Weekly Crypto Roundup: Bearish BTC Market Shifts Attention to Litecoin Ahead of Halving, BCH Preps For Major Upgrade

Last week saw Bitcoin prices drop to the lowest point since mid-March following a shift away from a greed-driven market in the first half of Q2 this year. Bitcoin’s recent short-term downward trend saw BTC prices impacted by low liquidity in cryptocurrency markets, catalyzing higher-than-average volatility.

Bitcoin prices concluded Friday with a 2.58 percent decrease, finishing the week ending May 12 at a price of $26,181. Daily lows on Friday fell to $25,833, Bitcoin’s lowest price level since March 17. Overall weekly Bitcoin price losses placed the market-leading crypto at a total cumulative loss of 11.25 percent, with March as Bitcoin’s worst-performing month since November 2022.

BTC/USDT Chart on 5-day Timeframe | Source: KuCoin

The total number of active Bitcoin wallet addresses holding at least 1 BTC has recently reached over 1 million, representing a significant increase in the sum of “wholecoiners” holding Bitcoin. Glassnode data reveals that, as of May 13, over 190,000 additional wallet addresses hold one or more Bitcoin despite a 65% cumulative decline in the price of BTC over the last year.

The recent increase in wallets holding entire Bitcoins can be partially attributed to decaying confidence in traditional banking ecosystems as multiple major bank collapses in the United States erode investor faith in fiat currency ecosystems, alongside US Federal Reserve interest rate hikes. The total number of Bitcoin wallets holding non-zero balances reached 46.6 million as of last Thursday.

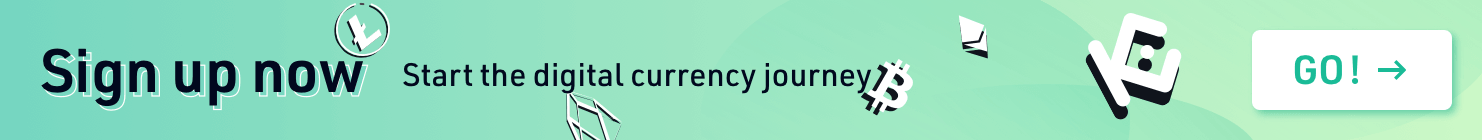

Crypto Heat Map | Source: Coin360

It’s important to note, however, that the increase in “wholecoiner” wallets is not necessarily attributed to an increase in retail investors holding BTC – in many cases, wallets that hold significant amounts of Bitcoin may be held by investment firms, blockchain-based businesses, and other blockchain industry platforms and projects.

Top Altcoin Gainers and Losers

Top Altcoin Gainers

Kava (KAVA) ➠+46.99%

Bitcoin SV (BSV) ➠+17.15%

Lido DAO (LDO) ➠+13.27%

Top Altcoin Losers

Pepe (PEPE) ➠-29.66%

Klaytn (KLAY) ➠-19.62%

WOO Network (WOO) ➠-14.45%

Fear and Greed Index at Locked at 50

Market sentiment maintained a neutral range at the end of the last week, momentarily shifting to fear following a mid-Friday price drop. Current Fear and Greed Index data signals a continuing tug of war between bulls and bears, remaining firmly locked at 50.

Crypto Fear & Greed Index | Source: Alternative

This Week’s Crypto News Highlights

BTC Network Traffic Surges as Ordinals Inscriptions Congest Bitcoin Blockchain

While the total number of Bitcoin wallets holding more than zero balance has increased alongside the number of wallets holding at least one entire Bitcoin, the ensuing increase in Bitcoin network traffic has caused significant transaction backlogs on the Bitcoin blockchain.

The recent blockchain community interest in Bitcoin Ordinals inscriptions, which facilitate NFT-like functionality and the issuance of BRC-20 tokens, has dramatically increased Bitcoin transaction load. To date, over 5 million Ordinals Inscriptions have been committed to the Bitcoin blockchain, with the total market capitalization of BRC-20 tokens surpassing $1 billion last week.

Ordinals Inscriptions Over Time | Source: Dune Analytics

With over 18,000 BRC-20 tokens created in the last few months, total BRC-20 market capitalization has expressed high volatility and, as of the time of publishing, accounts for roughly $500 million.

Upcoming Litecoin Halving Catalyzes LTC Market Interest

Litecoin (LTC) is approaching its halving event scheduled for August, where the generation of LTC by Proof of Work miners will be halved. With just three months remaining before the event, Litecoin blockchain activity has increased significantly alongside the total number of active Litecoin wallets.

