Limited Impact from Geopolitical Risks; Crypto Market Sentiment Continues to Recover

Summary

-

Macroeconomy: The U.S. surprise operation against Venezuela triggered significant geopolitical turbulence, leading to divergence across global financial markets. Safe-haven demand pushed gold prices back above USD 4,400, while silver surged by 5%. However, against the backdrop of oversupply in the oil market, the geopolitical conflict failed to materially disrupt crude prices, which instead declined unexpectedly.

-

Project Updates:

-

Trending Tokens: BONK, PEPE, WIF

-

BONK: Revenue at the meme launch platform letsBONK.fun surged sharply within just two days, alongside a rebound in on-chain activity

-

Meme Sector: As meme momentum recovered, tokens including WHITEWHALE, BONK, WIF, PIPPIN, GIGA, USELESS, and PEPE topped the performance rankings

-

AAVE: Aave plans to explore sharing non-protocol revenue with token holders and to support teams building independent products on top of the protocol

-

WLFI: A governance proposal to use part of the treasury to accelerate adoption of USD1 has been approved

-

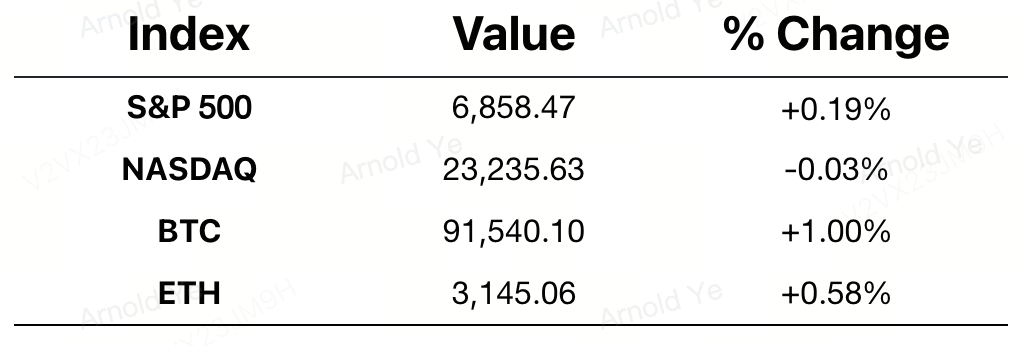

Major Asset Movements

Crypto Fear & Greed Index: 26 (vs. 25 24 hours ago), classified as Fear

Today’s Outlook

-

U.S. December ISM Manufacturing Index

-

Maduro may stand trial in the United States

-

ENA token unlock: 2.37% of circulating supply, valued at approximately USD 42 million

Macroeconomy

-

The United States has apprehended Venezuelan President Nicolás Maduro and removed him from Venezuela

Policy Direction

-

OECD’s crypto tax framework (CARF) enters implementation preparation, with 48 countries having initiated crypto tax data collection

-

Turkmenistan’s cryptocurrency regulatory law takes effect, legalizing mining and trading

-

El Salvador designates the integration of Bitcoin and artificial intelligence as a national policy

-

Iran will accept cryptocurrency payments for weapons orders

Industry Highlights

-

KuCoin was selected for Bitcoin.com’s “Best Crypto Exchanges to Start 2026” list and received recognition in the categories of Listings, Token Utility, and Trust Expansion, reflecting sustained industry acknowledgment of KuCoin’s strengths in quality project onboarding, ecosystem value creation, and long-term trust building

-

KuCoin launched its 2025 Annual User Report campaign, emphasizing personalized trading insights to help users review their yearly trading journeys

-

Tom Lee urged BitMine shareholders to approve a proposal by January 14 to increase authorized shares from 500 million to 50 billion

-

Michael Saylor once again released Bitcoin Tracker updates, with potential disclosure of additional purchases next week

-

Spot trading volume on Solana reached USD 1.6 trillion in 2025, surpassing most centralized exchanges

-

ETHGas raised USD 12 million and launched an Ethereum block space futures/auction marketplace

-

PwC expanded further into the crypto sector, with regulatory shifts viewed as a key driving force

