Precious Metals and U.S. Equities Pull Back, Stalling Bitcoin’s Rebound

Summary

-

Macro Environment: On the first trading day after the Christmas break, market sentiment remained cautious with thin liquidity. All three major U.S. stock indices retreated under pressure from tech stocks. Precious metals saw a capitulation-style selloff, with gold and silver plunging sharply intraday.

Project Updates

-

Hot Tokens: ZBT, AVNT, NIGHT

-

ZBT: ZEROBASE completed a key upgrade in late December and launched phase two of ZBT Tickets on the 25th. Combined with accelerating capital inflows led by Korean exchanges such as Upbit, ZBT surged 67.1% against the trend.

-

NIGHT: Midnight plans to collaborate with Creditcoin to research infrastructure for identity verification using financial history; mainnet launch date teased as imminent.

-

DOT: Polkadot proposal WFC #1710 (Hard Pressure) passed, confirming the first annual issuance reduction in March 2026, cutting annual inflation to 3.11%.

-

TEL: Telcoin officially launched digital asset banking operations after securing final approval from the Nebraska Department of Banking and Finance.

-

Whitewhale (meme): Market cap surpassed $50M, nearly 10k holders, and highly concentrated top holder distribution.

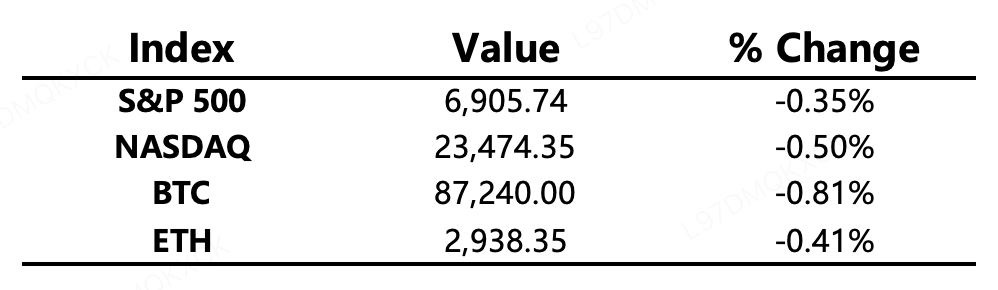

Market Snapshot

-

Crypto Fear & Greed Index: 23 (previous 24 hours: 24) — Extreme Fear

Key Events to Watch Today

-

FOMC meeting minutes release

-

Token unlocks:

-

Kamino (KMNO) ~229M tokens (~$11.8M)

-

Slash Vision Labs (SVL) ~234M tokens (~$6.8M)

-

Zora (ZORA) ~166M tokens (~$6.7M)

-

Macro Headlines

-

Trump: considering firing and prosecuting Powell; Fed chair nominee expected in January

-

Russia claims 91 Ukrainian drones targeted Putin’s residence; Zelensky denies; Trump “furious”

-

U.S. military conducts first strike on Venezuelan territory; Trump says a “major facility” was destroyed

-

Trump meets Netanyahu, issues fresh threats regarding Iran’s nuclear program

Policy & Regulation

-

South Korea’s Digital Asset Basic Act to introduce no-fault compensation and bankruptcy segregation for stablecoins; government bill may be delayed to next year

-

Japan releases 2026 tax reform outline; planning to reduce crypto tax rate to a unified 20%

Industry Highlights

-

BUIDL becomes the first tokenized U.S. treasury product to distribute over $100M to investors

-

CoinShares: $446M outflows from digital asset investment products last week

-

Strategy added 1,229 BTC at an avg. price of $88,568

-

BitMine added 44,463 ETH, holdings now exceed 4.11M ETH

-

Trust Wallet confirms $7M hack affecting 2,596 wallets; commits full compensation

-

North Korean crypto hacking incidents surge; 2025 marks record high theft and laundering

-

Russia’s Sberbank issues its first BTC-collateralized loan to a mining firm

-

South Korean financial giant Mirae Asset considering acquisition of Korbit

Industry Highlights Extended Analysis

-

BUIDL Becomes the First Tokenized U.S. Treasury Product to Distribute Over $100M

BlackRock’s BUIDL fund reaching this milestone signals that Real World Asset (RWA) tokenization has moved from proof-of-concept to large-scale commercial success. Distributing over $100 million in dividends validates the efficiency and transparency of on-chain yield mechanisms while proving the utility of blockchain for institutional liquidity management. BUIDL’s success is attracting more top-tier asset managers, driving deeper integration between traditional safe-haven assets and the DeFi ecosystem.

