Best Crypto to Buy Right Now: Deep Dive into AI, RWA, and DePIN Sectors – Where is the Next 100x Gem?

2025/12/09 07:48:02

Introduction: Identifying the Next Explosive Trend – Finding the Best Crypto to Buy Right Now

As the crypto market enters a new development cycle, the era of relying solely on the "Big Three" (BTC, ETH, etc.) is fading. Savvy investors are no longer blindly chasing pumps; instead, they are focusing on niche sectors that are deeply integrating with the real world, offering genuine use cases and massive technological potential. In the current market environment, which tokens possess the potential for explosion and truly qualify as the best crypto to buy right now?

The answer lies within three explosively growing narratives: Artificial Intelligence (AI), Real-World Assets (RWA), and Decentralized Physical Infrastructure Networks (DePIN). These three sectors are not only solving the challenge of Web3 adoption but are also attracting massive Web2 capital and users, signaling their potential to lead the next bull run.

This article will deeply analyze the core value of these three sectors and explore the projects within them that hold the most potential, helping you make informed investment decisions.

I. Sector Fundamentals: What Are AI, RWA, and DePIN?

Before diving into investment potential, it is essential to understand the basic concepts of these three major sectors:

Artificial Intelligence (AI)

-

Definition: In Web3, the AI sector primarily focuses on building decentralized AI services, computing marketplaces, data sharing platforms, or AI-driven decentralized applications. It aims to break the monopoly of a few tech giants over AI technology.

-

Core Pain Point: Traditional AI model training requires enormous computing power and vast amounts of data, and these resources are highly centralized. Web3 AI projects use token incentives to encourage global users to contribute idle computing resources and personal data, achieving the democratization of resources.

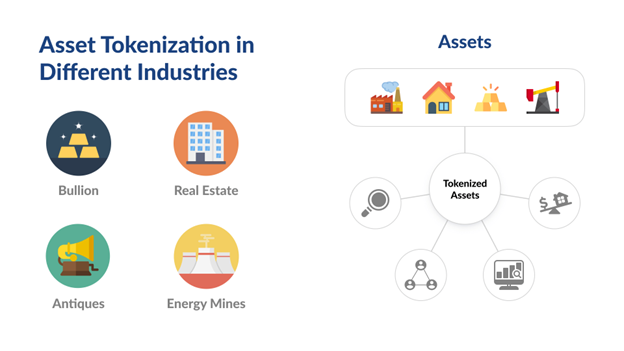

Real-World Assets (RWA)

-

Definition: RWA tokenization is the process of representing the value of tangible or intangible assets from the real world (such as US Treasury bonds, real estate, corporate debt, art, or carbon credits) as on-chain tokens.

-

Core Value: RWA brings the low-risk, stable yields of traditional finance (TradFi) into the DeFi world, providing crypto assets with diversified collateral and genuine sources of yield, significantly enhancing the utility and compliance of DeFi.

Decentralized Physical Infrastructure Networks (DePIN)

-

Definition: DePIN refers to the use of blockchain and token incentive mechanisms to encourage users globally to deploy and maintain physical infrastructure networks, such as 5G cell towers, sensor networks, decentralized storage servers, and energy grids.

-

Core Value: DePIN uses token incentives to replace traditional centralized construction models, building global infrastructure at a lower cost, faster speed, and with greater censorship resistance, achieving resource sharing and the decentralization of network ownership.

II. Artificial Intelligence (AI): The Wave of Data and Compute Democratization

AI is the future of technology, and blockchain is providing the necessary data, computing resources, and decentralized marketplace for AI. The AI sector is an area that cannot be overlooked when seeking the best crypto to buy right now.

A. The Core Value of AI and Web3 Integration

The value of AI projects in the crypto world is mainly reflected in two aspects:

1. Decentralized Compute and Data Sharing: Allowing global users to contribute idle computing power or data, breaking the monopoly of large tech companies.

2. AI-Driven DeFi and Tools: Utilizing AI algorithms for on-chain trading strategies, risk management, and automation services.

B. Potential Tokens and Investment Logic

- Compute and Services (e.g., $Render, $Fetch.ai, etc.):

- Positioning: These projects aim to build decentralized computing marketplaces or develop AI Agent infrastructure.

- Investment Logic: With the explosive growth in AI models' demand for computing, projects offering decentralized, cost-effective solutions will see their native tokens gain clear utility value. Look for projects with clear partnerships with mainstream AI companies or those with large compute communities.

- Data and Knowledge (e.g., $Ocean Protocol, etc.):

- Positioning: Focused on decentralized data sharing and monetization.

- Investment Logic: Data is the "fuel" for AI. Data marketplaces that provide high-quality, privacy-preserving data for AI training will flourish as AI applications become more prevalent. These projects are a steady choice for those pursuing the best crypto to buy right now.

