From PoW to PoS: What is Crypto Mining Now? A 2025 Investor’s Blueprint for the Digital Gold Rush

2025/10/31 16:00:02

Introduction: What is Crypto Mining and Why is it the Foundation of Digital Gold?

For cryptocurrency enthusiasts and investors, crypto mining is more than just a technical process; it is the core mechanism that allows the crypto economic system to function. It not only secures networks like Bitcoin (BTC) but also serves as the principal method for issuing new tokens and ensuring decentralized governance.

However, in 2025, the era of casual mining with a personal computer is long gone. Following the Bitcoin halving events, global regulatory shifts, and a strong focus on sustainability, the mining industry has become highly industrialized and institutionalized.

This guide provides an in-depth analysis of what is crypto mining, covering its working principles, main types, investment return analysis, and the key risks and future trends that investors must monitor in 2025.

I. Deconstructing What is Crypto Mining: The Core Concepts

1.1 The Essence and Purpose of Mining

In its simplest form, crypto mining is a competitive computational process. Miners use high-performance hardware to solve complex mathematical problems to validate and bundle new transaction blocks and add them to the blockchain.

The three primary objectives of mining are:

-

Network Security: By expending computing power (and energy), miners make it prohibitively difficult for malicious actors to tamper with the transaction ledger, thus ensuring the network's immutability.

-

Decentralization: Thousands of miners globally participate in the validation process, preventing any single entity from gaining control over the network.

-

Token Issuance: Miners are the only entities who receive the newly created tokens (block rewards), serving as the distribution mechanism for the cryptocurrency.

1.2 Core Mechanism: Understanding Proof-of-Work (PoW)

Most "mineable" cryptocurrencies, such as Bitcoin, utilize the Proof-of-Work (PoW) mechanism. This process requires miners to find a specific random number (Nonce) that, when combined with the block data, results in a "block hash value" that meets a network-set condition.

-

Hash Rate: The unit used to measure a miner's computational power (tries per second). A higher hash rate increases the probability of finding the valid Nonce.

-

Difficulty Adjustment: To ensure a predictable rate of block generation (e.g., every 10 minutes for Bitcoin), the network automatically adjusts the complexity of the computational puzzle based on changes in the total network hash rate.

II. Types of Mining and Participation Methods

In 2025, the market is highly segmented. Investors primarily look at these methods:

2.1 Hardware and Scaled Mining

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

| Mining Type | Applicable Coins | 2025 Status and Features |

| ASIC Mining | Bitcoin, Litecoin, specific PoW coins | The most efficient method, but hardware is specialized and costly. Due to high entry barriers, this is dominated by large-scale institutional operations. |

| Mining Pools | All PoW coins | Individuals and small farms pool their hash power to increase the stability and predictability of rewards. This is the standard method for most retail miners. |

| Cloud Mining | Bitcoin, various PoW coins | Renting hash power from large farms. Extremely high risk; plagued by scams. Use is discouraged unless from known, regulated entities. |

2.2 The Rise of Staking (PoS)

With major networks like Ethereum moving to Proof-of-Stake (PoS), the traditional concept of PoW mining has been largely superseded by "Staking."

-

How it Works: In PoS, miners (called Validators) lock up a required amount of tokens (Staking) to gain the right to validate transactions and create new blocks.

-

Investment Perspective: Staking is far more capital-efficient and energy-efficient than PoW. Rewards are based on the amount of tokens held and the network's inflation rate, shifting the investment risk to token price volatility rather than hardware and electricity costs.

III. Investment Returns and Economics of Crypto Mining

In 2025, the calculation of mining returns requires an institutional-grade perspective.

3.1 Profitability and Cost Analysis

For PoW mining, profitability relies on four key interconnected variables:

$$\text{Net Profit} = (\text{Block Reward} + \text{Transaction Fees}) \times \frac{\text{Miner Hash Rate}}{\text{Total Network Hash Rate}} \times \text{Coin Price} - \text{Operating Costs}$$

-

Operating Cost (OPEX) Optimization:

-

Electricity Cost is the Key: Farms must secure power contracts below $0.05 / kWh to remain competitive. Control over energy costs is a matter of survival, especially with volatile energy markets and sustainability requirements.

-

Maintenance: Professional cooling systems, such as immersion cooling, are crucial for increasing hardware longevity and reducing long-term maintenance expenses.

-

-

Hardware Cost (CAPEX) Depreciation:

-

ASIC miners have a short shelf life, often becoming obsolete within 1.5 to 3 years due to hash rate growth and halving events. Hardware must be treated as a rapidly depreciating asset.

