KuCoin Ventures Weekly Report: Pump.fun's Presale Frenzy Highlights Wealth Effect, Macro Tariff Risks Loom, as DeFi's Security and Competitive Landscape is Reshaped

2025/07/14 09:18:51

1. Weekly Market Highlights

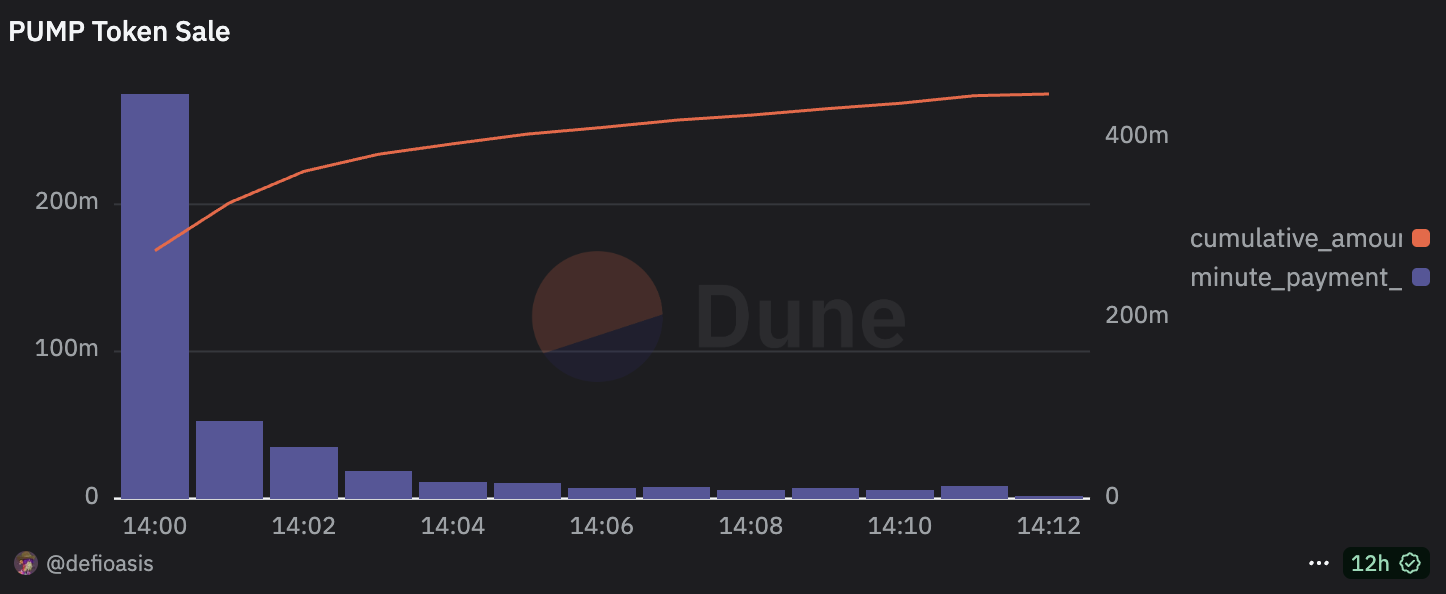

PUMP Token $4B Valuation Presale: $275M Raised in 1 Minute, Sold Out in 12 Minutes

On July 12 at 22:00 UTC+8, after multiple delays spanning over six months, Solana's well-known memecoin launchpad Pump.fun officially launched its PUMP token presale. Prior to the presale, CT was abuzz with heated debates over whether Pump.fun justified its $4 billion valuation, if it could raise $600 million in three days, and whether it had earned $600-700 million in SOL revenue from token creation/trading but likely sold off most of it. Despite no direct access to the presale, Binance, OKX, and Hyperliquid preemptively opened PUMP pre-market perpetual futures, with the pre-market price reflecting a FDV that rarely dipped below $4 billion and consistently maintained a positive funding rate. Once the presale began, PUMP tokens completed fundraising in just 12 minutes, with $275 million (45.8% of the total) poured in during the first minute alone. The fundraising speed far exceeded market expectations.

