BTC Cloud Mining Dangers & Deep Dive: The Investor’s 2025 Guide to Safe Bitcoin Mining Exposure

2025/10/31 16:00:03

Introduction: The Alluring Promise of BTC Cloud Mining

(Source: BitCourier)

(Source: BitCourier)The world of Bitcoin mining is complex, requiring significant capital expenditure (CAPEX) on ASIC hardware and perpetual operational expenditure (OPEX) on electricity and cooling. For the average crypto investor, BTC Cloud Mining—the practice of renting hashing power from remote data centers—promises a convenient shortcut. It offers the enticing potential for passive Bitcoin rewards without the hassles of equipment ownership.

However, entering 2025, the landscape of BTC Cloud Mining is highly polarized: legitimate, institutional-grade platforms exist, but they are vastly outnumbered by fraudulent schemes. This guide is mandatory reading for any investor considering this route, aiming to dissect the reality of BTC Cloud Mining and provide a secure investment framework.

I. What is BTC Cloud Mining and Why the Appeal?

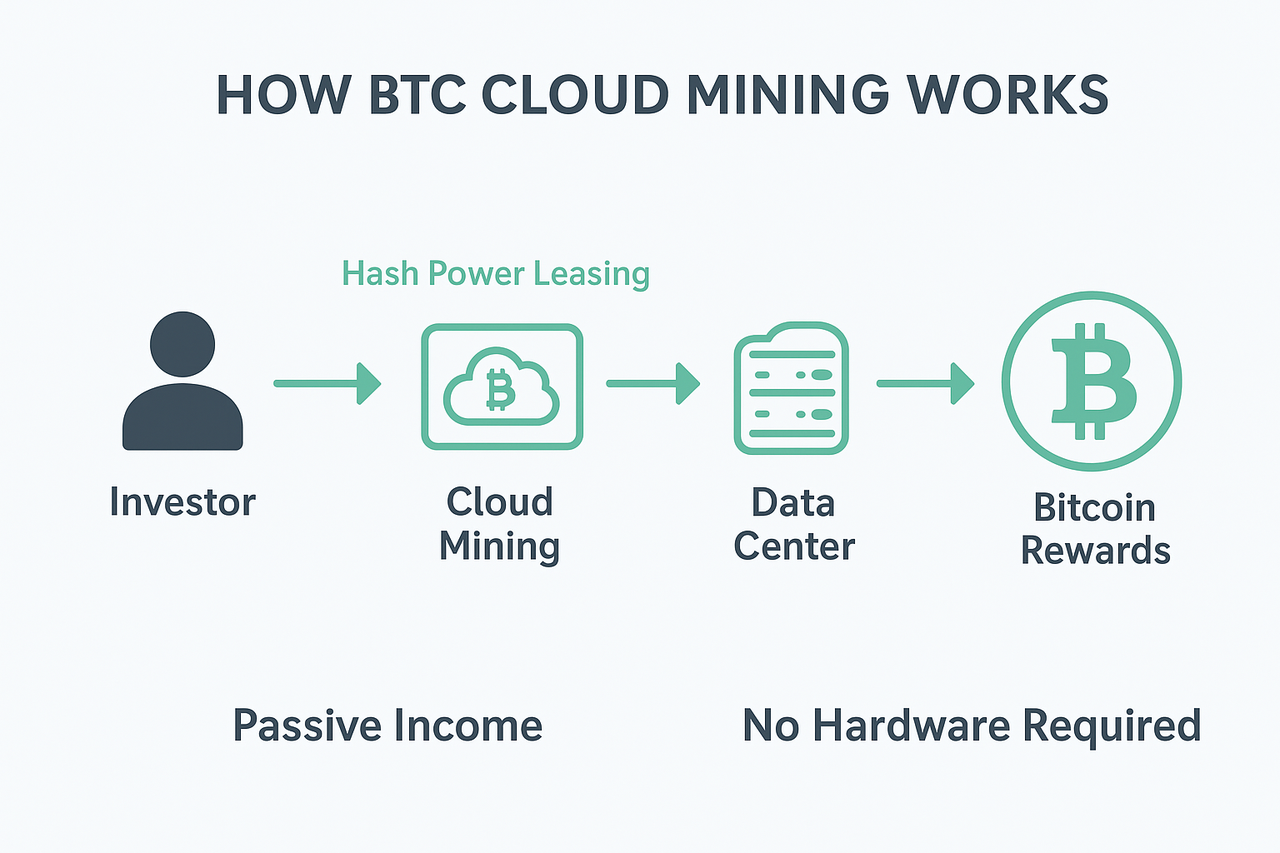

1.1 Defining the Mechanism: Hash Power Leasing

BTC Cloud Mining fundamentally means purchasing a contract for a specific amount of computing power (hash rate, measured in TH/s or PH/s) for a set period. Instead of directly owning and managing a physical ASIC miner, the investor is essentially renting a share of a large, professionally managed Bitcoin mining operation.

