“TACO Trade” Returns as Risk Assets Rebound in Sync

Summary

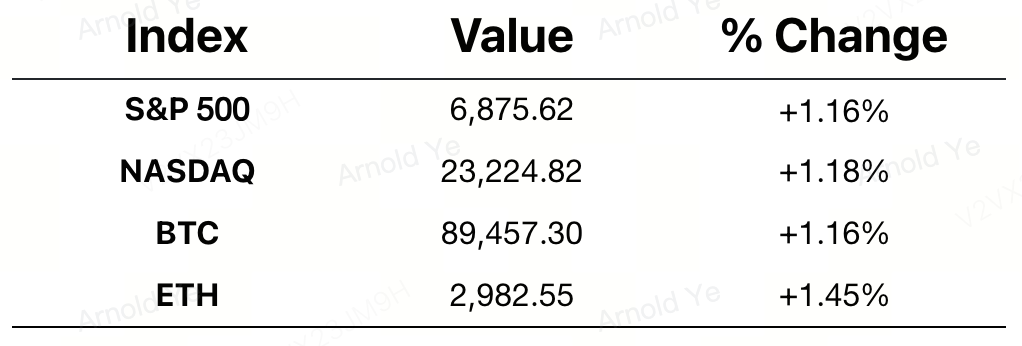

-

Macroeconomy: Trump stated he has no intention of acquiring Greenland through military means and said a framework agreement on Greenland has been reached with NATO, with no related tariffs to be imposed. The “TACO (Trump Always Chickens Out) trade” re-emerged, quickly restoring risk appetite. All three major U.S. equity indices rebounded and largely recouped the prior session’s losses, while the small-cap Russell 2000 index hit a new all-time high.

-

Crypto Market: Bitcoin moved closely in line with U.S. equities, staging a V-shaped rebound driven by the “TACO trade.” It closed up 1.16% on the day, ending a six-session losing streak. Altcoins followed with a modest rebound, while overall market-cap dominance remained stable, indicating that risk appetite has yet to meaningfully rotate into higher-volatility assets.

-

Project Updates

-

Hot tokens: GWEI, ROSE, SKR

-

SKR: Solana Mobile airdropped its SKR token, which surged 230%, with market capitalization surpassing $150m

-

GWEI: ETHGas completed its community airdrop; GWEI rose 90%, with market cap stabilizing around $50m

-

AXS: Closed up 23%, leading gains among the top 100 tokens; Korean trading volume surged, accounting for over 40%

-

KTA: Payments-focused public chain Keeta reached an agreement to acquire a bank, allocating 35 million KTA to support the acquisition process

-

Major Asset Moves

Crypto Fear & Greed Index: 20 (24 one day ago), Extreme Fear

Today’s Outlook

-

U.S. November Core PCE data

-

Immunefi to launch its platform token IMU on January 22

Macroeconomy

-

Trump reiterated that he does not intend to use military force regarding Greenland

-

Trump: A framework agreement on Greenland has been formed; related tariffs will not take effect

-

U.S. Treasury Secretary Bessent: Not concerned about any U.S. Treasury sell-off triggered by the Greenland issue

-

Trump: Will soon announce a new Fed Chair nominee, but expressed concern about potential “disloyalty” after appointment

Policy Direction

-

U.S. Senate Agriculture Committee to release the latest draft of the crypto market structure bill

-

David Sacks: Once the market structure bill passes, banks will fully enter the crypto sector

-

Trump: Hopes to sign crypto legislation as soon as possible and ensure the U.S. remains the world’s crypto capital

-

Vietnam has begun piloting a formal licensing regime for crypto asset trading platforms

Industry Highlights

-

Bloomberg: Wall Street institutions are exiting Bitcoin arbitrage trades

-

Galaxy plans to launch a $100m hedge fund in Q1, targeting profits from digital asset price volatility

-

Vitalik: 2026 will mark a full return to decentralized social networks

-

Strive to issue $150m in preferred shares to purchase more Bitcoin

-

Neynar acquires and takes over Farcaster, with protocol and application assets transferred in full

Deep Dive into Industry Highlights

-

Wall Street Institutions Exit Bitcoin Arbitrage Trades

Analysis: This phenomenon signals increased market efficiency and the fading of the "Institutional Bonus Period." Previously, a significant basis gap existed between spot and futures prices (especially on the CME), allowing institutions to capture stable returns via "long spot + short futures" strategies. As spot ETFs become mainstream and liquidity deepens, these pricing imbalances have rapidly narrowed, leading to diminishing yields. This reflects a shift in Wall Street’s behavior: moving away from simple low-risk arbitrage toward sophisticated asset allocation. Bitcoin is evolving from a volatile speculative pool into a mature, transparently priced asset class.

-

Galaxy Plans to Launch $100M Hedge Fund in Q1

Analysis: As traditional arbitrage spreads shrink, Galaxy is pivoting toward active strategies to capture volatility premiums. While a $100 million fund is modest for a top-tier asset manager, its strategy is highly representative: it targets both tokens and fintech equities (at a 30% allocation). This indicates that major digital asset managers are blurring the lines between "Crypto" and "Equities," adopting a holistic "Digital Finance" perspective. This cross-market allocation aims to hedge single-market risks while leveraging the unique high volatility of crypto to generate Alpha.

-

Vitalik: 2026 Will Mark a Full Return to Decentralized Social Networks

Analysis: Vitalik’s prediction serves as a critique of the excessive financialization of current social models. He views 2026 as the convergence point where technical maturity (such as data sharding and multi-client interoperability) meets user demand (the desire to escape algorithmic manipulation and echo chambers). Unlike early "SocialFi" models driven by token speculation, the next generation of Decentralized Social (DeSoc) will return to the essence of communication—prioritizing the fight against misinformation and the curation of high-value content. This suggests that protocols like Lens and Farcaster will evolve from "on-chain experiments" into socially impactful infrastructure.

-

Strive to Issue $150M in Preferred Shares to Purchase Bitcoin

Analysis: Strive (founded by Vivek Ramaswamy) is emulating the "Bitcoin Treasury Strategy" pioneered by MicroStrategy. By issuing preferred shares (SATA) with a 12.25% dividend rate to raise capital for Bitcoin purchases, the company is using aggressive financial engineering to lock in capital costs while betting on Bitcoin’s long-term appreciation. This highlights an emerging "Reserve Race" among U.S. public companies, treating Bitcoin as a ultimate hedge against fiat debasement and a tool for balance sheet optimization.

-

Neynar Acquires and Takes Over Farcaster

Analysis: This is a classic case of "Infrastructure Provider Swallowing the Core Application," signaling vertical integration within the Web3 social track. As Neynar is the primary infrastructure provider for Farcaster, the full transfer of protocol and application assets suggests a deep binding of "protocol development" and "developer tooling." With the original founders like Dan Romero stepping back, Farcaster is transitioning from a "founder-driven" project to "institutionalized operations." While this integration may accelerate technical iterations, it also sparks community debate regarding whether decentralized consensus might be diluted by corporate interests.

-

Ondo Global Markets Expands to the Solana Ecosystem

Analysis: This move pushes the scale of RWA (Real World Assets) to new heights. By bringing over 200 tokenized U.S. stocks and ETFs to Solana, Ondo leverages the network’s high throughput and low fees to enable "24/7, on-chain free flow" of traditional securities. This is more than just cross-chain asset migration; it is a disruptive challenge to the traditional brokerage model. The composability of Solana means these tokenized stocks can be used directly as collateral in DeFi protocols, effectively dissolving the "firewall" between traditional finance and decentralized finance.