MSCI Maintains DATSS Inclusion; Further Catalysts Needed for Bitcoin to Break Key Resistance

Summary

-

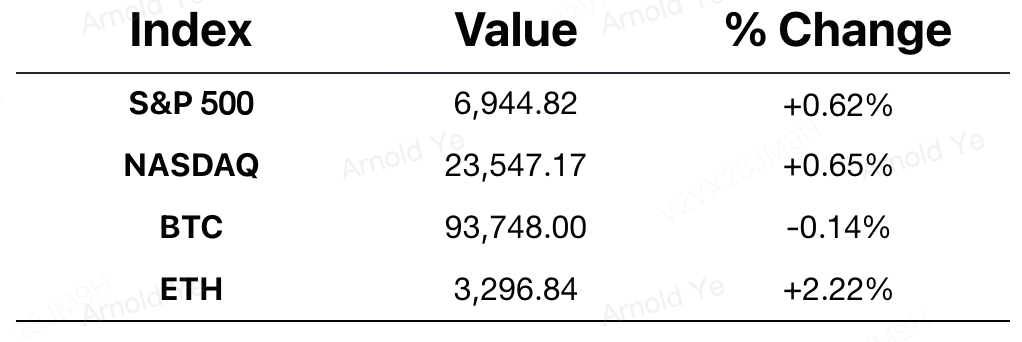

Macro Economy: Risk appetite in U.S. equities remained intact, with all three major indices closing higher. The S&P 500 and Dow Jones Industrial Average both reached new record highs. In commodities, the metals rally continued to gain traction, with gold, silver, and copper prices moving higher in tandem.

-

Crypto Market: MSCI confirmed it will maintain the inclusion of DATSS constituents, including MicroStrategy, removing the largest near-term downside risk and helping stabilize institutional expectations. However, Bitcoin failed to decisively break above the key resistance at 94.5k, ending a five-day winning streak. Structurally, the ETH/BTC ratio rebounded by 2.33%, lifting altcoin market cap share and signaling a marginal improvement in risk appetite.

-

Project Updates:

-

Trending Tokens: JUP, WIF, VIRTUAL

-

VIRTUAL: Virtuals Protocol launched three agent launch models: Pegasus (designed for rapid experimentation and fair distribution, suitable for early-stage projects), Unicorn (focused on capital formation with performance-linked incentives and enhanced transparency), and Titan (targeting established teams with scale, reputation, and capital, offering a structured market access pathway).

-

ZK: Upbit listed the ZKsync token (ZK); the token briefly surged 20% before retracing.

-

RIVER: River received strategic investment from Arthur Hayes’ Maelstrom Fund; RIVER rose over 20%.

-

LINK: Bitwise received SEC approval to list a spot LINK ETF on NYSE Arca.

-

Major Asset Indicators

-

Crypto Fear & Greed Index: 42 (44 24 hours ago), indicating Fear.

Today’s Outlook

-

U.S. December ADP employment report

-

Ranger to launch an ICO on MetaDAO with a USD 6 million fundraising floor

Macro Developments

-

The U.S. Supreme Court has designated Friday as an “Opinion Release Day,” with a potentially pivotal ruling on the legality of former President Trump’s global tariff measures.

-

Trump stated that Venezuela’s interim administration will transfer 30–50 million barrels of sanctioned oil to the U.S., to be sold at market prices.

Policy & Regulation

-

The U.S. Senate is advancing crypto market structure legislation; the Banking Committee is reportedly scheduling review/votes as early as next week.

-

Japan has implemented the OECD Crypto-Asset Reporting Framework (CARF).

-

South Korea is evaluating a “preventive freeze” and trading suspension regime, with crypto enforcement standards potentially aligned more closely with equity markets.

-

South Korea plans to impose fines of up to 10% of losses on hacked exchanges.

Industry Highlights

-

MSCI will maintain the inclusion of DATSS constituents, including MicroStrategy, deferring any removal decision to the 2026 review. The news lifted MSTR shares by approximately 5%–6% in after-hours trading.

-

Walmart launched BTC and ETH trading via OnePay, enabling crypto-to-retail spending conversions.

-

Morgan Stanley submitted filings to the SEC for BTC- and SOL-related products, targeting the spot ETF/trust segment.

-

Tether introduced a new accounting unit, “Scudo,” for Tether Gold (XAU₮) to streamline transactions.

Industry Highlights Extended Analysis

MSCI Maintains MicroStrategy (MSTR) in DATSS Inclusion

MSCI's decision to defer the removal of MicroStrategy reflects a cautious approach by index providers when dealing with highly volatile assets closely tied to Bitcoin. For MSTR, retaining its position in the index means that passive funds tracking these benchmarks (such as ETFs and mutual funds) are not forced to sell their holdings, which eliminated immediate liquidity pressure in the short term. The 5%–6% jump in after-hours trading illustrates the market's optimism regarding the continued stability of institutional capital inflows. This deferral also provides market observers more time to evaluate the long-term suitability of "Bitcoin-proxy" entities within traditional benchmark indices.

Walmart Launches BTC and ETH Trading via OnePay

Walmart’s move represents a significant step by a traditional retail giant toward integrating cryptocurrency into the physical payment ecosystem. By enabling the conversion of digital assets into retail spending through OnePay, the company is lowering the barrier to entry for non-native crypto users and enhancing the utility of BTC and ETH as "mediums of exchange" rather than just "stores of value." While this integration could prompt other retailers to follow suit and accelerate the global penetration of crypto at the point of sale, its ultimate success will depend on user perception of transaction costs, tax implications, and payment speed.

Morgan Stanley Files SEC Applications for BTC and SOL Products

Morgan Stanley’s filing for spot ETF/trust products marks the further institutionalization of digital assets by top-tier Wall Street investment banks. Notably, the inclusion of Solana (SOL) suggests that institutional interest is expanding beyond Bitcoin and Ethereum toward high-performance public chain ecosystems. If approved, these products would leverage Morgan Stanley’s massive wealth management distribution network to provide compliant and accessible entry points for high-net-worth and institutional capital. This reflects a broader shift where traditional financial institutions are evolving from "observers" into "infrastructure providers" for the digital asset market.

Tether Introduces “Scudo” Accounting Unit for Tether Gold (XAU₮)

The introduction of the "Scudo" unit is primarily aimed at addressing the complexities of pricing and settlement for tokenized gold assets in everyday micro-transactions. Because gold is typically priced per ounce—a relatively high unit value—it can be cumbersome to use in small-scale exchanges. By establishing a standardized accounting unit, Tether seeks to improve the bookkeeping efficiency and liquidity of XAU₮. This approach is similar to the use of "Sats" for Bitcoin, reflecting an effort by stablecoin issuers to deeper integrate Real-World Assets (RWA) with digital payment scenarios, providing a stability tool backed by hard assets within a volatile market.