Original Author: Bootly, Bitpush News

On January 22nd (Eastern Time in the U.S.), cryptocurrency custodian BitGo ($BTGO) officially rang the opening bell at the New York Stock Exchange.

The company, regarded as the "infrastructure lifeline" of the crypto asset industry, completed its IPO at $18 per share, opening at $22.43, a short-term surge of about 25% on its first day. This marked the opening shot of the wave of crypto-related company IPOs in 2026.

According to the IPO offering price, BitGo's valuation is approximately $2 billion. Although this figure is far lower than that of stablecoin issuer Circle ($CRCL), which went public last year with a valuation nearing $7 billion, BitGo's performance is still considered solid as one of the first major cryptocurrency companies to go public this year.

A Decade-Long Refinement: From Multisig Pioneer to Institutional Guardian

BitGo is the latest native cryptocurrency company to attempt an initial public offering, following the successful listings of multiple crypto firms in 2025.

Its story begins in 2013, when the cryptocurrency world was still in a "wild west" era, marked by frequent hacking attacks and private key management that felt like a nightmare. The founders, Mike Belshe and Ben Davenport, keenly realized that for institutional investors to enter the space, what they needed was not flashy trading software, but a true sense of "security."

BitGo founder Mike Belshe

Standing at the NYSE bell-ringing platform, Mike Belshe might recall that afternoon more than a decade ago.

As one of the first ten employees of the Google Chrome founding team and a pioneer of the modern web acceleration protocol HTTP/2, Mike was initially indifferent toward cryptocurrencies and even doubted that it was a scam. But he used the most "programmer-like" approach to disprove it: "I tried to hack Bitcoin, but I failed."

This failure instantly transformed him from a skeptic into a hardcore believer. In search of a safer place for his old laptop under the sofa, which was filled with bitcoins, he decided to personally dig a set of "trenches" for this wild market.

Early BitGo's office was more like a laboratory. While its contemporary, Coinbase, was busy acquiring users and boosting retail trading volume, Mike's team was exploring the commercial potential of multi-signature (Multi-sig) technology. Despite his close personal relationship with Ben Horowitz, a founding figure of Netscape and the head of a16z, Mike did not choose the fast track of venture capital backing. Instead, he opted for the slowest and most stable path.

In 2013, BitGo pioneered the introduction of multi-signature (Multi-sig) wallet technology, which later became an industry standard. However, BitGo did not stop at selling software; it made a strategic key decision: to transition into a "licensed financial institution."

By obtaining trust licenses in South Dakota and New York, BitGo successfully transformed into a "qualified custodian." This status has played a stabilizing role in the cryptocurrency ETF wave of 2024 and 2025. When major asset managers like BlackRock launched Bitcoin and Ethereum spot ETFs, it was BitGo and similar foundational service providers that were responsible for safeguarding assets and handling settlement processes behind the scenes.

Unlike trading platforms such as Coinbase, BitGo has built a solid "institutional flywheel": it first locks in assets (AUM) through highly compliant custody solutions, and then, around these deposited assets, it offers derivative services including staking, settlement, and prime brokerage.

This "infrastructure first" logic has enabled BitGo to demonstrate remarkable resilience amid market volatility. After all, regardless of bull or bear markets, as long as the assets remain in the "safe," BitGo's business continues uninterrupted.

Where is the confidence coming from for a 10x price-to-sales ratio?

Looking through BitGo's prospectus, its financial data appears quite "impressive."

Due to the requirements of U.S. GAAP (Generally Accepted Accounting Principles), BitGo is required to record the full principal amount of transactions as revenue. This led to its "Digital Asset Sales" gross revenue reaching an astonishing $10 billion in the first three quarters of 2025. However, in the eyes of sophisticated investors, these figures are merely "pass-through money" and do not reflect true profitability.

What truly supports its $2 billion valuation is "Subscription and ServicesThis business segment.

