Escalating AI Fears Weigh on U.S. Equities; Crypto Market Remains in Defensive Consolidation

Summary

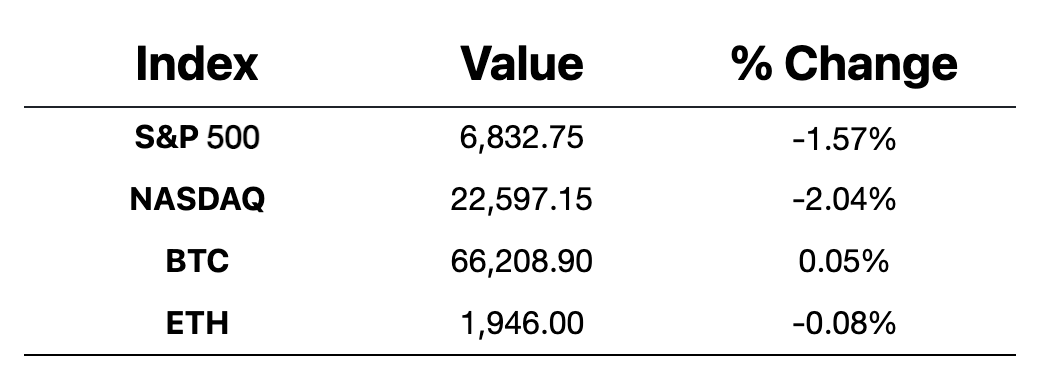

Macro:Investor concerns over AI disrupting traditional industry business models continued to intensify, triggering broad-based selling across risk assets. All three major U.S. equity indices fell more than 1%, with the Nasdaq leading losses at over 2%. Spot silver plunged more than 10%, while gold dropped over 3%, breaking below key technical levels. Meanwhile, U.S. Treasuries rallied, with yields on both the 10-year and 30-year bonds declining by more than 7 basis points, reflecting a clear shift toward risk aversion.

Crypto Market:Despite January’s nonfarm payrolls broadly signaling economic resilience, Bitcoin faced repeated resistance near the $69,000 level. After forming a short-term top, BTC entered a phase of choppy decline and established a short-term consolidation range between $67,800 and $68,000, indicating defensive price action following a structural breakdown.Expectations for altcoins to outperform remain subdued overall, though select narrative-driven tokens have shown relative strength. Market sentiment remains in the fear zone, albeit with modest improvement compared to the previous day.

Project Updates

Trending Tokens: ESP, S, WHITEWHALE, WIFI, BERA

-

ESP: Airdrop and multi-platform listings launched simultaneously; listings on major exchanges boosted market attention.

-

BERA: Token surged abnormally, with intraday gains exceeding 130%. The rally followed a strategic shift toward revenue-oriented applications and the smooth absorption of the Feb 6 token unlock without triggering a sell-off.

-

WIFI: WLFI plans to launch a forex platform, World Swap.

-

S: Sonic Labs announced a strategic restructuring, focusing on core blockchain infrastructure while streamlining peripheral product lines; the token rose briefly.

-

WHITEWHALE: After market cap halved, trader “TheWhiteWhale” publicly accumulated tokens, raising holdings to 58% of supply. Weekly purchases exceeded $2.1 million, with a daily rebound surpassing 50%.

Major Asset Moves

Crypto Fear & Greed Index: 9 (24 hours ago: 5) — Extreme Fear

Today’s Key Events

-

U.S. January CPI (YoY)

-

Coinbase annual report release

-

Pendle launches PENDLE buyback program

Macro Developments

-

U.S. House passes resolution opposing Trump’s proposed tariff increase on Canada

-

Mizuho Bank: Bank of Japan may raise rates up to three times this year

Policy & Regulatory

-

American Bankers Association urges regulators to slow crypto banking license approvals

-

Thai cabinet approves amendments to the “Derivatives Act” to allow cryptocurrencies as underlying assets

-

UAE Central Bank and Hong Kong Monetary Authority deepen financial cooperation and market connectivity

-

SEC Chair: Providing a clear regulatory framework for digital assets is among the SEC’s top priorities this year

