Bitcoin Perpetual Futures Explained: The Funding Rate vs. Expiration Date

For traders entering the cryptocurrency derivatives market, the term "BTC futures trading" can be misleadingly simple. While traditional futures contracts have been a staple of financial markets for decades, the advent of BTC perpetual futures introduced a significant innovation that has fundamentally reshaped how digital assets are traded. At the heart of this innovation lies a key distinction: the funding rate mechanism, which replaces the traditional contract's expiration date. This article will provide a clear, comparative analysis, highlighting why this difference is critical for any trader to understand.

The Defining Feature: Expiry vs. Perpetuity

The most straightforward distinction between these two contract types lies in their very nature:

- Traditional Futures Contracts have a specified expiration date and settlement process. For example, a "Bitcoin December 2024 Futures" contract is an agreement to buy or sell Bitcoin at a predetermined price on a specific date in December. As this date approaches, the contract's price converges with the spot price. Upon expiration, all open positions are either cash-settled or physically delivered. This design is excellent for hedging and price discovery for a specific period but can be limiting for traders who want to maintain a long-term position without the hassle of rolling over contracts.

- BTC Perpetual Futures, on the other hand, have no expiration date. This is their defining feature. A perpetual contract can theoretically be held indefinitely, allowing traders to maintain a long or short position as long as they meet the margin requirements. This offers unparalleled flexibility, making it a favorite for speculators and day traders who want to focus on price movements without the pressure of an impending settlement date.

The absence of an expiration date is what makes perpetual futures so appealing and a key driver behind their dominance in the crypto derivatives space.

Image: WallStreetMojo

The Central Mechanism: The Funding Rate as a Price Tether

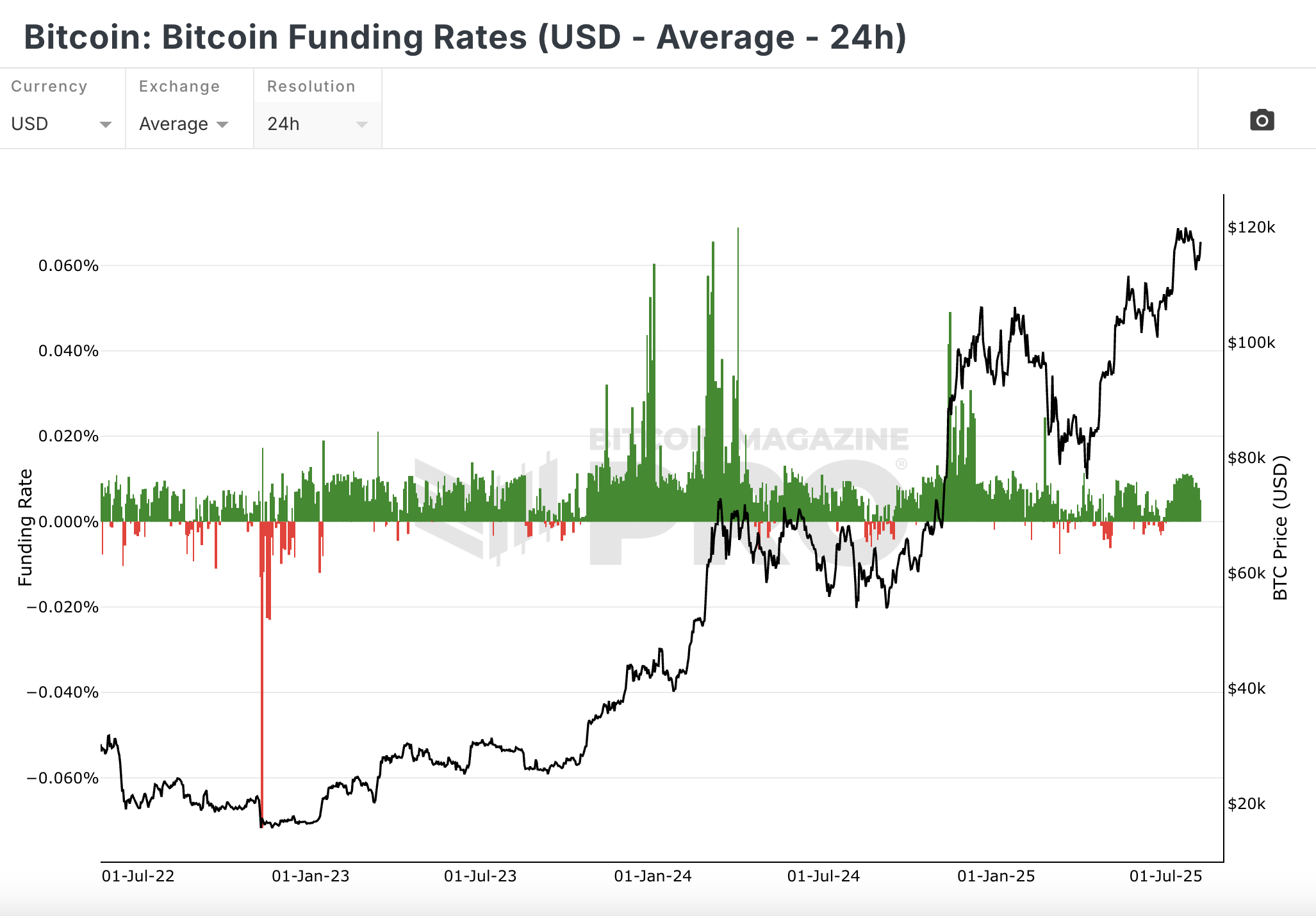

Without an expiration date to force the convergence of prices, a new mechanism was needed to ensure the BTC perpetual futures price stays closely tethered to the underlying spot price. This ingenious solution is the funding rate.

