Industry Edition

BoJ Tightens Cautiously, Bitcoin Extends Four-Day Rally

Summary

-

Macro Environment: The Bank of Japan raised rates as expected but emphasized a “cautious approach,” leading markets to price in the next rate hike no earlier than September next year. This eased concerns over an aggressive BoJ tightening cycle. The selection process for the next Fed Chair continues, with Trump reiterating that the next chair must be “super dovish” and saying an announcement will come soon. UAE capital participation in OpenAI’s $100 billion fundraising plan improved the debt outlook for Oracle and other ecosystem partners, significantly lifting risk appetite in U.S. equities. Markets are entering “Christmas mode” this week, with multiple stock exchanges closed.

-

Crypto Market: Supported by improved risk sentiment, Bitcoin recorded four consecutive days of gains last week, though it was repeatedly capped by resistance around 90k. Over the weekend, altcoins saw increases in both market cap and trading volume share, signaling a relative pickup in activity. Overall crypto market sentiment has stopped deteriorating but remains stuck in the Extreme Fear zone.

-

Project Developments

-

Hot tokens: UNI, ZKP, XAUT

-

UNI: Support for Uniswap’s “Fee Switch Activation Proposal” has reached 95.79%, with voting ending on December 25

-

ZKP: Coinbase listed zkPass (ZKP) for spot trading; ZKP surged 85%, lifting the broader ZK sector including NIGHT and H

-

XAUT: Gold continues to test prior highs, now just one step away from USD 4,381

-

Binance Alpha: BEAT, RAVE, and POWER posted gains

-

Lighter: Transfer of 250 million tokens from the contract address has fueled market speculation of a near-term TGE

-

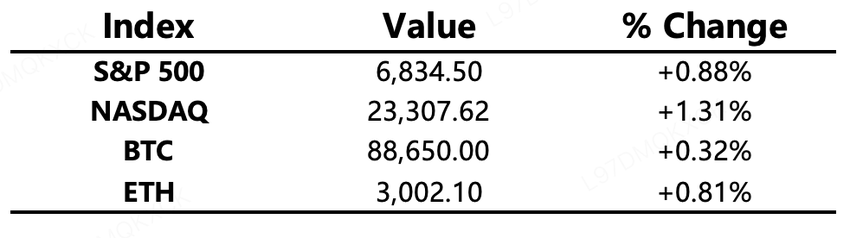

Major Asset Performance

Crypto Fear & Greed Index: 25 (vs. 20 24 hours earlier), Extreme Fear

Today’s Outlook

-

MBG by Multibank Group (MBG) to unlock approximately 15.84 million tokens, worth about USD 8.1 million

Macroeconomics

-

Fed’s Williams: Monetary policy is in a favorable position, with no urgency to take further action

-

Fed’s Hammack: A pause in rate cuts is my current baseline; more concerned about persistently high inflation and inclined to keep rates steady until spring

-

Hassett: Aligns with Goolsbee, noting ample room for rate cuts; Hassett’s odds of becoming the next Fed Chair have surged again

-

Bank of Japan raised rates by 25 bps as expected

Policy Signals

-

ECB indicated a digital euro could be launched within the next three years

-

Pro-crypto U.S. Senator Cynthia Lummis announced she will not seek re-election and plans to push for the formal signing of the crypto market structure bill into law during her remaining term

-

Hong Kong Secretary for Financial Services and the Treasury Christopher Hui: Some stablecoin licenses are expected to be issued in early next year

-

U.S. Senate approved Mike Selig as Chair of the CFTC

-

Hong Kong Treasury Bureau: Studying the legal and regulatory framework for issuing and trading tokenized bonds

Industry Highlights

-

Michael Saylor released another Bitcoin Tracker update

-

Support for Uniswap’s Fee Switch Activation Proposal stands at 95.79%

-

Crypto activity in Brazil surged in 2025, with total transaction volume up 43% YoY and average user investment exceeding USD 1,000

-

Vitalik Buterin: Prediction markets are a remedy for extreme views on emotionally charged topics

-

U.S. spot Bitcoin ETFs saw a net outflow of USD 497.1 million last week

-

Bitcoin miner revenue has fallen 11% since mid-October, raising capitulation risks

