KuCoin Ventures Weekly Report: The Warsh Shock Triggers a "Liquidity Black Hole": Synchronized Deleveraging in Gold, Silver & Crypto, DeFi 3.0's New Narrative, and the Behind-the-Scenes Gambit of AI Memes

2026/02/03 08:24:02

1. Weekly Market Highlights

“Supercycle” Narrative vs. Liquidity Reality: BTC Still Range-Bound as Safe Havens Delever First

In this week’s market context, CZ’s recent comments at the World Economic Forum about a potential “supercycle” — or a break from the traditional four-year halving-driven rhythm — read more like a long-horizon framework than an immediate catalyst. His point is that structural forces such as deeper institutional adoption and clearer regulation could increasingly decouple Bitcoin from the old “halving → bull → bear” loop. In practice, however, the past week’s pricing wasn’t driven by a self-contained “crypto narrative,” but by a broader repricing of monetary policy expectations and system-wide liquidity.

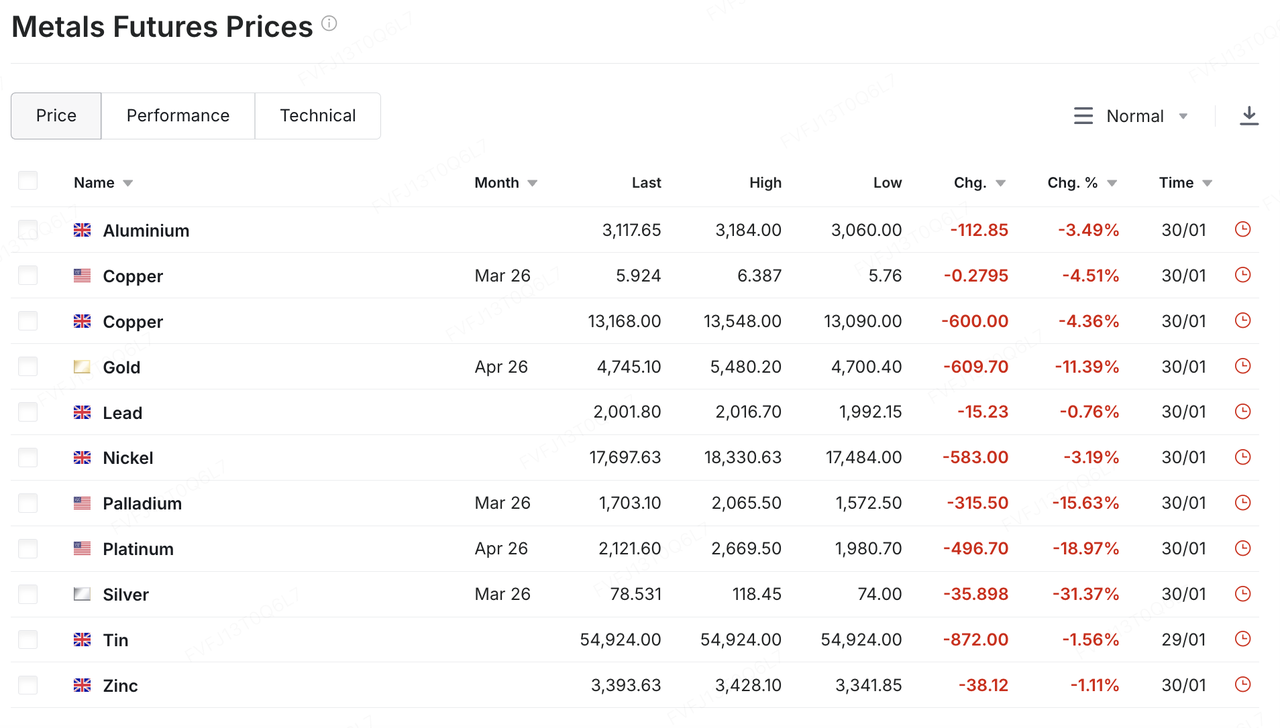

That liquidity reality showed up first in precious metals. After a powerful run fueled by heightened risk aversion and crowded positioning, gold and silver saw a sharp, cliff-like reversal last Friday: gold briefly fell below $5,000/oz with an intraday drawdown approaching double digits, while silver also sold off aggressively (around the ~30% range intraday), a textbook “post-overheating deleveraging” move. One catalyst was President Trump’s announcement of his intention to nominate Kevin Warsh as the next Fed Chair, which quickly revived market imagination around a more hawkish policy stance and faster balance-sheet tightening. The resulting shift in the dollar and rate expectations fed back into a pressure release across metals.

