The Dynamics of Ethereum dollar US: Comprehensive Analysis of Price, Drivers, and Future Trajectory

2025/12/23 14:24:02

Ethereum (ETH) is not just a digital asset; it is the fundamental infrastructure powering the decentralized internet (Web3), enabling decentralized finance (DeFi), and facilitating global digital identity. For investors across the world, the single most critical metric for assessing its worth and market health is the Ethereum dollar US price—the value of one unit of Ether denominated in the U.S. Dollar (USD).

Source:Admiral Markert

The USD remains the global standard for finance, making the ETH/USD pair the primary reference point for all crypto transactions. Understanding the forces that shape the Ethereum dollar US is essential for everyone, from experienced traders to newcomers observing the market. This comprehensive guide will analyze the current market, dissect the key drivers, and offer a strategic perspective on investing in Ethereum using US Dollars.

I. Real-Time Valuation and Historical Perspective

Tracking the Ethereum Live Price USD

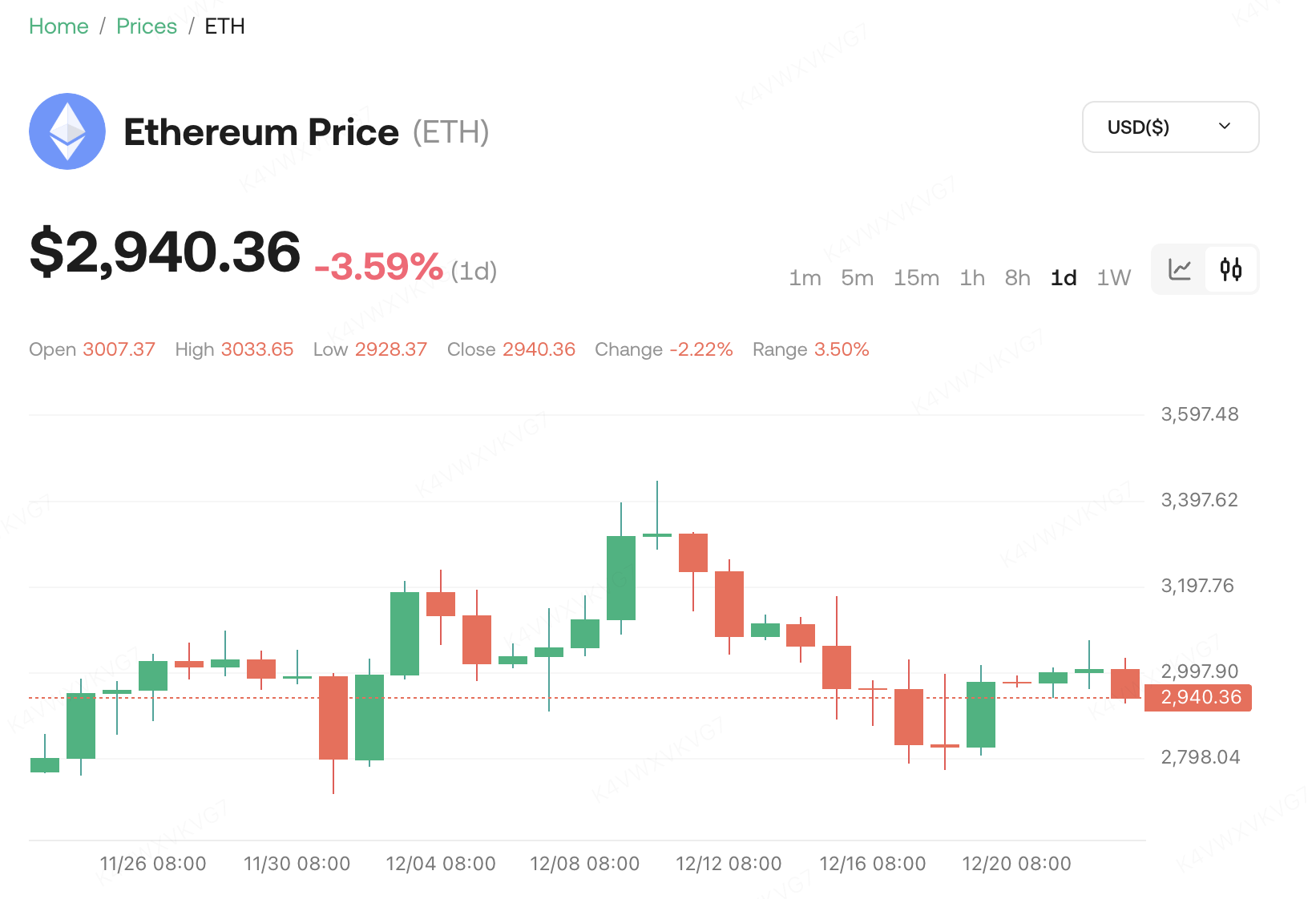

The Ethereum dollar US price is a reflection of continuous global consensus, shifting constantly based on millions of transactions executed across decentralized and centralized exchanges. For strategic investors, monitoring the Ethereum live price USD is a daily necessity. This real-time rate serves as the universal benchmark against which the performance and valuation of ETH are measured.

Charting the ETH/USD History

A review of the historical price action of the Ethereum dollar US reveals a pattern of disruptive innovation matched by intense market volatility.

