Deep Dive Into The Bitcoin Transaction Fee In 2025: Strategies For Optimal Payments And Investment

2025/11/06 07:15:02

Introduction: The Critical Role Of The Bitcoin Transaction Fee

Bitcoin has firmly established itself as the world’s premier digital store of value. However, every single transfer on the Bitcoin Layer 1 blockchain involves an inherent cost: the Bitcoin transaction fee. For cryptocurrency enthusiasts and investors alike, understanding the mechanics of this fee structure is not just about saving money; it is crucial for maximizing efficiency and accurately budgeting for digital asset movements, especially as network demand continues to grow into 2025.

Recent years have demonstrated the volatility of the Bitcoin transaction fee. During periods of high market excitement or the emergence of new network applications (such as Ordinals), these fees can temporarily surge to unsustainable levels for small payments, posing a significant challenge to user experience and adoption. This comprehensive guide dissects the underlying factors driving these costs and provides practical, future-proof strategies to optimize your payment and investment movements.

Section I: Defining The Bitcoin Transaction Fee

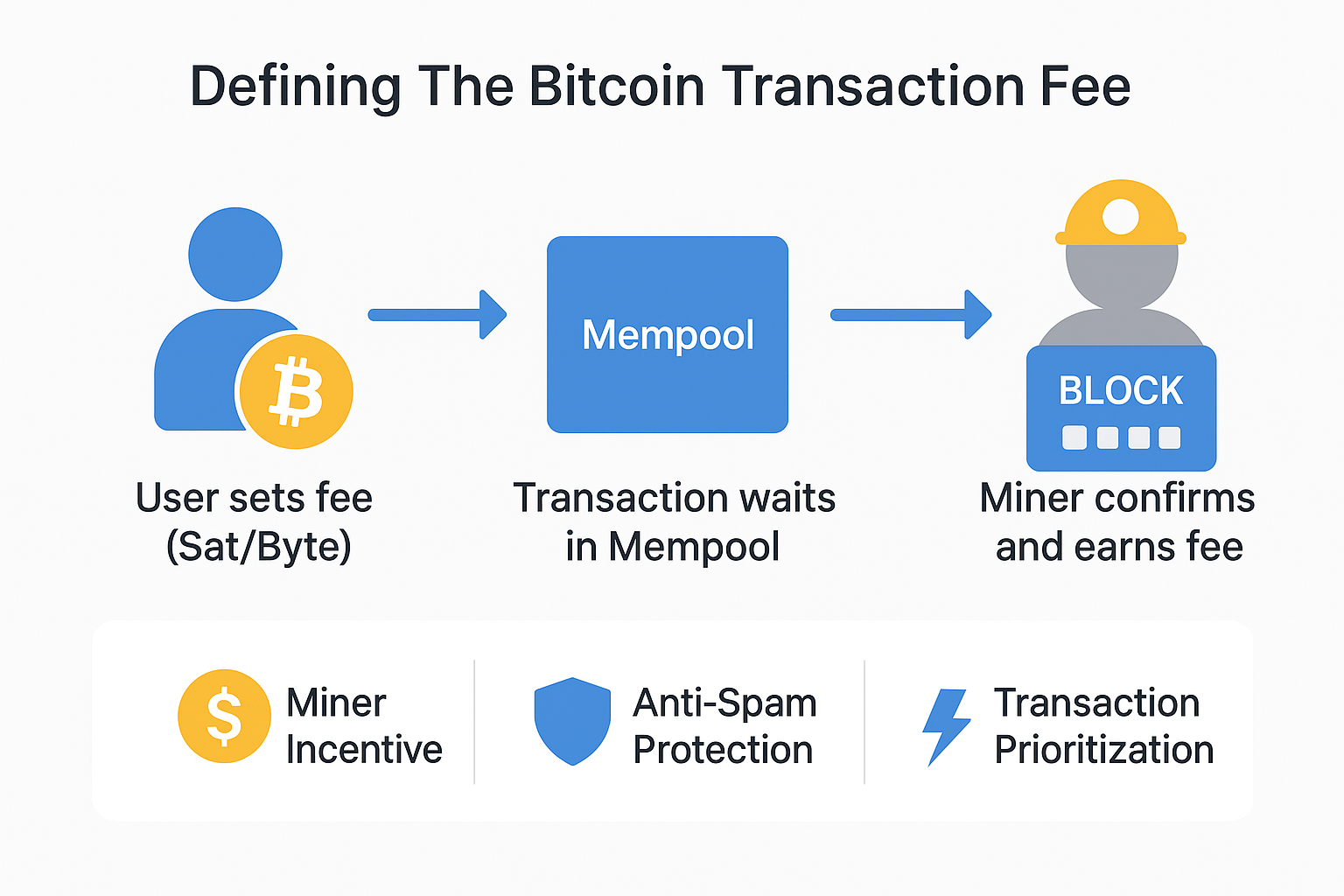

The Bitcoin transaction fee, often referred to simply as the miner fee, is the incentive mechanism users pay to the network’s miners. Miners compete to validate transactions and bundle them into the next available block, effectively securing the decentralized network.

The Essential Functions Of The Fee

-

Miner Incentive: The fee forms a core part of the miners' revenue, motivating them to dedicate substantial computational power (hash rate) to maintaining the security and immutability of the Bitcoin blockchain.

-

Anti-Spam Measure: By requiring a minimum payment, the fee acts as a defense mechanism, deterring malicious actors from flooding the network with numerous, economically non-viable transactions that would otherwise congest the limited block space.

-

Transaction Prioritization: Since the block size is limited (approximately 1 MB of data capacity per block), transactions must compete for inclusion. The higher the Bitcoin transaction fee a user is willing to pay, the higher their transaction's priority in the queue, and the faster it is likely to be confirmed.

It is vital to grasp that the Bitcoin transaction fee is not a percentage of the value transferred. A transaction sending 10,000 USD worth of Bitcoin could cost less than one sending 10 USD, depending entirely on the transaction’s data size.

Section II: Key Factors Influencing The Bitcoin Transaction Fee

Understanding the variables that dictate the final cost is the first step toward Bitcoin transaction fee optimization.