-

CoinShares: $446M Outflows from Digital Asset Investment Products Last Week

This significant outflow reflects a cautious, risk-averse sentiment as 2025 draws to a close. After a year of strong gains, macroeconomic uncertainty and year-end profit-taking have led institutional investors to flatten their positions. While Bitcoin and Ethereum faced selling pressure, the consistent inflows into Solana and XRP ETPs suggest that capital is not exiting the market entirely, but rather rotating into specific ecosystems with perceived high growth potential.

-

Strategy Added 1,229 BTC at an Average Price of $88,568

The continued accumulation by Strategy (MicroStrategy) highlights the persistence of the leveraged corporate Bitcoin treasury model. Adding to their position even near the $90,000 mark sends a powerful signal of confidence in Bitcoin’s long-term value as "digital gold." This strategy is fundamentally altering Bitcoin’s supply dynamics by moving more coins into the hands of "strong-handed" institutional holders, though it also intensifies market focus on the entity's financial leverage risks.

-

BitMine Added 44,463 ETH, Holdings Now Exceed 4.11M ETH

Significant accumulation by large miners and institutions like BitMine suggests a long-term bullish outlook on Ethereum’s staking economics (Proof of Stake). Holding over 4.11 million ETH (valued at roughly $12 billion) not only strengthens their influence in network governance but also demonstrates that major capital views ETH as a productive, interest-bearing asset. This "whale-level" accumulation continues to squeeze secondary market supply, setting the stage for future scarcity.

-

Trust Wallet Confirms $7M Hack; Commits to Full Compensation

Affecting 2,596 wallets through a browser extension vulnerability, this hack exposes the security fragility of wallet plugins in complex environments. Trust Wallet’s swift commitment to full compensation via its SAFU-style fund helped mitigate a total collapse of user trust, though the brand took a short-term reputational hit. The incident serves as a stark reminder for users to rotate private keys and use hardware security, while pushing wallet providers to implement more rigorous code audits.

-

North Korean Crypto Hacking Incidents Surge to Record High in 2025

Data indicates that North Korean-linked groups have stolen a record-breaking $2 billion in 2025, with laundering techniques becoming more automated across multi-chain bridges. This state-level threat is forcing global regulators to heighten Anti-Money Laundering (AML) cooperation and impose stricter sanctions on mixers and non-KYC protocols. For the industry, this persistent "geopolitical risk" likely means that DeFi protocols will face increasingly stringent compliance requirements in the near future.

-

Russia’s Sberbank Issues First BTC-Collateralized Loan to a Mining Firm

Sberbank’s issuance of its first crypto-backed loan is a landmark moment for cryptocurrency legalization within Russia. By utilizing its proprietary "Rutoken" custody solution, the bank has bridged the gap between crypto liquidity and traditional fiat financing for mining companies. If this pilot expands, it could open a significant new financing channel for Russian firms under international sanctions and signals that major traditional banks are formally integrating crypto-lending services.

-

Mirae Asset Considering Acquisition of Korbit for Up to $100M

The potential acquisition of Korbit by the South Korean financial giant Mirae Asset marks the full-scale penetration of traditional finance (TradFi) into the crypto retail gateway. In a market dominated by the "Big Two" (Upbit and Bithumb), Mirae Asset aims to use its established reputation and compliance expertise to rebrand Korbit and execute a differentiated strategy. If completed, this deal would break the existing duopoly and accelerate the institutionalization of the South Korean crypto industry.