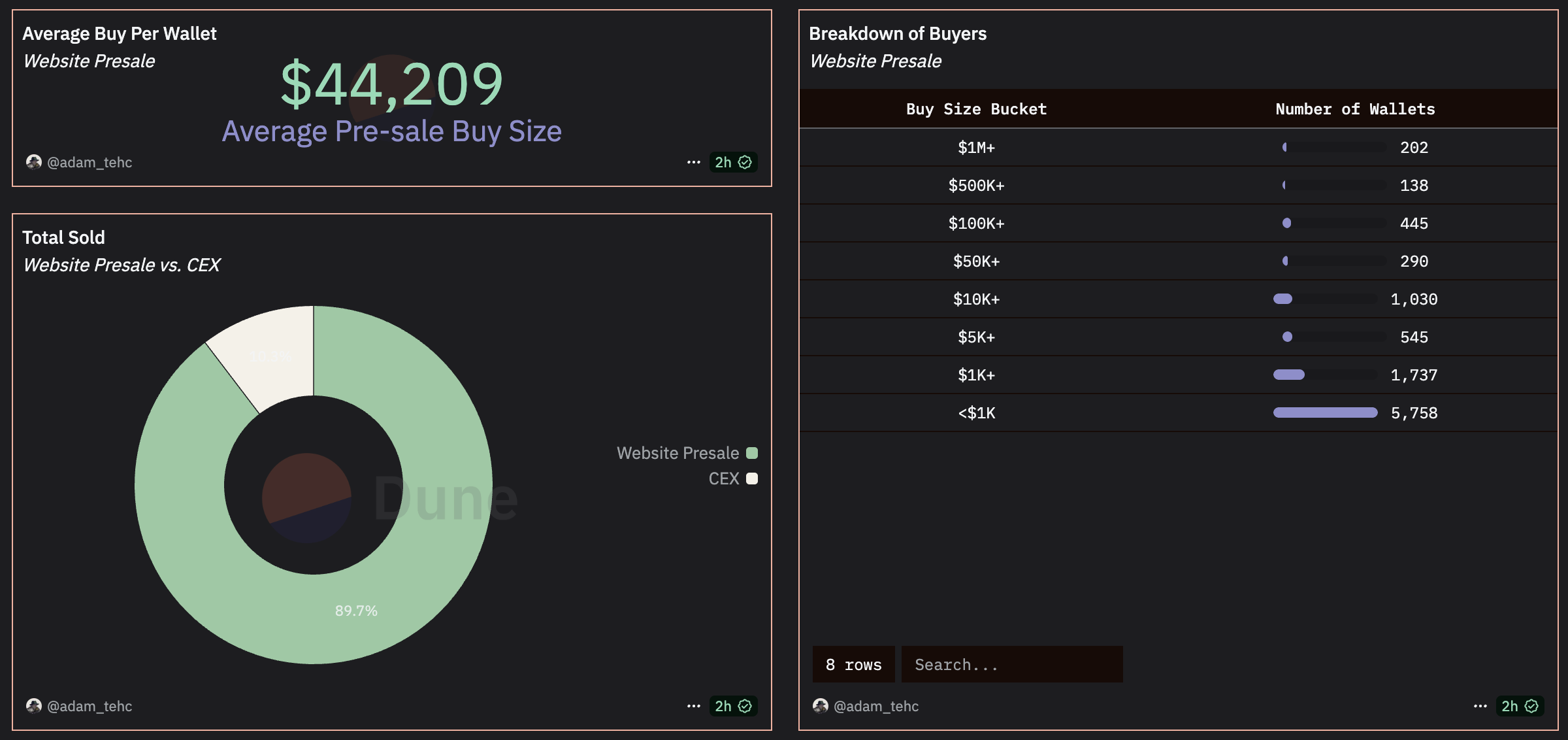

According to Adam’s data dashboard, among users participating in the PUMP token presale through official channels, a total of 23,959 wallets completed KYC, but only 10,145 wallets (42.3%) successfully participated in the presale. The average purchase amount was $44,209. Of these, 202 wallets hit the $1 million hard cap, 138 wallets purchased between $500,000 and $1 million, and 445 wallets bought between $100,000 and $500,000. However, over half of the wallets purchased less than $1,000. Further analysis of wallets that invested $1 million revealed that, in addition to several new wallets, some had earned millions in profits from trading memecoins. For example, wallets like 2JrTud...vdW5uR made $5 million from GOAT and DoJQdo...QV5EK8 earned $5 million from TRUMP. These players, who reaped significant profits from on-chain memecoin trading, were the main force behind the presale.

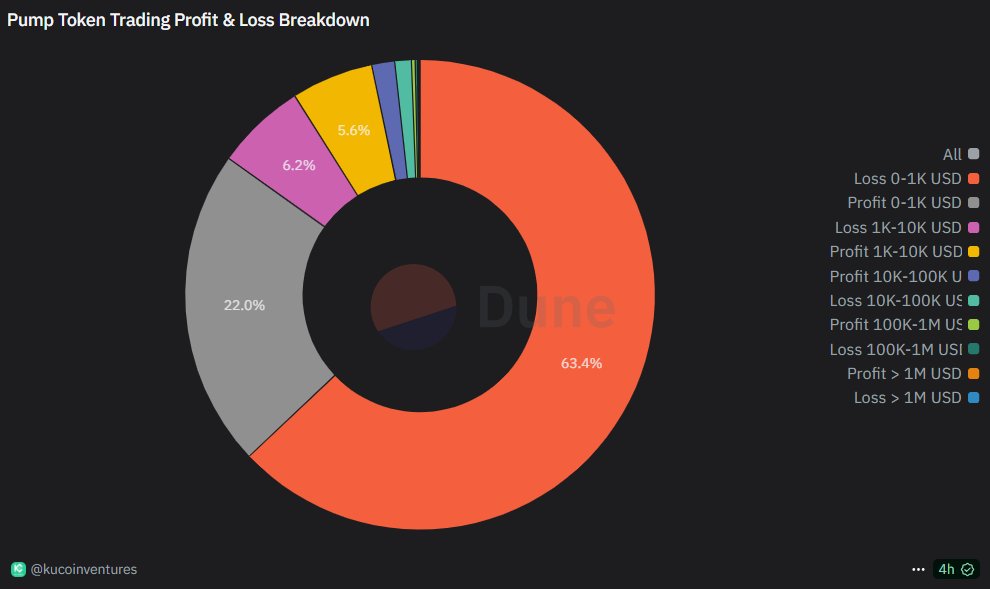

A review of Pump.fun’s history reveals that traders of tokens created by Pump.fun collectively earned approximately $4.1 billion in profits and created 630 millionaires. This is likely a key factor supporting Pump.fun’s $4 billion valuation presale.