-

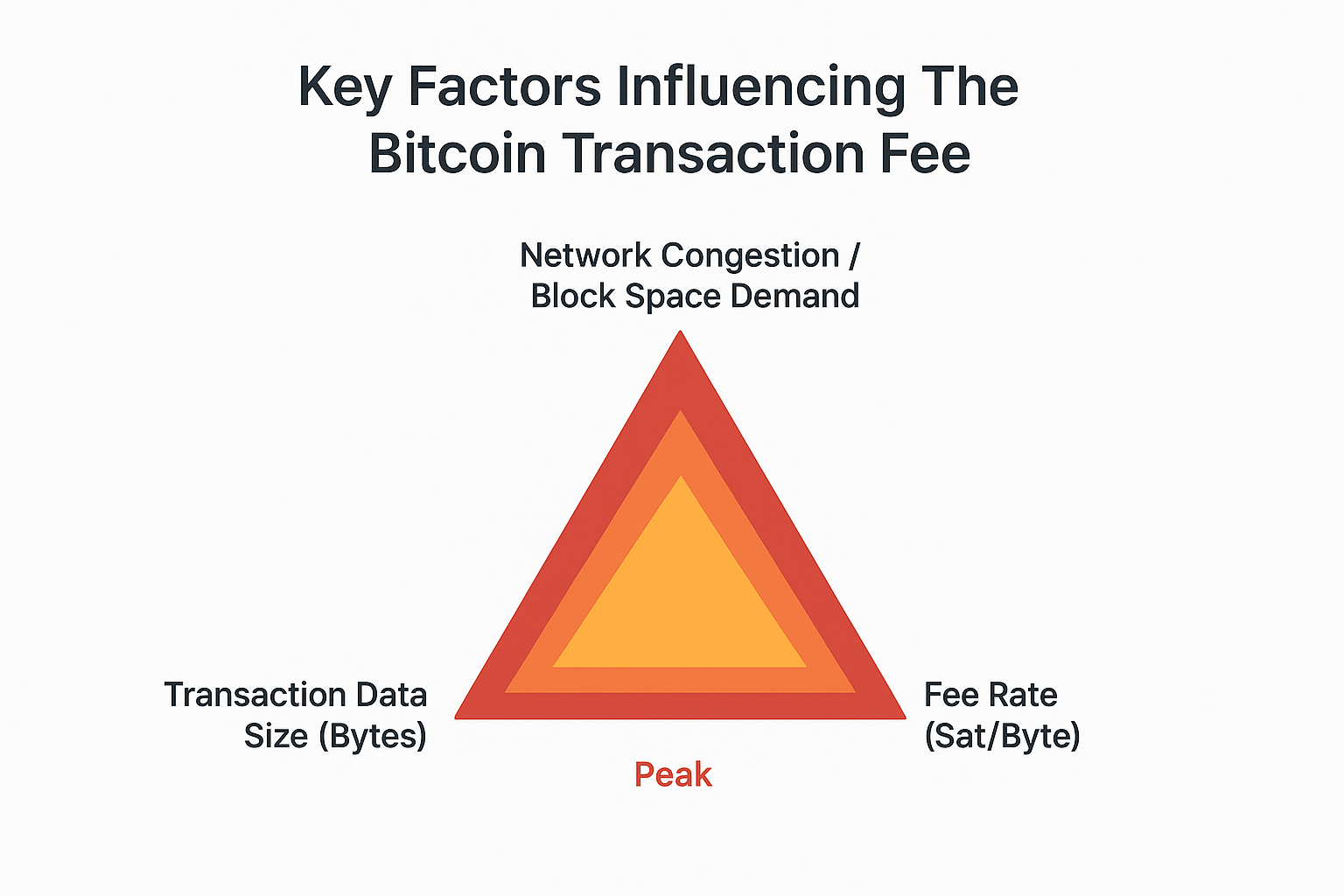

Network Congestion And Block Space Demand

This is arguably the most significant driver of a high Bitcoin transaction fee. When overall transaction volume spikes—a common occurrence during market rallies or major network events—the pool of unconfirmed transactions (Mempool) grows rapidly. Since block space remains constrained, users are forced into an auction mechanism, bidding higher Sat/Byte rates to ensure their transactions are picked up by miners. Increased competition directly translates into a higher Bitcoin transaction fee.

-

Transaction Data Size (In Bytes)

As priorly discussed, fees are based on the data volume of the transaction, not its monetary value. A transaction's size is determined by its complexity, specifically the number of inputs (the previous unspent transaction outputs, or UTXOs, that the sender is spending) and outputs (the recipient address and the change address).

A transaction aggregating many small UTXOs as inputs will be much "heavier" in terms of data than a simple transaction with just one input. This heavier data load demands more block space, resulting in a higher Bitcoin transaction fee.

-

The Sat/Byte Rate (Fee Rate)

The fee rate is the metric that ties size and cost together. It specifies how many Satoshis (the smallest unit of Bitcoin) the sender is paying for every virtual byte (vByte) of data their transaction consumes.

Total Bitcoin Transaction Fee equals Transaction Size (Bytes) multiplied by Fee Rate (Sat/Byte).

The current market demand for block space determines the prevailing Sat/Byte rate. When the network is busy, the required Sat/Byte rate increases exponentially for time-sensitive transactions.

Section III: Strategies To Optimize Your Bitcoin Transaction Fee

For investors and users who prioritize efficiency and cost control, optimizing the Bitcoin transaction fee is crucial. These practices constitute the core of Bitcoin transaction fee optimization.

-

Embrace SegWit And Bech32 Addresses

The SegWit (Segregated Witness) upgrade, activated in 2017, separates the signature data (the largest part of the transaction) from the main data stream. This structural change significantly reduces the transaction's effective data size.

Actionable Advice: Always use wallets that support and default to Native SegWit addresses, which begin with bc1 (also known as Bech32 addresses). These addresses can reduce the required Bitcoin transaction fee by 30% to 50% compared to older legacy formats. This is one of the most effective ways to influence how to calculate Bitcoin transaction fee in your favor.

