AI Concerns Resurface, Weighing on Tech Stocks as Bitcoin Extends Range-Bound Volatility

Summary

-

Macro:

US retail sales came in below expectations, increasing uncertainty around the economic growth outlook ahead of the upcoming major nonfarm payrolls release. Concerns surrounding the AI sector resurfaced, dragging down technology and software stocks and pulling the S&P 500 and Nasdaq lower, while the Dow Jones recorded its third consecutive all-time high. Precious metals continued consolidating at elevated levels, with gold holding firm above the $5,000 mark.

-

Crypto market:

Bitcoin fell below the $70k level, briefly dropping to a low of $67.9k before rebounding and moving into a consolidation range. Trading volume declined gradually. Total crypto market capitalization fell for a second consecutive day, and altcoins retreated alongside the broader market. Overall trading volume saw only a slight recovery. Market sentiment remains in the fear zone but shows no signs of further deterioration.

-

Project developments

-

Trending tokens: BNKR, ZRO, GWEI

-

BNKR: Bankr has launched its token issuance platform and will soon roll out an LLM key feature. BNKR’s market cap once surpassed a new high of $120 million.

-

GWEI: Coinbase added ETHGas (GWEI) to its listing roadmap, while Binance Wallet launched an ETHGas (GWEI) trading competition.

-

CLAWNCH: The AI-agent-focused launch platform CLAWNCH saw its token market cap surge to $12 million, up 18.6% in 24 hours.

-

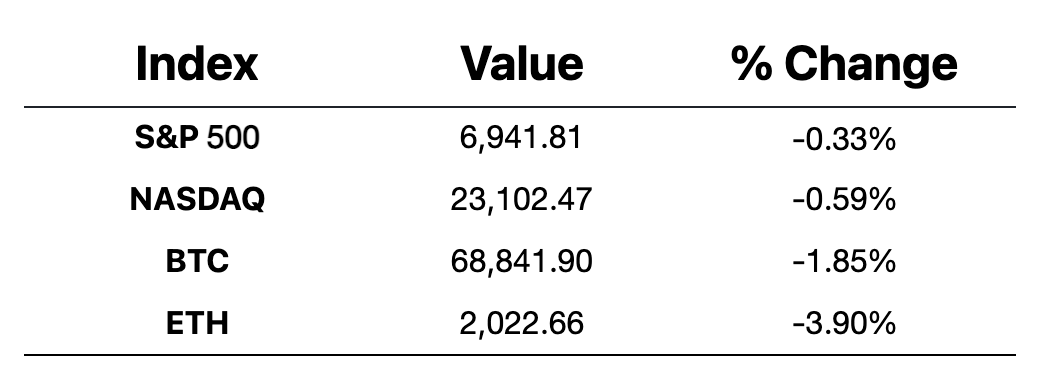

Major asset moves

Crypto Fear & Greed Index: 11 (vs. 9, 24 hours ago) — Extreme Fear

Today’s outlook

-

US Department of Labor to release January nonfarm payrolls data

-

Nevada court to issue a temporary injunction against Polymarket and hold a preliminary hearing

-

Avalanche (AVAX) to unlock ~1.67 million tokens (~$15.2 million)

Macro economy

-

Trump is expected to hold a second round of US–Iran talks next week and deploy a second carrier strike group to the Middle East.

-

Fed’s Hammack: Interest rate policy may remain unchanged for a considerable period

-

White House trade advisor Navarro: Does not expect weak employment data

-

US December retail sales MoM: 0% (forecast: 0.4%)

Policy direction

-

US Treasury Secretary Bessent: The crypto market structure bill needs to be passed this spring.

-

Bloomberg: Russian regulators begin restricting Telegram access

-

US Treasury Secretary Bessent criticizes Coinbase’s opposition to the CLARITY Act, calling it a “stubborn participant”

Industry highlights

-

Goldman Sachs disclosed $2.36 billion in crypto exposure, including BTC, ETH, XRP, and SOL

-

Robinhood Q4 earnings missed expectations: Crypto revenue came in at $221 million, down 38% year-over-year.