Data Source: https://www.investing.com/commodities/metals

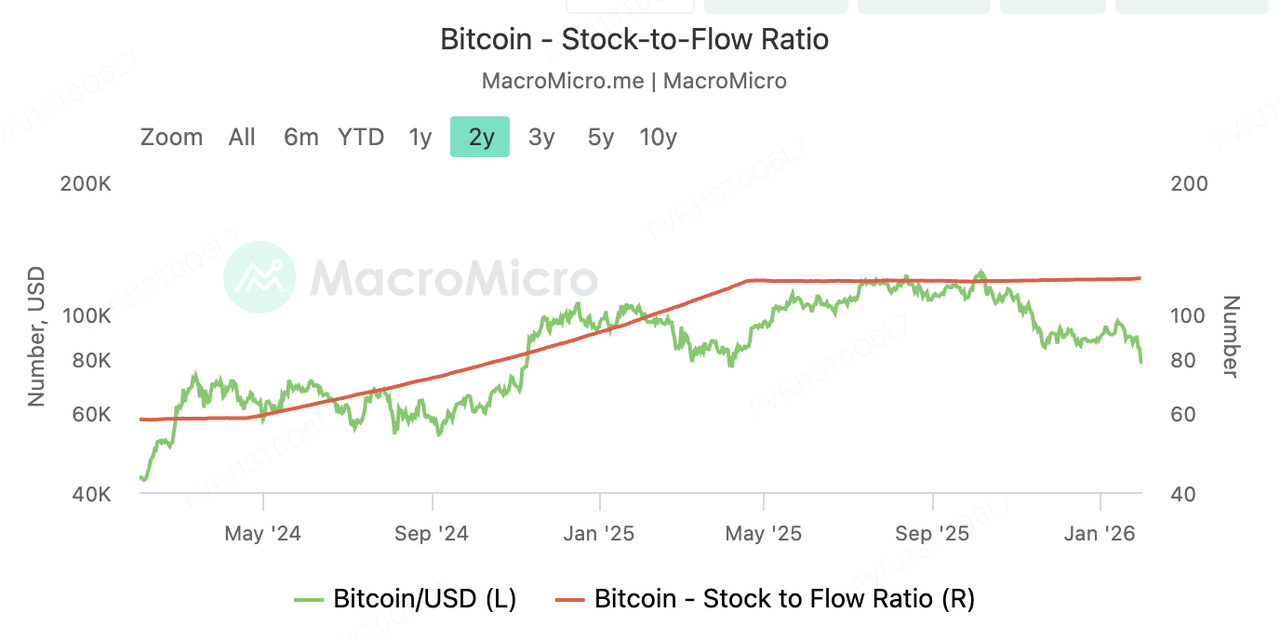

Crypto did not receive “safe-haven” pricing through this episode. Even on scarcity metrics, Bitcoin’s stock-to-flow (S2F) ratio has climbed to around ~121 following the 2024 halving (as of late January), materially higher than gold’s commonly cited ~60 range — a straightforward mathematical statement that Bitcoin’s supply dilution is now lower. Yet price action has not rewarded that thesis. BTC’s long-running, low-volatility range around the ~$90k area remained intact — until last Saturday, when thin weekend liquidity amplified the downside and BTC briefly slipped below $80,000.

Major large-caps such as ETH and SOL saw double-digit drawdowns in tandem. Rather than answering whether Bitcoin is “digital gold,” the market’s behavior delivered a more immediate message: in the short run, crypto is still being priced as a liquidity-sensitive risk bucket, highly reactive to shifts in tightening/quantitative tightening expectations.

The contrast becomes even starker on a market-cap basis. CompaniesMarketCap estimates gold’s market cap at roughly $34.1 trillion. A single 4%–5% day in gold therefore implies a $1.4–$1.7 trillion swing — enough to “match” Bitcoin’s entire scale. When macro expectations flip, both precious metals and crypto can end up pulled by the same liquidity narrative, producing synchronized deleveraging days that overwhelm asset-specific stories.