The crypto funding rate indicates how much a trader has to pay, or how much they will receive every 8 hours (typically), for being long or short on a perpetual contract.

The amount they have to pay or receive is dependent on the difference in price between the perpetual contract they are trading versus the spot price - which is the price it would cost to buy Bitcoin on an exchange at that time. The spot price is sometimes also referred to as the index price. Below is its core mechanism.

Credit: 2025 Bitcoin Magazine Pro.

- When the futures price is higher than the spot price (Futures > Spot):

The market is in a premium, which indicates a bullish sentiment with more traders holding long positions. In this scenario, the funding rate is positive. Long position holders will pay a small fee to short position holders. This payment incentivizes traders to open short positions or close long ones, which applies downward pressure on the futures price, pulling it back towards the spot price. - When the futures price is lower than the spot price (Futures < Spot):

The market is in a discount, suggesting a bearish sentiment with more traders holding short positions. The funding rate is negative. Short position holders will pay a small fee to long position holders. This incentivizes traders to open long positions or close short ones, pushing the futures price back up toward the spot price.

This funding rate is typically calculated and paid every eight hours, though this can vary by exchange. For a high-volume product like BTC perpetual futures, the funding rate is a critical piece of market data. It not only keeps the price in check but also presents unique arbitrage opportunities for experienced traders. For example, a trader could hold a spot position and simultaneously short a perpetual contract to collect a high positive funding rate, creating a market-neutral yield.

