Web3 Yield Farming: The Precise Trade-off Between the Return Engine and Impermanent Loss

In the world of Web3's decentralized finance (DeFi), Yield Farming has become a core asset management strategy. It offers crypto asset holders an unprecedented opportunity: instead of simply "holding" (HODL) their assets long-term, they can put idle capital into decentralized networks to become "digital farmers," earning returns by providing liquidity. This strategy is a key embodiment of DeFi innovation and a delicate game of risk versus reward.

Becoming a 'Digital Farmer': The Return Engine of Yield Farming

At the heart of yield farming is the liquidity pool. You can think of a liquidity pool as an "automated currency exchange machine" run by code that never sleeps. It doesn't rely on a traditional order book; instead, it's driven by an Automated Market Maker (AMM) model, which uses a mathematical formula to determine prices.

To make these liquidity pools function, they need Liquidity Providers (LPs). LPs deposit two equal-value tokens (for example, 50% Ethereum (ETH) and 50% USD Coin (USDC)) into the pool. This is like injecting currency reserves into the exchange machine, allowing other users to trade smoothly. As proof of providing liquidity, LPs receive a Liquidity Provider (LP) Token that represents their share of the pool.

In return, LPs earn two main types of rewards, which together form their "return engine":

- Transaction Fees: Every time a user swaps tokens in the pool, they pay a transaction fee (e.g., 0.3% on Uniswap). LPs automatically receive a share of these fees proportional to their stake in the pool. High trading volume in a pool directly leads to higher fee rewards.

- Extra Token Rewards: To incentivize early participants and quickly bootstrap liquidity, many protocols also distribute their platform's governance tokens to LPs. These rewards can be very lucrative and are often the main driver behind the high APYs (Annual Percentage Yields) in yield farming, serving as a key step in a protocol's tokenomics model.

The Hidden Risk Behind the Returns: A Breakdown of Impermanent Loss

While the return engine appears very attractive, liquidity providers must confront a unique and significant risk: Impermanent Loss.

Simply put, Impermanent Loss is the temporary loss of funds that a liquidity provider experiences when the price of their deposited assets changes relative to simply holding them in their wallet. This loss is caused by the liquidity pool's Automated Market Maker (AMM) mechanism.

Let's use a concrete example to explain the mechanism:

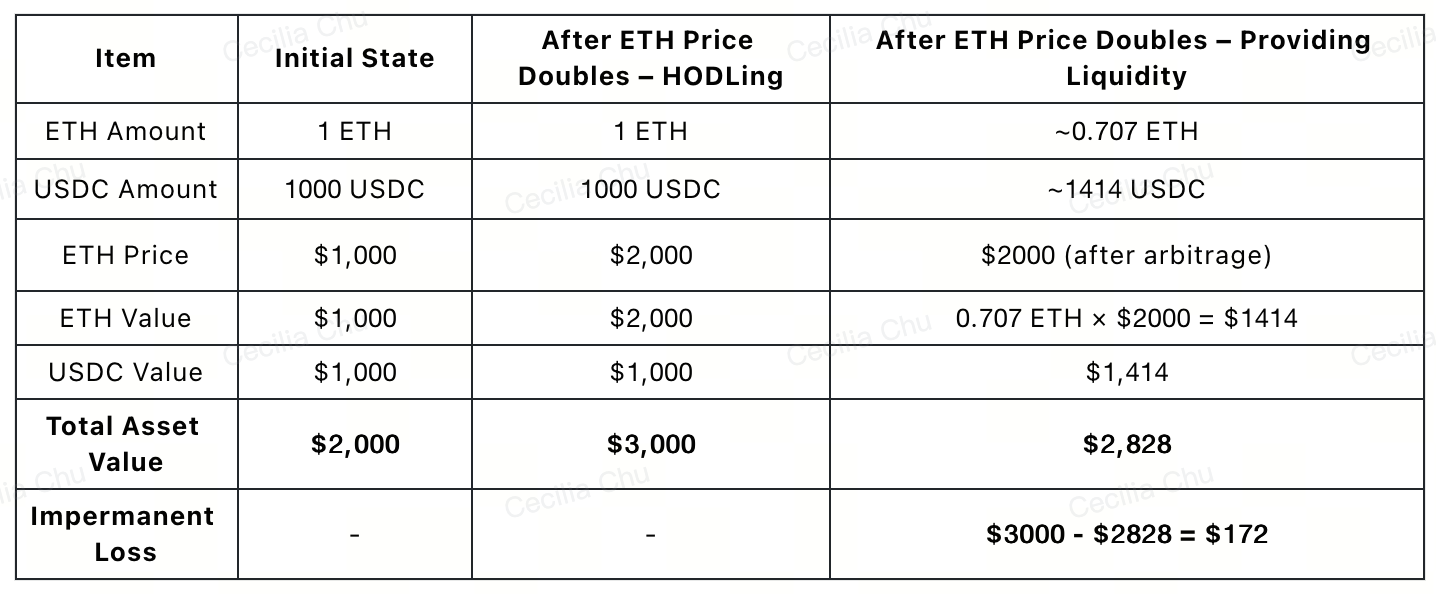

Imagine you deposit 1 ETH and 1000 USDC into a pool, with ETH's price at $1000.

- Scenario 1: The price of ETH remains stable. Your asset value is still 1 ETH + 1000 USDC.

- Scenario 2: The price of ETH doubles to $2000. At this point, the ETH in the pool is undervalued compared to the external market. Arbitrageurs step in, depositing USDC to buy ETH from the pool until the ETH price is pushed back up to $2000. This process causes the pool to hold less ETH and more USDC. Eventually, the pool rebalances to hold roughly 0.707 ETH and 1414 USDC. Your total asset value becomes 0.707 ETH (worth $1414) + 1414 USDC, for a total of approximately $2828.

- The Comparison: If you had simply held your 1 ETH and 1000 USDC in your wallet without participating in yield farming, your total asset value would be 1 ETH (worth $2000) + 1000 USDC, for a total of $3000.

The Impermanent Loss is the difference: $3000 - $2828 = $172.

This loss is called "impermanent" because if the token prices eventually return to their original ratio, the loss disappears. However, if the price never recovers and you choose to withdraw your funds, this "impermanent" loss becomes a permanent loss.

The Precise Trade-off: The Wisdom of Web3 Investors

Yield farming is a precise trade-off between risk and reward. The potential for high returns, especially from extra token rewards, must be sufficient to offset the potential risk of impermanent loss. Therefore, smart Web3 investors take the following steps to manage this risk:

- Choose Stablecoin Pairs: Trading pairs like USDC/DAI, which have very low price volatility, have almost negligible impermanent loss risk.

- Evaluate Trading Volume: High-volume pools generate more transaction fees, which can help to offset impermanent loss more quickly.

- Focus on Token Rewards: In high-volatility pairs, it is only worthwhile to assume the risk of impermanent loss if the extra token rewards (i.e., the APY) are high enough.

Yield farming is a key component of Web3 innovation that opens new doors to participate in the financial world. However, understanding and managing its core risk—impermanent loss—is the first lesson every "digital farmer" must learn.