-

Nasdaq-listed Mangoceuticals plans to launch a USD 100 million SOL digital asset treasury

Industry Highlights Extended Analysis

Michael Saylor released another Bitcoin Tracker update

Michael Saylor’s latest Bitcoin Tracker update once again reinforces MicroStrategy’s unwavering long-term accumulation strategy, signaling continued institutional conviction despite short-term market volatility. Historically, these updates tend to act as sentiment anchors for Bitcoin bulls, as they demonstrate balance-sheet-level confidence rather than speculative positioning. While such disclosures don’t always trigger immediate price reactions, they strengthen the narrative of Bitcoin as a corporate treasury reserve asset and help normalize BTC exposure among publicly listed companies.

Support for Uniswap’s Fee Switch Activation Proposal stands at 95.79%

The overwhelming 95.79% support for Uniswap’s Fee Switch proposal marks a pivotal moment for DeFi governance, potentially transforming UNI from a governance-only token into one with direct cash-flow implications. If activated, a portion of protocol fees would be redirected to UNI holders, strengthening the investment thesis around value accrual rather than pure utility. This development could set a precedent across DeFi, accelerating a broader shift toward revenue-sharing models that appeal more strongly to institutional and long-term investors.

Crypto activity in Brazil surged in 2025, with total transaction volume up 43% YoY and average user investment exceeding USD 1,000

Brazil’s sharp rise in crypto activity underscores Latin America’s accelerating adoption curve, driven by inflation hedging, digital payment demand, and increasing regulatory clarity. A 43% year-over-year growth in transaction volume, coupled with higher average investment sizes, suggests that users are moving beyond small speculative trades toward more deliberate portfolio allocation. This trend positions Brazil as a key emerging market for exchanges, stablecoins, and tokenized asset platforms looking to capture real-world usage rather than purely speculative flows.

Vitalik Buterin: Prediction markets are a remedy for extreme views on emotionally charged topics

Vitalik Buterin’s commentary highlights a deeper philosophical role for crypto beyond finance, positioning prediction markets as tools for collective truth discovery. By financially incentivizing accuracy over ideology, prediction markets can counter polarization in emotionally charged debates, ranging from politics to public health. This perspective reinforces Ethereum’s broader vision as a neutral coordination layer, where economic incentives help surface probabilistic truth rather than amplify the loudest narratives.

U.S. spot Bitcoin ETFs saw a net outflow of USD 497.1 million last week

The significant net outflow from U.S. spot Bitcoin ETFs reflects short-term risk-off behavior rather than a fundamental reversal in institutional demand. Such outflows often coincide with macro uncertainty, profit-taking after rallies, or reallocations toward yield-bearing assets. Importantly, ETF flows tend to be cyclical, and sustained outflows would matter more than a single week’s data—making this a cautionary signal, but not yet a structural bearish indicator.

Bitcoin miner revenue has fallen 11% since mid-October, raising capitulation risks

The 11% decline in miner revenue since mid-October places additional stress on less efficient mining operations, particularly in a post-halving environment. Historically, periods of miner capitulation can act as late-stage corrective phases, flushing out weaker players before restoring network health. While short-term selling pressure may increase as miners cover operating costs, such conditions have often preceded longer-term price stabilization or recovery once hash rate adjustments normalize.

The 11% decline in miner revenue since mid-October places additional stress on less efficient mining operations, particularly in a post-halving environment. Historically, periods of miner capitulation can act as late-stage corrective phases, flushing out weaker players before restoring network health. While short-term selling pressure may increase as miners cover operating costs, such conditions have often preceded longer-term price stabilization or recovery once hash rate adjustments normalize.

Nasdaq-listed Mangoceuticals plans to launch a USD 100 million SOL digital asset treasury

Mangoceuticals’ plan to establish a USD 100 million Solana-based digital asset treasury signals a growing diversification trend among public companies exploring alternatives beyond Bitcoin and Ethereum. This move not only validates Solana’s positioning as a high-performance Layer 1 but also reflects rising corporate interest in ecosystems with active DeFi, NFT, and real-world application layers. If executed successfully, it could encourage other mid-cap public firms to consider ecosystem-specific treasury strategies rather than single-asset crypto exposure.