-

Transaction Timing And Dynamic Fee Estimation

The reasons for Bitcoin fee spikes are often cyclical and predictable, tied to global financial markets or specific days/times.

Timing: Avoid transacting during peak North American trading hours (midday EST). Fees are often lower during weekends or very late at night UTC when global network activity is at a minimum.

Estimation: Do not rely on fixed, manual fee settings. Use advanced wallets or public mempool tracking sites (like Mempool.space) to get real-time, dynamic fee estimates. Set your fee to the best Bitcoin wallet fee settings for your priority level. A Low Priority setting saves money if you can wait several hours for confirmation.

-

Replace-By-Fee (RBF) And Batching

RBF: This is a protocol feature that allows a sender to resend an unconfirmed transaction with a higher fee. If you underpay your initial Bitcoin transaction fee and your transaction gets stuck, RBF allows you to pay an extra amount without having to wait for the original low-fee transaction to eventually fail or confirm.

Batching: Commonly used by exchanges and businesses, batching involves bundling multiple payments to different recipients into a single on-chain transaction. This dramatically lowers the cumulative Bitcoin transaction fee compared to sending each payment individually.

Section IV: The Future Of Low-Cost Transactions: Layer 2 Scaling

For everyday transactions, the long-term solution to volatile and high Bitcoin transaction fee problems lies in scaling solutions built atop the main chain.

