Industry Edition

Dovish Fed Signals Strengthen Rate-Cut Expectations, Risk Assets Rebound Broadly

Summary

-

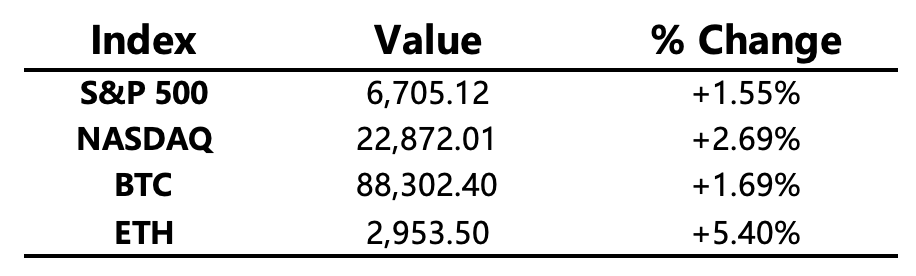

Macro Environment: Federal Reserve officials continued delivering dovish messages, pushing the probability of a December rate cut up to 80%. U.S. equities opened higher and extended gains, with the S&P 500 posting its largest six-week jump and the Nasdaq recording its best single-day performance since May. The VIX fear index fell sharply.

-

Crypto Market: Boosted by the U.S. equity rebound, Bitcoin strengthened in tandem, breaking above $89,000 and closing up 1.69% on the day. ETH saw an even stronger move, rebounding 5.4% amid ongoing accumulation by DAT. Structurally, the market remains cautious—altcoin market cap dominance (excluding BTC and ETH) remains anchored around 34%, indicating risk appetite has yet to meaningfully recover.

-

Project Developments:

-

Hot Tokens: FARTCOIN, 67, PIPPIN

-

With broader market sentiment turning positive, meme tokens such as FARTCOIN, USELESS, BONK, 67, PIPPIN, SPX, and POPCAT saw sharp collective rebounds, leading daily gainers.

-

MON: Monad’s highly anticipated mainnet officially launched, but its token price underperformed post-listing, briefly falling below its ICO price.

-

PIEVERSE: Bithumb to list PIEVERSE with a KRW trading pair.

-

RAIN: Enlivex plans to raise $212 million to build a treasury for the RAIN token, the native asset of an Arbitrum-based prediction market protocol. ARB rebounded 9%.

-

XRP: Grayscale launched the Grayscale XRP Trust ETF on NYSE Arca.

-

Major Asset Movements

Crypto Fear & Greed Index: 20 (up from 19 twenty-four hours earlier), classified as Extreme Fear.

What to Watch Today

-

U.S. September PPI

-

Starknet v0.14.1 mainnet upgrade

-

XPL unlock: 0.89% of circulating supply (~$18.1M)

-

WCT unlock: 10.07% of circulating supply (~$11.6M)

Macro Updates

-

Fed’s Daly: Labor market may deteriorate suddenly; supports a December rate cut.

-

Amazon to invest $50B to expand AI and supercomputing infrastructure for U.S. government agencies.

-

U.S. September PCE rescheduled to December 5; Q3 GDP preliminary report cancelled.

Policy Trends

-

New Zealand plans to include digital currencies in its 2026 financial education curriculum.

-

South Korean regulators to impose sanctions on exchanges including Bithumb.

-

South Korea’s STO bill passes first parliamentary review; tokenized securities market expected in H1 next year.

-

Japan’s FSA to require exchanges to establish mandatory liability reserves.

Industry Highlights

-

Franklin Templeton’s XRP ETF approved for listing on NYSE; fee set at 0.19%.

-

BitMine accumulated 69,822 ETH last week, raising total holdings to ~3.629M ETH.

-

JPMorgan disclosed Q3 MSTR holdings of 2,375,683 shares, down 772,453 from the prior quarter.

-

CME crypto futures and options reached 795K contracts in daily trading volume, a new all-time high.

Expanded Analysis of Industry Highlights

-

Franklin Templeton’s XRP ETF Approved for Listing on NYSE; Fee Set at 0.19%

-

Content Expansion: Asset management giant Franklin Templeton has launched its Franklin XRP ETF (XRPZ), which has received regulatory approval and is trading on the NYSE Arca. This milestone signals the growing acceptance of XRP as a digital asset by traditional financial institutions and the regulatory framework.

