KuCoin Ventures Weekly Report: Liquidity Stress Test & The Rise of Compliant Capital: NVDA’s "Sell the News" Triggers Cross-Asset Deleveraging, Coinbase Reclaims Pricing Power via Monad, and The Stress Test on Base

2025/11/25 06:51:02

1. Weekly Market Highlights

Macro “Data Fog” Meets MSTR Index Risk: Short-Term Rebound After a Sharp Shake-Out

Last week, the crypto market went through a classic “macro expectations + idiosyncratic event” shock. On the macro side, the aftereffects of the U.S. government shutdown disrupted the release schedule of key indicators such as inflation and employment, leaving the Fed effectively speaking to the market with an incomplete data dashboard. In the first half of the week, several Fed officials delivered hawkish comments, and market pricing for a December rate cut fell sharply. Later on, some policymakers shifted to a more cautious tone, emphasizing tighter financial conditions and the risk of asset-price corrections. The CME FedWatch Tool then showed the implied probability of a December cut quickly rebounding above 70%. This “brake-and-rebound” in rate expectations over a very short period, combined with rising concerns over an AI bubble, forced a sharp repricing across global risk assets as their valuation anchors were repeatedly shaken.

Against this backdrop, Bitcoin fell from a prior high of around $96,000, breaking below the key $93,714 level late last week and extending its decline to roughly $80,600. It then stabilized and rebounded on the back of recovering rate-cut expectations, briefly trading back near $88,000 and currently consolidating around $86,818. Over the same period, total crypto market capitalization recovered toward the $3 trillion mark after two days of repair over the weekend, with a 24-hour gain of about 0.7%. Structurally, spot trading volume on major centralized exchanges spiked to recent highs at the close of BTC’s daily candle on 21 November, indicating a clear phase of high-volume turnover at lower levels. Historically, this pattern often corresponds to a short-term local bottom, but whether it can evolve into a more durable inflection point will still depend on whether subsequent macro signals continue to improve.

Data Source: TradingView

On the internal side, expectations around a potential index methodology change involving MicroStrategy (MSTR) and MSCI became a key amplifier of this move. According to estimates by JPMorgan and other institutions, if MSCI ultimately decides to remove companies that “hold Bitcoin or other digital assets as primary balance-sheet assets and whose share prices closely track a single asset” from its investable market indices, then passive flows within the MSCI family alone could generate roughly $2.8 billion of forced selling in MSTR. If other major index providers such as Nasdaq, Russell, and FTSE were to follow with similar rule changes, the total scale of passive outflows could theoretically expand to around $8.8 billion.

MSCI’s motivation in launching this public consultation is to draw a clearer line, at the index-construction level, between “traditional operating companies” and “vehicles that effectively provide high-volatility asset exposure,” in order to avoid equity indices passively carrying excessive indirect Bitcoin exposure and to better control the associated concentration and tracking-error risks. MSCI has already begun the consultation process and plans to deliver a final decision by 15 January 2026. During this period of unresolved structural uncertainty, MSTR’s share price has significantly underperformed Bitcoin, with a drawdown notably larger than BTC’s in this episode—essentially reflecting the market’s attempt to price in a scenario where passive funds may be forced to reduce their holdings.

Data Source: https://datboard.panteraresearchlab.xyz/

Overall, last week’s sharp volatility was less about a single negative headline and more about “both the macro anchor and the index anchor shifting at the same time.” On one hand, the rate-cut path, muddied by a data fog and divergent Fed communication, drove multiple rounds of rapid portfolio rebalancing and a swift swing in risk appetite from contraction to partial repair. On the other, the potential MSTR × MSCI index event provided a concrete focal point for fear, leading to selling pressure not only in BTC and other major tokens but also in high-beta “treasury-style” crypto equity names. In the short term, the rebound after high-volume turnover has given the market some breathing room. But until the December FOMC decision is behind us and MSCI’s final stance becomes clearer, treating elevated volatility and choppy direction as the “base case” may be the more prudent way to characterize this phase.

2. Weekly Selected Market Signals

Liquidity Stress Test: The Expectation Trap Behind NVDA’s Stellar Earnings & Cross-Asset Deleveraging

Last week, panic regarding global risk assets spread further across the market, culminating in a particularly brutal sell-off on Friday. The market's main narrative revolved around the compounded pressures of "AI Bubble Fears + Cooling Rate Cut Expectations + Year-End Profit Taking."

Despite AI bellwether Nvidia delivering a flawless earnings report, the US stock market staged a classic "Sell the News" event. The Nasdaq recorded its largest three-week decline since April, while the S&P 500 fell nearly 2% for the week. Even when Fed officials released "dovish" signals on Friday in an attempt to salvage sentiment, the market remained extremely fragile.

