Cooling U.S. Inflation Lifts Risk Assets, Bitcoin Pulls Back After a Failed Rally Amid Elevated Volatility

Summary

-

Macro Environment: U.S. CPI unexpectedly cooled, strengthening expectations for rate cuts next year. Initial jobless claims declined last week, reversing the prior spike, signaling easing risks in both inflation and employment. Ahead of Friday’s “quadruple witching,” the S&P 500 snapped a four-day losing streak, with all three major U.S. equity indices closing higher. The Bank of England cut rates by 25 bps, while the ECB held rates unchanged; European equities closed at record highs.

-

Crypto Market: Bitcoin failed another breakout attempt, selling off sharply by 5.5% after testing the 90k level, marking two consecutive days of extreme volatility. Total crypto market cap edged up 0.62%, with trading volumes rising amid dense macro narratives. Altcoins declined in tandem, though volumes showed a mild rebound. Market sentiment saw no material improvement and remains in the Extreme Fear zone.

-

Project Updates:

-

Hot tokens: ZEC, UNI, LDO

-

ZEC: The Zcash Foundation released Zebra 3.1.0, improving speed and flexibility for running Zcash nodes; ZEC rose.

-

LDO: Robinhood has listed LDO for spot trading.

-

XAUT: Gold continues to challenge all-time highs.

-

SUI: Bitwise filed an S-1 registration statement with the U.S. SEC for a spot SUI ETF.

-

67: Meme token $67 surpassed a $20m market cap, surging 82% in a single day.

-

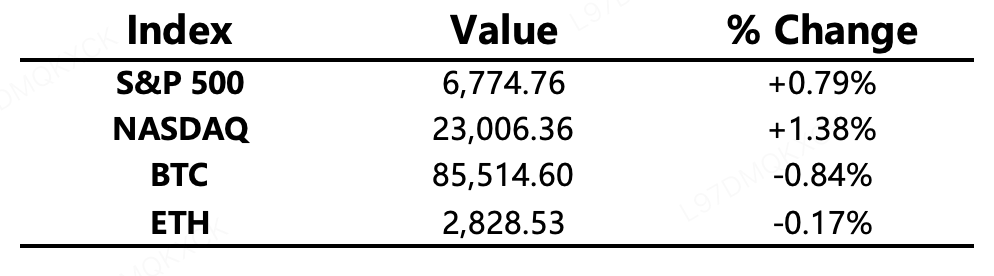

Major Asset Moves

Crypto Fear & Greed Index: 16 (vs. 17 24 hours ago) — Extreme Fear

Today’s Agenda

-

Bank of Japan monetary policy meeting

-

U.S. releases December University of Michigan Consumer Sentiment Index

-

LayerZero (ZRO) unlock: ~25.71m tokens (~$38.6m)

-

Lista DAO (LISTA) unlock: ~33.44m tokens (~$5.5m)

Macroeconomy

-

U.S. November CPI rose 2.7% YoY, below expectations; core CPI increased 2.6%, unexpectedly slowing to the lowest level since 2021.

-

Trump: The next Fed chair must be “super dovish,” with a pick to be announced soon.

-

U.S. initial jobless claims fell to 224k last week, reversing the prior surge.

-

Hassett: The Fed still has substantial room to cut rates.

-

Bank of England delivered a hawkish 25 bps cut, bringing rates to a nearly three-year low.

-

ECB held rates for the fourth consecutive meeting; officials suggested the easing cycle may be nearing its end.

-

U.S. rate futures price in 62 bps of Fed cuts next year.

Policy Watch

-

David Sacks: We are “closer than ever” to passing crypto market structure legislation, with hopes to complete it in January.

Industry Highlights

-

JPMorgan made its first large-scale entry into public blockchains, deploying its digital deposit token JPM Coin on Base.

-

Circle launched the Arc L1 blockchain builder fund.

-

Roughly $23bn in Bitcoin options are set to expire next Friday.

-

Norwegian travel retailer TRN now accepts Bitcoin payments at Oslo Airport.

-

Vitalik Buterin: Excessive complexity is eroding blockchain’s “trustless” foundation.

