Summary

-

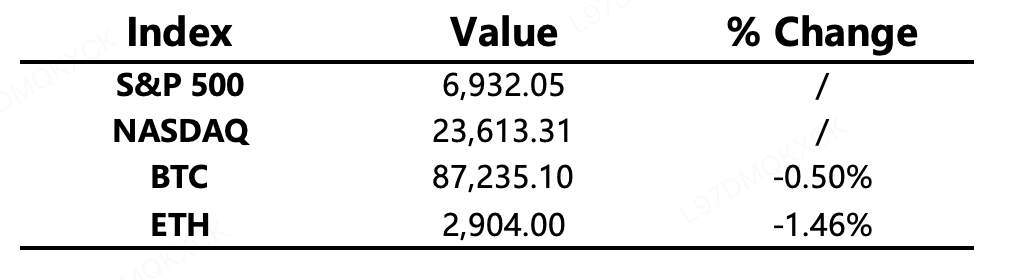

Macro environment: Due to the Christmas holiday, major financial markets in the U.S. and Europe are closed. After pulling back from recent highs, gold prices once again moved above USD 4,500, supported by ongoing geopolitical risks and the inflation narrative; silver continued to hit new highs amid spot market squeezes.

-

Crypto market: The holiday effect did not carry over to crypto assets. Bitcoin briefly climbed to 88.6k before retreating again, failing to establish a sustained rebound, while overall trading volume continued to contract. Altcoin market-cap share declined, but their share of trading volume increased. Market sentiment remains in the fear zone. Approximately USD 23 billion in Bitcoin options expire today, which could become a key catalyst for a short-term increase in volatility.

-

Project developments

-

Trending tokens: XAUT, UNI, ZBT

-

XAUT: Gold prices consolidated at high levels and moved back above USD 4,500

-

ZBT: The node upgrade was officially implemented on December 20; on December 25, ZBT Tickets entered Phase II issuance, with ZBT rising 65%

-

SYRUP: Maple released its 2025 year-end letter, stating assets under management increased to USD 5 billion, with a 2026 revenue target of USD 100 million

-

TAO: Bittensor launched MEV Shield, encrypting transactions until block confirmation to reduce frontrunning and sandwich attacks

-

ONDO: Plans to launch “tokenized U.S. stocks and ETFs” on Solana in early 2026

-

Major asset movements

Crypto Fear & Greed Index: 20 (24 hours ago: 23), classified as Extreme Fear

Today’s agenda

-

Approximately USD 23 billion in Bitcoin options expire, double the level of the same period last year

Macroeconomy

-

Bank of Korea: Will assess upcoming data to determine the timing of rate cuts

-

Bank of Japan Governor: If baseline forecasts are realized, the BOJ is likely to continue raising interest rates

-

Tokyo inflation: The slowdown exceeded expectations but is unlikely to prevent the BOJ from continuing rate hikes

Policy direction

-

Record surge in SEC filings in 2025, with the crypto sector being a major driver

-

U.S. crypto legislative window: media reports suggest that the “market structure” bill may have only the first half of next year left for advancement

Industry highlights

-

Two major Russian stock exchanges have completed preparations to list cryptocurrency trading

-

Uniswap Foundation financial statements drew community backlash over claims of “high pay, low performance”

-

Maple released its 2025 year-end letter: AUM rose to USD 5 billion, with a 2026 revenue target of USD 100 million

-

Bittensor launched MEV Shield to reduce frontrunning and sandwich attacks by encrypting transactions until block confirmation

-

Ondo Finance: Plans to launch “tokenized U.S. stocks and ETFs” on Solana in early 2026

-

Streamflow launched the yield-bearing stablecoin USD+ on Solana

Industry Highlights Extended Analysis

-

Trip.com Launches Stablecoin Payments (USDT/USDC)

Trip.com’s integration of stablecoin payments marks a significant milestone in Web3’s entry into mainstream consumption. By partnering with Triple-A, a licensed payment institution in Singapore, the platform allows users to book hotels and flights using only their name and email, greatly simplifying the cross-border payment process while enhancing privacy. For frequent travelers in crypto-friendly regions—particularly in Southeast Asia—this method reduces foreign exchange losses and offers tangible benefits, such as significant flight discounts, signaling a shift for crypto payments from a niche tool to a high-frequency utility.

-

Russian Stock Exchanges Prepare for Crypto Trading

The preparation by the Moscow Exchange (MOEX) and the Saint Petersburg Exchange (SPB) to list cryptocurrency trading signifies Russia's formal embrace of "crypto-finance" under international sanction pressure. This move aims to bring millions of grey-market traders into regulated channels. By setting a 300,000 ruble annual cap for retail investors while allowing unrestricted access for qualified professionals, Russia is attempting to balance regulatory oversight with market liquidity. This is not just an upgrade to domestic infrastructure; it is a strategic maneuver to bypass traditional payment systems like SWIFT.

-

Uniswap Foundation Backlash Over Financial Transparency

Recent financial disclosures from the Uniswap Foundation revealed that executive compensation accounts for nearly 37.5% of its total budget, while grant output significantly trails behind peers like Optimism. This has sparked a "firestorm" of accountability within the community. Coming on the heels of the UNIfication proposal’s approval, where expectations for token value empowerment are high, the Foundation's high operating costs are being questioned as a departure from the lean, efficient principles of decentralized organizations. This controversy will likely force top DeFi protocols to reconsider their spending efficiency and commitment to token holders.

-

Maple Finance 2025 Year-End Letter: $5 Billion AUM

Maple Finance demonstrated the powerful expansion of institutional-grade DeFi lending at the close of 2025. By hitting its AUM targets early and setting a revenue goal of $100 million for 2026, Maple has proven that the synergy between Real-World Assets (RWA) and on-chain credit is scalable. Its 66% growth in assets is largely driven by a thirst among institutions for compliant lending channels. This suggests that DeFi is moving beyond "circular liquidity pools" and toward providing low-friction, transparent credit services for the real economy and global institutions.

-

Bittensor Launches MEV Shield for Transaction Privacy

The launch of MEV Shield by Bittensor is a fundamental technical fortification that cuts off frontrunning and sandwich attacks at the source by encrypting transactions before block confirmation. In a decentralized AI ecosystem where transaction ordering and pricing are highly sensitive, this feature acts as a native firewall for miners and validators. Not only does it protect users from "slippage slippage" and capital erosion, but it also enhances the overall execution credibility of the Bittensor network, giving it a competitive edge in handling high-value liquidity.

-

Ondo Finance to Bring Tokenized Stocks and ETFs to Solana

Ondo Finance’s plan to launch over 100 tokenized U.S. stocks and ETFs on Solana in early 2026 is a pivotal step for the RWA sector toward high-net-worth assets. Unlike synthetic assets, this "custody-backed" model ensures that holders receive actual economic exposure—including dividends—through regulated broker-dealers. By leveraging Solana’s high throughput and sub-second settlement, investors can trade U.S. equities 24/7, breaking the constraints of traditional market hours and enabling a truly seamless global flow of capital.

-

Streamflow Launches Yield-Bearing Stablecoin USD+ on Solana

The launch of USD+ by Streamflow challenges the traditional stablecoin model where issuers retain all the interest (e.g., USDC/USDT). By passing the yield from the underlying collateral (U.S. Treasuries) directly to holders as a daily distribution of tokens, USD+ transforms the stablecoin from a mere medium of exchange into a "yield-bearing on-chain asset." This provides a liquid, non-staking solution for Web3 treasuries to manage idle funds and will likely pressure traditional stablecoin giants to rethink their profit-sharing mechanisms.