Author: Bitpush Editorial Department

Over the past month, Bitcoin has mostly fluctuated wildly around $80,000-$90,000, while altcoins have generally corrected by 15%-40%. This has provided whales with the perfect window for "private accumulation." According to real-time monitoring data from on-chain large holders tracked by Santiment and others, whales are quietly building positions in the following sectors, with some coins even reaching new highs for accumulation since 2025.

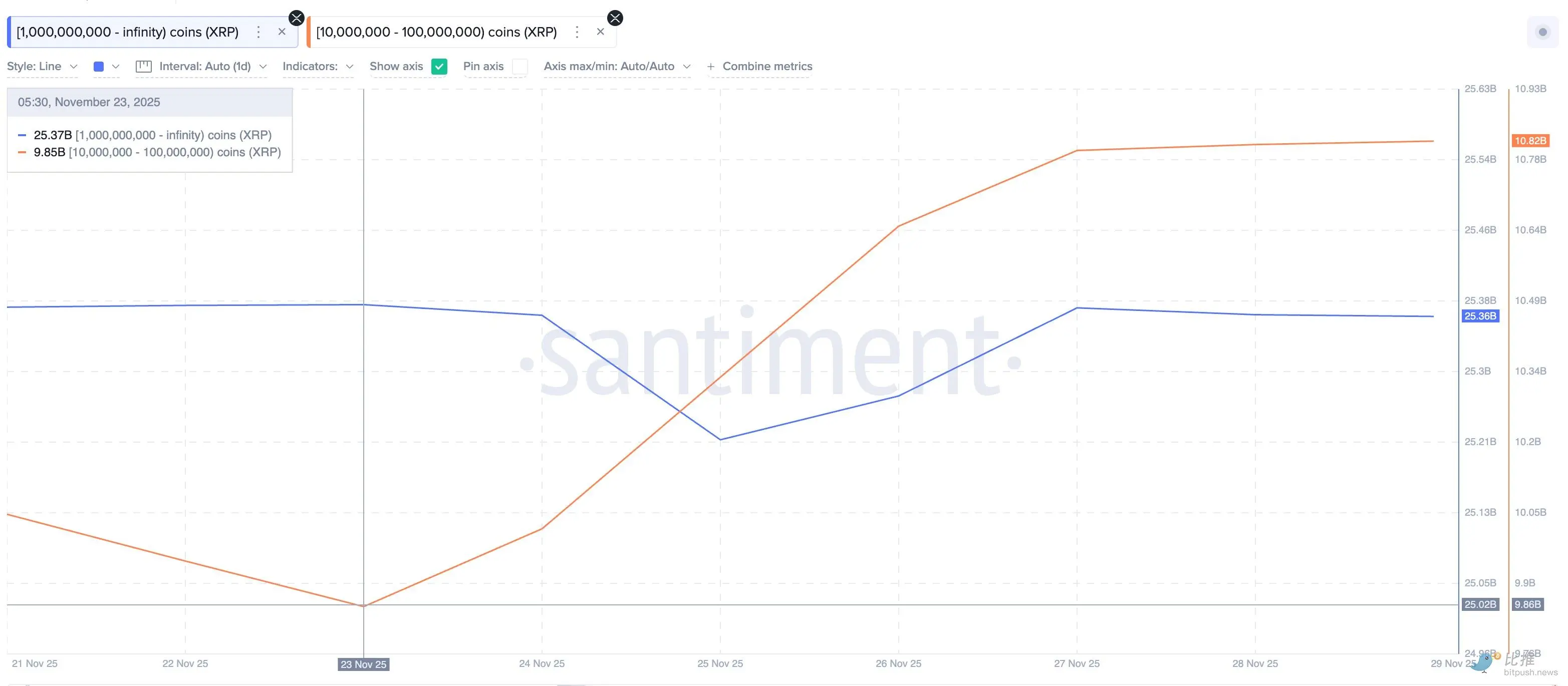

I. Payment/Cross-border Settlement Sector: XRP Becomes a Whale Favorite

With the settlement between the SEC and Ripple finalized, the XRP ETF has moved from expectation to reality, further stimulating whale accumulation. Over the past 30 days, XRP has seen the most dramatic net inflow of whales among all altcoins:

Addresses holding 100 million to 1 billion XRP saw a net increase of 970 million XRP; addresses holding over 1 billion XRP saw a net increase of 150 million XRP; the combined inflow from these two types of addresses exceeded $2.4 billion; XRP balances on exchanges continued to decline, hitting a new low since 2023.

