Dollar Weakens, Gold Hits New Highs, BTC Rebounds to 89k

Summary

-

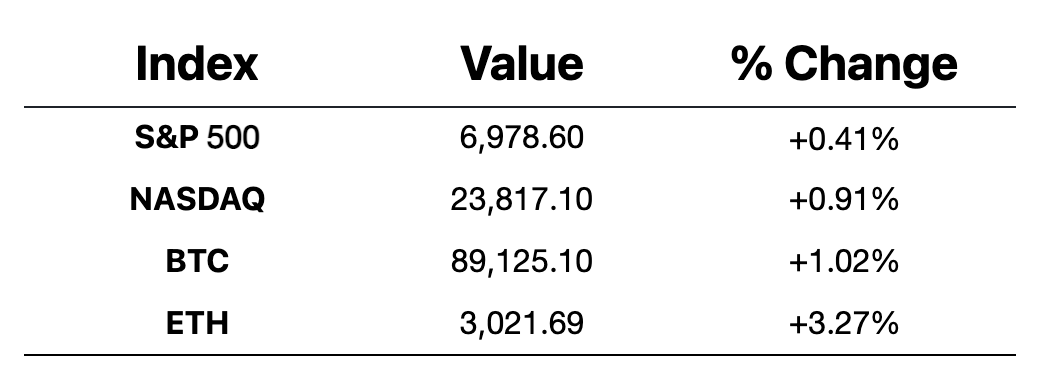

Macro Economy:Rising macro uncertainty and Trump’s remarks on the US dollar pushed the Dollar Index (DXY) below 96. US equities showed divergence: the S&P 500 and Nasdaq gained 0.41% and 0.91%, while the Dow fell 0.83%. US consumer confidence came in below expectations, and Treasury yields dipped to intraday lows. Geopolitical tensions in the Middle East supported a rebound in crude oil. Gold marked its sixth consecutive day of record highs, breaking above $5,200/oz for the first time.

-

Crypto Market:BTC dipped to $86,000 before rebounding slightly toward $89,000. Overall sentiment remains in the “Fear” zone. Altcoins were relatively muted, with no clear expansion in risk appetite. The $85,000 level has become a key battleground after multiple retests, holding as support so far. The market remains in a consolidation phase, with bulls and bears locked in stalemate awaiting a directional break.

-

Project Updates:

-

Trending Tokens: XAUT/PAXG, HYPE, PENGUIN, PUMP

-

XAUT/PAXG: Gold continues making new highs above $5,200/oz

-

HYPE: HIP-3 trading volume reached a new record; HYPE surged over 25% in a single day

-

PENGUIN: Solana co-founder changed their X profile picture to a penguin-themed concept image, triggering a short-term token rally

-

PUMP: Meme token sentiment on Solana has recovered; Pump.fun protocol revenue surpassed Hyperliquid over the past 24 hours

-

BIRB: NFT project Moonbirds released the BIRB tokenomics model

-

COPPERINU: Echo.xyz founder Cobie posted about “Copper Inu” on X, driving a rise in the similarly named token

-

Major Asset Moves

-

Crypto Fear & Greed Index: 29 (unchanged from 24 hours ago) — Level: Fear

Today’s Watchlist

-

Federal Reserve FOMC meeting

-

Fed Chair to hold a monetary policy press conference

-

US Treasury: Trump to attend the Trump Account Summit

-

Google to remove unregistered overseas crypto exchange apps from the Korean app store starting Jan 28

-

Optimism token buyback proposal vote ends on Jan 28

-

SIGN unlock: 17.68% of circulating supply (~$12.2M)

-

JUP unlock: 1.70% of circulating supply (~$10.6M)

Macro Economy

-

South Korea’s special envoy will visit the US to discuss trade agreement implementation; Trump announced higher tariffs on Korea this morning

-

Dollar Index DXY fell below 96, now at 95.886, the lowest since Feb 2022

Policy Direction

-

South Korea is considering allowing domestic institutions to issue virtual assets; stablecoins remain controversial

-

Japan plans to classify XRP as a regulated financial product before Q2 2026

-

US senators agreed to withdraw the credit card swipe-fee amendment to avoid jeopardizing the CLARITY Act review

-

Australia listed regulatory gaps in crypto oversight as a key risk for 2026

-

Arizona draft bill proposes exempting “virtual currency” from property tax

Industry Highlights

-

KuCoin appointed former London Stock Exchange Group executive Sabina Liu as Head of European Operations, aiming to expand compliance under EU MiCA regulations

-

KuCoin Web3 officially launched a decentralized Web3 wallet supporting native perpetual contract trading within the wallet, offering global users an efficient one-stop self-custody asset management experience