-

Monthly adjusted stablecoin transaction volumes have surpassed Visa and PayPal.

-

Ondo Finance announced the Ondo Cross-Chain Bridge for on-chain securities.

-

Synthetix returned to Ethereum mainnet after three years.

Industry Highlights Extended Analysis

-

JPMorgan Deploys JPM Coin to Base Mainnet

This represents a watershed moment for traditional banking’s migration toward public blockchains. By deploying JPM Coin on the Base network, JPMorgan has dismantled the "walled garden" of private ledgers. For institutional clients, this allows for 24/7 real-time settlement and lower operational costs while maintaining bank-grade compliance. This move signals that deposit tokens are entering the public sphere, not only challenging the dominance of traditional stablecoins but also paving the way for institutional-grade finance to live natively on-chain.

-

Circle Launches Arc L1 Blockchain Builder Fund

Circle’s launch of the Arc L1 Fund is a strategic maneuver to evolve from a simple stablecoin issuer into a provider of an "Economic Operating System." The Arc chain is designed as a financial bedrock for enterprises, offering low latency, configurable privacy, and deterministic settlement. By focusing on RWA (Real-World Assets), private credit, and machine-to-machine economies, Circle is building a vertical financial ecosystem with USDC as the core liquidity medium.

-

~$23bn in Bitcoin Options Set to Expire Next Friday

A massive $23 billion in options open interest suggests that market volatility will likely spike as the expiry date approaches. As traders hedge their positions, we often see the "Max Pain" effect, where spot prices are pulled toward specific strike prices. Given BTC's recent struggle to hold the $90k mark, this massive expiration could serve as the ultimate battleground for bulls and bears, marking a critical window for institutional rebalancing.

-

Norway’s TRN Accepts Bitcoin at Oslo Airport

The adoption of Bitcoin by TRN at a major international hub like Oslo Airport is a prime example of crypto entering high-frequency retail scenarios. By leveraging the Lightning Network, TRN has solved the pain points of slow transactions and high fees, enabling instant payments for duty-free goods. This offers international travelers a hedge against currency exchange losses and demonstrates the immense potential of crypto in the global travel and tourism sector.

-

Vitalik Buterin: Excessive Complexity Erodes the "Trustless" Foundation

Vitalik’s recent warning serves as a philosophical alarm for the industry. He argues that if a protocol becomes so complex that only a handful of experts can comprehend it, it loses its trustless essence and reverts to a system where users must blindly trust a "priestly class" of developers. This call for radical simplification suggests a shift in the Ethereum roadmap—moving away from feature bloat toward a leaner, more transparent, and auditable architecture.

-

Stablecoin Volumes Surpass Visa and PayPal

Monthly adjusted stablecoin transaction volumes exceeding $300 billion—thereby overtaking legacy payment giants—symbolizes a shift in the global balance of financial power. Stablecoins are no longer just "on-ramps" for crypto traders; they have evolved into a vital value-transfer network for the global economy. As non-crypto-native users increasingly adopt stablecoins for cross-border remittances and savings, traditional payment rails are facing an unprecedented crisis of efficiency.

-

Ondo Finance Announces the Ondo Cross-Chain Bridge

To solve the "liquidity silo" problem in the RWA sector, Ondo’s new bridge enables the seamless movement of over 100 tokenized securities across multiple chains like Ethereum and BNB Chain. This move significantly boosts the utility of on-chain Treasuries and ETFs. By breaking down the barriers between isolated ecosystems, Ondo is constructing a unified on-chain capital market, allowing traditional assets to flow as freely as native tokens.

-

Synthetix Returns to Ethereum Mainnet after Three Years

After years of scaling on Layer 2, Synthetix’s return to the Ethereum L1 with a high-performance Perpetual DEX represents a strategic shift toward security and liquidity depth. By combining off-chain order matching with on-chain settlement, the protocol seeks to offer a CEX-like experience while retaining the custody benefits of the Ethereum mainnet. For the SNX ecosystem, this move is a bet on capturing the $90B+ liquidity pool of the mainnet to redefine the "DeFi-native" trading experience.