Source: https://dune.com/queries/5294908

From the creation of Pump.fun’s first token to the eve of the PUMP token presale, over the course of more than a year, among the 5,918,144 addresses with more than 10 transactions and two-way trading on Pump.fun tokens:

-

Realized profits over $1 million: 630 addresses (0.0106%)

-

Realized profits between $100,000 and $1 million: 10,243 addresses (0.173%)

-

Realized profits between $10,000 and $100,000: 90,110 addresses (1.523%)

-

Realized profits between $1,000 and $10,000: 331,289 addresses (5.6%)

-

Realized profits between $0 and $1,000: 1,302,337 addresses (22%)

-

Realized losses between $0 and $1,000: 3,750,364 addresses (63.37%)

-

Realized losses between $1,000 and $10,000: 365,239 addresses (6.17%)

-

Realized losses between $10,000 and $100,000: 63,119 addresses (1.067%)

-

Realized losses between $100,000 and $1 million: 4,664 addresses (0.0788%)

-

Realized losses over $1 million: 149 addresses (0.0025%)

Based on the median of each range and an estimated $2 million for the “profit/loss over $1 million” category, Pump.fun tokens have collectively generated approximately $4.1 billion in net profits for all traders over the past year. While the majority of users incurred losses, a small number of high-profit wallets significantly boosted the total net profit. In summary, winners are few but reap massive gains; most lose money but not heavily. The 630 millionaires created by Pump.fun are undoubtedly the most likely big buyers of PUMP tokens.

With a few days left until PUMP’s spot market launch, the presale’s exceeding expectations pushed the FDV of PUMP’s pre-market perpetual futures to over $7 billion at one point. Although it has since cooled, PUMP tokens still maintain a price roughly 50% above the presale level. However, it’s worth noting that with challenges from LetsBONK and the rise of other launchpads, Pump.fun faces unprecedented pressure in the Solana launchpad race. Whether the launch of PUMP tokens and the subsequent revenue model adjustments can reinvigorate Pump.fun’s future remains a key focus. Meanwhile, the BONK community is actively hyping USELESS for listings on top exchanges on Crypto Twitter, even garnering support from Raydium and Solana’s official accounts. The competition between Pump.fun, LetsBONK, and other rivals now extends beyond launchpads to encompass token launches, trading, distribution, and brand operations in a comprehensive showdown.

2. Weekly Selected Market Signals

Frenzy and Risk Coexist as a New Crypto Narrative Emerges Amidst Macro Headwinds

Over the past few months, despite concerns of "de-dollarization" and simultaneous sell-offs in stocks, bonds, and currency, the U.S. stock market has staged a strong rebound, outperforming global markets. Last week, led by tech giants, both the S&P 500 and Nasdaq 100 indices hit new all-time highs. Notably, NVIDIA's market cap briefly surpassed the $4 trillion mark, exceeding the combined market value of the Canadian and Mexican stock markets, as well as the total market cap of all publicly listed companies in the UK, once again proving the immense capital appeal of the AI narrative.

This bullish sentiment quickly spread to the digital asset space. Following the stock market's rally, BTC's price followed suit, breaking to a new high. More significantly, the Assets Under Management (AUM) of U.S. spot Bitcoin ETFs reached a new record, posting record-breaking single-day and weekly net inflows (with weekly inflows reaching $2.72 billion). Ethereum ETFs also saw strong market demand, with their AUM reaching $13.5 billion, attracting $383 million in a single day on July 10th alone. This demonstrates continued strong demand from mainstream capital for core crypto assets.

Source: SoSoValue

The day after the S&P 500 set its record high, former President Trump announced a 35% tariff on Canada and threatened to impose widespread tariff hikes on all other countries. On Saturday, it was stated that major U.S. trade partners Mexico and the European Union would face 30% tariffs starting August 1st. U.S. stock futures opened lower on Monday as Wall Street grappled with renewed tariff risks and the upcoming Q2 earnings season.

