KuCoin Ventures Weekly Report: Crypto in the Fog: Inside Trump's New Gambit, Macro Headwinds, and the Reality Check for Altcoin ETFs

2025/11/04 03:03:02

1. Weekly Market Highlights

Trump Family Enters Prediction Markets as Coinbase Earnings Call Drops a Hint

This past week, the prediction market sector in the US experienced a pivotal "mainstreaming moment." Two seemingly isolated events converged to point toward a clear future: within an increasingly clear regulatory framework in the US, prediction markets are being elevated to a strategic priority by both political and business giants, thanks to their natural affinity with political power and clear commercial demand.

The first major move came from the political arena. On October 28, Trump Media & Technology Group announced that its social platform, Truth Social, will partner with Crypto.com to launch a service called "Truth Predicts." The initiative will allow users to wager on events ranging from the presidential election and inflation rates to sporting events, aiming to directly convert Trump's global influence into active users for prediction markets. The platform will launch first in the United States before expanding globally as preparations are completed.

In a statement, Trump Media CEO Devin Nunes, who also chairs the President's Intelligence Advisory Board, framed the move as a way to "democratize information and transform free speech into actionable foresight." By tying user opinions to real-money wagers, Truth Social can not only generate real-time market odds reflecting supporter sentiment but also significantly amplify its influence through media citations and social discussions. This marks a significant step in integrating prediction markets into the toolkit of top-tier US political forces, turning them into a new battleground for mobilizing public opinion and shaping narratives.

Coincidentally, Coinbase added to the buzz around prediction markets in a very direct manner. At the conclusion of its Q3 earnings call, CEO Brian Armstrong, in a seemingly impromptu move, precisely recited a series of crypto keywords: "Bitcoin, Ethereum, Blockchain, Staking, Web3." These were the very terms featured in popular prediction markets on platforms like Polymarket, where users were betting on which concepts he would mention. Armstrong's action directly intervened in and decided the market outcomes, causing all related prediction events to settle as "YES."

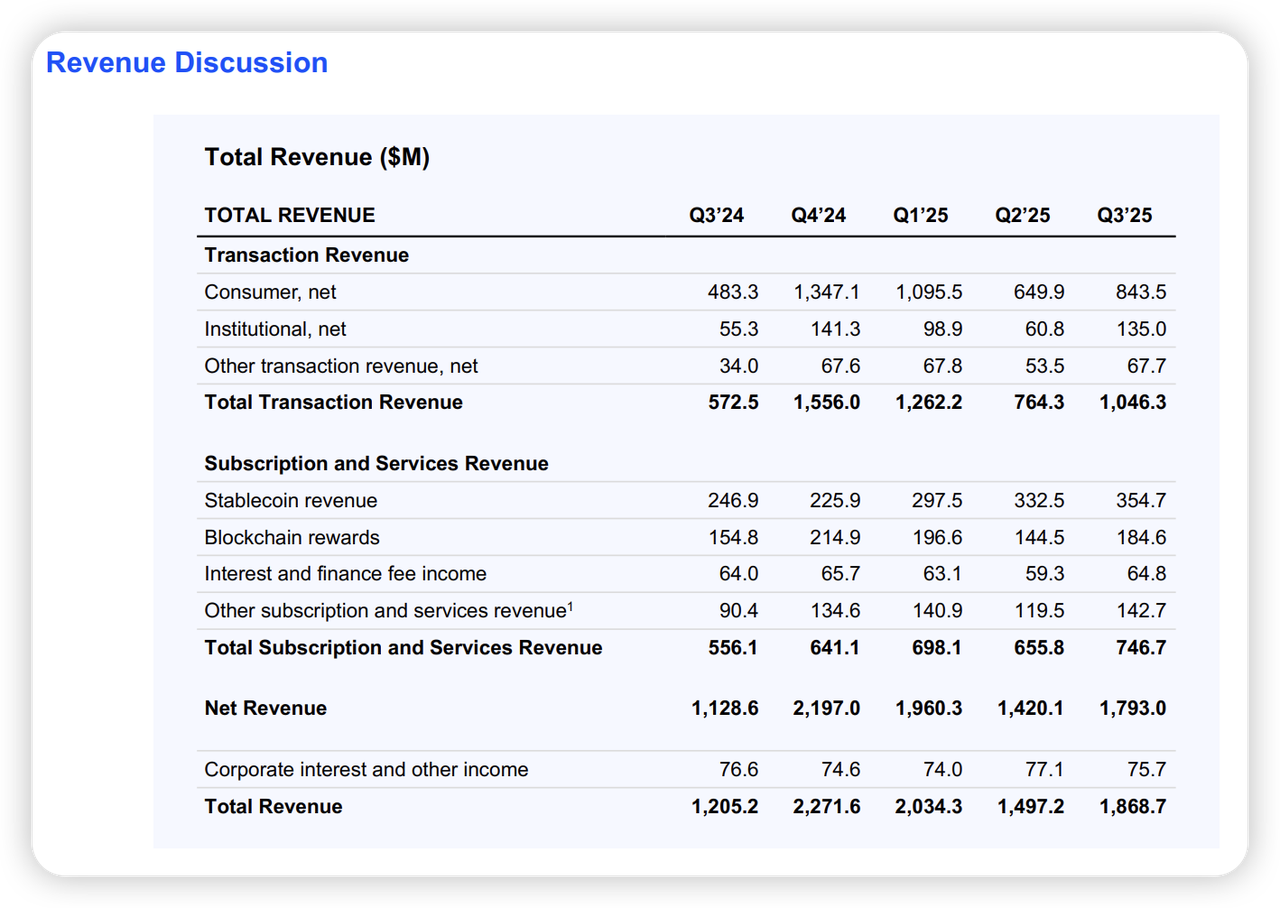

Data Source: https://investor.coinbase.com/files/doc_financials/2025/q3/Q3-25-Shareholder-Letter.pdf

