Risk Assets Brush Off Geopolitical Tensions as Crypto Market Sentiment Continues to Improve

Summary

-

Macroeconomy: Risk assets largely ignored developments in Venezuela, with all three major U.S. equity indices closing higher. Tesla led gains among technology stocks, while energy shares pushed the Dow Jones Industrial Average to a new all-time high after former President Trump stated that major U.S. oil companies would invest in Venezuela.

-

Crypto Market: Bitcoin extended its rally for a fifth consecutive day, approaching the key resistance level at USD 94,500, as market sentiment continued to recover. Activity in derivatives markets also rebounded, with the notional value of USD 100,000 call options expiring at the end of January increasing sharply. Bitcoin’s market dominance fell below 59%, signaling a broader rebound in altcoin activity.

-

Project Updates:

-

Trending Tokens: XRP, SUI, PRCL, VIRTUAL

-

PRCL: Polymarket partnered with Parcl to launch a real estate prediction market, using Parcl’s daily housing price index as the settlement reference

-

WOO: WOOFi proposed a governance plan to permanently burn 300 million WOO tokens (approximately 15% of total supply), which has entered the voting phase. If approved, the proposal would eliminate future dilution risk and terminate the “match + burn” mechanism, while maintaining the existing revenue distribution framework (40% to staking rewards, 40% to buyback and burn, 20% to foundation expenses). The voting period is set at 7 days

-

LIT: Lighter launched perpetual futures trading for the LIT token

-

UXLINK: The CEO completed a personal buyback of 1% of the token supply and locked it into the strategic reserve pool

-

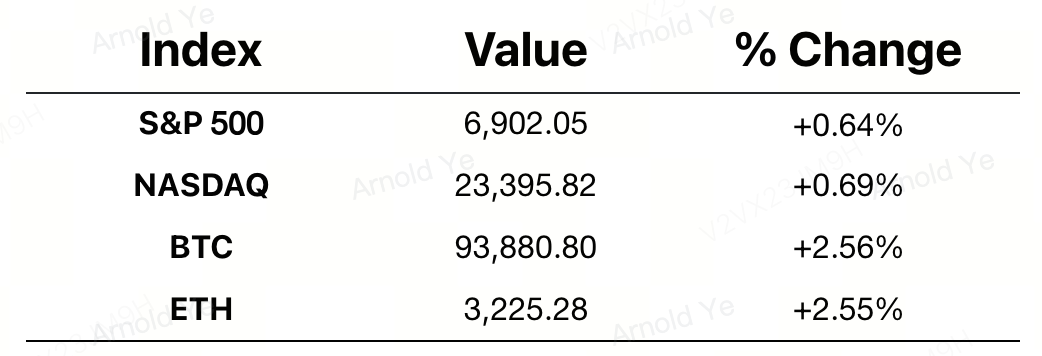

Major Asset Movements

Crypto Fear & Greed Index: 44 (vs. 26 24 hours ago), classified as Fear

Today’s Outlook

-

U.S. December S&P Global Services PMI (final)

-

“Tech Super Bowl” CES 2026 to be held in Las Vegas from January 6–9

-

HYPE token unlock: 3.61% of circulating supply, valued at approximately USD 313 million

Macroeconomy

-

U.S. December ISM Manufacturing PMI recorded its sharpest contraction since 2024, surprising to the downside

Policy Direction

-

Bank of America allows wealth advisors to recommend a 4% allocation to Bitcoin

-

The U.S. Department of Justice was accused of improperly selling Bitcoin seized from Samourai Wallet developers

-

Japan’s Finance Minister designated 2026 as the “Year of Digital Assets,” supporting the promotion of digital assets via exchanges and signaling potential reference to the U.S. ETF pathway

Industry Highlights

-

Strategy disclosed the acquisition of an additional 1,287 BTC and increased its USD cash reserves by USD 62 million

-

Bitcoin options open interest is concentrated around the January 30 expiry, with the notional value of USD 100,000 call options more than double that of USD 80,000 put options with the same maturity