The Lightning Network: Low-Cost, Instant Payments

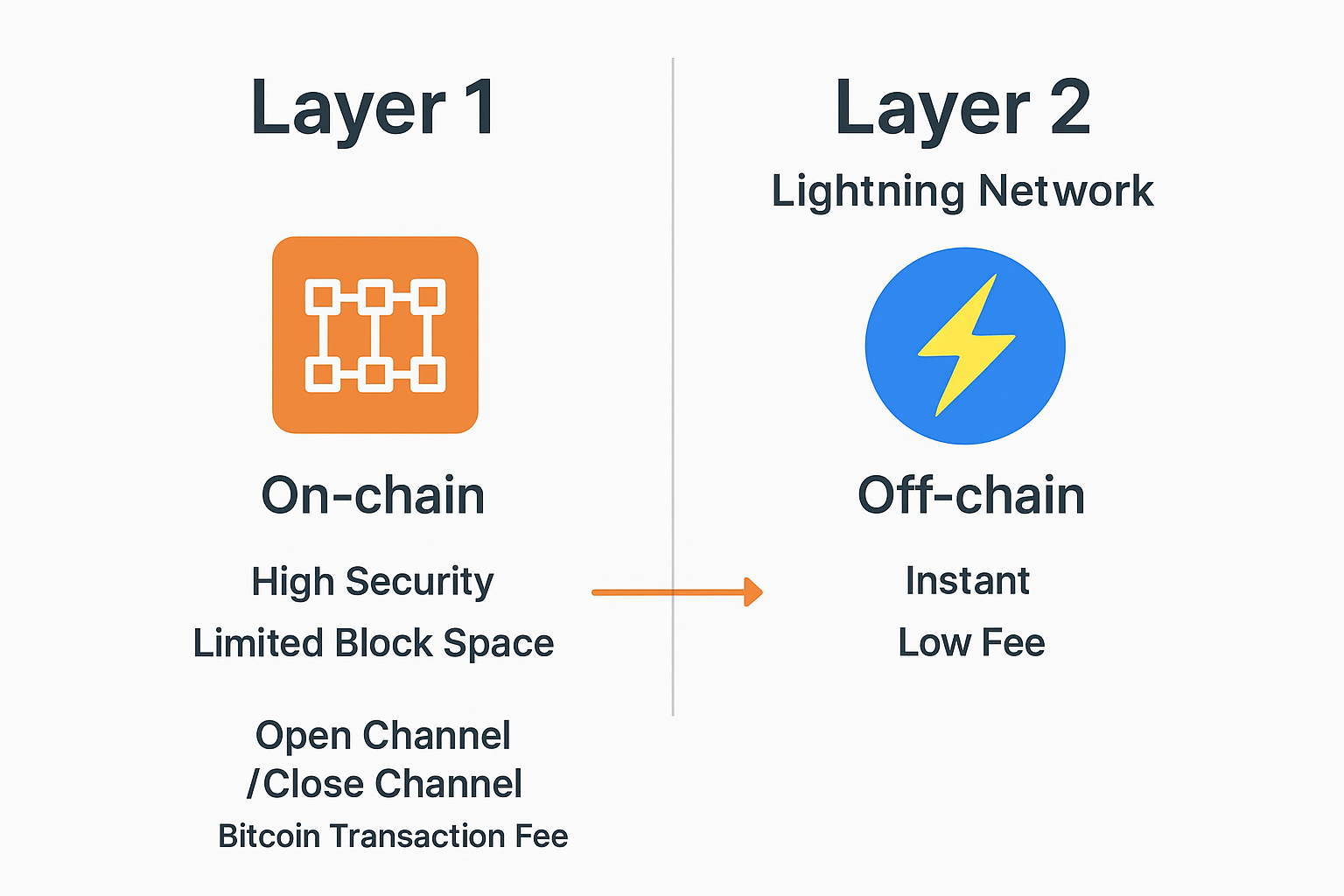

The Lightning Network (LN) is the most prominent Layer 2 solution, enabling near-instant, near-zero-cost Bitcoin payments.

Mechanism: Users open payment channels with one another or with network hubs. Transactions within this channel occur off-chain, meaning they do not consume the limited Layer 1 block space. Only the initial opening and the final closing of the channel require an on-chain Bitcoin transaction fee.

Impact: By routing small payments off the main chain, the Lightning Network effectively renders the Bitcoin transaction fee irrelevant for daily purchases and micro-transactions. Understanding Layer 2 solutions and Bitcoin fees is crucial for newcomers aiming to use Bitcoin as a medium of exchange.

Taproot Upgrade And Script Efficiency

The Taproot upgrade, activated in 2021, brings enhanced privacy and efficiency. By utilizing Schnorr signatures, complex multi-signature transactions and future smart contracts can be bundled to look like standard, single-signature transactions. This reduces the data footprint of complex transactions, thus lowering the required Bitcoin transaction fee for these operations in the future.

Conclusion: Balancing Cost, Speed, And Security

The Bitcoin transaction fee is an intrinsic and essential component of the network's security model. It is the cost paid for the privilege of utilizing the world’s most secure, decentralized settlement layer. As Bitcoin matures, so too must the strategies employed by its users.