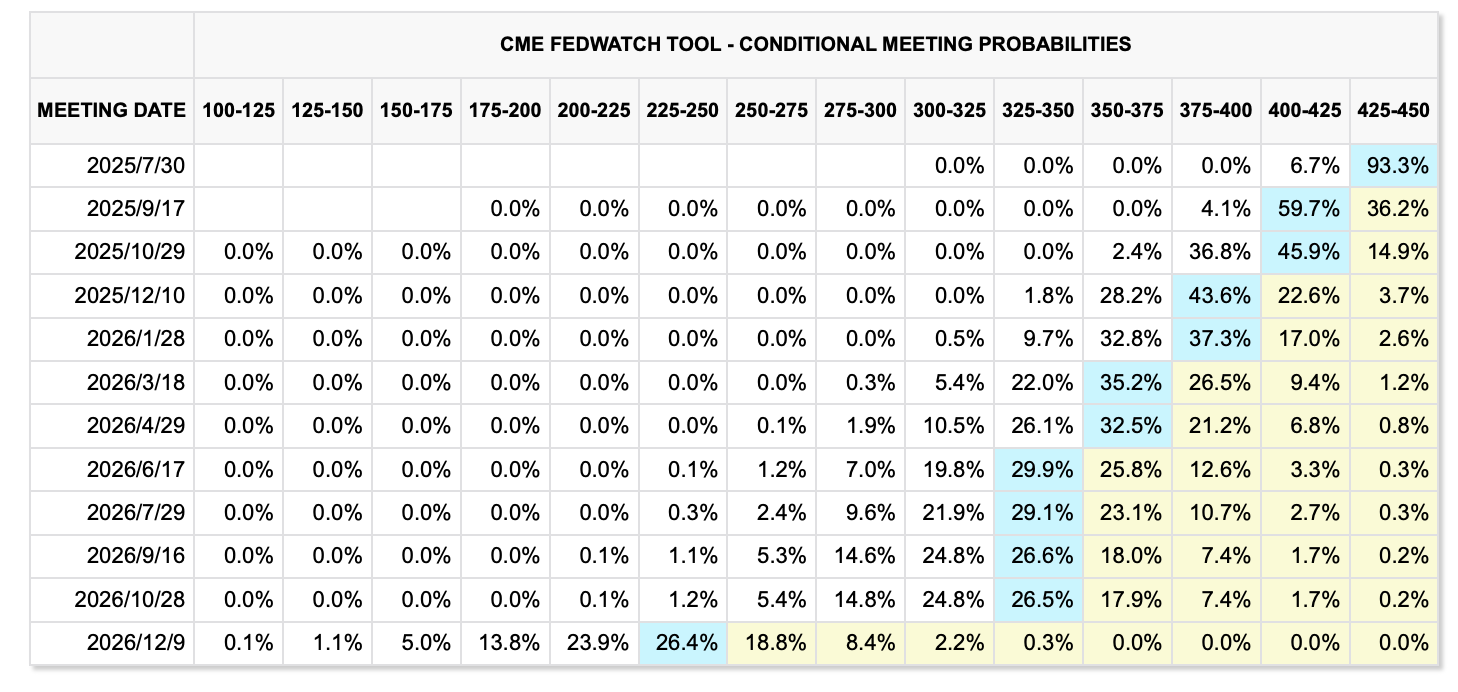

From a liquidity perspective, the market is currently pricing in a high probability of an interest rate cut in September. However, with One Big Beautiful Bill Act leading to the upcoming issuance of new U.S. Treasury bonds, this will drain liquidity from the supply side, potentially creating headwinds for risk assets, including cryptocurrencies.

Source: FedWatch Tool

Key Macro Events to Watch This Week:

-

U.S. Crypto Legislation: The U.S. House of Representatives is set to debate three major crypto bills: the Genius Act, Digital Asset Market Clarity Act, and the Anti-CBDC Surveillance State Act. This signals that U.S. lawmakers are accelerating efforts to establish a detailed regulatory framework for crypto and digital assets.

-

Key Macroeconomic Data: The release of U.S. inflation data for June (CPI & PPI) and the Federal Reserve's Beige Book will be crucial inputs for future interest rate decisions.

-

Speeches from Fed Officials: At least eight Federal Reserve officials, including Chairman Jerome Powell, are scheduled to speak this week. Their comments will provide important clues for the interest rate decision at the end of July.

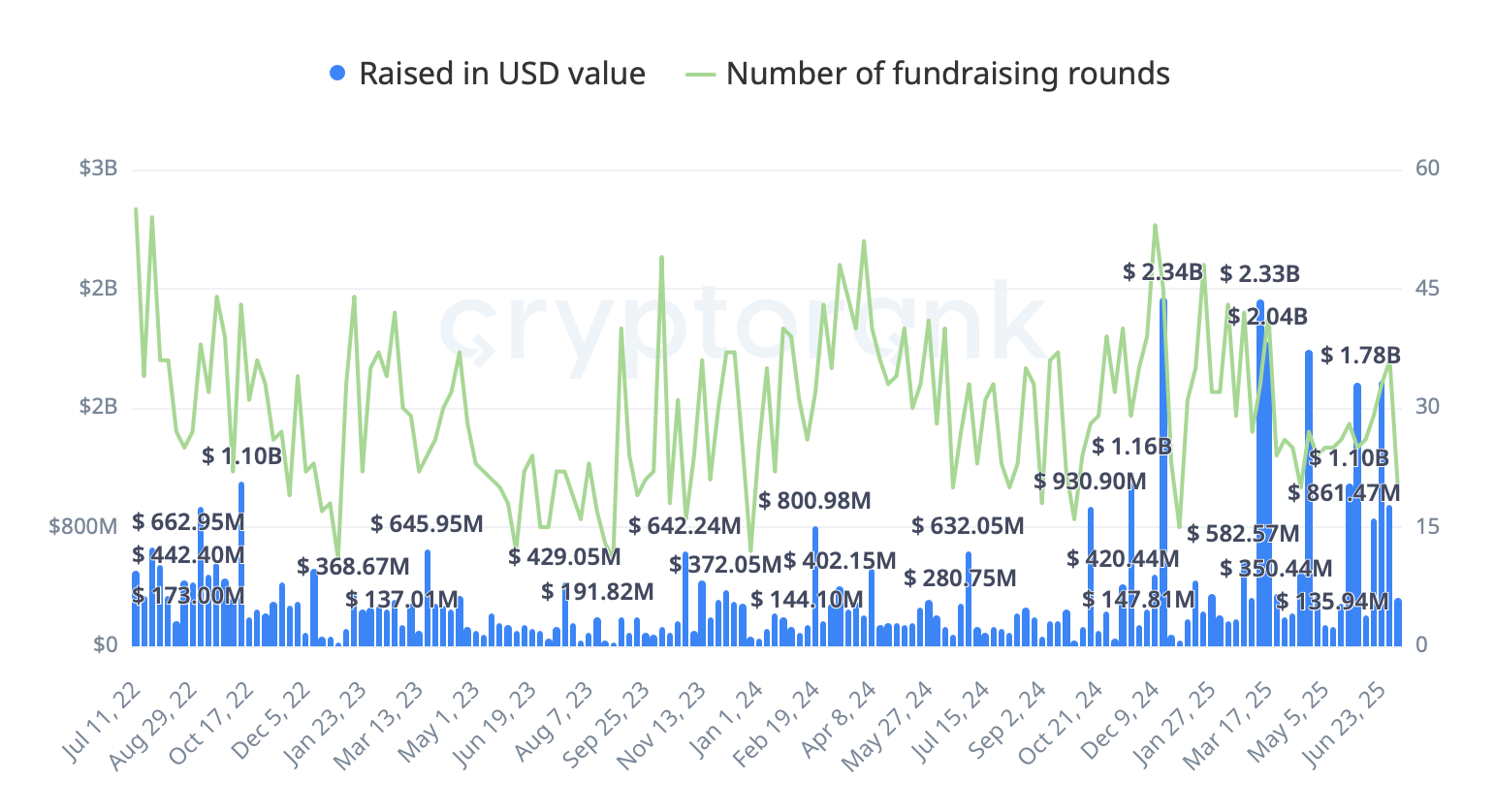

Primary Market Financing Observations:

Last week, primary market funding returned to a normal range, with a total of $319 million raised. The largest single deal was a $200 million financing round for Nasdaq-listed company Upexi, Inc., comprising common stock and convertible notes. This funding will significantly increase Upexi's holdings of Solana (SOL), with the company expected to hold approximately 1.65 million SOL post-transaction, more than doubling its previously disclosed holding of 735,000 SOL.