-

Cycles of Growth: Since its launch, ETH has undergone several dramatic bull and bear cycles, achieving all-time highs that have vaulted it into global financial prominence. Analyzing these historical cycles—identifying periods of accumulation, peak speculation, and necessary corrections—provides crucial context for investors, helping them to manage risk and spot long-term accumulation zones.

-

Technical Analysis: Investors rely heavily on USD-based charts to identify key trading zones. Support areas (where demand typically absorbs selling pressure) and Resistance barriers (where supply overcomes demand) are vital. A decisive move above a key USD resistance level often signals a robust change in trend for the Ethereum dollar US price.

II. Core Factors Driving the Ethereum dollar US Valuation

The movement of the Ethereum dollar US is a complex interplay of internal network fundamentals and external macroeconomic and geopolitical forces.

Fundamental Network Drivers

Ethereum's value proposition is intrinsically linked to the utility and efficiency of its platform:

-

Proof-of-Stake and Supply Dynamics: Ethereum’s transition to the Proof-of-Stake (PoS) consensus mechanism and the integrated fee-burning mechanism (EIP-1559) have fundamentally altered its supply model. This reduction in net issuance—often making ETH deflationary during peak usage—creates scarcity.

-

DeFi and NFT Ecosystem Usage: Ethereum remains the undisputed leader in Total Value Locked (TVL) within the DeFi space and transaction volume for major NFT marketplaces. Increased adoption of these applications drives higher demand for ETH, which is necessary to pay network fees (Gas) and participate in staking, thereby elevating the Ethereum dollar US valuation.

-

Scaling Solutions (Layer-2s): Continued progress and adoption of Layer-2 scaling solutions (like rollups) reduce transaction costs and increase transaction throughput. By making the network more accessible and affordable, these improvements dramatically increase utility, translating directly into stronger demand for the underlying asset.

Macroeconomic and Market Sentiment Forces

External pressures, particularly those emanating from the U.S. financial system, are major influences on the Ethereum dollar US price:

-

U.S. Federal Reserve (Fed) Policy: As the custodian of the dollar, the Fed's decisions on interest rates and quantitative easing/tightening are paramount. A loose monetary policy (low rates) tends to favor risk assets like ETH, while tightening policy can increase the cost of capital and lead to selling pressure across the crypto market.

-

U.S. Dollar Strength (DXY): The strength of the USD, measured by the Dollar Index (DXY), has an inverse relationship with many risk assets. A strengthening USD can often correlate with a temporary pullback in the Ethereum dollar US, as global liquidity tightens.

-

Institutional Adoption and Regulation: The growing involvement of major U.S. institutional players (e.g., asset managers) and the regulatory landscape for products like spot Ethereum ETFs are critical. Approval for such products represents significant regulated capital entering the market, which can provide sustained, long-term upward momentum.

-

Bitcoin (BTC) Correlation: As the market benchmark, Bitcoin's price trajectory dictates the overall sentiment. While Ethereum often exhibits a higher beta (more exaggerated movements) than BTC, a major rally or decline in Bitcoin typically precedes a similar move in the Ethereum dollar US.

III. Practical Guide: Investing in Ethereum with US Dollars

For investors aiming to acquire ETH using USD, simplicity, security, and minimizing transaction costs are key strategic considerations.

Platform Selection and Purchase

Investors should utilize exchanges that are fully compliant, highly liquid, and provide robust support for USD deposits via methods like ACH, domestic wire transfers, or credit/debit cards. Regulated platforms such as Coinbase, Kraken, or Binance.US are common choices.

-

Process: Select a platform, complete mandatory KYC verification, link your U.S. bank account, deposit USD, and execute the ETH/USD trade.

The Power of Dollar-Cost Averaging (DCA)

A highly recommended strategy for managing the volatility of the Ethereum dollar US is Dollar-Cost Averaging (DCA). Instead of attempting to perfectly time the market—a strategy fraught with risk—DCA involves investing a fixed, predetermined amount of USD into ETH at regular intervals (e.g., weekly or monthly). This systematic approach naturally lowers the investor's average purchase price over time and mitigates the risk of buying only at market peaks.

IV. Ethereum Price Prediction USD: Long-Term Outlook and Risks

The Long-Term Value Proposition

The long-term outlook for the Ethereum dollar US remains compelling, rooted in its status as a decentralized global settlement layer. As Web3 continues its trajectory toward mass adoption, the demand for Ethereum’s scarce digital real estate and its core asset (ETH) is projected to increase exponentially. Many analysts see the Ethereum dollar US valuation eventually matching or surpassing that of some of the world's largest tech companies, driven purely by its utility and network effects.

Essential Investment Risks

Prudent investors must maintain awareness of potential downside risks:

-

Technological Execution: Delays or major flaws in critical network upgrades could dampen market confidence and adoption.

-

Regulatory Headwinds: Adverse or restrictive regulatory actions in the US, particularly concerning staking or DeFi protocols, could trigger market fear and a significant sell-off.

-

Competition: While Ethereum dominates, emerging Layer-1 blockchains continue to pose competitive threats, potentially fragmenting the developer and user base.

V. Conclusion

The Ethereum dollar US price is more than a ticker; it is a real-time barometer of the digital economy’s growth and ambition. Its inherent volatility is a direct consequence of its disruptive nature. Successful participation in the Ethereum market—whether as a trader or a long-term HODLer—requires continuous study of market fundamentals, technological advancements, and the critical influence of macroeconomic trends. By staying informed, investors can navigate the complexities and capitalize on the massive potential represented by the Ethereum dollar US.