In that sense, the “supercycle” is best understood as a 5–10 year narrative framework for structural participation — not a near-term pricing engine. At this stage, short-horizon market direction is still dominated by the familiar triangle of rate expectations, balance-sheet policy, and risk appetite.

The more actionable question for the weeks ahead may be less about whether scarcity can persuade markets, and more about when liquidity variables turn again: whether Warsh’s policy stance and QT bias become clearer, the direction of the dollar and real yields, and whether risk assets (including crypto) can regain trading continuity and incremental inflows after deleveraging.

2. Weekly Selected Market Signals

Liquidity Shock: Crypto Collapses as Precious Metals Suffer Worst Crash in 40 Years

This week, global financial markets experienced a historic "liquidity black hole." Donald Trump officially nominated Kevin Warsh as the next Federal Reserve Chair. This, combined with multiple macroeconomic factors, triggered an epic cross-asset deleveraging event. Driven by a strengthening dollar and a stampede of crowded long trades, the sell-off in precious metals from last week extended into the Asian morning session on Monday, February 2nd. Spot silver plunged over 7% at one point in early trading, while spot gold dropped nearly 4%.

The root cause lies significantly in Warsh being viewed as a "hawk," with his policy stance interpreted by the market as strong support for the US dollar. Following Trump's public nomination, the dollar index climbed, directly suppressing the appeal of dollar-denominated assets. Simultaneously, large asset managers engaging in month-end portfolio rebalancing (closing short dollar and long precious metals positions) further amplified this volatility against the backdrop of a sudden spike in the dollar index.

Following precious metals, the crypto market entered a "Black Sunday" mode, with market liquidity drying up further amidst panic. Bitcoin suffered indiscriminate selling during the cross-asset margin calls triggered by the crash in gold and silver. Following Friday's plunge, Bitcoin fell heavily again on Saturday and Sunday, touching a low near $75,700, returning to levels last seen in April 2025.

However, the market is not entirely pessimistic. Although tensions in the Middle East remain high, Trump expressed hope on February 1st to "reach a deal" with Iran. This potential signal of easing tensions somewhat weakened pure war-hedge buying, refocusing the market on the logic of tightening liquidity. Some major banks emphasized that unless an event more destructive than the current macro narrative occurs, the bull market logic for precious metals driven by currency devaluation remains solid, though caution is warranted regarding liquidity deleveraging risks in the first half of the year.

Data Source: SoSoValue

In terms of capital flows, US spot Bitcoin ETFs have recorded net monthly outflows for three consecutive months. This marks the longest period of capital retreat since the ETFs launched, with total Bitcoin ETF AUM shrinking to $106.96 billion. Hit by the double whammy of price crashes and redemptions, the total AUM of Ethereum ETFs has also slid from over $18 billion at the beginning of the month to $15.86 billion.

This ETF decline is likely due to Bitcoin breaking the key support level of $85,000, triggering massive forced liquidations of leverage, leading to passive ETF redemptions. Current capital flows are "following price" rather than "leading price," and until prices stabilize, ETF demand remains extremely fragile.