Agora: White-Label Stablecoin Issuance Infrastructure

Last week, stablecoin startup Agora announced the completion of a $50 million Series A funding round led by Paradigm, with participation from Dragonfly. This capital will be used to drive the global expansion and compliance efforts for its core products. This follows a $12 million seed round in April 2024, led by Dragonfly with participation from Robot Ventures, Hack VC, Wintermute, and Galaxy Digital.

Agora's core product is AUSD, a stablecoin whose collateralized bonds are managed by VanEck, with State Street Bank acting as the custodian. Agora does not directly serve consumers (B2C). Instead, it positions AUSD as a foundational, unified settlement asset and offers white-label issuance services on top of it, enabling CEXs, enterprises, Web3 projects, and international payment companies to issue their own stablecoins. Agora shares the yield from the underlying assets with these partners based on issuance volume.

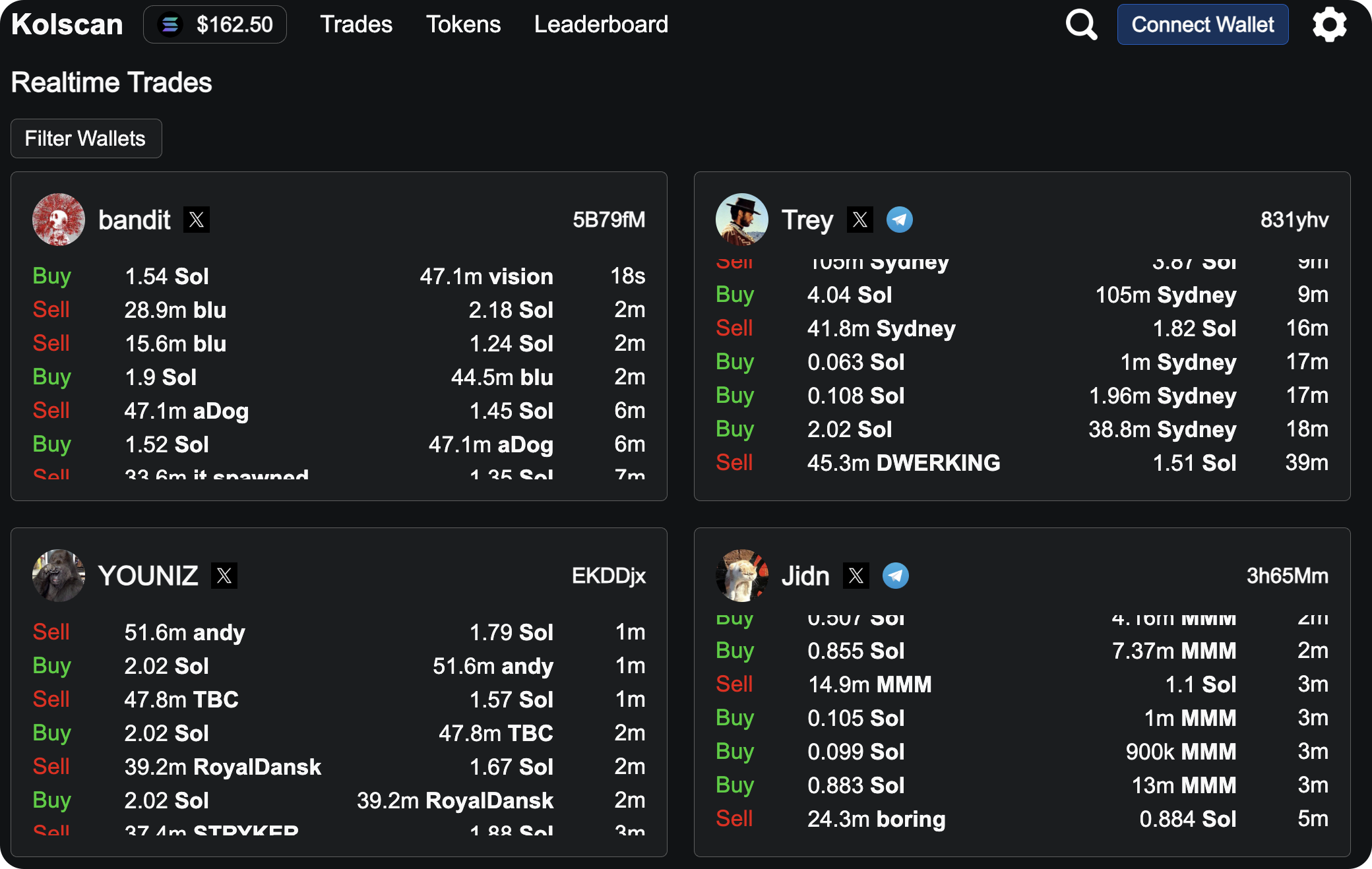

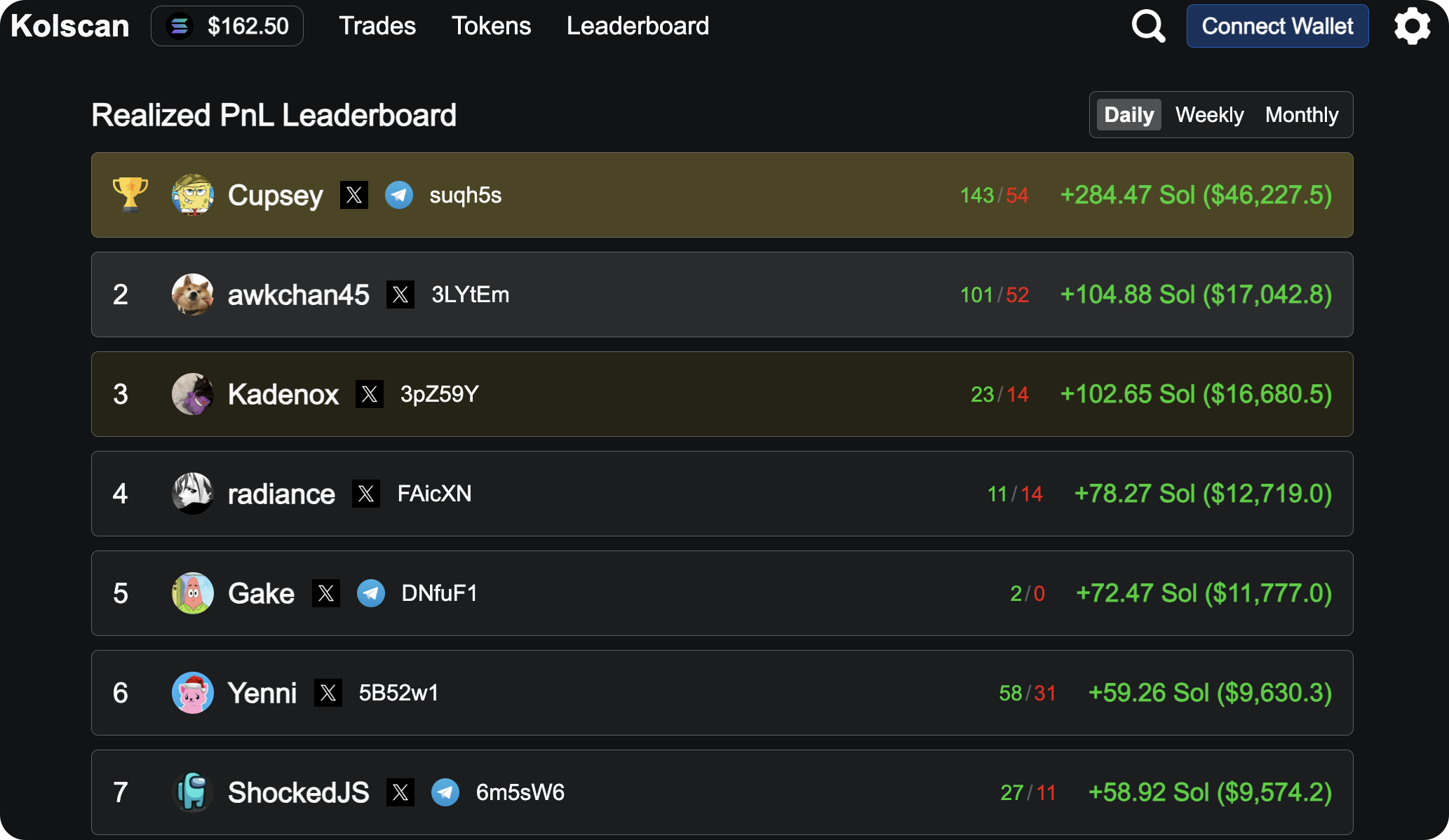

Kolscan: On-Chain KOL Trading Monitoring Tool

Pump.fun announced the acquisition of the on-chain wallet tracking tool Kolscan, marking Pump.fun's first public acquisition. The tool monitors the activities of top on-chain traders, providing real-time transaction monitoring and performance rankings for both traders and specific tokens.

Source: Kolscan

Pump.fun's strategy is to deeply integrate Kolscan's data tracking and analysis capabilities into its developing crypto social platform. In the future, the company plans to offer Kolscan's services for free, enhance its copy-trading analysis features, and improve the authenticity of its leaderboards. This move is aimed at realizing its grand vision of "gamified trading" and "social trading" to better compete in an increasingly crowded market.

3. Project Spotlight

Crypto-Stock Rally Continues Amid Divergence in Altcoin Markets: ETH Meme Tokens Recover, BSC Frenzy Falters, and PENGU ETF Speculation Gains Traction

Following the recent surge in U.S. crypto-related equities driven by stablecoin narratives, Hong Kong-listed stablecoin concept stocks also rallied on July 11. Jinyong Investment (01328.HK) spiked over 30% intraday, while Guotai Junan International (01788.HK) and OSL Group (00863.HK) recorded significant gains. Some market participants linked the rally to a recent internal seminar hosted by the Shanghai SASAC on crypto and stablecoin development, signaling a potential uptick in regional policy attention and capital interest.