The primary attraction for investors is the elimination of three major pain points associated with physical Bitcoin mining:

-

Zero CAPEX Risk: No need to buy expensive, rapidly depreciating ASIC hardware.

-

Zero OPEX Hassle: No worries about rising electricity costs, cooling infrastructure, or physical maintenance.

-

Accessibility: A low financial barrier to entry, often starting with small contract purchases.

1.2 The Two Models of BTC Cloud Mining

-

Leased Hash Power (True Cloud Mining): The investor pays a fee to rent a portion of the provider's existing hash power. This is the most common model and carries the highest risk of fraud if the provider does not have a real mining facility.

-

Hosted Mining: The investor buys the ASIC machine and pays the provider a monthly fee to host, power, and maintain the miner in their data center. This model offers more transparency but still relies on the host's integrity and efficiency.

II. The Critical Risks of BTC Cloud Mining in 2025

The high difficulty and low transparency inherent in BTC Cloud Mining make it a breeding ground for scams. Investors must understand the core risks:

2.1 The Risk: High Probability of Fraud

In the BTC Cloud Mining space, most non-audited platforms are suspected to be Ponzi schemes that merely use new investor funds to pay out returns to older investors, without any actual Bitcoin mining occurring.

Red Flags for Identifying a Scam:

-

Unrealistic Stability: Guaranteed daily returns or fixed profit percentages, which are impossible given the volatility of the BTC price and the Bitcoin mining difficulty.

-

Lack of Proof-of-Work: Refusal to provide live public mining pool data, third-party audit reports, or verifiable video evidence of their physical mining farms.

-

Aggressive Recruitment: Offering high affiliate or referral bonuses, a classic characteristic of pyramid schemes.

2.2 Unfavorable Contract Economics

Even with a legitimate BTC Cloud Mining provider, contracts are often deliberately structured to favor the operator, especially in the wake of the 2024 Bitcoin Halving:

-

Exorbitant Fees: Contracts often hide high Maintenance Fees and Management Fees that may be fixed in USD. If the Bitcoin price drops or the mining difficulty surges, these fixed fees can quickly exceed the value of the mined BTC, leading to zero payouts.

-

Difficulty Surge: The contract's profitability forecast is rarely revised downward. Since the global Bitcoin mining difficulty consistently rises, the actual BTC yield for a fixed hash rate contract will consistently fall over time, often making the contract unprofitable prematurely.

III. Safer Alternatives to BTC Cloud Mining (A 2025 Strategy)

For investors seeking exposure to the Bitcoin mining sector without the extreme risks of unverified BTC Cloud Mining contracts, several transparent and regulated alternatives exist:

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

| Strategy | Advantages | Risk Profile |

| Invest in Publicly Traded Mining Stocks | High Transparency: Public companies (e.g., Marathon, Riot) provide audited financial statements, operational data, and clear ESG metrics. | Stock Market Risk: Subject to stock volatility and management decisions. |

| Invest in Bitcoin Mining ETFs | Diversification: Exposure to a basket of mining companies, reducing single-company risk. | Lower Barrier: Easier entry point for retail investors through brokerage accounts. |

| Direct Bitcoin Purchase | Zero Operational Risk: The cleanest way to gain BTC exposure without any fee erosion or maintenance worries associated with BTC Cloud Mining. | Price Volatility: Exposure only to the price risk of BTC. |

The Institutional Shift

The reason the BTC Cloud Mining market is risky for retail investors is simple: the largest, most profitable mining farms are prioritizing institutional capital. They prefer self-mining, direct joint ventures with energy companies, or private equity deals, as these routes offer superior capital efficiency compared to managing thousands of small retail BTC Cloud Mining contracts.

Conclusion: Choose Transparency Over Convenience

BTC Cloud Mining presents a tantalizing opportunity to participate in the lucrative world of Bitcoin mining without heavy commitment. However, in 2025, the vast majority of opportunities promise convenience at the expense of capital safety.

A secure Bitcoin mining investment strategy must prioritize transparency and verifiable operations above all else. Before committing to any BTC Cloud Mining contract, investors must conduct rigorous due diligence, treating the offering with extreme skepticism.

Actionable Advice: If you cannot verify the source of the hash power, the efficiency of the operation, and the integrity of the contract terms, your capital is better allocated to a regulated and audited alternative. The safest way to earn Bitcoin is often the simplest: buying and holding the asset directly.