Bessent rules out aggressive balance-sheet reduction; crypto market trades quietly and consolidates

Summary

-

Macro:

Ahead of Wednesday’s nonfarm payroll release, the White House signaled expectations in advance to manage market sentiment. Hassett hinted that job growth may come in below market expectations.

Treasury Secretary Bessent stated that even if Warsh were to become Fed Chair, the balance-sheet reduction process would not be accelerated, effectively ruling out aggressive monetary tightening.

Previously battered tech and software sectors extended their rebound, lifting U.S. equities broadly; the Dow closed at another record high for the second consecutive session.

Precious metals remained range-bound, with gold consolidating around $5,000 and silver near $80.

-

Crypto market:

The crypto market has entered a consolidation phase. Bitcoin is fluctuating around the $70k level, with trading volume slightly rebounding from Sunday. Overall activity remains subdued; most altcoins continue to decline and volumes are contracting.

Market sentiment has weakened further since the weekend, with the Fear & Greed Index falling back to single digits.

-

Project developments:

-

Trending tokens: XAU/XAG, XRP, PIPPIN

-

XAU/XAG: Gold consolidates around $5,000; silver around $80

-

PIPPIN: Market cap temporarily at $278M, up 11% in 24h

-

SKY: Sky Protocol repurchased 31M SKY tokens last week; cumulative buyback exceeds 108M USDS

-

ADA/LINK/XLM: CME lists futures for ADA, LINK, and XLM, including micro contracts

-

TON: TON Foundation launches payment SDK “TON Pay”

-

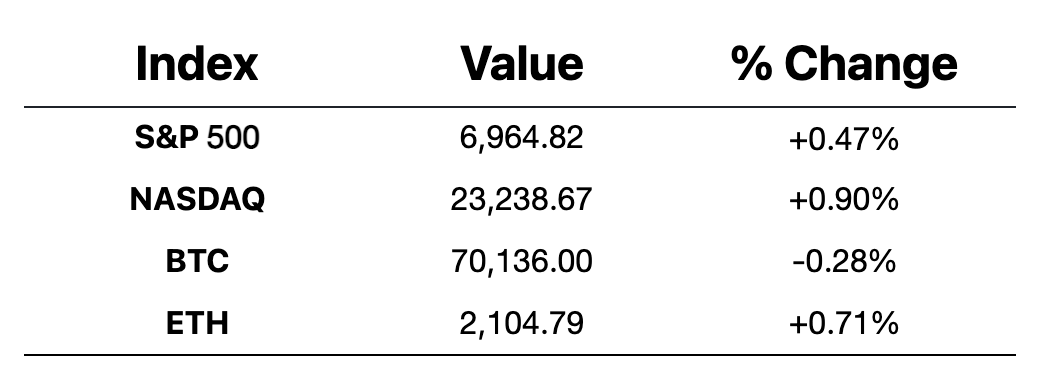

Major asset changes

Crypto Fear & Greed Index: 9 (14, 24 hours ago) — Extreme Fear

Today’s outlook

-

Next White House meeting on stablecoin yield discussions

-

Speech: 2026 FOMC voter and Cleveland Fed President Hammack

-

Speech: 2026 FOMC voter and Dallas Fed President Logan

-

U.S. December retail sales MoM

-

Robinhood annual report release

-

Consensus HK opens

-

Aptos (APT) unlock: ~11.31M tokens (~$12.3M)

Macro economy

-

Trump claims Warsh could drive 15% U.S. economic growth and again criticizes Powell

-

Hassett: Employment data likely to decline slightly but should not trigger panic

-

Fed Governor Waller: A “streamlined master account” will be introduced this year

Policy direction

-

Former House Financial Services Committee Chair Patrick McHenry and White House advisor Patrick Witt said in a livestream that U.S. crypto legislation is accelerating. A major bill covering crypto market structure could be completed within months.

-

The Bithumb incident may affect CEX business qualifications; Korean regulators will investigate the “ghost bitcoin” issue across the industry.

-

U.S. law firms begin investigating potential securities claims against Balancer related to the $128M hack.

-

Hong Kong Chief Executive’s Policy Unit digital finance roundtable: shifting focus from financial innovation toward serving the real economy and promoting high-quality financial development.

-

Polymarket sues Massachusetts, seeking federal court intervention.