-

Ethereum stablecoin transfer volume reached a quarterly all-time high, exceeding USD 8 trillion

Industry Highlights Extended Analysis

-

KuCoin Named "Best Crypto Exchange to Start 2026" by Bitcoin.com

This recognition is more than just a brand honor; it marks the strategic success of KuCoin’s high-quality asset onboarding and ecosystem value conversion. In the 2026 market environment, investors have moved beyond chasing the sheer quantity of tokens, shifting their focus toward the "security barriers" and "long-term certainty" of trading platforms. By strengthening compliance and empowering its ecosystem token (KCS), KuCoin has successfully transitioned from a traffic-driven exchange to a trust-anchored institution, building a foundation for attracting high-net-worth clients in this institutionalized era.

-

2025 Annual User Report: Personalized Trading Insights

The launch of this report is far more than a marketing tactic; it is a textbook case of data-driven retention. By visualizing personalized trading paths, P&L analysis, and risk preference maps, KuCoin not only enhances user loyalty but also "educates" users through data feedback. This "hyper-personalized" service model reflects the evolution of top-tier exchanges from simple "trading counters" into intelligent investment assistants.

-

BitMine Proposal to Increase Authorized Shares to 50 Billion

Tom Lee’s push for this proposal (with a vote deadline of Jan 14) hides a massive ambition for BitMine to become the "MicroStrategy of Ethereum." Currently holding over 4.11 million ETH, the company’s massive increase in authorized shares is likely not for immediate dilution, but to prepare for stock splits and large-scale Mergers & Acquisitions (M&A). In a climate where ETH price may surge due to tokenization trends, lowering the entry barrier for retail investors via a split will significantly enhance the stock's liquidity premium.

-

Michael Saylor’s Continuous Bitcoin Tracker Updates

Saylor’s Bitcoin Tracker has become a macro risk barometer for global financial markets. The anticipation of potential new purchase disclosures next week not only boosts market sentiment but also reinforces the feasibility of "Bitcoin as a corporate reserve." As his holdings approach the $60 billion mark, this highly transparent disclosure mechanism is forcing more Nasdaq-listed companies to follow suit, shifting crypto from a "speculative asset" to a "strategic corporate asset."

-

Solana’s 2025 Spot Volume Hits $1.6 Trillion

Surpassing most Centralized Exchanges (CEXs) in volume signals the official arrival of the "On-chain Mainstreaming" era. This is not just a victory of numbers, but a commercial validation of Solana’s high-throughput and low-latency architecture. This data suggests that a massive amount of liquidity has migrated from custodial platforms to decentralized protocols (DEXs), positioning Solana as the dominant settlement layer for the global retail and Meme-coin ecosystem in 2025.

-

ETHGas Raises $12M and Launches Block Space Futures

The emergence of ETHGas addresses Ethereum’s long-standing pain point: Gas fee unpredictability. By introducing "Block Space Futures," it converts uncertain transaction costs into hedgeable financial products. This is critical for Rollup providers, institutional market makers, and high-frequency traders. It signifies Ethereum's evolution from a "primitive distributed ledger" into a global financial infrastructure with financial predictability.

-

PwC’s Crypto Expansion: The Regulatory Dividend

PwC’s deepening involvement is the ultimate manifestation of the "Compliance Premium." As global regulatory frameworks (especially the shift in U.S. policy) become clearer, the demand for auditing, compliance consulting, and tax planning within the crypto sector has exploded. PwC’s expansion predicts a massive "professionalization" of crypto firms and indicates that traditional financial giants are capturing the Web3 profit pool under the safety of regulatory umbrellas.

-

Ethereum Stablecoin Volume Hits Quarterly Record of $8 Trillion

The quarterly volume exceeding $8 trillion proves that Ethereum has become the world’s largest programmable USD network. While Solana leads in transaction frequency, Ethereum maintains an unshakeable dominance in the settlement of large-value stablecoins (specifically USDT and USDC). This data reveals a qualitative shift for stablecoins: moving from "trading collateral" to a global cross-border settlement tool and B2B payment infrastructure.