III. Real-World Assets (RWA): A Trillion-Dollar Market Restructuring

Source:Medium

RWA tokenizes tangible real-world assets and places them on the blockchain. This sector is the main gateway for Traditional Finance (TradFi) capital into DeFi, with a potential scale reaching trillions of dollars.

A. Drivers of the RWA Sector Explosion

-

Compliance and Security: RWA projects typically emphasize compliance, attracting institutional investors with strict risk and regulatory requirements.

-

Genuine Yield Sources: RWA introduces real yields with low correlation to crypto assets (like Treasury yields) into DeFi, enhancing the stability of the DeFi ecosystem.

B. Potential Tokens and Investment Logic

-

Infrastructure and Protocols (e.g., $MakerDAO, $Ondo, etc.):

-

Positioning: Projects like ONDO Finance focus on providing institutional-grade RWA solutions, while blue-chip projects like MakerDAO optimize their stablecoin collateral composition with RWA assets.

-

Investment Logic: A top choice for the best crypto to buy right now should focus on those at the RWA infrastructure layer or projects that have secured partnerships with traditional financial giants. They serve as crucial "toll booths" for TradFi capital entering Web3.

-

-

Credit and Private Markets (e.g., $TrueFi, etc.):

-

Positioning: Moving real-world credit and lending demands onto the blockchain for more efficient capital matching.

-

Investment Logic: They utilize the transparency of blockchain to improve lending efficiency and offer differentiated yields not found in traditional DeFi.

-

IV. Decentralized Physical Infrastructure Networks (DePIN): The Perfect Blend of Hardware and Incentives

The DePIN sector uses token incentives to encourage global users to deploy and maintain physical infrastructure (such as wireless networks, sensors, energy grids). It represents a disruptive restructuring of real-world infrastructure by Web3.

A. The Core Appeal of DePIN

-

Real-World Utility: DePIN projects provide networks and services that are tangible and usable by consumers, solving the pain point of "lack of real use cases" that plagues many crypto projects.

-

Flywheel Effect: Token incentives attract more people to deploy hardware $\rightarrow$ network coverage expands $\rightarrow$ attracts more users $\rightarrow$ increases network fees and token value.

B. Potential Tokens and Investment Logic

-

Wireless Networks and Sensors (e.g., $Helium, $Render, etc.):

-

Positioning: Building decentralized 5G networks, LoRaWAN, or environmental sensor networks.

-

Investment Logic: The best crypto to buy right now in this space must be assessed based on the physical network coverage and token burning mechanisms. The wider the network coverage and the higher the user adoption, the greater the deflationary pressure and utility value of the token.

-

-

Storage and Compute (e.g., $Filecoin, $Arweave, etc.):

-

Positioning: Providing permanent or decentralized file storage services.

-

Investment Logic: With the surge in demand for Web3 applications and AI data storage, these decentralized storage solutions have become critical infrastructure. They are often undervalued "digital real estate."

-

V. Summary and Investment Strategy: The Best Crypto to Buy Right Now is a Combination Play

Finding the best crypto to buy right now requires a balanced, combination strategy:

-

AI (High Growth/High Risk): Allocate a small portion of funds to AI tokens with strong technical teams and actual compute demand, capitalizing on the potential for exponential tech-driven returns.

-

RWA (Steady Growth/Compliance): Allocate a moderate portion of funds to RWA infrastructure and blue-chip projects as a portfolio stabilizer, benefiting from the structural growth driven by the entry of traditional finance capital.

-

DePIN (High Potential/Cyclical): Allocate a moderate portion of funds to DePIN projects that have established a strong network flywheel effect, betting on their disruption of traditional monopolistic infrastructure.

Remember, the best crypto to buy right now is not a single asset, but a sector-based portfolio carefully constructed according to market narratives and your risk tolerance. Currently, AI, RWA, and DePIN offer the best entry ticket to the next cycle.

VI. FAQ (Frequently Asked Questions)

Q1: How can I determine if an RWA project is compliant?

A: A compliant RWA project typically exhibits the following characteristics: the underlying assets are backed by a legal entity, the assets are held by a third-party custodian, there are regular independent audit reports, and the project clearly informs investors of the legal rights and risks associated with their tokens. Investors should prioritize projects that collaborate with regulated financial institutions.

Q2: What is the difference between the AI sector and the DePIN sector?

A:

-

AI Sector: Primarily addresses the decentralization of digital resources (computing power, data, algorithms).

-

DePIN Sector: Primarily addresses the decentralized construction and incentivization of physical infrastructure (networks, storage hardware, sensors).

-

While both use token incentives, AI focuses more on software and digital services, while DePIN emphasizes the deployment of hardware and physical networks.

Q3: For beginners, what is the safest strategy for choosing the best crypto to buy right now?

A: The safest strategy is diversification. It is recommended to allocate the majority of your funds to market-dominant blue-chip coins (like BTC, ETH), and then allocate the remaining capital in a 60/40 or 70/30 split to leading projects in the RWA and AI/DePIN sectors, respectively. Never invest more money than you can afford to lose in any high-risk asset.