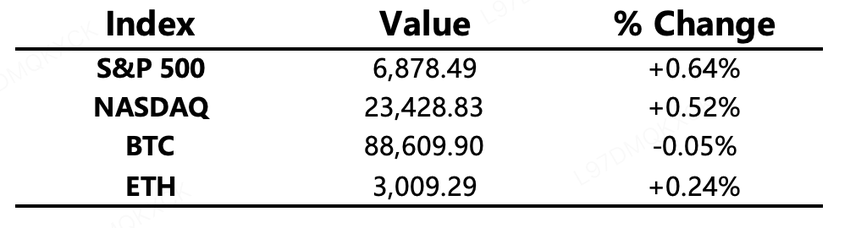

Santa Rally Lifts U.S. Equities as Bitcoin Fails to Break Higher

Summary

-

Macro Environment: The Santa rally has begun, with U.S. equities closing higher in low-volume, narrow-range trading led by technology stocks. The S&P 500 is on track to post its longest streak of monthly gains since 2018. Rising U.S.–EU trade frictions pushed commodity prices higher, with gold and silver hitting new all-time highs and oil prices rising 2%.

-

Crypto Market: Bitcoin continued its “Asia up, U.S. down” intraday pattern, briefly rallying to 90k ahead of the U.S. equity open before quickly retracing 3% to find support near 88k, again failing to achieve a decisive breakout above the 90k resistance level. Altcoin market activity increased, with market cap dominance declining while trading volume share remained elevated at 66.2%. Overall market sentiment was largely unchanged, remaining in the Extreme Fear zone.

-

Project Developments:

-

Trending Tokens: XAUT, POLYX, UNI

-

XAUT: Gold prices extended their rally to fresh record highs, peaking at USD 4,486.

-

POLYX: Polymesh DevNet launched the Confidential Assets feature, enhancing privacy functionality and enabling privacy-preserving tokenized assets on-chain.

-

ZRO: LayerZero is conducting its third fee-switch governance vote; if approved, protocol fees will be used to buy back and burn ZRO.

-

AAVE: Aave’s founder purchased 32,660 AAVE at an average price of USD 157.78.

-

UNI: Support for Uniswap’s proposal to burn 100 million UNI has exceeded 69 million votes, well above the 40 million threshold.

-

Major Asset Movements

-

Crypto Fear & Greed Index: 24 (vs. 25 24 hours earlier), classified as Extreme Fear

Today’s Outlook

-

U.S. Q3 GDP release

-

U.S. Q3 annualized QoQ real Personal Consumption Expenditures (PCE)

-

U.S. Q3 annualized QoQ Core PCE price index

-

SOON: ~21.88 million tokens unlocked (~USD 8.0 million)

-

Undeads Games (UDS): ~2.15 million tokens unlocked (~USD 5.2 million)

Macroeconomy

-

Acting CFTC Chair Caroline Pham officially stepped down; Michael Selig was sworn in as the 16th Chair of the CFTC.

-

Trump may appoint a new Federal Reserve Chair in the first week of January next year.

Policy Direction

-

Ghana passed legislation legalizing the use of cryptocurrencies.

-

U.S. federal banking regulators confirmed that banks are permitted to engage in crypto-related activities.

-

Hong Kong’s Insurance Authority proposed new rules aimed at guiding insurance capital into crypto assets and related infrastructure.

Industry Highlights

-

Kalshi partnered with BNB Chain, enabling users to deposit BNB and stablecoins via BSC to participate in prediction markets.

-

Strategy: Did not add Bitcoin last week; increased cash reserves by USD 748 million.

-

BitMine: Added approximately 98,800 ETH last week, bringing total holdings above 4 million ETH.

-

As part of redeeming outstanding senior secured convertible notes, ETHZilla sold 24,291 ETH for approximately USD 74.5 million.

-

JPMorgan is considering offering crypto trading services to institutional clients.

-

Trump Media purchased an additional 300 BTC, increasing total holdings to 11,542 BTC.

-

DWF Labs completed its first physical gold transaction and plans to expand into the RWA market.

-

JPY stablecoin issuer JPYC partnered with South Korean IT conglomerate ITCEN GLOBAL to conduct stablecoin research.

