Industry Update

Market Stays Cautious Ahead of FOMC Meeting; Bitcoin Trades in a Narrow Range

Summary

-

Macro Environment:

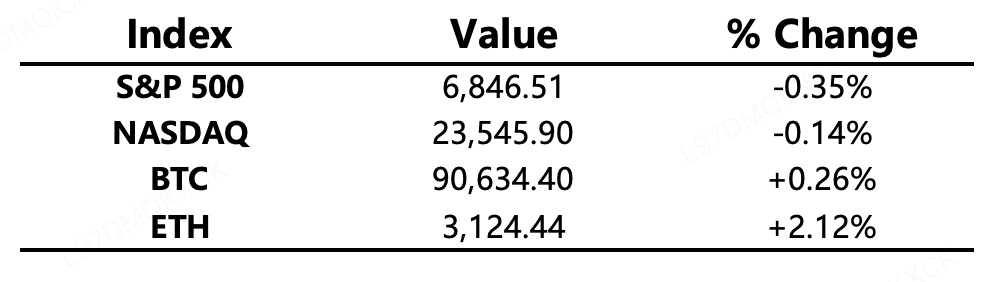

Despite dovish remarks from U.S. Treasury Secretary Bessent and Fed Chair nominee Hassett, markets remained cautious ahead of this week’s highly anticipated FOMC rate decision. The S&P 500 and Nasdaq ended their four-day winning streaks.

-

Crypto Market:

Market sentiment remains deeply fearful, with Bitcoin fluctuating mildly within the $90,000–$92,000 range. The altcoin market cap share climbed above 40%, but trading activity stayed subdued—showing a pattern of “low-volume gains.”

Project & Token Developments

-

Trending Tokens: ETH, ONDO, TAO, ZEC

-

ETH: BlackRock filed for an iShares Staked Ethereum Trust ETF.

-

ONDO: The U.S. SEC closed its two-year investigation into Ondo with no charges; ONDO jumped 10% briefly.

-

PLUME: Coinbase listed PLUME; PLUME rose 7%.

-

TAO: Bittensor’s first halving is scheduled for December 14.

-

Terraform Labs: Sentencing for founder Do Kwon is set for December 11; related tokens LUNA, LUNC, and USTC rallied.

-

Privacy Sector: Ahead of the SEC’s December 15 roundtable on crypto privacy, ZEC, DASH, DCR, and DUSK posted broad gains.

Major Asset Movements

Crypto Fear & Greed Index: 22 (vs. 20 yesterday) — Extreme Fear

Today’s Key Events

-

Speech by Bank of Japan Governor Kazuo Ueda at the FT Global Boardroom.

-

U.S. October JOLTs job openings data.

-

Bitcoin financial firm Twenty One Capital to list on NYSE.

-

BounceBit (BB) unlocking ~29.93M tokens (~$2.7M).

Macro Updates

-

Fed Chair frontrunner Hassett: Rates should continue to be lowered moderately with data-dependent caution.

-

U.S. Bureau of Labor Statistics will not publish October PPI; both October and November PPI will be released Jan 14, 2026.

-

New York Fed one-year inflation expectation for November: 3.2% (previous: 3.24%).

-

Treasury Secretary Scott Bessent expects the U.S. to finish the year with ~3% real GDP growth.

Policy & Regulatory Developments

-

CFTC launched a pilot program allowing BTC, ETH, and USDC to be used as collateral in derivatives markets.

-

USDT officially recognized by Abu Dhabi regulators as a “fiat-referenced token,” enabling licensed custodial and trading services.

-

SEC ends the two-year investigation into Ondo with no recommended charges.

-

SEC to host a crypto privacy roundtable on December 15.

Industry Highlights

-

BlackRock submits filing for an iShares Staked Ethereum Trust ETF.

-

Strategy CEO: Firm will hold Bitcoin at least until 2065; Strategy bought 10,624 BTC last week for $962.7M.

-

BitMine added ~138,400 ETH last week; now holds over 3.86M ETH.

