margin trading account.

Assuming that Bob has $2,000 worth of ETH on an exchange, he can short sell $4,000 worth of ETH through the KuCoin exchange's margin. If the price drops by $500, his profits will be multiplied by 2 to reach $1,000. However, if the price increases by $500, Bob's losses would also be magnified in the same proportion.

The KuCoin margin trading platform offers two types of Margins:

⧫ Cross margin

⧫ Isolated margin

Margin Trading on KuCoin

Cross margin: The borrower has a maximum leverage of 5x in cross margin mode, and the maximum borrowable assets are 4x the total assets in the cross margin account.

For instance, if you have 100 USDT in your cross-margin account, you can borrow up to 400 USDT, bringing your total available funds to 500 USDT. You may borrow several coins. For example, you could keep BTC in your cross-margin account while borrowing other coins like ETH, USDT, and LUNA. Later you can repay loans manually at any time before the due date.

Select Margin Type on KuCoin

Isolated margin: The maximum leverage in isolated margin mode varies depending on the trading pair, up to 10x. With 10x leverage, the maximum borrowable assets are 9x the total assets in the isolated margin account.

For instance, If you have 100 USDT in a BTC/USDT isolated margin account, you can borrow up to 900 USDT, bringing your total available funds up to 1000 USDT. This isolated margin account can only borrow BTC or USDT to go short or long.

Check out KuCoin's guide on Margin Trading as we will move ahead to discuss how to short Bitcoin and altcoins on margin trading.

Process of Margin Trading

⧫ You must first transfer funds to your Margin Account (which will be used as the margin for borrowing). You can use any coin or token as the margin in the cross margin.

⧫ The amount of money you can borrow is determined by the margin in your Margin Account. The most you can borrow is 9X your margin.

⧫ You can borrow from the market on your own or use Auto-Borrow to have the system borrow funds for you.

⧫ Margin trading follows the same procedures as spot trading, and the market depth for margin and spot is the same.

⧫ You can either repay manually after closing positions or enable Auto-Repay to automatically authorize the system to repay your debts and accured interests.

Now, as you understand Margin trading and different ways of borrowing, it's beneficial in making money in market conditions, especially when the market is crashing.

KuCoin Margin Trading

Short Cryptocurrency on KuCoin Margin Trading

You could also short Cryptocurrencies on the KuCoin Margin Trading platform:

⧫ Navigate to KuCoin Margin Trading and enable your margin trading first.

⧫ Transfer your funds from the main account to either Cross Margin Account or Isolated Margin Account.

⧫ Select order type from Limit, Market, or Stop Limits.

⧫ Enter the price and quantity you want to Sell/Short. By the way, you can follow the same procedure to buy coins.

⧫ The order will appear in your Open orders, and later you can close the trade when your desired target price is achieved.

Read our Margin Trading guide to ensure you understand how the platform works.

4. How to Short Cryptocurrencies via KuCoin Leverage Tokens?

KuCoin offers leveraged trading not only through margin trading but also through its Leveraged Tokens. They represent leveraged crypto derivatives users can invest in the crypto spot market. Each leveraged token represents a basket of perpetual contract positions, with the price of the tokens reflecting the change in the nominal value of the perpetual contract positions in the basket and the chosen leverage.

Short Selling Bitcoin via Leveraged Tokens

Unlike margin trading, users can take a leveraged position without depositing any collateral, maintaining margin, or worrying about liquidation risk. For instance, if the underlying asset is BTC, and its price rises by 1%, the net value of BTC3L rises by 3%, while the net value of BTC3S falls by 3%.

KuCoin Leveraged Tokens are perpetual tokens with no expiration date and negative price, so there is no liquidation risk. Investors can subscribe to or redeem those tokens in the primary market and purchase or sell them in the secondary market. For KuCoin Leveraged Tokens, traders do not need to pay any margin. The rest of the process is the same as Spot trading.

Here’s everything you need to know about about Leveraged Tokens.

5. How to Short Cryptocurrencies via KuCoin Trading Bot?

KuCoin Trading Bot is a free trading tool that can assist users in saving time and energy while increasing profits. It's the same as setting up a 24-hour, all-around bot butler for your trading strategy.

KuCoin Trading Bot Navigation

Newbie and experienced traders can use KuCoin trading bots to short Bitcoin and other altcoins to profit in the future.

Futures Grid: Make Passive Income By Buying Low & Selling High

Futures Grid, one of the most classic and popular trading strategies, works by selling high and buying low to profit at a specific price. As a result, it is a good trading strategy in a volatile market, where higher volatility may result in higher returns.

For instance, if you believe the price of Bitcoin will fluctuate between $20,000 and $30,000 in the coming days, you can set the two prices as the price range of your Futures Grid. Then, the KuCoin Futures Grid bot can be used for shorting cryptocurrencies. The KuCoin trading bot will automatically short-sell Bitcoin at the $30,000 level.