It appears the market's core logic is shifting forcefully from "Fundamental-driven" to "Liquidity & Leverage-driven." Nvidia’s revenue grew 62% YoY with guidance exceeding expectations, yet its stock price reversed from a 5% intraday gain to a 7% plunge. This anomaly is being widely compared by Wall Street to the "Cisco Moment" of 2000—when Cisco’s CEO hailed the "Second Industrial Revolution" at the peak of earnings, only for the stock to halve within a year.

Deeper panic stems from "The Big Short" investor Michael Burry, who publicly released data targeting the pain points of the AI industry: "Circular Financing" and "Pseudo-demand." Burry argues that the current AI boom is built on an illusion of giants funneling capital to each other; stripping away Capex, the real revenue from terminal applications is "laughably small." This narrative fracture, superimposed on Goldman Sachs data showing dried-up market depth (S&P 500 top-of-book liquidity dropped to just $5 million), meant the market could not absorb any selling pressure, resulting in severe slippage.

The Crypto Market also experienced its darkest hour this week. In just two months, Bitcoin plunged from an ATH of $126,000 to below $80,553, a retracement of over 30%, technically entering a bear market. The "Institutional Allocation + Corporate Treasury" narrative that previously supported the rally faced a severe liquidity stress test.

Renowned hedge fund manager Bill Ackman noted that the market underestimated the potential shock of crypto leverage on traditional financial assets. Since many macro hedge funds adopted a high-beta strategy of "Long Crypto + Long Tech," when the more volatile crypto assets liquidated first (with nearly $1 billion cleared in a single day on Friday), investors were forced to sell their most liquid US stock assets to meet margin requirements. This "Crypto Margin Call -> Sell US Stocks" negative feedback loop is likely a primary reason why the crypto crash spilled over into equities.

Data Source: SoSoValue

Looking at ETF flows, institutional participation showed significant divergence this week, entering a period of intense gaming. On one hand, "Right-side" momentum funds are retreating. As Bitcoin broke key technical levels, Spot BTC ETFs ended their streak of net inflows. Short-term profit-takers began to exit, with both BTC and ETH ETFs seeing sustained outflows mid-week. Notably, BTC ETFs saw a net outflow of $903 million on November 20, the largest single-day outflow since March. On the other hand, "Smart Money" is entering on the left side (contrarian). Amidst the panic selling, BTC and ETH Spot ETFs recorded net inflows after Friday's close. Concurrently, ARK Invest has been aggressively adding positions in Coinbase, Robinhood, Circle, and Bullish over several consecutive days.

