The cryptocurrency world is like a rollercoaster: prices swing wildly, creating both immense excitement and a fair bit of anxiety. But what if you could not only ride those waves but also strategically profit from them, whether prices are going up or down? This is where BTC futures trading comes in, offering a powerful tool for aspiring traders to navigate and potentially benefit from the inherent volatility of the Bitcoin market.

Why Bitcoin Futures Can Create Opportunities

Image: Investopedia

Unlike simply buying and holding Bitcoin (spot trading), Bitcoin futures unlock several key advantages, turning market fluctuations into potential opportunities:

-

Go Long or Go Short: This is arguably the biggest game-changer. With spot trading, you generally profit only when the price of Bitcoin goes up. Futures, however, allow for two-way trading. If you believe Bitcoin's price will rise, you can "go long." If you anticipate a decline, you can "go short," selling futures contracts to profit from the downtrend. This flexibility means you can seek opportunities in both bull and bear markets.

-

Leverage Effect: Futures trading often involves leverage, meaning you can control a larger position with a smaller amount of capital. For example, with 10x leverage, a $100 investment can control $1000 worth of Bitcoin futures. While this amplifies potential profits, it's crucial to understand that it equally amplifies potential losses.

-

Hedging Spot Holdings: If you already own Bitcoin, futures contracts can be used to hedge your existing spot positions. For instance, if you're holding BTC but anticipate a short-term price dip, you can short a corresponding amount of Bitcoin futures to offset potential losses on your spot holdings.

Key Steps to Get Started with BTC Futures Trading

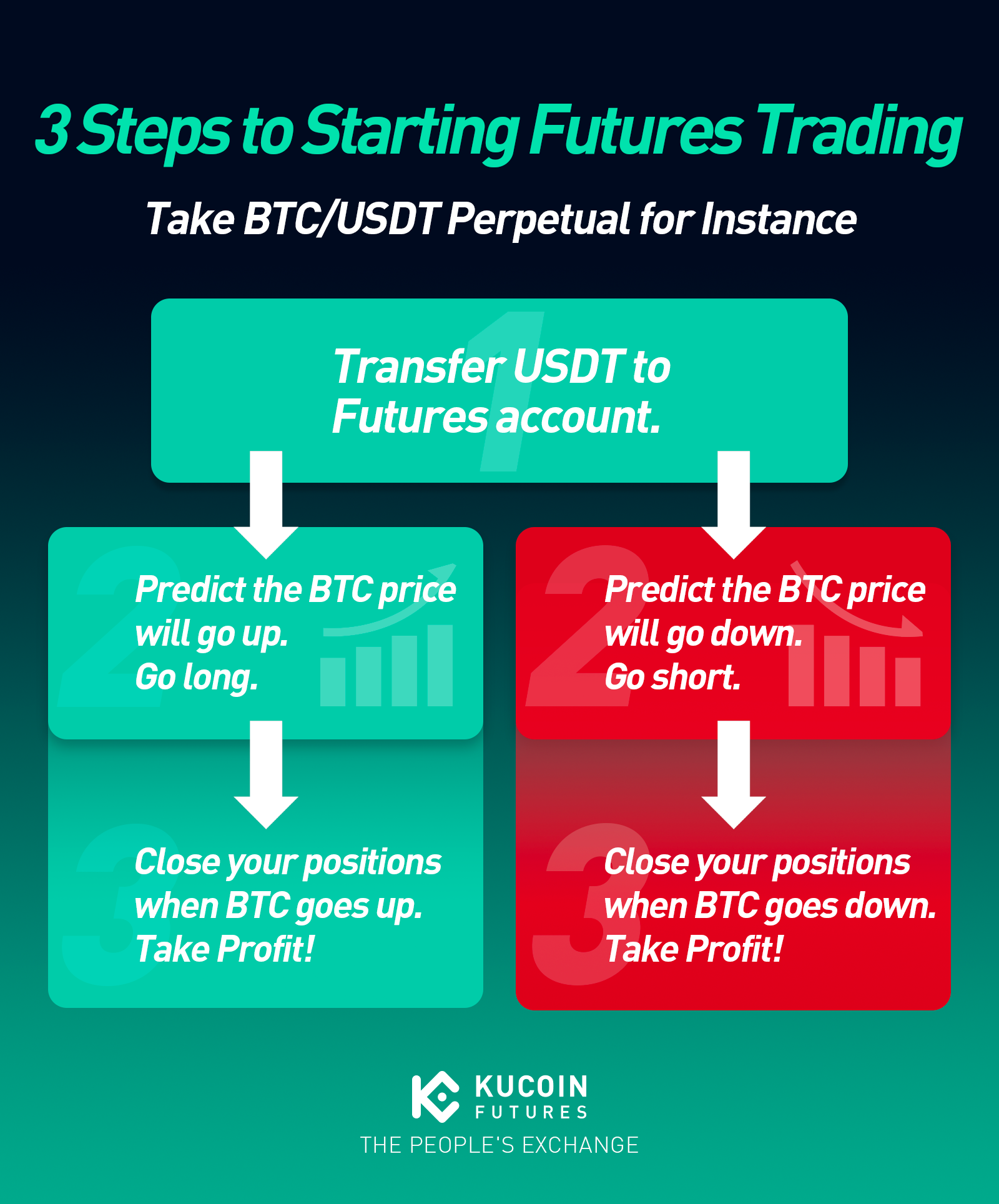

Diving into BTC perpetual futures doesn't have to be daunting. Here are the essential steps to get you started:

-

Choose a Reliable Platform:Your first and most critical step is selecting a reputable and user-friendly exchange. Look for platforms with good liquidity, competitive fees, and robust security. For instance, you can explore KuCoin Futures as a strong contender for your trading needs. KuCoin offers a straightforward interface, competitive leverage options, and a wide range of trading pairs. It also stands out with features like Copy Trading, allowing you to mimic the strategies of successful traders, and Grid Trading Bots, which can automate your trades in volatile markets, making it a powerful tool for both new and experienced traders.

-

Understand Core Terminology: Before you place your first trade, familiarize yourself with key terms:

-

Margin: The initial capital required to open and maintain a leveraged position.

-

Leverage: The multiple by which your exposure is magnified.

-

Funding Rate: (Specific to BTC perpetual futures) A small payment exchanged between long and short positions, typically every 8 hours, to keep the perpetual contract price in line with the spot price.

-

Liquidation: The forced closure of your position by the exchange when your margin falls below a certain level, usually due to adverse price movements.

-

-

Start Small & Practice:Begin with a small amount of capital that you are comfortable losing. Many platforms also offer demo or simulated trading environments. This is an invaluable tool to practice your strategies, understand the platform's mechanics, and get a feel for market movements without risking real money.

How to Make Your First BTC Perpetual Futures Trade

-

Select Your Pair and Transfer your assets: Navigate to the futures trading interface and select the BTC/USDT Perpetual contract or else. Then transfer assets to your Futures account.

-

Choose Your Direction:

-

Going Long: If you believe BTC's price will increase, you'd click "Buy/Long."

-

Going Short: If you believe BTC's price will decrease, you'd click "Sell/Short."

-

-

Set Your Order Details:

-

Amount: Decide how many contracts you want to trade (this will depend on your capital and chosen leverage).

-

Leverage: Select your desired leverage (e.g., 5x, 10x, 20x). Remember, higher leverage means higher risk.

-

Order Type:

-

Limit Order: Set a specific price at which you want your order to be executed.

-

Market Order: Your order is executed immediately at the best available market price.

-

-

Stop Loss & Take Profit: Crucially, set your stop-loss (a price at which your position will automatically close to limit losses) and take-profit (a price at which your position will automatically close to lock in gains). This is non-negotiable for risk management.

-

-

Confirm & Monitor: Review your order details and confirm. Once open, closely monitor your position and the market.

Effective Risk Management is the Cornerstone of Success

Without sound risk management, trading Bitcoin futures can quickly become a gamble. Here are fundamental principles:

-

Capital Management: Never allocate more than a small percentage of your total trading capital to a single trade. A common rule of thumb is 1-2% per trade.

-

Always Use Stop-Loss Orders: This cannot be overstressed. A stop-loss is your safety net, preventing small losses from snowballing into catastrophic ones. Define your maximum acceptable loss before you enter a trade.

-

Avoid Excessive Leverage: While tempting, high leverage (e.g., 50x, 100x) drastically increases your liquidation risk. Start with lower leverage (e.g., 3x-5x) until you gain significant experience.

-

Understand Liquidation: Know your liquidation price. If the market moves against you and your margin falls too low, your position will be automatically closed, and you could lose your entire margin.

Common Questions & Misconceptions

"Is futures trading just gambling?"

No. While it carries risk, strategic BTC futures trading with proper risk management, technical analysis, and a well-defined plan is a skilled endeavor, not mere chance. Gambling relies on luck; trading relies on analysis and disciplined execution.

"Is liquidation really that scary?"

It can be, but it's largely avoidable with good risk management. By using appropriate leverage and setting tight stop-loss orders, you can control your potential losses and prevent your position from being liquidated unexpectedly.

Conclusion

Bitcoin futures trading offers a dynamic way to engage with the cryptocurrency market, providing opportunities to profit from both upward and downward price movements and leverage your capital. As a beginner, demystifying Bitcoin futures starts with understanding the basics, choosing the right tools like KuCoin Futures, and above all, committing to diligent risk management. With continuous learning and disciplined practice, you can navigate the volatility of BTC and explore its potential for your trading journey.