In addition to the upcoming Litecoin halving, the imminent rollout of Litecoin’s LTC20 token standard, aimed primarily at the NFT market, has captured the attention of the blockchain community at large.

Other factors, including congestion on both the Ethereum and Bitcoin blockchains, have catalyzed increased adoption and use of the Litecoin network primarily due to the higher speed and lower cost of Litecoin transactions compared to major networks under heavy load.

LTC/USDT Chart on 5-day Timeframe | Source: KuCoin

Bitcoin Cash Upgrade Promises Ethereum-Like Functionality

The upcoming Bitcoin Cash (BCH) network upgrade, scheduled for May 15, has gained attention for introducing significant enhancements to the functionality of the Bitcoin Cash network. Promising features similar in scope to Ethereum’s ERC-20 token standard, changes to the BCH network will see Bitcoin Cash deliver expanded smart contract and token issuance features.

Details outlined in the Bitcoin Cash Network Upgrade Specification Document will see the Bitcoin Cash network integrate a number of innovative features on May 15, including the activation of CHIP-2021-01 Restrict Transaction Version, CHIP-2021-01 Minimum Transaction Size, CHIP-2022-02 CashTokens, and CHIP-2022-05 P2SH32.

One of the most important elements of the upcoming upgrade will see Bitcoin Cash provide users with access to the CashTokens issuance mechanism, enhancing BCH with the ability to create tokens similar to ERC-20 tokens.

The introduction of CashTokens potentially allows for advanced on-chain applications such as more secure vaults, decentralized exchanges, and bridged sidechains. This functionality resembles Ethereum's capabilities but promises improved scalability and lower transaction costs.

Tether Continues to Dominate Stablecoin Market

Tether (USDT) remains the crypto market’s preferred stablecoin amidst ongoing banking uncertainties in the United States, as reflected in its recent attestation report. The report reveals that Tether recorded a net profit of almost $1.5 billion in Q1 2023.

During this period, Tether's excess reserves reached a record high of $2.44 billion, compared to $960 million at the end of Q4 2022. The stablecoin's consolidated total assets stood at $81.8 billion, while its consolidated total liabilities were around $79.4 billion.

Tether's reserves include bitcoin, physical gold, overnight repo, and corporate bond allocations. Its Bitcoin holdings amounted to $1.5 billion, with precious metals accounting for $3.3 billion. The majority of Tether's investments, approximately 85%, are in cash, cash equivalents, and short-term deposits. Gold and bitcoin represent around 4% and 2% of the total reserves, respectively.

To ensure liquidity protection, Tether aims to reduce its reliance on pure bank deposits and instead utilizes the Repo market as an additional measure.

Worldcoin AI Crypto Project Positioned to Capture Significant Funding

Sam Altman, CEO of OpenAI, has reportedly obtained funding for Worldcoin, a cryptocurrency project centered around iris-scanning technology-enabled identity services. Blockchain and AI industry commentary indicates that Worldcoin is currently in discussions to raise $100 million ahead of its launch, following a recent multi-billion dollar partnership with Microsoft.

Co-founded by Altman and Alex Blania in 2019, Worldcoin aims to establish a global identification system using eye-scanning technology, enabling universal access to cryptocurrencies worldwide. The project recently introduced the World App, a digital wallet designed for the Worldcoin ecosystem, providing authentication through World ID and facilitating cross-border transfers of digital money.

Bitcoin (BTC/USDT) Technical Analysis

Bitcoin (BTC) exhibited a recovery from a recent two-month low on Saturday as buyers seized the opportunity to purchase the dip following a drop to $25,833 on Friday. The relative strength index (RSI) also suggests that the market may return to bullish territory, but it has remained below the 80-level following weekend trading action.

BTC/USDT Chart on 5-day Timeframe + RSI | Source: KuCoin

Bitcoin (BTC) has followed a bearish trend since the beginning of last week, briefly experiencing bullish momentum mid-weel before succumbing to bearish pressure once again. The current BTC/USD trading level hovers around $27,000, and could potentially break below this support in the upcoming days due to prevailing bearish sentiment in the market.

The recent relief rally in the U.S. dollar index (DXY) may be exerting downward pressure on Bitcoin, as these two assets typically have an inverse correlation. Currently priced at $27,411 as of the time of publishing, Bitcoin has incurred a weekly loss of over 1.78%. The market is currently dominated by bears, and it may require significant buying activity for Bitcoin to mount a recovery.