-

Bitmine added 32,977 ETH last week, valued at approximately USD 104 million; it now holds over 3.43% of total ETH supply, with total assets reaching USD 14.2 billion

-

Grayscale’s Ethereum staking ETP/ETF has begun distributing staking rewards to investors

-

CME: Average daily notional trading volume of crypto derivatives/products reached approximately USD 12 billion in 2025, marking a record high

-

NFT Paris & RWA Paris 2026 have been officially canceled

Industry Highlights Extended Analysis

-

MicroStrategy’s Continuous Accumulation: A Dual Reserve Strategy

MicroStrategy’s acquisition of an additional 1,287 BTC reinforces its position as the world's largest corporate holder of Bitcoin, with total holdings now reaching 673,783 BTC. Notably, the USD 62 million increase in cash reserves demonstrates a maturing "dynamic asset allocation" strategy. It shows the company isn't just "going all in" blindly; by retaining liquidity while raising capital through ATM (At-the-Market) equity offerings, they are maintaining a buffer for market volatility or debt obligations. This "Bitcoin as reserve + healthy cash flow" model has become the definitive playbook for corporate crypto asset management.

-

Bitcoin Options Market: Strong Bullish Expectations for Late January

Options data for the January 30 expiry reveals extreme bullish sentiment. The fact that the notional value of USD 100,000 call options is more than double that of USD 80,000 puts suggests that institutions and sophisticated traders are betting heavily on Bitcoin breaking the $100,000 milestone in early 2026. This concentration of open interest often creates a "magnet effect," where price action gravitates toward the strike prices with the highest volume as expiry approaches, potentially leading to increased short-term volatility.

-

Bitmine’s Quest to be the "MicroStrategy of Ethereum": The 5% Strategy

Bitmine’s purchase of 32,977 ETH (approx. USD 104 million) last week has pushed its ownership to 3.43% of the total ETH supply. Their core strategy appears to be a drive toward the "Alchemy of 5%"—a goal to control 5% of all circulating ETH. Unlike MicroStrategy’s passive holding of BTC, Bitmine’s strategy includes a "yield-generating" logic: by operating their own validation network (MAVAN), they turn ETH into a productive asset that generates consistent cash flow. Reaching USD 14.2 billion in total assets signals that the institutionalization of Ethereum has entered a tier comparable to Bitcoin.

-

Grayscale’s Staking Rewards: Bridging the Yield Gap for ETH ETFs

The commencement of staking reward distributions by Grayscale’s Ethereum ETP/ETF is a major milestone in the evolution of crypto investment vehicles. Previously, spot ETH ETFs only provided exposure to price movements, failing to capture the ~3.5% - 4% native staking yield. By enabling distributions within an ETF structure, Grayscale allows institutional investors to hold ETH much like a high-dividend stock. This significantly boosts Ethereum's appeal compared to Bitcoin products, attracting conservative, long-term capital seeking "fixed income + capital appreciation."

-

CME’s Record Volumes: Concrete Evidence of Institutional Dominance

CME’s record-breaking average daily volume of USD 12 billion in 2025 is more than just a number; it is a sign of deep structural improvement in the market. It proves that traditional financial giants—banks, hedge funds, and asset managers—are no longer just "observers" but are now the primary liquidity providers. High trading volumes lead to better price discovery and deeper liquidity, while also paving the way for the "futurization" of other assets like XRP or SOL, marking the full integration of crypto into the mainstream global derivatives system.

-

Cancellation of Paris Events: A Harsh Divergence in Market Narratives

The abrupt cancellation of NFT Paris and RWA Paris 2026 serves as a stark reminder of the uneven recovery within the industry. While Bitcoin and Ethereum are surging at the institutional level, the NFT market remains mired in a liquidity crisis, with volumes down roughly 95% from their peak. The organizers’ decision, likely driven by financial pressure and a lack of sponsorship, reflects a reality where the "pure culture/art NFT" narrative struggles to sustain large-scale commercial events in 2026. Meanwhile, although RWA (Real World Assets) has a bright future, it is still in a heavy compliance and infrastructure-building phase, not yet ready to support a standalone international convention of that scale.