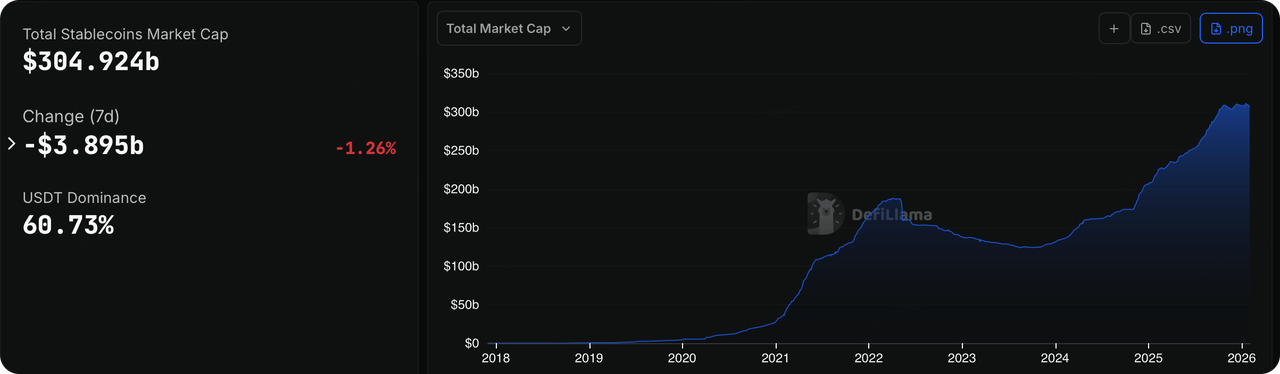

Data Source: DeFillama

Last week, on-chain liquidity flashed an even starker warning signal than falling prices. The compliant stablecoin sector, previously seen as a "vane for incremental capital," suffered a significant contraction in circulating supply during the market downturn, indicating capital is substantively flowing out of the crypto ecosystem. Data shows that USDC, following a net reduction of approximately $6.5 billion in January, recorded further significant net outflows last week, with its issuance dropping by 2.98%. With short-term US Treasury yields remaining high, holding stablecoins (like USDC and PYUSD) has become "expensive." Institutions prefer to move idle capital back into T-bills or money market funds rather than keeping it on-chain.

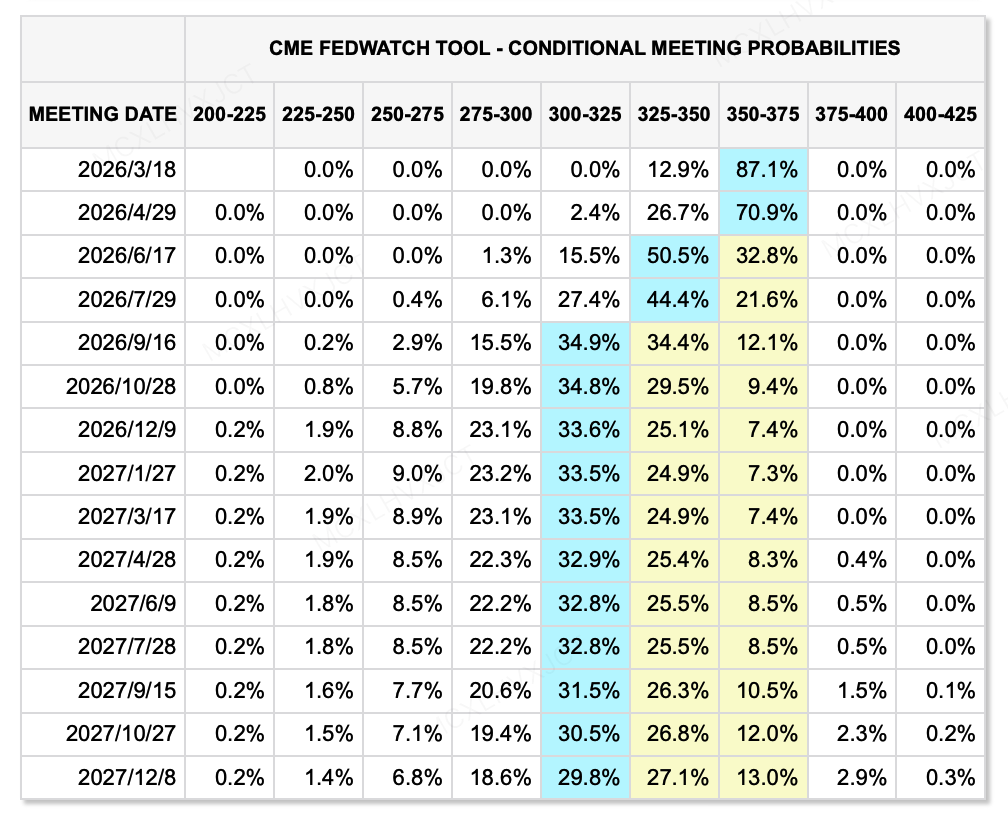

Data Source: CME FedWatch Tool

On the macro liquidity front, why did risk markets react so strongly to Kevin Warsh? Because the market is being forced to digest an extremely rare and dangerous policy combination—"Pragmatic Monetarism." In the past, the market was accustomed to equating "easing" with "rate cuts + balance sheet expansion," but the new paradigm brought by Warsh is "rate cuts + aggressive balance sheet reduction (QT)."

To align with the Trump administration's demand for low interest rates and to support the real economy, according to the latest FedWatch data, the market still expects 2 rate cuts by the end of 2026. However, this does not mean liquidity will improve. Warsh has long criticized the current "ample reserves regime" for allowing banks to "earn interest while lying flat" and for diverting funds away from the real economy.