Shorting with Futures Grid Bot - Source: KuCoin Trading Bot

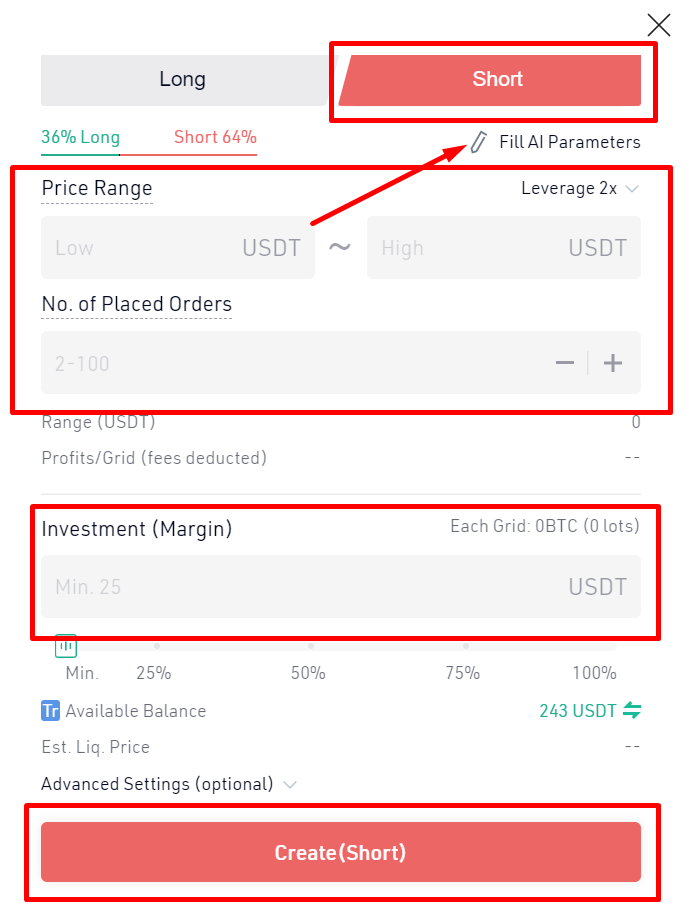

As you can see on the screenshot above, the KuCoin trading bot offers you the option to set Auto parameters or customize them manually.

Auto Parameters

Using a trading bot with auto parameters is fairly simple because the bot automatically fills values for you and all you need to do is the following:

⧫ Select a contract

⧫ Choose between long and short. Since we want to short sell, you should select short.

⧫ Enter your investment margin

⧫ Select "Create (Short)"

Futures Grid Bot Automatic Parameters - Source: KuCoin Trading Bot

Customize Parameters

⧫ Select a contract.

⧫ Choose between long and short.

⧫ Determine your leverage.

⧫ Determine a price range. (You can click Fill Al Parameters to autofill it.)

⧫ Enter the number of orders, also known as grids. The more orders in the same price range there are, the more grids there are, and the buy low and sell high occurs more frequently.

⧫ Enter your investment margin.

⧫ Select "Create (Short)" to start the bot.

Futures Grid Bot Customized Parameters - Source: KuCoin Trading Bot

You can also do advanced settings; see the KuCoin trading bot guide for more information on these options. So you now know that this is one of the ways to profit from the falling crypto markets.

Trading Fees on KuCoin

The popularity of KuCoin can be associated with its low trading fees. KuCoin is a one-stop shop as it provides almost all trading features under one roof, such as spot trading, peer-to-peer trading (P2P), a futures account, a trading bot, and much more.

Despite having all the trading features, what about KuCoin fees? Investors look for a deposit fee, withdrawal fees on a particular coin, and a daily withdrawal limit.

Speaking of KuCoin fees, the leading crypto exchange charges very competitive and low fees. Moreover, your KuCoin account fee structure is straightforward and easy to understand.

The first consideration is KuCoin spot trading fees, with every transaction subject to a 0.1% fee. KuCoin fees tend to decrease based on your 30-day trading volume or KuCoin Token(KCS) holdings, which entitle you to the additional 20% trading fee discount. Furthermore, you can use KCS tokens to cover some of your trading fees through KCS Pay.

For Futures trading, there’s a ‘Futures Bonus’ column for users to purchase our deduction coupons that can be used to deduct the Futures trading fees at a discounted price, with the trial fund included. This is a good option for users who want to trade with Futures with lower fees in the long term and details can be found here: https://futures.kucoin.com/welfare.

Spot and Futures Account Fee

KuCoin spot trading fees vary by trading fee level; for instance, a crypto trader with a higher trading fee level must pay lower trading fees. Check out the link for a detailed overview of KuCoin spot and futures trading fees.

KuCoin Exchange Trading Fee Structure

KuCoin Deposit Fees

Even if some brokers and exchanges charge deposit fees, KuCoin doesn't charge anything, now even low fees.

KuCoin Withdrawal Fees & Daily Withdrawal Limit

In contrast to the deposit fee, which is free, KuCoin does charge a fraction of the withdrawal fee. Like spot trading, withdrawal fees vary by coin, and a minimum withdrawal limit exists to execute a withdrawal.

KuCoin Withdrawal Fee Structure

Check out the complete withdrawal fees Kucoin here.

Bottom Line

Cryptocurrency shorting can be more complex than it looks at first glance. The values of cryptocurrencies keep fluctuating with time, which means that it can be hard for you to pinpoint a period when the token will be on a steady decline.

However, crypto exchanges such as KuCoin are constantly working towards making shorting crypto as easy as possible, all in hopes that traders will use all the tools available to them to create viable and profitable strategies.

Head over to the KuCoin Exchange today and start profiting from both bull and bear cryptocurrency market movements!

Find The Next Crypto Gem On KuCoin!