U.S. Employment Weakness Pushes Bitcoin to a New Cycle Low

Summary

-

Macro Environment: U.S.–Iran negotiations, originally scheduled for the 6th and previously at risk of collapse after U.S. threats to withdraw, have temporarily resumed. U.S. economic data showed divergence: the services PMI remained strong while ADP employment figures weakened sharply. Ongoing AI-related concerns continued to pressure U.S. equities, with mega-cap tech underperforming again; among the three major indices, only the Dow posted gains. Driven by geopolitical risk and employment concerns, gold briefly returned above $5,000 but failed to hold the level.

-

Crypto Market: Amid complex external pressures, Bitcoin fell to a new cycle low, briefly touching $71.8K. Total crypto market capitalization dropped below $2.5 trillion. Altcoins declined with increased volume but posted relatively smaller losses, leading to a slight rebound in market dominance. Sentiment remains deeply entrenched in the Extreme Fear zone with no meaningful improvement.

-

Project Updates

-

Trending Tokens: XAUT, OPN, WHITEWHALE

-

XAUT/PAXG: Gold briefly reclaimed the $5,000 level

-

HYPE: Ripple Prime integrated Hyperliquid, expanding institutional DeFi access

-

OPN: Prediction market platform Opinion completed a $20M Series A led by investors including Jump Crypto

-

WHITEWHALE: Market cap rebounded to $100M; token’s prototype figure “The White Whale” has been actively accumulating

-

WMTX: World Mobile released its 2026 global expansion roadmap, accelerating decentralized telecom adoption

-

DOOD: Coinbase listed Doodles (DOOD)

-

CLAWSTR: AI-agent decentralized social network Clawstr’s token surged 33x within 24 hours, with market cap reaching $13.7M

-

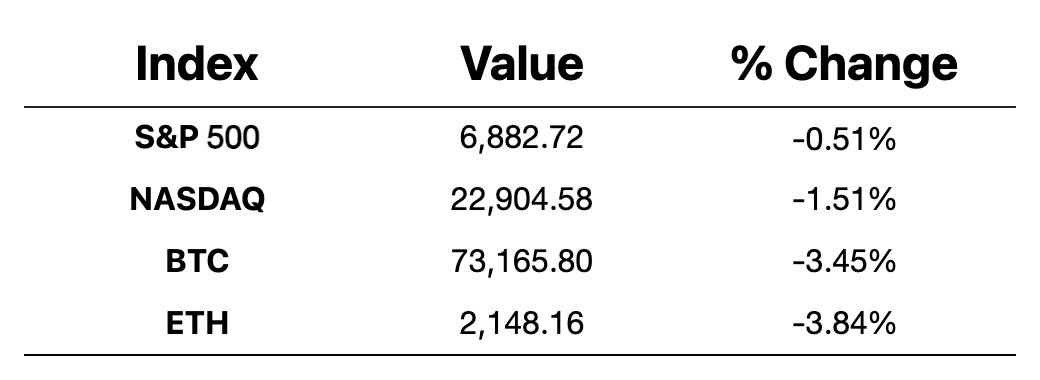

Major Asset Performance

Crypto Fear & Greed Index: 12 (vs. 14 24h earlier) — Extreme Fear

Today’s Outlook

-

U.S. initial jobless claims (week ending Jan 31)

-

Speech by Atlanta Fed President Bostic (2027 FOMC voter)

-

XDC Network (XDC) token unlock: ~841M tokens (~$29.3M)

Macro Economy

-

U.S. Bureau of Labor Statistics delayed the January Nonfarm Payrolls report to Feb 11

-

U.S.–Iran talks scheduled for the 6th have resumed after nearing collapse

-

U.S. January ISM Services PMI: 53.8, matching the highest level since Oct 2024 and beating expectations

-

U.S. January ADP employment: +22K, below the 48K consensus; labor market continues to cool

-

U.S. Treasury quarterly refunding plan released in line with expectations

Policy & Regulation

-

CME affiliate Bitnomial to launch the first regulated Tezos (XTZ) futures in the U.S.