He advocates returning to a pre-crisis "scarce reserves regime," meaning the Fed would aggressively cut its $6.6 trillion balance sheet through Quantitative Tightening (QT). Therefore, even if nominal interest rates fall, if the total amount of "water" in the system decreases, the valuation center of asset prices must shift downward. This also explains why the dollar rose anomalously last week—because the dollar, as base money, is set to become more "scarce."

Key Events to Watch This Week:

Looking ahead, companies like Amazon, Google, AMD, and Palantir will release earnings reports. Recently, financial markets have become nervous about US tech giants again, and investors are becoming pickier about who can truly emerge from massive AI spending, especially those popular stocks that previously rallied on AI earnings expectations. Companies with sky-high market expectations must now deliver real results to prove themselves. Even if they achieve growth, stock prices could be punished if they fail to meet market expectations.

-

February 2: China and the Eurozone release January PMI; US releases January ISM Manufacturing Index.

-

February 4: Google releases earnings report.

-

February 5: ECB announces interest rate decision; Amazon releases earnings report.

-

February 8: Japan holds House of Representatives election.

Primary Market Financing Observation:

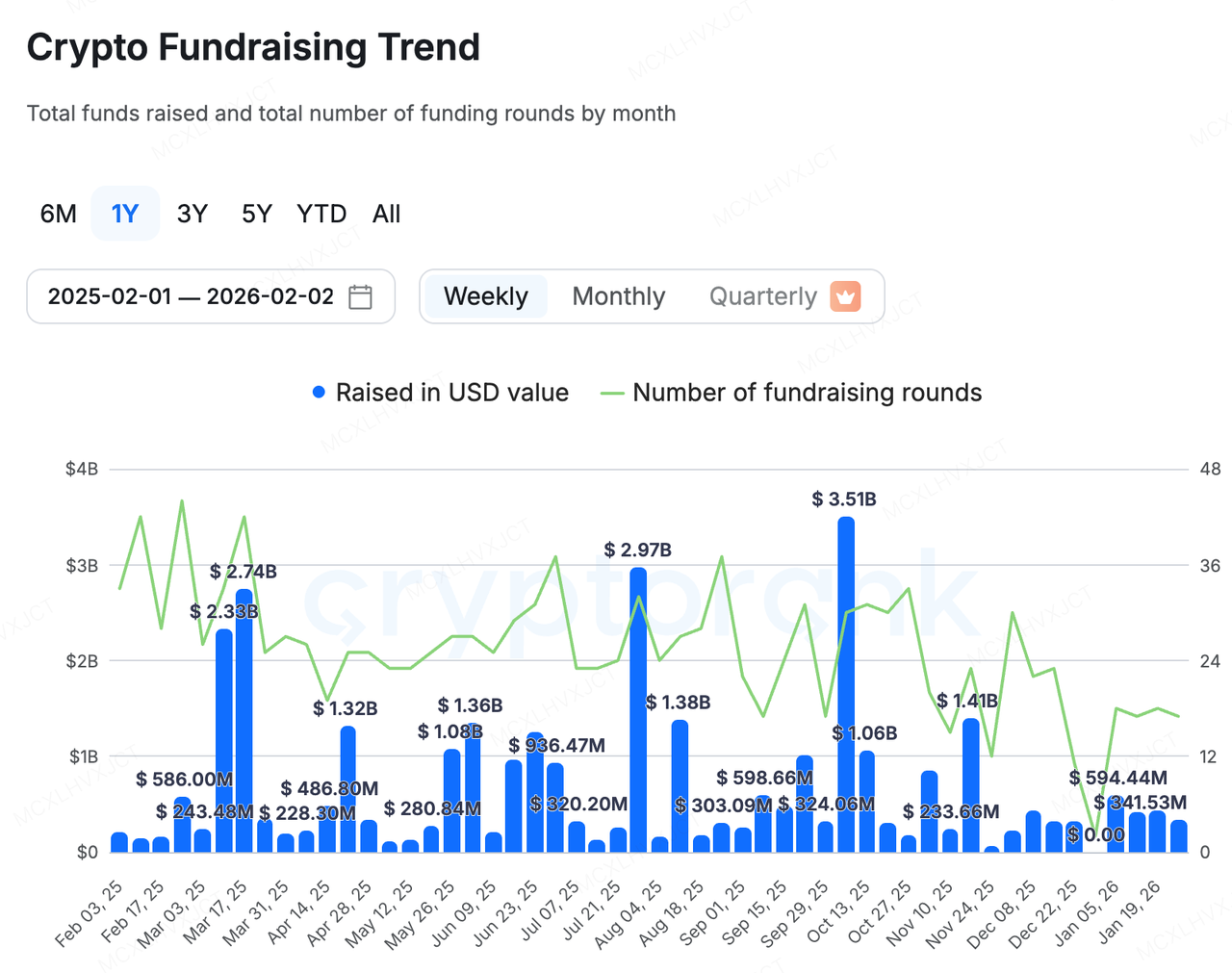

Data Source: CryptoRank

The primary market remained polarized last week: new financing was mostly secured by listed companies refinancing or by upstream and downstream projects in the RWA sector accelerating their implementation through new funding, such as:

-

Talos, the crypto version of the Bloomberg Terminal, secured a $45 million Series B round, bringing its post-money valuation to $1.5 billion. In addition to existing shareholders a16z crypto, BNY, and Fidelity increasing their stakes, new investors including Robinhood, Sony Innovation Fund, IMC, and QCP Capital also participated. As the central console for crypto trading for traditional institutions, Talos is becoming a core hub connecting TradFi and Crypto.

-

Propy, a leading RWA project, announced it secured a $100 million credit facility from Metropolitan Partners Group. This capital will be specifically used to support Propy's large-scale M&A strategy. Propy plans to acquire traditional title and escrow companies and digitally transform them using its AI and blockchain technology.

On the other hand, the DeFi sector finally welcomed financing for a top-tier project.

Flying Tulip Completes Series A Financing with $1 Billion Valuation

Flying Tulip recently completed a $25.5 million Series A private token round, reaching a fully diluted valuation (FDV) of $1 billion. This round was led by Amber Group, Fasanara Digital, and Paper Ventures.