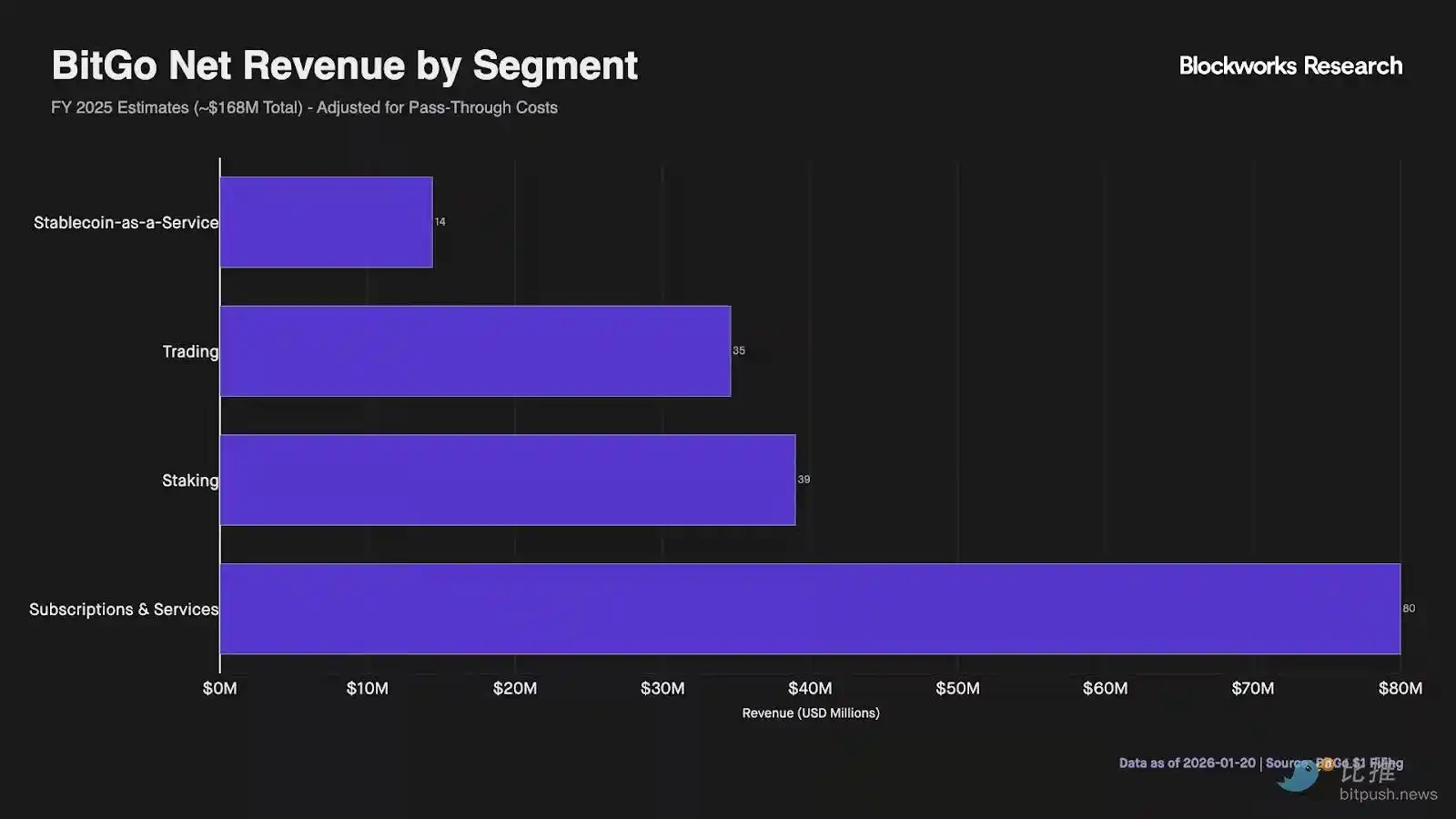

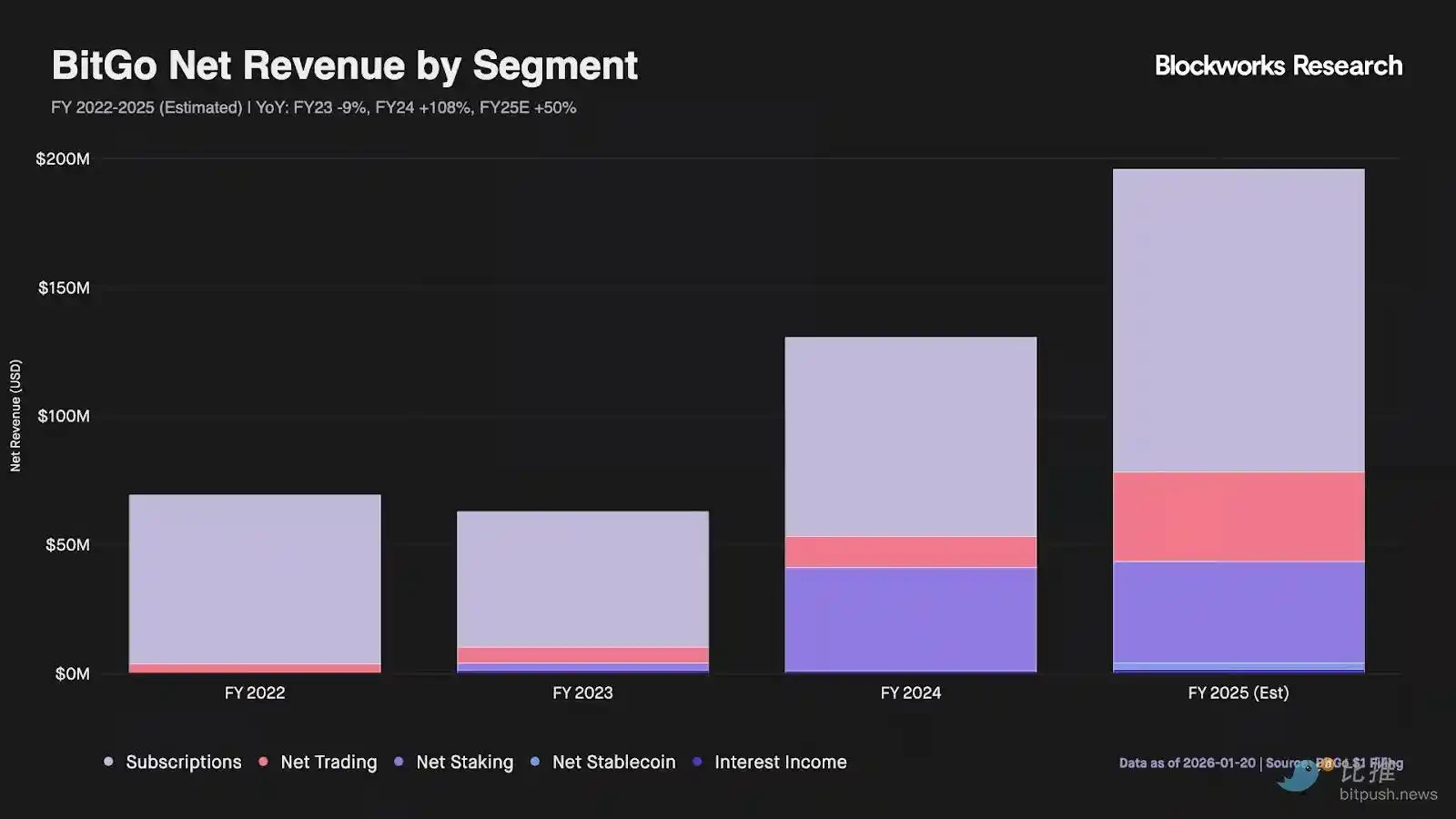

According to chart data from Blockworks Research, BitGo's core economic revenue (excluding third-party fees and pass-through costs) is projected to be approximately $195.9 million in fiscal year 2025. Of this, the subscription business contributes the majority of the high-margin recurring revenue, generating nearly 48% of total net revenue with a contribution of $80 million. This portion of revenue primarily comes from recurring fees that BitGo charges to more than 4,900 institutional clients.

In addition, staking services became an unexpected growth driver. Staking revenue reached up to $39 million, ranking second. This reflects that BitGo is no longer merely a "safe deposit box," but has significantly improved capital efficiency by providing value-added returns based on its custodied assets.

Looking at the trading and stablecoin business, although trading volume accounts for the highest proportion of total revenue, it only contributes $35 million in adjusted net income.

The newly launched "Stablecoin-as-a-Service" contributed $14 million, and although it is still in its early stages, it has already demonstrated a certain level of market penetration.