-

Hang Seng Gold ETF will issue tokenized fund units on Ethereum

-

Base launched Breakout, a crypto-Twitter attention-based prediction market

-

Hyperliquid silver contract trading volume exceeded $1B in the past 24 hours

-

Moonbirds launched Nesting 2.0, allowing NFT holders to claim birb tokens over the next 24 months

-

Clawdbot founder stated no token will be issued and denied involvement in any crypto projects

In-Depth Industry Analysis

-

KuCoin Appoints Sabina Liu as Head of Europe to Accelerate MiCA Compliance

KuCoin’s hiring of Sabina Liu, a former executive at the London Stock Exchange Group (LSEG), signals a strategic pivot toward institutional maturity following earlier regulatory hurdles. With over a decade of experience in top-tier financial institutions, Liu’s primary mission is to steer KuCoin through the European Union’s Markets in Crypto-Assets (MiCA) framework. This move is not just about securing licenses in regions like Austria; it is a "compliance-first" strategy designed to rebuild institutional trust, using the European market as a global blueprint for KuCoin’s transition from a high-leverage altcoin hub to a regulated financial service provider.

-

KuCoin Web3 Wallet Launches Native Perpetual Trading

The introduction of native perpetual contract trading within the KuCoin Web3 wallet represents a shift from simple asset management to a "one-stop interactive" experience. By integrating derivatives directly into a self-custody environment, users can bypass the friction of moving funds between Centralized Exchanges (CEXs) and private wallets, significantly improving capital efficiency and reducing slippage risks. This "decentralized experience with centralized efficiency" model is gradually eating into the market share of traditional CEXs, reinforcing the Web3 wallet’s role as the primary gateway for crypto traffic.

-

Hang Seng Investment to Issue Tokenized Gold ETF Units on Ethereum

Hang Seng Investment’s plan to issue tokenized units of its Gold ETF on the Ethereum blockchain is a heavyweight signal of Traditional Finance (TradFi) entering the RWA (Real-World Asset) space. With HSBC acting as the tokenization agent, this initiative merges the security of physical gold with the liquidity of blockchain. While currently restricted to authorized distributors without secondary market trading, this experiment on a public mainnet (Ethereum) lays the infrastructure for 24/7 settlement and cross-platform collateralization, further blurring the lines between on-chain assets and traditional securities.

-

Base Launches Breakout: A Social-Attention Prediction Market

The launch of Breakout on the Base ecosystem tightly binds "prediction markets" with "social media influence." Unlike traditional political or macro forecasting, this model prices assets based on trending topics and the attention of Key Opinion Leaders (KOLs) on Crypto Twitter (CT). This is essentially the monetization of social capital and reflects the industry's deep dive into the "Attention Economy." If data integrity and manipulation risks can be managed, this product could become a new paradigm for combining social applications with financial derivatives.

-

Hyperliquid Silver Volume Surpasses $1B in 24 Hours

The surge in silver contract trading on Hyperliquid highlights the new role of Decentralized Derivative Exchanges (DEXs) as "macro trading hubs." As Bitcoin’s volatility narrows, capital is flowing into on-chain commodity contracts that offer high leverage and instant settlement. The fact that silver volume exceeded that of major public chain tokens like Solana suggests that crypto-native investors are using decentralized infrastructure for global macro hedging. With its high-performance engine, Hyperliquid is successfully capturing traffic that traditionally belonged to legacy commodity futures markets.

-

Moonbirds Launches Nesting 2.0 to Reshape Community Incentives via $BIRB

The introduction of Nesting 2.0 and the $BIRB token distribution is an attempt by the Moonbirds project to evolve from a "niche collectible" into a "full-scale ecosystem economy." By implementing a 24-month linear vesting period, the project aims to discourage short-term speculation and reward long-term ecosystem contributors. With 65% of the token supply allocated to the community, it shows a commitment to community-driven growth. As the Token Generation Event (TGE) approaches on January 28, this mechanism will test whether Moonbirds' brand equity can be sustained through tokenomics following its acquisition by Yuga Labs.

-

Clawdbot Founder Denies Token Issuance and Crypto Involvement

The clarification from the Clawdbot founder serves as a cooling agent against the recent "AI Agent token frenzy." Despite Clawdbot’s impressive performance in automating trades on prediction markets like Polymarket, the founder has explicitly refused to weaponize the tool into a speculative token project. This stance is notably sober in the current MEME-driven market, reflecting a tension between technical AI teams and speculative crypto capital—protecting brand reputation and technical integrity often holds more long-term value than the quick profits of a token launch.