Simultaneously, the project announced it raised an additional $50 million on Impossible Finance's Curated platform and plans to launch a public sale on CoinList on February 3. Investment commitments have already exceeded $1.36 billion. Due to a hard cap set to prevent excessive dilution, the remaining capacity is only about $400 million, indicating an extremely oversubscribed status.

The project's innovation lies mainly in two areas:

Tokenomics and Financing:

-

Principal Protection Mechanism: This is the project's biggest innovation. Investors hold an "on-chain redemption right," allowing them to burn tokens and retrieve their principal at any time. This mechanism provides extremely strong downside protection, limiting risk to "opportunity cost."

-

Yield-Funded Buybacks: Raised funds will not be spent directly by the team but deployed into low-risk on-chain strategies (e.g., Aave, Ethena) to earn an annual yield of ~4%. A portion of the interest generated by the treasury will automatically be used to buy back and burn tokens on the open market. This means the token's value is supported by real capital earnings.

-

Team token Initial Zero Unlock: There is no initial unlock for the team's share; they can only acquire tokens through open market buybacks, greatly aligning the team's interests with the community.

Product Level: Current DeFi is fragmented: you go to Uniswap for spot trading, Aave/Compound for lending, and Hyperliquid for perps. Capital sits idle between different protocols, resulting in low efficiency. Flying Tulip proposes the concept of "Spot as the Pricing Spine."

-

Unified Liquidity: Spot trading serves as the "pricing spine" of the entire system, with its liquidity pool directly supporting lending and derivatives. This design greatly improves capital efficiency, allowing a single collateral to back multiple financial activities.

-

Adaptive Mechanism: The project will employ an adaptive AMM + CLOB market-making mechanism that dynamically adjusts based on market volatility. When volatility is low, the algorithm concentrates liquidity like Curve to reduce slippage; when volatility is high, it disperses liquidity like Uniswap to protect LPs and reduce impermanent loss.

-

Oracleless Derivatives: Its perpetual contract product uses internal spot prices directly, eliminating reliance on external oracles and removing the oracle attack risks common in traditional DeFi.

-

Native Stablecoin ftUSD: Minted using Delta-neutral strategies (e.g., spot long + perp short), it not only maintains value stability but also generates yield for holders through funding rate arbitrage (sftUSD).

