Industry Update

U.S. equities hit fresh highs on Christmas Eve; Bitcoin trades sideways on lower volume

Summary

-

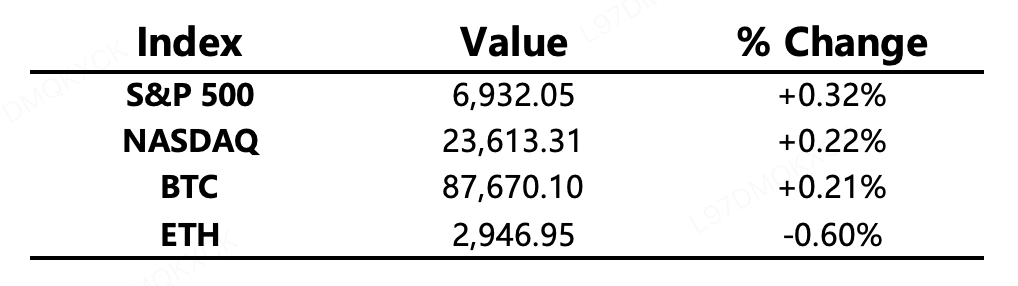

Macro environment: Initial jobless claims in the U.S. declined last week, indicating a marginal improvement in the labor market and continued resilience. On Christmas Eve, the three major U.S. equity indices extended their gains, with both the S&P 500 and the Dow Jones Industrial Average closing at record highs. Gold prices briefly broke above the USD 4,500 level before giving back gains, while oil prices rebounded modestly amid geopolitical disruptions. Multiple financial markets are closed today for the Christmas holiday.

-

Crypto market: Overall performance in the crypto asset market was subdued. Total market capitalization fell by 0.73% alongside contracting trading volume. Bitcoin remained in a narrow range, dipping intraday to 86.4k before rebounding with U.S. equities to a high of 88.1k. Altcoins were relatively more active, with slight increases in market-cap and volume share. Market sentiment showed limited change and remains in the extreme fear zone.

-

Project developments

-

Trending tokens: XAUT, PENGU, HYPE

-

XAUT: After gold broke above USD 4,500, XAUT maintained high-level consolidation

-

PENGU: Pudgy Penguins’ appearance on the Las Vegas Sphere boosted attention

-

HYPE: The Hyper Foundation stated that HYPE held in the assistance fund address has been “officially recognized as burned”

-

Binance airdrop tokens: ZBT, BANANA, LAYER, and ZKC rose

-

ARB: Offchain Labs announced additional purchases of ARB tokens, further increasing investment in the development and growth of Arbitrum

-

Major asset movements

Crypto Fear & Greed Index: 23 (24 hours ago: 24), classified as Extreme Fear

Today’s agenda

-

U.S. equity markets closed for Christmas

-

Bank of Japan Governor Kazuo Ueda to deliver a speech at the Japan Business Federation (Keidanren)

-

Humanity (H) to unlock approximately 105 million tokens, valued at about USD 14.8 million

-

Plasma (XPL) to unlock approximately 88.89 million tokens, valued at about USD 11.7 million

Macroeconomy

-

Minutes from the Bank of Japan’s October policy meeting: multiple members warned of inflation risks

-

U.S. initial jobless claims for the week ending December 20: 214,000 (vs. 224,000 expected), stronger than expected; continuing claims at 1.923 million

-

Bessent hinted at the Fed’s future direction: an “inflation corridor” framework, elimination of the “dot plot,” support for the Treasury, and a return to operating “behind the scenes”

Policy direction

-

The Philippines blocks unlicensed crypto exchanges including Coinbase and Gemini

-

Hong Kong’s Financial Services and the Treasury Bureau and the SFC released consultation conclusions on legislative proposals to regulate virtual asset trading and custody services

-

The EU increases taxation on cryptocurrencies as the DAC8 directive formally takes effect

-

The Hong Kong SFC lists RWA tokens related to “Jiangxiang Yuanjiang Liquor” as suspicious investment products

Industry highlights

-

Crypto industry M&A in 2025 reportedly reached USD 8.6 billion, up sharply from USD 2.17 billion last year

-

Hyper Foundation: HYPE in the assistance fund address has been “officially recognized as burned”

-

Grayscale submitted an updated S-1 filing to the SEC for an Avalanche (AVAX) ETF

-

Offchain Labs announced additional ARB purchases, further increasing investment in Arbitrum’s development and growth

-

Swedish listed company Bitcoin Treasury Capital plans to raise USD 783,000 to purchase more Bitcoin

-

Metaplanet’s board approved a plan to increase Bitcoin holdings

-

China Zhiyuan Investment Holdings plans to acquire digital assets such as BNB and include them in its strategic reserves

-

Financial Times: Crypto industry M&A deal value reached USD 8.6 billion in 2025, a record high