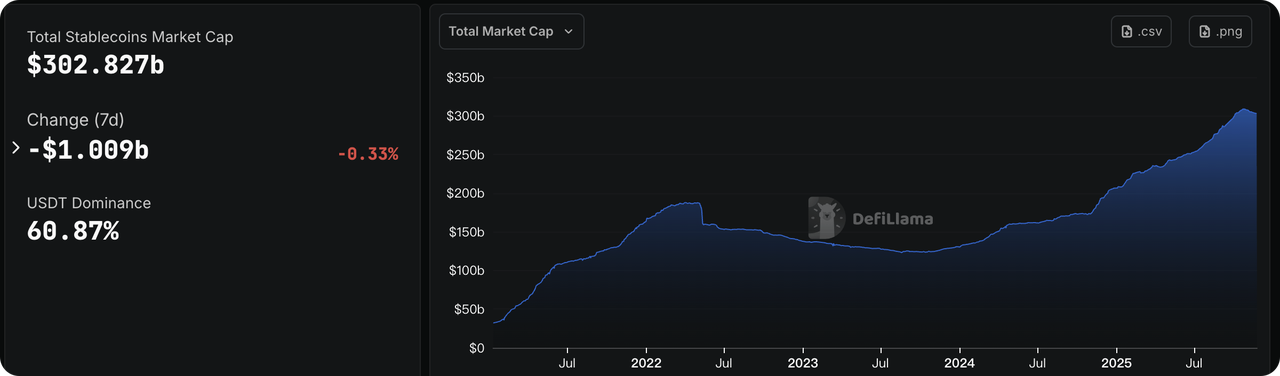

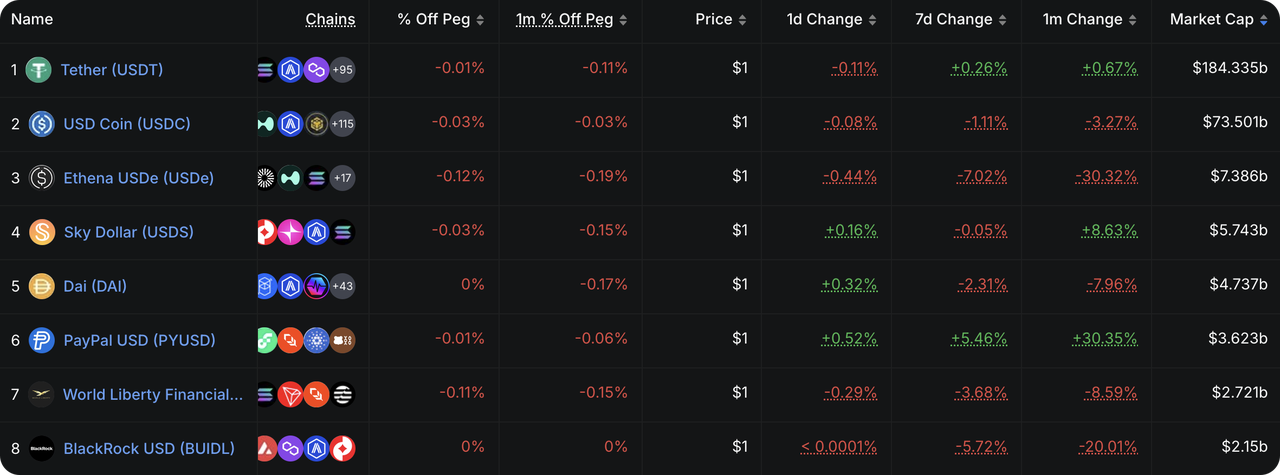

Data Source: DeFiLlama

Regarding On-Chain Liquidity, total stablecoin issuance continues to trend lower, indicating weak purchasing power. Mainstream stablecoins like USDC, USDe, and DAI all recorded net outflows for the week. However, it is worth noting that PayPal's PYUSD has shown strength recently, with issuance growing 30.35% in the last month. With a current circulation of 3.623 billion, it has jumped to become the sixth-largest stablecoin globally and the third-largest compliant fiat-backed stablecoin, a bright spot in the liquidity winter.

The tightening Macro Environment was the final straw crushing risk assets. Rate Expectation Repricing: Influenced by strong economic data and hawkish internal Fed rhetoric, the probability of a 25bp rate cut in December dropped from 70% to 46%, before rebounding to around 69.4% following Williams' speech on Friday. During the week, the 10-year Treasury yield rebounded above 4.15%, and the rise in the risk-free rate directly compressed the valuation ceiling for risk assets.

Data Source: CME FedWatch Tool

Key Events to Watch This Week:

-

Macro Data Backfill (Nov 26-27): Due to the previous government shutdown, a backlog of September PCE, PPI, and some employment data will be released in a cluster. This is a critical window to verify if the US economy is entering "Stagflation."

-

Michael Burry Continues Tech Sniping (Nov 25): Expectations that Burry will disclose more details regarding tech giants "underestimating depreciation to inflate profits."