-

SBF seeks retrial and has submitted an appeal filing

-

Interactive Brokers launches Coinbase Nano Bitcoin and Ethereum futures with 24/7 trading

-

Circle invests in edgeX, bringing stablecoins into core decentralized high-frequency derivatives use cases

-

Blockchain com successfully registers in the UK after nearly four years since abandoning its FCA application

-

Michael Saylor: Concerns about Strategy selling BTC are unfounded; will continue buying

-

Polymarket to partner with Kaito AI to launch an “attention market”

-

Sahara AI partners with Korean payments giant Danal Fintech to co-develop a stablecoin AI payment system

Deep Dive: Industry Highlights (Feb 11, 2026)

-

Goldman Sachs Discloses $2.36B Crypto Exposure

This disclosure marks a definitive shift for the Wall Street giant from "observational interest" to "substantial holding." By diversifying beyond BTC and ETH into assets like XRP and SOL, Goldman is signaling institutional validation of the broader crypto ecosystem. Such a massive position suggests that crypto has become a permanent fixture in multi-strategy institutional portfolios, likely triggering a "follow-the-leader" effect among family offices and sovereign wealth funds.

-

Robinhood Q4 Earnings Miss: Crypto Revenue Down 38%

Despite growth in user numbers, the sharp decline in crypto revenue highlights Robinhood’s heavy reliance on retail swing trading. Retail engagement tends to crater during periods of high volatility or sideways price action, directly dragging down top-line growth. This reflects a "reshuffling" of the retail market, where traders may be moving away from simple spot trading toward more complex derivatives or long-term ETFs, posing a structural challenge to traditional brokerages.

-

SBF Seeks Retrial via Appeal Filing

SBF’s appeal, grounded in claims of "lack of due process" and "government pressure on witnesses," is an attempt to dismantle his 2023 conviction. His argument—that FTX always had enough assets and only suffered a "liquidity crisis"—is viewed by legal experts as more of a "last-ditch effort" to prolong the legal cycle rather than a viable path to exoneration, given the robust evidence provided by former Alameda executives.

-

Interactive Brokers Launches 24/7 Coinbase Nano Futures

By launching "Nano-sized" futures with 24/7 trading, Interactive Brokers is significantly lowering the barrier to entry for professional and retail hedgers. The small contract sizes (0.01 BTC and 0.1 ETH) allow regulated platforms to reclaim market share from unregulated offshore exchanges. This marks the "fragmentation" and "commoditization" of crypto trading within traditional financial infrastructure, offering users more precise risk management tools.

-

Circle Invests in edgeX for High-Frequency Derivatives

Circle’s investment in edgeX aims to elevate USDC from a simple "trading pair intermediary" to a "high-frequency financial foundation." By focusing on Decentralized Exchanges (DEXs) and high-performance trading, this move suggests that stablecoins are penetrating the core of DeFi—leveraging blockchain’s real-time settlement to support millisecond-level derivatives. This increases USDC’s velocity and strengthens the competitiveness of decentralized finance against CEXs.

-

Blockchain.com Successfully Registers with UK FCA

Securing FCA approval four years after abandoning its initial application demonstrates a commitment to "long-term compliance." As the UK solidifies its position as a global crypto hub (especially in the wake of departures like Gemini), Blockchain.com’s return completes its regulatory map in Europe. It signals that the UK regulatory environment is becoming clearer and more navigable, which is essential for attracting institutional-grade capital.

-

Michael Saylor: Concerns Over BTC Sales are Unfounded

Saylor’s stance remains a "North Star" for Bitcoin maximalism. By explicitly denying rumors of selling and reaffirming a "buy and hold forever" strategy, he is attempting to stabilize market sentiment. Even with MSTR's stock under pressure due to BTC's volatility, the company’s $1.4 billion cash reserve for interest payments ensures they aren't forced to liquidate at lows. His conviction remains the primary psychological floor for the market.

-

Polymarket Partners with Kaito AI for "Attention Markets"

Polymarket is expanding prediction markets from discrete events (like elections) to "social media attention" and "sentiment metrics." By utilizing Kaito AI’s "mindshare" and sentiment data, users can now bet on the rise and fall of internet trends and narratives. This financialization of "narrative trading" aligns perfectly with the current "attention economy" logic of crypto, potentially creating a new asset class between data analytics and risk-betting.

-

Sahara AI & Danal Fintech to Co-develop AI Payment System

This partnership brings "Agentic AI" (autonomous decision-making AI) directly into the payment clearing process. Danal, a South Korean payment giant, provides the physical retail footprint, while Sahara AI provides the intelligent protocols for cross-border settlement, real-time risk management, and fraud detection. This marks the transition of "AI + Payments" from a theoretical concept to a regulated financial utility, aiming to solve the high fees and inefficiencies of traditional cross-border systems.