-

Key Analysis Points:

-

Institutional Endorsement: Franklin Templeton, which manages over $1.69 trillion in assets (as of October 31, 2025), entering the XRP ETF space brings immense credibility and institutional liquidity to the asset.

-

Competitive Fee: The 0.19% expense ratio is highly competitive in the crypto ETF market, which is crucial for attracting large investors looking for low-cost exposure to crypto assets.

-

Market Impact: Its launch, alongside other approved XRP ETFs (such as Grayscale XRP Trust ETF and Bitwise's product), contributes to the Altcoin ETF boom, providing a regulated and convenient XRP investment vehicle for a wider range of retail and institutional investors.

-

-

BitMine Accumulated 69,822 ETH Last Week, Raising Total Holdings to ~3.629M ETH

-

Content Expansion: Crypto mining and investment company BitMine Immersion Technologies (BMNR) continued its aggressive Ethereum (ETH) accumulation strategy over the past week. This increased its total ETH holdings to approximately 3.629 million ETH, cementing its position as one of the world's largest Ethereum treasuries.

-

Key Analysis Points:

-

Strategic Accumulation: BitMine's goal is to accumulate 5% of the total ETH supply (a strategy referred to as the "5% Alchemy"). The current holding represents approximately 3.0% of the total ETH supply, demonstrating strong long-term confidence in the Ethereum ecosystem.

-

Financial Strength and Positioning: The company's total crypto and cash assets exceed $11.2 billion (as of November 23, 2025), positioning it as the world's second-largest crypto treasury, only surpassed by MicroStrategy (MSTR).

-

Business Development: BitMine plans to launch the Made in America Validator Network (MAVAN) in early 2026, a dedicated staking infrastructure for its Ethereum assets, aiming to enhance security and efficiency while earning staking rewards from its massive holdings.

-

-

JPMorgan Disclosed Q3 MSTR Holdings of 2,375,683 Shares, Down 772,453 from the Prior Quarter

-

Content Expansion: JPMorgan Chase disclosed a significant reduction in its holdings of MicroStrategy (MSTR) shares in its Q3 13F filing. This move reflects a shifting approach by traditional financial giants in managing their risk exposure to MSTR, which has been historically viewed as a Bitcoin "proxy stock."

-

Key Analysis Points:

-

Institutional De-Risking: MSTR was previously used by many institutions as a convenient way to get indirect exposure to Bitcoin. However, with the proliferation of regulated Spot Bitcoin ETFs and other crypto custody solutions, institutional investors no longer need to rely on MSTR, which comes with a high premium and corporate-level risks.

-

Structural Risk Concerns: The massive sell-off by JPMorgan and other Wall Street giants (such as BlackRock and Vanguard) may be related to concerns over MicroStrategy's aggressive debt-fueled Bitcoin purchases strategy, share dilution, and governance risks.

-

Index Exclusion Risk: JPMorgan analysts have previously warned that MSTR could be excluded from major stock indices like the MSCI USA and the Nasdaq 100 due to its valuation structure and volatility, which could trigger billions in passive selling and further pressure the stock price.

-

-

CME Crypto Futures and Options Reached 795K Contracts in Daily Trading Volume, a New All-Time High

-

Content Expansion: The CME Group's (Chicago Mercantile Exchange Group) suite of cryptocurrency derivatives (futures and options) hit a new single-day trading volume record on November 21, 2025, reaching 794,903 contracts, surpassing the previous high.

-

Key Analysis Points:

-

Surge in Hedging Demand: This new high occurred against a backdrop of market uncertainty and a drop in crypto asset prices (e.g., US Spot Bitcoin ETFs saw $1.22 billion in net outflows last week). This indicates that the demand from institutional investors for regulated, highly liquid crypto risk management tools offered by the CME is accelerating during volatile market periods.

-

Product Line Expansion: CME offers various crypto futures and options products, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and XRP, and its average daily volume has grown by over 100% year-over-year since Q4.

-

Market Maturity: The surge in derivatives trading volume is a sign of the crypto market's maturation. Professional traders and institutions are actively using futures and options to hedge spot holdings, speculate on price movements, or execute arbitrage strategies, which provides deeper liquidity and a price discovery mechanism for the market.

-