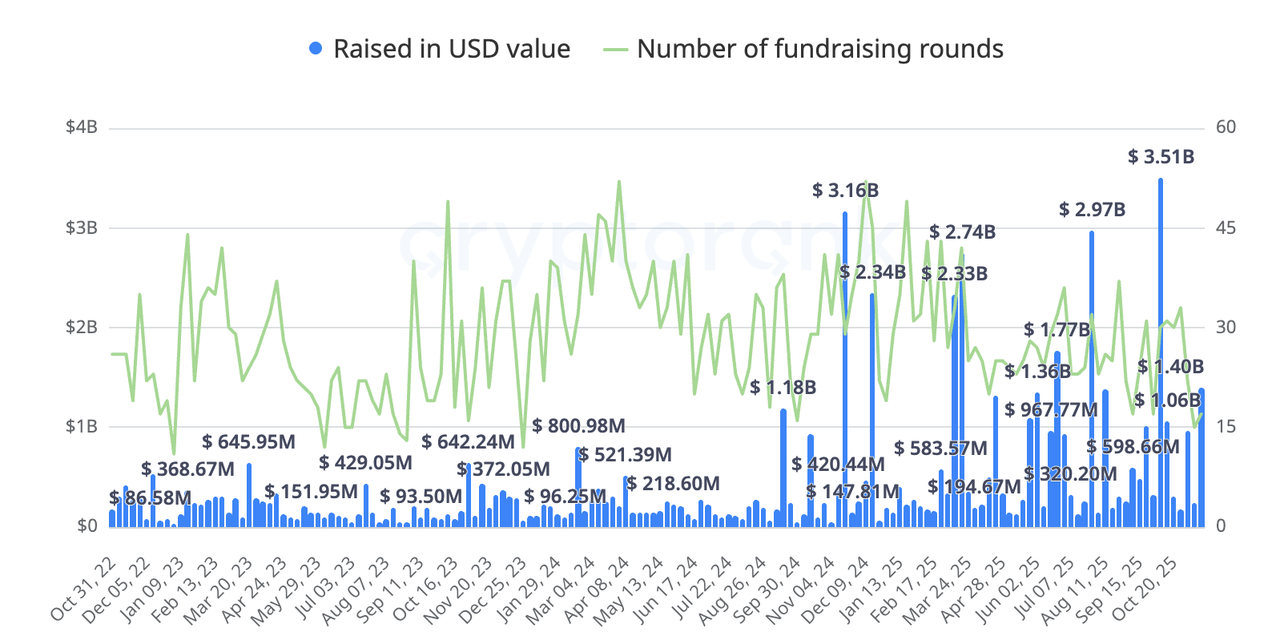

Primary Market Financing Observation:

Data Source: CryptoRank

The primary market is showing massive structural divergence: financing for pure application-layer projects has gone cold, while focus is highly concentrated on the expansion of Compliant Exchanges and Infrastructure.

-

Kalshi raised $1 billion at a valuation soaring to $11 billion, with participation from Sequoia, a16z, Paradigm, and Google’s CapitalG.

-

Kraken confirmed securing another $200 million strategic investment from Citadel in its Pre-IPO round. With $800 million raised in recent rounds, its valuation has reached $20 billion. Beyond bringing in traditional market maker giants as backers, its recent acquisition of Small Exchange signals an intent to enter the US domestic compliant derivatives market, aiming to become a full-suite financial giant rather than just a spot exchange.

The "1.5 Market" Battle: Monad’s Dramatic Fundraising Record

Data Source: https://mon-stats.swishi.xyz/

The focal battle of the "1.5 market" (Public Sale/Pre-market) this week was undoubtedly the debut of the high-performance Layer 1, Monad, on Coinbase’s brand-new public sale platform. As a strategic project for Coinbase to restart "Compliant ICOs," Monad faced a "Dark Moment" amid the double-kill of US stocks and crypto. After several twists, it finally completed a $274 million raise, achieving 146.1% of its target.

-

Opening FOMO: Within 23 minutes of launch, it attracted $43 million (23% progress).

-

Mid-Game Stagnation: Progress then stalled for days, reaching only 48% after the first 6 hours. As pre-market prices on platforms like Binance tumbled, the spread between primary and secondary markets was compressed to the extreme, causing subscription speeds to drop off a cliff.

-

End-Game Sweep: Approaching the window close, large capital (Whales) confirmed market stabilization and swept the remaining allocation, resulting in oversubscription.

From a rational perspective, Monad’s $2.5B pricing appeared relatively restrained compared to other public chains (launched or unlaunched), theoretically leaving room for the secondary market. However, the sale coincided with BTC crashing below $81,000, transmitting secondary market panic directly to the primary market. Furthermore, Coinbase adopted a "Fixed Window" rather than "First Come, First Served" (FCFS) mechanism, eliminating Gas Wars and the urge to front-run, leading capital to wait until the final moments to decide.

Although the raise was oversubscribed, it demonstrates that current users/institutions are no longer "blindly aping in." Capital has become extremely picky; a top-tier narrative public chain at a $2.5B FDV is now viewed by the market as the "Reasonable Ceiling" under current conditions.

Regaining Pricing Power: Monad is just the beginning of Coinbase’s ambition. According to Reuters, Coinbase plans to host similar token sales monthly. Under the expectation of regulatory relaxation from the incoming Trump administration, Coinbase is attempting to solve the distribution problem via a "Compliant KYC + Algorithmic Fairness" model. This is a strategic move to wrestle pricing power for top-tier asset issuances away from Binance Launchpool. It is a battle between Compliant Capital and Offshore Capital, and Monad was the first shot fired.