If you want to see BitGo's true valuation, you need to adjust its reported financial figures. If you only consider its approximately $1.6 billion GAAP revenue, its valuation appears extremely low (a price-to-sales ratio of about 0.1x). However, after excluding non-core items such as pass-through transaction costs, staking revenue sharing, and payments from stablecoin issuers, the moat of its core business becomes evident:

- Estimated core economic revenue for fiscal year 2025: approximately $19.59 million.

- Implied valuation multiple: Enterprise Value / Core Revenue ≈ 10x

This 10x valuation multiple places it above retail-focused wallet peers, with the premium reflecting its regulatory moat as a "qualified custodian." Simply put, at a $1.96 billion valuation, the market is willing to pay a premium for its subscription business, while its low-margin transaction and staking services are merely value-added features.

Matthew Sigel, Director of Research at VanEck, believes that equity in BitGo represents a more tangible asset compared to the majority of crypto tokens with market capitalizations exceeding $200 million that have never generated net profits. The nature of this business is akin to "selling shovels"—as long as institutions continue to trade, ETFs remain operational, and assets require storage, it can consistently earn fees. This model may not be as eye-catching as certain altcoins during bull markets, but in volatile or bear markets, it is a "steady job."

More symbolically significant is the manner of its listing itself. Unlike IPOs of other crypto companies, BitGo has taken a more "crypto-native" approach: by partnering with Ondo Finance, it synchronized its shares on-chain on the day of its listing.

Tokenized BTGO shares will circulate on Ethereum, Solana, and BNB Chain, allowing global investors nearly instant access to this newly listed custodian. In the future, tokenized BTGO stocks may be used as collateral to directly participate in DeFi lending protocols, bridging TradFi (traditional finance) and DeFi.

Summary

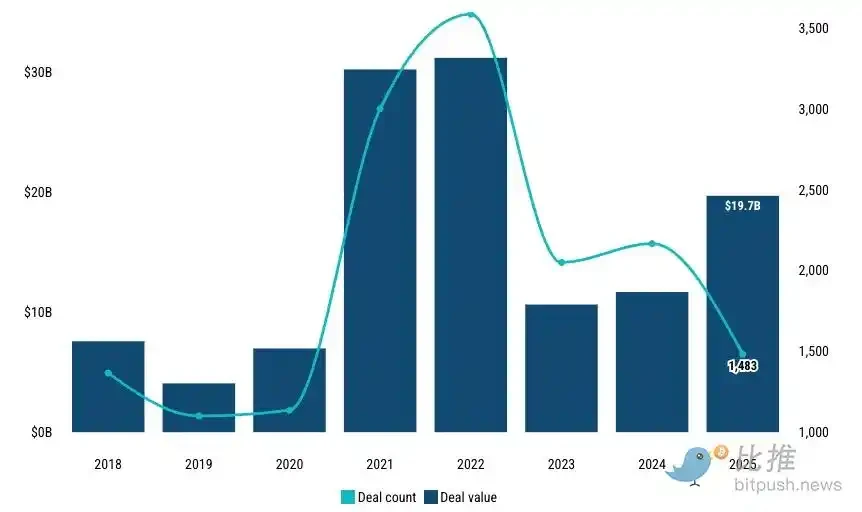

Image source: PitchBook

Looking back at the just-ended year 2025, venture capital (VC) transactions in the crypto space surged to $19.7 billion. As PwC's IPO expert Mike Bellin noted, 2025 completed the "professionalization" of cryptocurrency, and 2026 will be the year of a full-scale liquidity explosion.

After pioneers such as Bullish, Circle, and Gemini successfully went public in 2025, initial public offerings (IPOs) by crypto companies have exhibited a dual trend of "infrastructure development" and "consolidation into industry giants." Currently, Kraken has submitted a confidential application to the SEC, positioning itself to potentially become the largest crypto trading platform to go public in a single year. ConsenSys is closely collaborating with JPMorgan, aiming to gain financial influence within the Ethereum ecosystem. Meanwhile, Ledger is capitalizing on the surge in self-custody demand, aligning itself with a New York-based securities trading platform.

Of course, the market has never been free from the fluctuations of macroeconomic conditions, and the memory of some companies' initial public offerings (IPOs) immediately trading below their issue price in 2025 is still fresh. However, this precisely indicates that the industry is maturing. Capital is no longer willing to pay for every good story; instead, it is beginning to focus on financial health, compliance frameworks, and sustainable business models.