In-Depth Industry Analysis

-

Kalshi Partners with BNB Chain: The Multi-Chain Expansion of Prediction Markets

Kalshi’s partnership with BNB Chain marks an accelerated integration of regulated prediction markets into the Web3 ecosystem. By supporting direct deposits of BNB and stablecoins via BSC, Kalshi not only lowers the barrier for crypto-native users—eliminating complex cross-chain or fiat on-ramping—but also significantly boosts the platform's liquidity potential. For BNB Chain, this solidifies its position as a hub for high-frequency on-chain applications and signals that "Prediction Markets" will be a major growth driver in the RWA (Real-World Asset) sector throughout 2026.

-

Strategy’s "Cash Reservoir" Tactic: Prioritizing Liquidity Amid Volatility

Against the backdrop of Bitcoin prices hovering near all-time highs, Strategy (formerly MicroStrategy) opted to pause its aggressive BTC accumulation last week, choosing instead to bolster its cash reserves by $748 million via an ATM (At-the-Market) offering. This move reflects institutional prudence during periods of market exuberance. With holdings exceeding 670,000 BTC, building a massive cash cushion allows the firm to comfortably manage interest payments on convertible notes while maintaining "dry powder" for potential market corrections—a sign of maturing corporate crypto-treasury management.

-

BitMine’s ETH Ambition: The Flagship "MicroStrategy of Ethereum"

BitMine’s acquisition of approximately 98,800 ETH last week—bringing its total holdings past 4 million ETH (roughly 3.37% of the total supply)—formally establishes it as the world’s premier institutional Ethereum treasury. BitMine is effectively replicating the MicroStrategy playbook, providing investors with pure ETH exposure via equity leverage. As its "Made in America Validator Network (MAVAN)" staking initiative goes live in early 2026, BitMine will evolve from a passive holder into a primary engine for harvesting Ethereum’s base-layer yields.

-

ETHZilla’s Debt Redemption: Essential Capital Structure Reorganization

ETHZilla’s sale of 24,291 ETH to redeem outstanding senior secured convertible notes is essentially a "deleveraging" exercise aimed at restoring corporate fiscal health. While the $74.5 million in selling pressure may temporarily dampen market sentiment, the move clears debts with premiums as high as 117%. Post-redemption, ETHZilla’s balance sheet will be significantly more transparent and robust, providing a cleaner slate for its strategic pivot toward core businesses like RWA tokenization.

-

JPMorgan’s Entry: Breaking the Final Frontier of Wall Street Banking

JPMorgan’s consideration of offering crypto spot and derivatives trading to institutional clients suggests that the final barriers between traditional banking and digital assets are collapsing. Driven by pro-crypto shifts in the Trump administration and legislative progress like the Stablecoin Act, JPMorgan is leveraging its tokenization infrastructure (such as commercial paper issued on Solana) to enter the trading space. This move is poised to unlock trillions in potential institutional capital and fundamentally redefine the interplay between TradFi and decentralized finance.

-

Trump Media’s Strategic Accumulation: Crypto as a Political and Commercial Bridge

Trump Media (TMTG) increasing its holdings to 11,542 BTC (valued near $1 billion) serves as more than just a wealth preservation strategy; it positions the company as a bellwether for "crypto-friendly" enterprises. Given that Truth Social has already begun integrating prediction market services powered by Crypto.com, TMTG is evolving from a pure social media platform into a Web3 conglomerate that blends political influence, digital asset reserves, and decentralized financial utilities.

-

DWF Labs’ Physical Gold Transaction: Breakthrough in the RWA Market

DWF Labs’ completion of its first transaction involving 25kg of physical gold—with plans to expand into silver, platinum, and cotton—marks a strategic pivot for top-tier market makers into physical RWA sectors. By using blockchain to solve issues of liquidity, fractional ownership, and transparency for high-value commodities, DWF is positioning itself to capture the next multi-trillion-dollar market. This move proves that RWAs have moved beyond simple "T-bill tokenization" into the complex world of global physical supply chains.

-

JPYC and ITCEN’s Partnership: Unifying the East Asian Stablecoin Landscape

The collaboration between Japan’s JPYC and South Korea’s ITCEN GLOBAL represents a major strategic layout for two of East Asia’s most active crypto markets in terms of stablecoin compliance and cross-border payments. Combining Japan’s leading stablecoin legislation with ITCEN’s expertise in gold-backed RWAs (K-Gold), the partnership aims to build a cross-border settlement system based on the JPY stablecoin. Once matured, this regional alliance will drastically reduce financial costs for Japan-Korea trade and provide a vital sandbox for the internationalization of the Yen in the on-chain world.