3. Project Spotlight

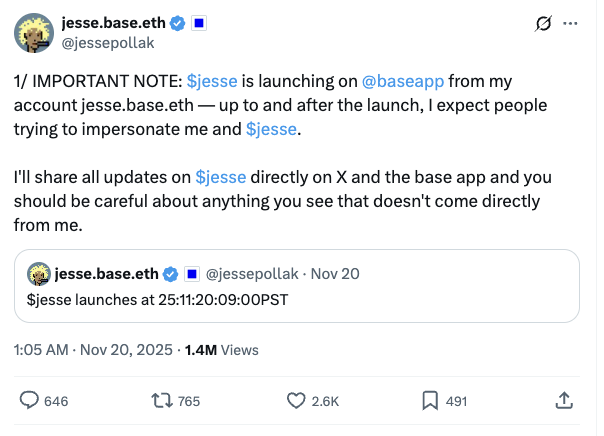

Base Co-Founder Jesse Token Launch Faces “Scientist” Sniping: A Live Stress Test for Base App and Flashblocks

Last week, Base co-founder Jesse Pollak announced the launch of his personal creator token, JESSE, via the Zora Coins module inside Base App, using his account jesse.base.eth as the issuing address. He framed the experiment as a “content coin + creator coin flywheel”: content coins are meant to track short-term attention, while creator coins are designed to capture long-term content value, with ownership and economic rights tying creators and their fans into a single incentive loop. For Base, the launch also served as a highly visible product showcase: Base App is positioned as an “onchain life” entry point, combining content feeds, payments, chat, and asset trading in one interface, where users can browse social content, trade tokens and NFTs, and hold USDC that currently offers an annualized yield of around 3.8%.

Data Source: https://x.com/jessepollak/status/1991191167430717940

What actually triggered controversy was the way the launch played out onchain. In theory, JESSE was intended to debut primarily to Base App users. In practice, the contract address was identified onchain ahead of time, and the opening moments were immediately swarmed by so-called “scientists” (MEV/quant bots). On-chain data show that one bot address acquired roughly 26% of the initial supply within a single block, and two snipers together used Base’s newly deployed Flashblocks mechanism to complete a full cycle of low-price accumulation and high-price distribution in under a minute, with combined profits exceeding $1.3 million. One address alone spent around $40,000 just on L2 gas to secure priority. By the time these “scientists” had finished buying and exiting their positions, most retail users’ price charts had not even fully loaded.

Data Source: https://dexscreener.com/base/0xc39acb3ce11ebcd3e1c5d67cdfb8707ab12674449fdab859327a8aabee03cd10

Flashblocks works by splitting the standard 2-second block time into multiple 200 ms “micro-blocks,” providing near-real-time pre-confirmation for transactions. The original goal was to improve user experience and reduce perceived latency. However, in an open launch setting without additional protective mechanisms, this speed advantage was fully exploited by high-frequency bots, turning what looked like a “fair creator token launch” on the surface into a block-level race among a very small group of sophisticated participants.

From Base App’s own metrics, though, the controversy does not appear to have derailed product adoption; if anything, it functioned as a stress test. Users who connect a Farcaster account and finish creating a smart account receive a non-transferable BetaAccess NFT, which denotes Base App beta user status. On-chain data show that addresses holding this NFT have now exceeded 131,000, which can be viewed as a rough proxy for Base App’s user base. During the week of 10–16 November, new users increased by more than 23,000, setting a new weekly high. On the day Jesse announced the token launch, Base App saw more than 3,200 new registrations. Although this did not surpass the previous peak, it does suggest that the creator-token narrative provided a tangible boost to incremental traffic, more akin to a short-term acceleration on top of an existing growth trend rather than a regime shift.

Data Source: https://dune.com/defioasis/baseapp

Looking at interaction patterns, Base App is clearly trying to bundle as many “everyday” use cases as possible into a single entry point. Over the past seven days, the most frequently interacted contracts inside the app have been USDC, cross-chain component Relay Link, NFT marketplace OpenSea Seaport, airdrop-verification contracts such as IRYS/Authena, and the OKX DEX Router. This indicates that beyond “social + content,” stablecoin payments, cross-chain swaps, NFT trading, and one-click routing into external DeFi protocols already form the core of Base App’s current usage. Among them, Relay Link—which is relatively unfamiliar to the broader market—is deeply embedded inside the app and plays a central role in high-frequency routing and asset bridging.

Taken together, the JESSE launch looks less like a simple marketing event and more like a concentrated manifestation of the tension between infrastructure design and product narrative. On one side, Base is using creator tokens and the broader “content economy” story to position Base App as a super app for onchain identity and relationships. On the other, the confirmation-speed dividend brought by Flashblocks, in the absence of additional fairness safeguards, was amplified by high-frequency participants into a targeted extraction of retail liquidity. Going forward, the more meaningful questions are not about JESSE’s price path itself, but whether Base App’s user base and activity can sustain an uplift from such experiments, and whether the team will introduce a “second iteration” of launch design—around rules, allowlists, limits or auction mechanisms—to turn the combination of “creator economy + ultra-fast settlement” from a one-off high-risk experiment into a more durable and more equitable long-term model.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.