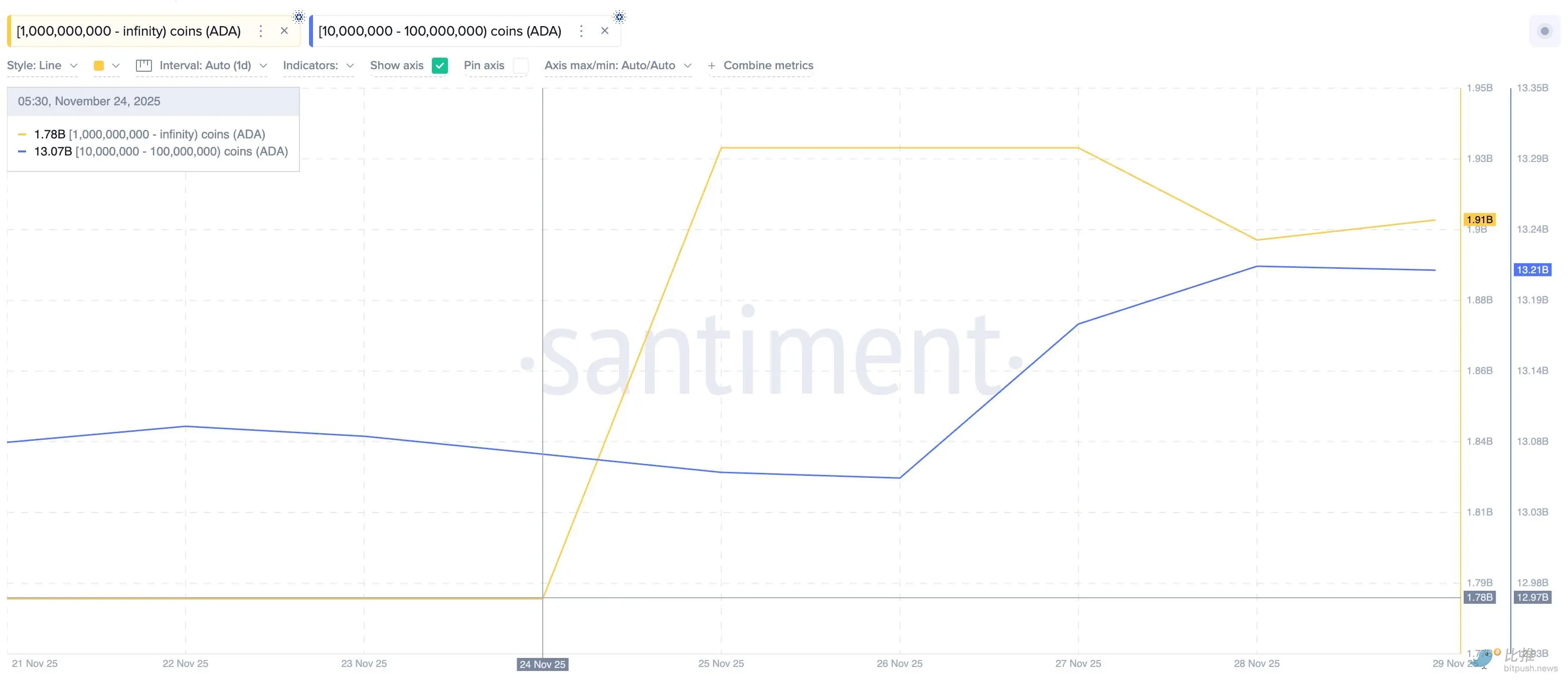

II. Established Layer 1: Contrarian Accumulation of ADA

During the 12 days from November 24th to December 4th, Cardano (ADA) witnessed an extremely rare phenomenon: "whale rotation buying." The wallet with the largest holdings (over 1 billion ADA) began increasing its holdings on November 24th, accumulating an additional 130 million ADA to date.

Wallets holding between 10 million and 100 million ADA began increasing their holdings on November 26th, adding 150 million ADA.

Both groups achieved net increases within a few days, indicating strong confidence among large holders even as ADA trading near recent lows.