The challenge of high Bitcoin transaction fee events is being successfully addressed through a combination of user education and technical innovation. By adopting SegWit addresses, practicing strategic timing, and actively utilizing Layer 2 solutions and Bitcoin fees via the Lightning Network, users can retain the security of the Bitcoin network while ensuring their transactions are both cost-efficient and timely. The key for every participant—be they investor or enthusiast—is to adopt these modern optimization techniques to minimize their average Bitcoin transaction fee and fully realize Bitcoin's potential.

FAQ (Frequent Asked Questions)

Q1: Why Is My Bitcoin Transaction Fee Consistently High?

A: The most common reasons are high network congestion, or your wallet not using SegWit (bc1 starting) addresses, resulting in an oversized transaction data package. Please refer to the optimization strategies in this article.

Q2: How Can I Accurately Calculate The Lowest Safe Bitcoin Transaction Fee?

A: You can use professional Mempool explorers (like Mempool.space) to view the current Sat/Byte rates required for different transaction priorities. Your wallet's "dynamic fee" feature should use this data to recommend the best Bitcoin transaction fee.

Q3: If I Set My Bitcoin Transaction Fee Too Low, Will The Transaction Get Stuck?

A: Yes. If your Sat/Byte bid is too low, miners may ignore your transaction for a long time, causing it to remain in the Mempool. If the transaction is unconfirmed for an extended period (e.g., over 24 hours), you may need to use the Replace-By-Fee (RBF) mechanism to increase the Bitcoin transaction fee and accelerate confirmation.