Industry highlights

-

KuCoin will attend Consensus Hong Kong 2026 (Feb 10–12). VP and Head of Risk Control Edwin Wong will join the roundtable “Turning Intelligence Into Action,” discussing how “trust-first” infrastructure can convert market data, on-chain signals, and AI capabilities into actionable risk control and governance practices.

-

Strategy bought an additional 1,142 BTC last week for $90M (avg. price $78,815).

-

Bitmine added another 40,000 ETH today (~$83.38M); last week added 40,613 ETH. Tom Lee expects ETH to stage a typical “V-shaped” rebound.

-

CME officially launches ADA, LINK, and XLM futures.

-

CoinShares: Digital asset investment products saw $187M outflows last week.

-

Jump Trading exchanged market-making/liquidity services for small equity stakes in Kalshi and Polymarket.

-

Backpack tokenomics announced: total supply 1B; 25% unlocked at TGE; team/insiders locked until at least one year after IPO.

Deep Dive: Industry Highlights (Feb 10, 2026)

KuCoin at Consensus HK: The Synergy of Risk Control and AI

KuCoin’s "Trust-first" philosophy, to be presented at Consensus Hong Kong, signals that top-tier exchanges are shifting risk management from a "back-office defense" to a "front-end asset." Edwin Wong’s participation suggests that future competition will hinge not just on liquidity, but on the ability to use AI to convert massive on-chain data into real-time governance. This is a strategic move to address global regulatory pressures and rebuild user trust through proactive, automated defense in an era of sophisticated cyber threats.

MicroStrategy (Strategy): The Relentless "Leveraged" Bitcoin Accumulator

By adding 1,142 BTC at approximately $78,815, Strategy continues to ignore short-term volatility in favor of long-term scarcity. Their model of raising capital via At-The-Market (ATM) equity offerings to buy BTC essentially funnels legacy stock market liquidity into Bitcoin. Despite the proximity of the market price to their average cost basis, this "never-sell" balance sheet strategy has solidified the firm’s role as the premier proxy for Bitcoin within the traditional financial system.

Bitmine’s ETH Accumulation: Betting on a "Mean Reversion"

Bitmine’s massive acquisition of over 80,000 ETH within two weeks aligns perfectly with Tom Lee’s "V-shaped" rebound thesis. This suggests that institutional "whales" view Ethereum as significantly undervalued following Bitcoin’s recent dominance. Such aggressive accumulation typically indicates a belief that ETH has hit an oversold floor and that a rotation of capital from BTC to ETH is imminent.

CME Launches ADA, LINK, and XLM Futures: The "Coming of Age" for Altcoins

The official launch of these futures by the Chicago Mercantile Exchange (CME) provides a bridge for institutional capital to enter the altcoin market. While such launches can sometimes lead to "sell-the-news" volatility in the short term, the long-term value lies in providing regulated hedging tools. This marks the transition of ADA, LINK, and XLM from purely speculative assets to institutional-grade instruments viable for global hedge fund portfolios.

CoinShares Report: A Defensive Retreat in Market Sentiment

The $187 million outflow from digital asset products reflects a "risk-off" posture amid high-level market consolidation. Coupled with cautious macroeconomic signals, this indicates that institutional investors are opting to lock in profits or wait for clearer direction. However, the outflow volume remains modest compared to previous peak cycles, suggesting the market is in a period of healthy consolidation rather than a mass exodus.

Jump Trading & Prediction Markets: Trading Liquidity for Ecosystem Equity

Jump Trading’s move to exchange market-making services for equity in Kalshi and Polymarket is a masterful "tech-for-equity" play. As prediction markets have proven their accuracy and utility throughout 2024-2025, Jump is securing a stake in the "source of truth." By providing the underlying liquidity, Jump isn't just a trader; they are becoming the indispensable infrastructure provider for the world’s fastest-growing sentiment-analysis sector.

Backpack Tokenomics: Aligning Incentives with Long-term IPO Goals

Backpack’s decision to lock team and insider tokens until a year after a potential IPO is an extreme departure from the typical "pump and dump" cycles seen in crypto. This structure aligns the team’s incentives with the long-term capital market success of the company rather than short-term token price action. With 25% unlocked at TGE for the community, it balances immediate liquidity needs with a hardcore commitment to institutional-grade governance.