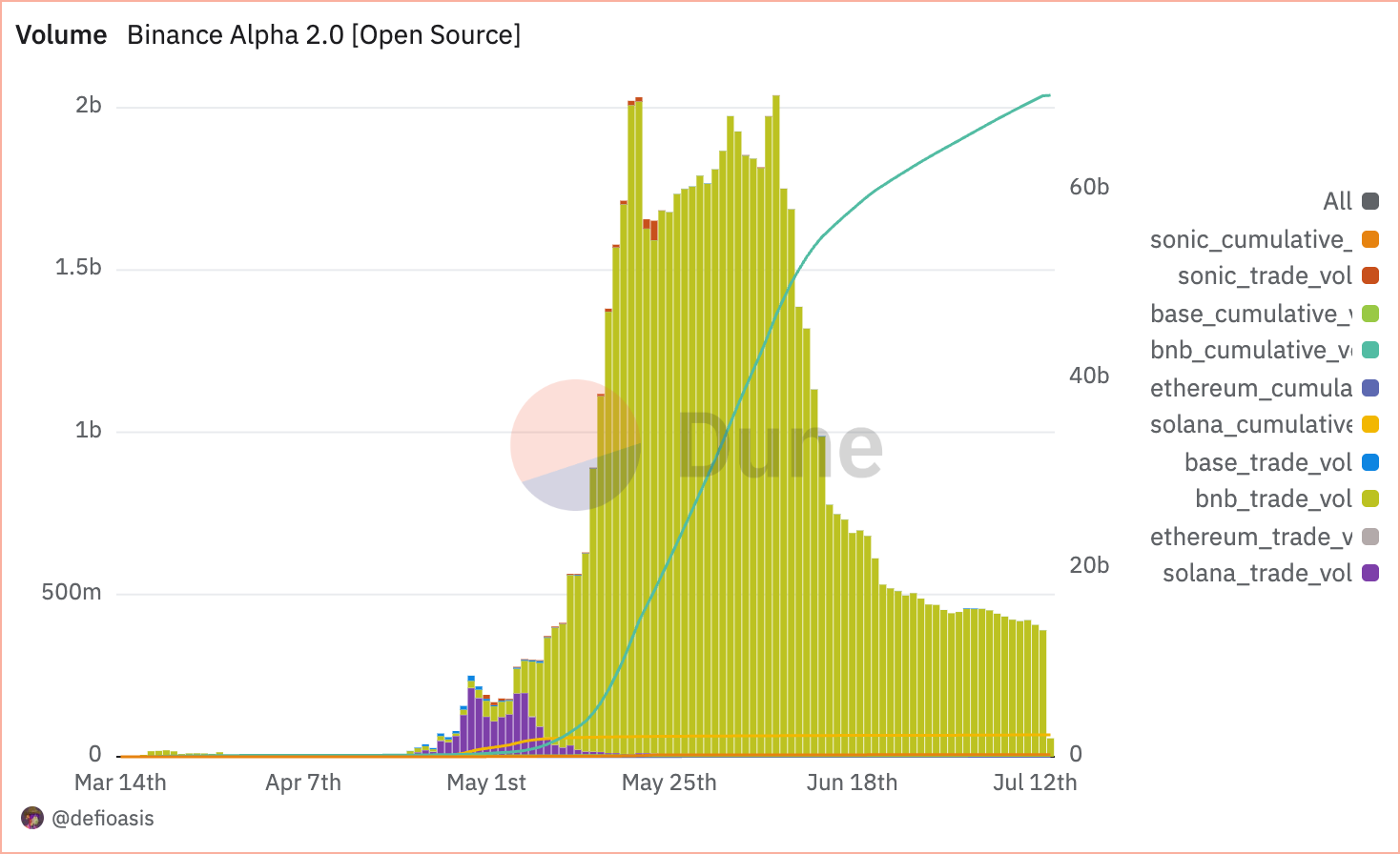

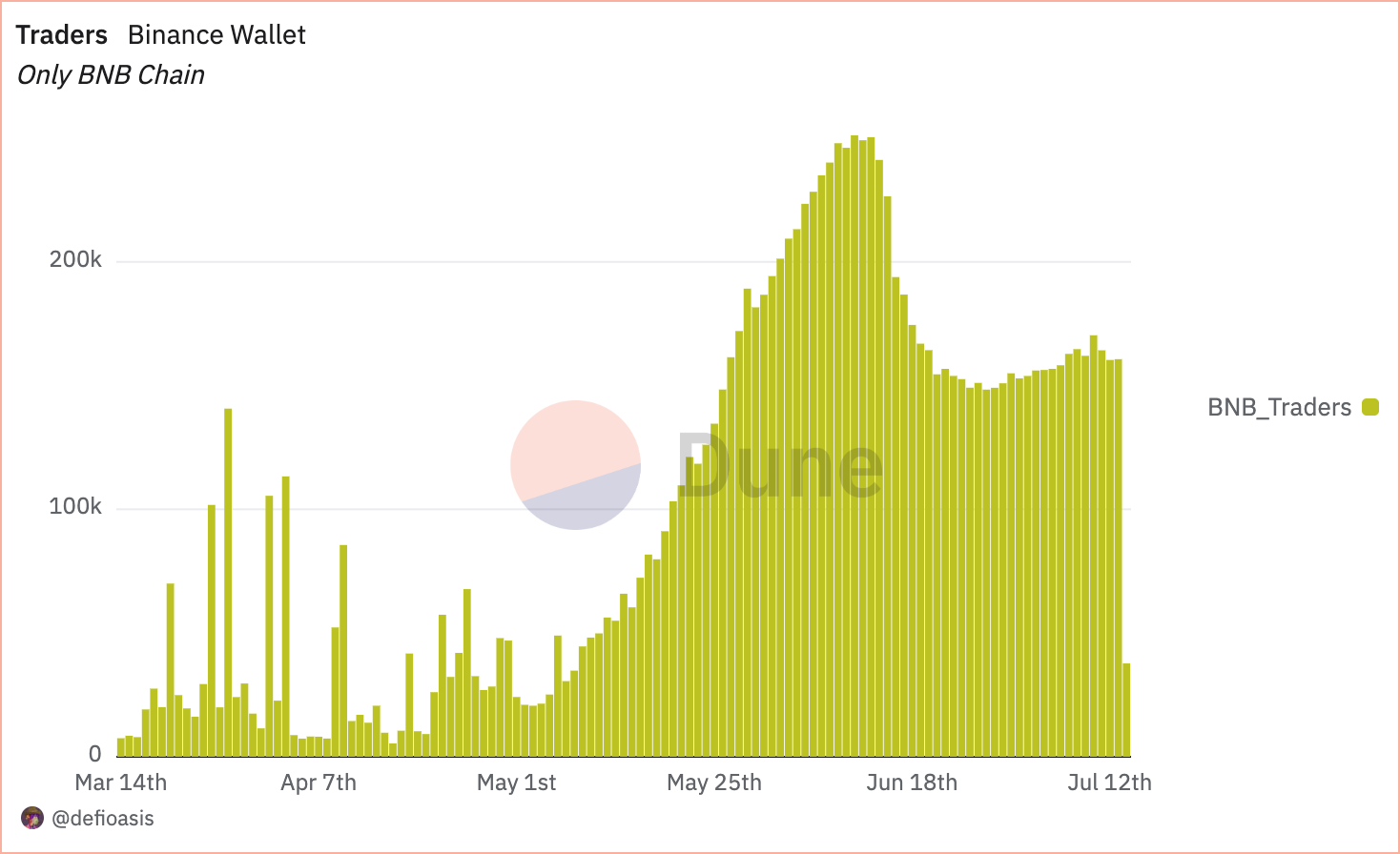

In contrast to the momentum around policy-themed equities, legacy altcoin markets remain subdued. Within the meme token segment, BSC-based $BANANAS31 surged from $0.015 to $0.05 within a week, only to plummet below $0.008 due to weak liquidity and rapid sentiment reversal—becoming a textbook case of hype-driven pump-and-dump. Binance Alpha’s overall trading volume also continued to decline, with total volume reaching just $392 million on July 13, well below peak levels. Several Alpha projects saw severe crashes after liquidity was removed, further intensifying platform-wide risk aversion and liquidity constraints.

Data Source: Dune Analytics

Meanwhile, beyond continued speculation in BSC Bonk-style assets like $USELESS, the Ethereum ecosystem is showing early signs of recovery. ETH climbed back above $3,000 for the first time since late May, triggering renewed activity in its meme sector. Notably, viral Shiba Inu-style meme token $MANYU topped CoinMarketCap’s Most Visited MemeCoins, posting strong short-term gains and reviving investor interest in ETH-based on-chain alpha opportunities.

Another highlight this week was the surge in interest around our portfolio project, Pudgy Penguins ($PENGU), which soared over 30% after the SEC acknowledged Canary Capital’s spot ETF filing on July 10. The ETF proposes to allocate 80–95% of assets to $PENGU tokens and 5–15% to Pudgy Penguins NFTs—potentially making it the first to combine meme tokens and NFTs in a traditional financial product. With $PENGU gaining nearly 197% over the past 30 days, this development underscores the growing crossover between Web3-native assets and legacy market instruments.

Overall, the market is experiencing increasing polarization. On one hand, emerging meme tokens within major ecosystems such as ETH are staging structured rebounds with community and liquidity support. On the other, short-term tokens overly reliant on sentiment and storytelling continue to follow a boom-and-bust pattern, weighing on platform liquidity and trading depth. The entrance of ETFs and other TradFi structures may offer fresh narrative drivers and capital inflows for blue-chip meme assets, but investors should remain cautious—especially regarding liquidity depletion, community sustainability, and project fundamentals—when navigating such fast-rotating markets.

HYPE Breaks New Highs as GMX Exploit Reignites DeFi Security Concerns