-

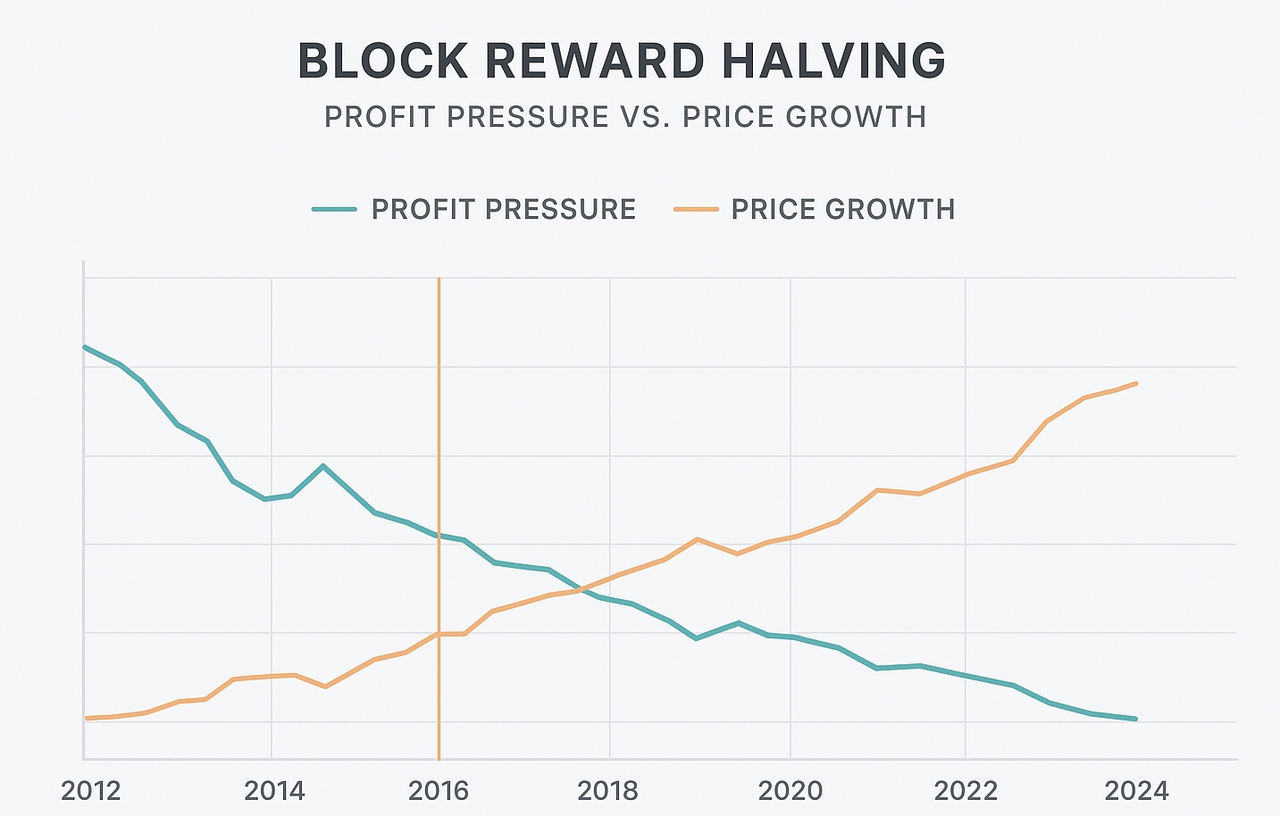

3.2 The Impact of Halving

The periodic "Halving" of Bitcoin's block reward immediately cuts miner revenue in half, instantly weeding out miners with higher electricity costs or older hardware. While halving is historically associated with long-term price appreciation, the short-term pressure on profit margins is severe.

IV. Risks and Future Trends for Crypto Mining in 2025

4.1 Key Risk Assessment

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

| Risk Category | Description | 2025 Focus & Mitigation |

| Price Volatility Risk | Costs are paid in fiat currency (electricity), but revenue is in crypto. A sudden drop in coin price can lead to immediate losses. | Using Hedging strategies, like futures contracts, to lock in revenue. |

| Regulatory & Geopolitical Risk | Changes in government policies regarding energy consumption, capital outflow, and environmental standards. | Migration of mining operations to regions with stable regulation and access to green energy. |

| Hardware Obsolescence | Chip technology rapidly advances, leading to newer miners significantly outperforming old ones. | Requirement for continuous capital reinvestment to upgrade equipment. |

4.2 Industry Transformation: Green, Institutional, and Professional

In 2025, the crypto mining industry is undergoing a significant shift toward green energy and industrialization:

-

Transition to Sustainable Energy (ESG Focus): Institutional investment increasingly favors mining operations that utilize sustainable sources like hydro, solar, and wind power. Green energy usage has become a key metric for valuing mining enterprises.

-

Institutional Dominance: Mining is now a game played by large energy companies and Wall Street firms with access to cheap power, professional site management, and deep capital for hardware procurement. The profit margin for retail PoW mining is severely constrained.

-

Integration with Energy Grids: Leading mining companies are partnering with grid operators, using mining's "interruptible load" capability to stabilize the power grid, receiving subsidies, and becoming a crucial part of the energy infrastructure.

Conclusion: The Path Forward for Crypto Mining Enthusiasts

Crypto mining, whether through PoW competition or PoS staking, remains an essential component of the digital economy.

For investors in 2025:

-

For PoW Mining: Retail investors without access to extremely low-cost power should be cautious. A safer approach is to gain indirect exposure by investing in publicly traded mining company stocks or ETFs to mitigate hardware and operational risks.

-

For PoS Staking: This offers a more accessible and energy-efficient way to participate. By staking major PoS tokens, you can securely earn passive income as a network validator.

The future success of crypto mining hinges on capital efficiency, energy strategy, and adaptability to the evolving regulatory landscape. Always conduct thorough due diligence and use profitability calculators before beginning any mining operation.