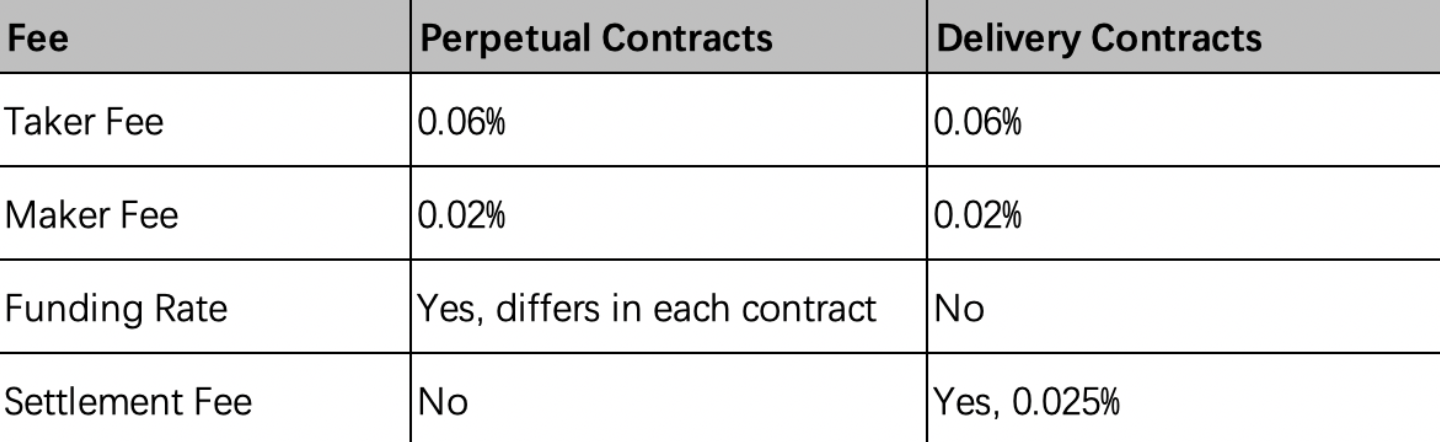

KuCoin Futures Fee Structure

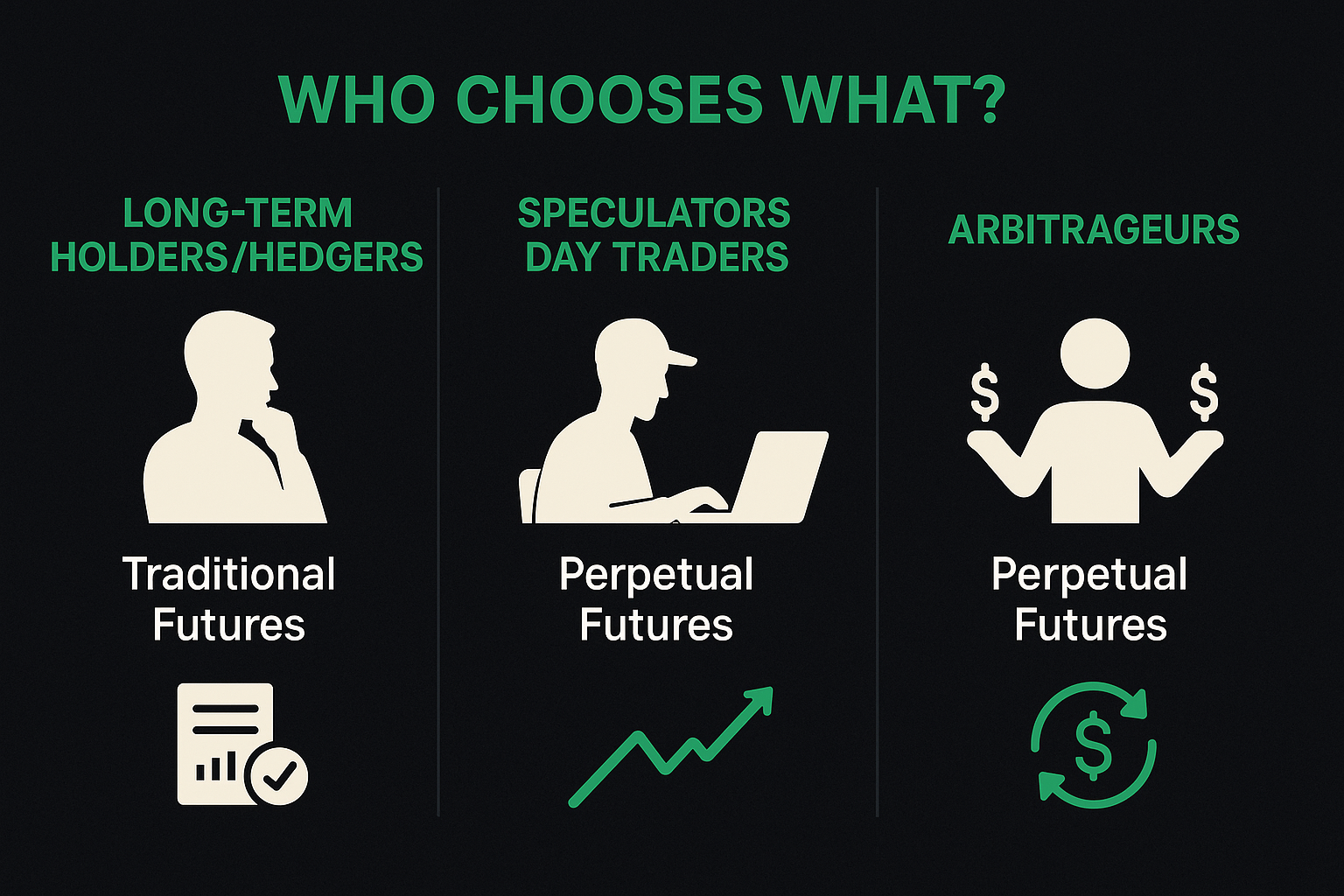

Trading Scenarios: Who Chooses What?

The core difference between the expiration date and the funding rate mechanism directly influences how different types of traders approach the market.

- For Long-Term Holders and Hedgers: Traditional futures contracts are often a preferred tool. An investor with a long-term spot holding who wants to hedge against a specific, anticipated market downturn over a few months can use a traditional futures contract with a matching expiration date. This provides a clean, predictable way to manage risk without worrying about the ongoing costs or variable nature of the funding rate.

- For Speculators and Day Traders: BTC perpetual futures are the clear winner. The lack of an expiration date means day traders and swing traders can focus purely on technical analysis and price action without the added pressure of a contract roll-over. The ability to hold a position indefinitely allows for more flexible position management, while the high liquidity and tight spreads on perpetual contracts make them ideal for quick entries and exits.

- For Arbitrageurs: Perpetual futures also offer a more continuous opportunity for arbitrage. While traditional futures provide arbitrage opportunities as they approach expiration, the funding rate mechanism on perpetuals creates a constant, though small, source of potential profit by balancing long and short positions.

Platform Choice and Market Access

The choice of a trading platform is crucial for leveraging the unique advantages of these contracts. A robust platform should offer deep liquidity, reliable execution, and transparent data on both contract types. For traders interested in exploring the high-liquidity and flexible nature of BTC perpetual futures, platforms like KuCoin offer a powerful trading interface.

You can find the trading page for one of their most popular perpetual futures contracts, which provides real-time data on price, volume, and funding rates here: https://www.kucoin.com/futures/trade/XBTUSDCM.

Conclusion: The Future is Perpetual

The creation of the BTC perpetual futures contract was a pivotal moment in the evolution of the crypto derivatives market. By eliminating the expiration date and introducing the ingenious funding rate mechanism, it created a highly flexible and liquid tool for traders worldwide. While traditional futures still serve a vital role for hedging and long-term planning, the dominance of perpetual contracts in the crypto space is a testament to their superior fit for the fast-paced, 24/7 nature of digital asset trading. Their ability to attract massive trading volumes and provide constant price discovery solidifies their position as the go-to instrument for the modern crypto trader.