The development of Flying Tulip may mark the transition from DeFi 2.0 to DeFi 3.0. Its plan attempts to build a sustainable, low-risk, and highly capital-efficient on-chain financial giant through a model of "principal protection + real yield + full-stack integration." The massive bets by institutions also reflect the market's thirst for this relatively pragmatic approach that focuses more on revenue generation.

-

Project Spotlight

The Clawdbot Renaming Saga: From “Topic Sniping” to the Secondary Market’s Exit-Liquidity Trap

The “name-hijack-to-token” episode around Clawdbot didn’t start as a crypto story at all. Clawdbot was originally an open-source AI agent designed to run locally, helping users execute practical tasks through chat interfaces like WhatsApp and Telegram—everything from inbox cleanup and email sending to calendar management and travel bookings. After going viral on GitHub (peaking at over 80k stars), it ran into a trademark dispute: because the name closely resembled Anthropic’s Claude/Clawd-related trademarks, founder Peter Steinberger was asked to rebrand.

During the rapid migration of the GitHub organization and X account, scammers seized a brief window—when the old handle was released and the new one had not been fully secured—to take over and hijack the accounts. The compromised account then promoted an unrelated Solana meme token using the same ticker, $CLAWD. Speculative flows pushed its market cap above $16 million within hours before it quickly collapsed—an archetypal “24-hour round-trip” token cycle. Although X intervened quickly, the account reportedly remained in a compromised state for roughly 20 minutes—more than enough time, in meme-token terms, to ignite distribution and enable early-stage selling.

Importantly, the fallout did not end with a single rebrand. After the trademark dispute, account compromise, impersonation, and broader confusion, the project went through a second rebrand and ultimately settled on OpenClaw, with the official site updated to openclaw.ai. The security ripple effects also escalated—ranging from impersonation campaigns to malicious payload distribution—exploiting a classic social-engineering window created by “multiple name changes + lagging user recognition.” In other words, the team wasn’t just forced to rename; it was pushed to rapidly shore up non-product workstreams: account security, official-channel verification, and supply-chain risk communication.

On the surface, this looks like an unfortunate one-off incident. In reality, it highlights a structural feature of today’s crypto secondary market. In a phase where fresh hotspots are scarce and narrative supply is thin, the fastest “token strategy” is often not building a new product or inventing a new story—it’s capturing the newest mainstream topic and converting off-chain attention into on-chain liquidity as quickly as possible.

AI, sports, corporate rebrands, breaking news—anything that can create a fleeting “authority illusion” or short-lived information asymmetry can be packaged into a tradable on-chain asset. In that sense, the mechanics are not fundamentally different from celebrity coins or legacy meme cycles: both borrow external attention to fill an internal narrative gap.

The key difference is intent. Celebrity coins operate under a public expectation of monetization; most AI founders have no intention to issue tokens, yet they end up bearing real costs—reputational damage, user confusion, and even harassment. Steinberger publicly distanced himself from the token, expressed anger, and warned that the behavior was harming the project, noting the pressure and harassment that followed.

Data Source: X

Notably, the “Clawd/Clawdbot” trading label did not remain confined to Solana. On Base, similarly named or adjacent pairs appeared and spread quickly. This kind of cross-chain name spillover materially raises the risk of misattribution—especially when the asset is not issued or authorized by the project itself. In those moments, markets tend to treat a familiar name as a proxy for legitimacy, which further amplifies the fragility created by “buying without diligence” layered on top of “thin exit liquidity.”

Ultimately, the episode points to a structural vulnerability that has become difficult to ignore in the current secondary market: the combination of impulse buying without verification and insufficient exit liquidity can turn risk nonlinear the moment the narrative corrects. For many participants, the purchase decision may be triggered by a repost, a handle, or a mistaken signal of endorsement. Losses, however, often don’t come from “misreading the story,” but from ending up in a position that cannot be exited.

These assets frequently exhibit a classic “market-cap mirage”: price and headline market cap can be propped up briefly by extremely thin pools, creating an illusion of prosperity—until attention fades, trading freezes, and the market degrades from “tradable” to “non-exitable.” In topic-driven meme trades, perceived “information advantage” is often just seeing the propagation node earlier. The hard constraint that determines outcomes is whether the token has enough depth, controllable slippage, and sustained trading continuity to support exits. In a market environment this noisy, risk control and secondary verification are often more important than chasing the narrative itself.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.