Industry Highlights

-

Base.dev launches a leaderboard feature showcasing top-performing applications on Base

-

USD AI introduces a “Level Up” mechanism; Allo Game participants can choose Boost and Max strategies

-

Stellar partners with TopNod to accelerate real-world asset (RWA) adoption

-

Lightning Labs open-sources lightning-agent-tools, enabling native AI agent integration with Lightning Network payments

-

Pudgy Penguins to launch Pengu Visa card in partnership with KAST

-

Strategy plans to issue additional perpetual preferred shares to reduce stock price volatility

-

Zerohash adds support for Monad to expand USDC stablecoin payment services

Deep Dive: Industry Highlights (Feb 13, 2026)

-

Base.dev Launches Leaderboard to Showcase Top Applications

The introduction of a leaderboard on the Base developer platform marks a strategic shift from "infrastructure building" to a "quality-driven app competition." By providing transparent metrics—such as active users and transaction volume—this feature offers investors and users a clear filtering tool. It directs capital and traffic toward high-quality projects while incentivizing developers to optimize their products to secure a top-tier position within the Base ecosystem.

-

USD AI Introduces "Level Up" Mechanism and Allo Game Strategies

USD AI is integrating gamification into the intersection of AI and finance. By offering Boost and Max strategies, the platform expands the dimensions of user engagement. This design leverages behavioral finance—specifically the drive for achievement—to guide participants into choosing yield-enhancement paths that match their specific risk appetites, thereby strengthening the user stickiness of the Allo Game ecosystem.

-

Stellar Partners with TopNod to Accelerate RWA Adoption

Stellar continues its focus on payments and cross-border clearing, with this partnership centered on "low-barrier access." TopNod’s non-custodial, seedless wallet experience (powered by TEE technology) significantly lowers the technical entry barrier for traditional finance users. Combined with Stellar’s high throughput and low costs, this move will accelerate the tokenization of real-world assets, such as real estate and treasury bonds, particularly in Asian and emerging markets.

-

Lightning Labs Open-Sources Tools for Native AI Agent Payments

This is a landmark moment for the "AI Economy." By open-sourcing

lightning-agent-tools, AI Agents can now perform instantaneous, micro-payments via the Lightning Network without human intervention or traditional bank accounts. This lays the groundwork for automated Machine-to-Machine (M2M) commerce, allowing AI to not only process data but also manage its own "wallet" to purchase computing power or digital services.-

Pudgy Penguins to Launch Pengu Visa Card with KAST

As a top-tier NFT "blue chip," Pudgy Penguins is bridging the gap between "digital art" and "consumer finance." With incentives like up to 12% rewards and 7% yields, the Pengu Visa card enables crypto assets to be spent at 150 million merchants worldwide. This not only boosts the utility of the PENGU token but also provides a blueprint for NFT projects transitioning into mainstream lifestyle brands.

-

Strategy Plans to Issue Perpetual Preferred Shares to Curb Volatility

By issuing "Stretch" perpetual preferred shares, the company (likely following a MicroStrategy-style model) aims to balance its high-volatility balance sheet. With dividend rates resetting monthly (e.g., at 11.25%), these shares function as a fixed-income product. They attract conservative investors seeking exposure to digital asset growth without the extreme drawdowns of common stock, thereby optimizing the company's capital structure.

-

Zerohash Adds Support for Monad to Expand USDC Payments

The integration of the high-performance L1 Monad by Zerohash, a regulated infrastructure provider, reflects the market's dual demand for "ultra-fast transactions" and "regulatory compliance." Monad’s parallel processing capabilities combined with the stability of USDC are ideal for B2B settlements and real-time account funding—scenarios that require the high efficiency traditionally missing in blockchain but present in legacy finance.

-

Sui Collaborates with Ethena Labs to Launch eSui Dollar

The launch of eSui Dollar (suiUSDe) provides the Sui ecosystem with its own yield-bearing synthetic dollar. The highlight here is "Value Recirculation": the yields generated are designated for SUI token buybacks. This mechanism ties the liquidity expansion of the stablecoin to the deflationary pressure (buybacks) of the native token, enhancing SUI’s attractiveness to DeFi users while reinforcing the token's underlying value.