-

Hong Kong accelerates stablecoin regulation; HKMA aims to issue the first licenses in March

-

Nevada filed a civil lawsuit against Coinbase for allegedly offering sports event contracts without a license

-

CFTC to reassess regulatory and enforcement approaches toward prediction markets/event contracts, rolling back some Biden-era initiatives

Industry Highlights

-

Ripple Prime integrates Hyperliquid for on-chain derivatives trading

-

European stablecoin progress: BBVA joins EU bank stablecoin initiative Qivalis

-

ProShares launches the first U.S. ETF offering one-click exposure to the top 20 crypto assets

-

Prediction market Opinion completes $20M Series A (Jump Crypto among investors)

-

UBS reportedly considering crypto services for retail clients

-

U.S.-listed firm Tian Ruixiang plans equity-linked transactions to acquire 15,000 BTC

-

Vitalik Buterin states the original L2 vision is “outdated,” calling for new development paths

-

UK’s largest Bitcoin treasury company SWC lists on the London Stock Exchange main board

Deep Dive: Industry Highlights (Feb 05, 2026)

Ripple Prime Integrates Hyperliquid to Deepen On-Chain Derivatives Presence

Ripple’s institutional brokerage arm, Ripple Prime, has officially integrated the decentralized exchange Hyperliquid into its service suite, marking the platform's first direct support for a DeFi protocol. Through this integration, institutional clients can now access on-chain derivatives and perpetual contracts on Hyperliquid within a unified risk and margin framework. This move signifies a further convergence of traditional institutional finance and DeFi liquidity, aiming to provide professional investors with more transparent and efficient on-chain asset management tools.

BBVA Joins Qivalis Initiative as European Bank-Led Stablecoins Gain Momentum

Spanish banking giant BBVA has formally joined Qivalis, a consortium of 12 major European financial institutions collaborating to develop a Euro-backed stablecoin compliant with the EU’s MiCA (Markets in Crypto-Assets) regulations. Based in Amsterdam, the project aims to leverage blockchain technology to optimize cross-border payments, supply chain finance, and real-time settlement of tokenized assets. As a regulated Electronic Money Institution (EMI), Qivalis plans to launch in the second half of 2026, challenging the current market dominance of non-bank stablecoin issuers.

ProShares Launches First "One-Click" Top 20 Crypto Asset ETF in the U.S.

Asset management firm ProShares has launched KRYP (ProShares CoinDesk 20 Crypto ETF) in the U.S., the first exchange-traded fund to track the CoinDesk 20 Index. By utilizing swap contracts rather than direct spot holdings, the ETF offers investors a simplified way to gain exposure to the 20 largest and most liquid crypto assets (such as BTC, ETH, and SOL). This product lowers the technical barrier for retail and institutional investors alike, providing a more diversified beta source for traditional investment portfolios.

Prediction Market "Opinion" Closes $20M Series A Led by Jump Crypto

Opinion, a decentralized prediction market built on the BNB Chain, has successfully raised $20 million in a Series A round led by Hack VC and Jump Crypto. Utilizing an all-on-chain settlement mechanism, Opinion currently accounts for approximately one-third of the global decentralized prediction market volume. The new funds will be used for global expansion, particularly to enhance its forecasting tools for macroeconomic trends, sports, and geopolitical events ahead of the 2026 World Cup and several major national elections.

UBS Reportedly Considering Crypto Trading Services for Retail Clients

UBS CEO Sergio Ermotti has indicated that the bank is evaluating the possibility of opening cryptocurrency investment access to its retail client base. While maintaining a "fast follower" strategy, UBS has already built the necessary internal infrastructure and explored solutions for tokenized deposits and digital asset custody. This shift reflects a growing trend among top-tier private banks to meet the rising demand for digital asset allocation while navigating capital requirements under the Basel III framework.

Tian Ruixiang (TIRX) Plans to Acquire 15,000 BTC via Equity-Linked Transactions

Nasdaq-listed firm Tian Ruixiang has announced a strategic plan valued at approximately $1.5 billion, intending to issue shares to specific global digital asset investors in exchange for 15,000 Bitcoins. The company plans to hold these Bitcoins as a core treasury reserve and use them as a foundation to develop AI-driven crypto trading systems and risk management infrastructure. This pivot mirrors the "Bitcoin Treasury" model popularized by MicroStrategy, seeking to enhance balance sheet resilience through digital assets.

Vitalik Buterin: L2 Vision Must Shift from "Scaling" to "Functional Differentiation"

Ethereum co-founder Vitalik Buterin recently noted that as the Ethereum mainnet (L1) improves its own scaling through technology and increased gas limits, the original vision of L2s serving merely as "official sharding extensions" has become outdated. He urged L2 projects to look beyond simple throughput and find new value propositions, such as privacy features, ultra-low latency for specific applications, or built-in oracles. He emphasized that L2s should form a diverse spectrum rather than just being shadows of the mainnet.

SWC Lists on LSE Main Board, Becoming UK’s Largest Bitcoin Treasury Company

Formerly known as The Smarter Web Company, SWC has officially transitioned its listing from the Aquis Market to the Main Board of the London Stock Exchange (LSE). As the UK’s largest corporate holder of Bitcoin (with approximately 2,674 BTC), SWC aims to attract more institutional capital through mainstream financial channels. Despite recent market volatility, the company remains committed to its "Bitcoin-standard" treasury strategy, with the long-term goal of entering the FTSE 250 index.