These whales have relatively low costs; if the price breaks through $0.43, it could rise to $0.52. However, if it falls to $0.38, the bullish trend will weaken, and the reversal signal may become invalid

III. DeFi Blue Chips: UNI and AAVE Simultaneously Sold Off

UNI: Over the past week, whales added approximately 800,000 UNI (worth nearly $5 million USD). After the fee switch vote passed, the top 100 addresses hold a total of 8.98 million UNI, demonstrating strong accumulation momentum, while the supply on exchanges continues to decrease.

AAVE: Over the past 30 days, whales added over 50,000 UNI, bringing their total holdings to 3.98 million ATH.

Commonality between the two: TVL continues to recover + real revenue (fees) begins to rise, indicating whales' early positioning.

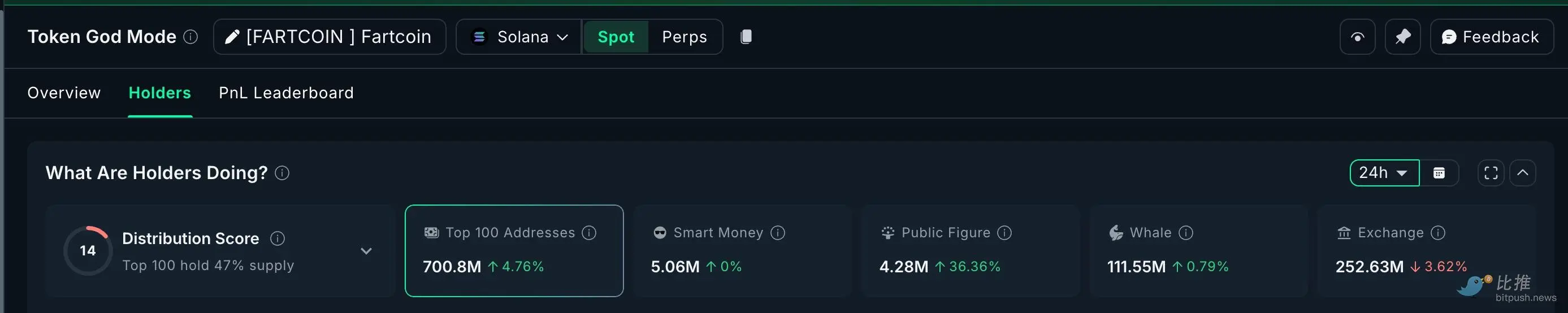

IV. Meme Coin: Overall Correction, with Some Coins "Buied at Low Prices" by Whales

Main Battlegrounds:

FARTCOIN: A single address bought 32.43 million coins (US$10.7 million) in 24 hours.

PIPPIN: Whales removed 40.45 million coins (US$7.28 million) in 24 hours.

PEPE: Whale holdings increased by 1.36% over the past 30 days, accumulating to over 10 million coins. In short, both speculative and established funds are entering the market, and a violent surge is possible at any time after liquidity dries up.

V. AI + Data Sector: ENA and TIA are the Most Favored

ENA (Ethena): Whale holdings increased by 2.84% over the past 7 days, with the top 100 addresses adding over 50 million coins.

TIA (Celestia): Exchange supply decreased by 5%, and both staking ratio and TVL reached record highs. The combination of AI narratives and modular narratives makes it one of the long-term sectors with high certainty in this round.

VI. Storage Sector: FIL and ICP

Starting in late November, both FIL and ICP saw significant outflows from exchanges from whale addresses. Active addresses and TVL (Total Value Linked) rebounded in tandem, indicating that the demand for decentralized storage from AI large-scale models is materializing.

FIL: Whale holdings increased by over 100,000 FIL in the past 30 days, totaling approximately $50 million; exchange supply decreased by 15%.

ICP: On-chain active addresses increased by 30%, with whales transferring over 50,000 FIL from exchanges; TVL rebounded to $120 million.

Summary

It can be seen that whales' current operational logic is:

Pullbacks are buying opportunities; they buy more as prices fall, almost ignoring short-term prices;

Prioritizing sectors with "real revenue" or "certainty of policy benefits";

Meme remains a high-risk, high-return "lottery zone";

Long-term sectors (AI, modularity, storage, privacy) have been positioned for by whales 2-3 quarters in advance.

Risk Warning: Whale accumulation does not guarantee a price increase and may become subsequent selling pressure. Please be sure to trade on DYOR, carefully follow trades, and strictly control your position size.