-

Robinhood launched ETH and SOL staking; will introduce altcoin futures with lower fees.

-

Ethereum network average daily fees hit their lowest level since July 2017.

-

Bittensor’s first halving scheduled for December 14.

Industry Highlights Analysis

-

BlackRock submits filing for an iShares Staked Ethereum Trust ETF.

The filing by BlackRock, the world's largest asset manager, for an Ethereum Trust ETF that includes staking functionality marks a significant institutional validation of the Ethereum ecosystem, particularly its staking economy. Following the successful launch of its Bitcoin spot ETF, this move signals a deepening acceptance of cryptocurrencies within mainstream finance and positions Ethereum as a critical asset. If approved, the ETF would not only allow traditional investors to gain exposure to the price movements of ETH through a regulated product but also enable them to indirectly benefit from staking yields, increasing the product's attractiveness. This could draw substantial institutional capital into Ethereum and have a long-term positive impact on ETH's market price and staking ratio.

-

Strategy CEO: Firm will hold Bitcoin at least until 2065; Strategy bought 10,624 BTC last week for $962.7M.

The statement by Strategy's CEO demonstrates extreme confidence in Bitcoin as a long-term store of value and reserve asset, with the holding commitment (at least until 2065) positioning Bitcoin as a macroeconomic asset spanning multiple decades. The aggressive acquisition of 10,624 BTC for nearly a billion dollars last week highlights the firm's ongoing, active adoption of a "Bitcoin Standard" strategy, showing its commitment to transitioning capital away from traditional currencies (like USD) into the hard currency of Bitcoin. This sends a strong bullish signal to the entire market, reinforcing Bitcoin's credibility as a corporate treasury asset.

-

BitMine added ~138,400 ETH last week; now holds over 3.86M ETH.

The substantial accumulation of approximately 138,400 ETH by BitMine (assuming a major institutional holder or mining company) brings its total holdings to over 3.86 million ETH. Accumulation on this scale suggests that major players have exceptionally high expectations for Ethereum's long-term value, its status as programmable money, and potential future price appreciation. Large-scale institutional "HODLing" reduces the circulating supply available in the market, which could exert significant upward pressure on the price of ETH during any future surge in demand.

-

Robinhood launched ETH and SOL staking; will introduce altcoin futures with lower fees.

Robinhood, a prominent retail trading platform, launching staking services for Ethereum (ETH) and Solana (SOL) greatly simplifies the process of participating in these Proof-of-Stake blockchains. This lowers the barrier to entry for retail users, bringing staking yields to a much broader audience, which helps enhance the utility and network security of both cryptocurrencies. Furthermore, the plan to introduce altcoin futures products with lower fees indicates that Robinhood is actively expanding its derivatives offerings to meet the needs of sophisticated traders for broader crypto assets and low-cost trading, increasing the platform's competitiveness and potentially improving altcoin liquidity.

-

Ethereum network average daily fees hit their lowest level since July 2017.

The drop in the Ethereum network's average daily transaction fees (Gas Fee) to their lowest level since 2017 is a two-sided signal. On the positive side, extremely low fees suggest that Ethereum's scaling solutions (particularly Layer 2 networks) are successfully offloading transaction activity and congestion from the mainnet, dramatically improving the user experience and affordability of applications. This is highly beneficial for high-frequency activities like DeFi and NFTs. However, from another perspective, very low fees might also imply lower user activity and demand on the mainnet, or a relatively subdued market sentiment where traders are not rushing to execute transactions on the main chain.

-

Bittensor’s first halving scheduled for December 14.

Bittensor's (TAO) first halving is a key disinflationary event, meaning the block rewards earned by miners or validators for TAO will be cut in half. Halving events are typically designed to control the asset's supply inflation rate, thereby increasing its scarcity. If market demand remains stable or increases, this supply shock often triggers a bullish price reaction around the halving date. For Bittensor, a blockchain focused on decentralized machine learning, the halving is not just a technical milestone but a significant economic event that will test the long-term sustainability of its network security and token economic model.