This week, Hyperliquid continued its expansion with $HYPE pushing toward $50, bringing its circulating market cap to approximately $16.46 billion and placing it 11th on CoinMarketCap—cementing its leadership in the perpetual DEX sector. The project’s strong performance reflects growing recognition of its high-performance, low-latency trading infrastructure, alongside the steady progress of its HyperEVM layer, which together provide a robust foundation for growth.

It is worth noting that Hyperliquid previously faced a brief trust crisis after $JELLYJELLY—a highly volatile meme token—triggered controversy over its forced liquidation mechanism during extreme price swings. While the incident raised community concerns, it did not materially undermine the protocol’s architecture or capital base. On the contrary, the team responded swiftly with technical fixes, enhanced liquidity, and ecosystem expansion, showcasing resilience and market responsiveness.

As Hyperliquid gains momentum, long-established perpetual DEX GMX suffered a critical security breach this week due to a reentrancy vulnerability in its V1 contracts on Arbitrum, resulting in losses exceeding $40 million. The attacker exploited flawed pricing logic by opening a large number of short positions through reentrant calls, manipulating the global average price and draining GLP liquidity pools. Security firms noted that insufficient identity and state protection within the contract enabled the exploit path and distorted AUM calculations.

This incident is a sobering reminder that even mature DeFi protocols can suffer devastating attacks if core mechanisms like contract design and state management are not airtight. For fast-growing platforms like Hyperliquid, market cap alone does not mitigate security risks. Instead, projects must prioritize robust audit frameworks and modular security during protocol scaling and ecosystem integration. HYPE’s recent surge reflects strong market optimism toward next-generation on-chain trading systems, but GMX’s downfall underscores the need for a cautious balance between performance and security.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer: This content is provided for general informational purposes only, without any representation or warranty of any kind, nor shall it be construed as financial or investment advice. KuCoin Ventures shall not be liable for any errors or omissions, or for any outcomes resulting from the use of this information. Investments in digital assets can be risky.