A deeper look at the earnings report reveals a clear shift in Coinbase's growth narrative. Amid a slowdown in trading user growth across the crypto market, the company is actively trying to reduce its sole reliance on highly volatile transaction fees. Q3 financial data shows its "Subscription and Services Revenue" was robust, reaching $747 million and accounting for over 40% of the company's total net revenue. This segment of revenue is driven by more sustainable on-chain economic activities, such as $355 million in stablecoin revenue from USDC (+7% Q/Q), while blockchain rewards from services like staking grew to $185 million (+28% Q/Q). This indicates that Coinbase's strategic focus is evolving from being a passive transaction-matching platform to becoming more of an "infrastructure service provider" that builds and benefits from the on-chain ecosystem. This perhaps reveals a noteworthy evolutionary direction for CEXs in the current cycle: building more diversified and resilient revenue structures that go beyond transaction fees.

This strategic shift in focus also provides context for understanding why Armstrong publicly engaged with prediction markets. As one of the more active applications on-chain currently, prediction markets not only drive the issuance and usage of USDC but also bring real use cases and transaction demand to L2 networks like Base—directly correlating with the growing business segments in its earnings report. Consequently, when both key political figures and business titans view prediction markets as a growth engine for the on-chain economy, their rise into the American mainstream appears inevitable.

2. Weekly Selected Market Signals

Cautious Rebound Amid Data Fog and Shutdown Risk — Tech Earnings Provide a Floor; BTC Spikes Then Fades; ETFs and Stablecoins Underperform

Following the latest FOMC meeting, Chair Jerome Powell struck a more cautious tone, noting that a December rate cut is “far from a done deal” and likening the current backdrop to “driving in fog.” The market read this as a signal that policy actions will remain conservative until data gaps are filled. On the equity side, Amazon’s strong results lifted the tech complex with a near +10% single-day gain; the three major U.S. indices finished higher. Apple opened up post-earnings but faded to a modest loss, while Meta fell for two consecutive sessions and was down nearly 12% for October. Despite recurring geopolitical noise and month-end pressure, major indices still posted monthly gains in October, with several benchmarks up for at least six straight months.

In crypto, large caps rebounded for three consecutive sessions from Friday. BTC tested around $111,000 at the highs (peaking near ~$111,200) before sentiment cooled early Monday and price briefly dipped below $108,000. BTC dominance hovered near 60%. Altcoins’ market share slipped slightly even as their share of trading volume ticked higher. Overall, the weekend recovery did not fully repair risk appetite, and sentiment remained in the “fear” zone.

Data Source: CoinMarketCap

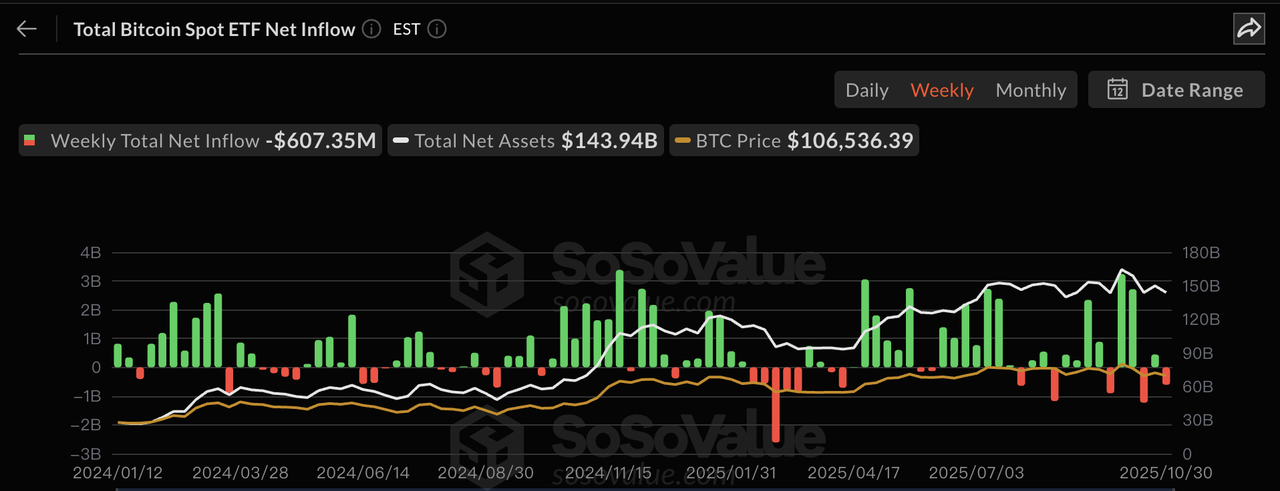

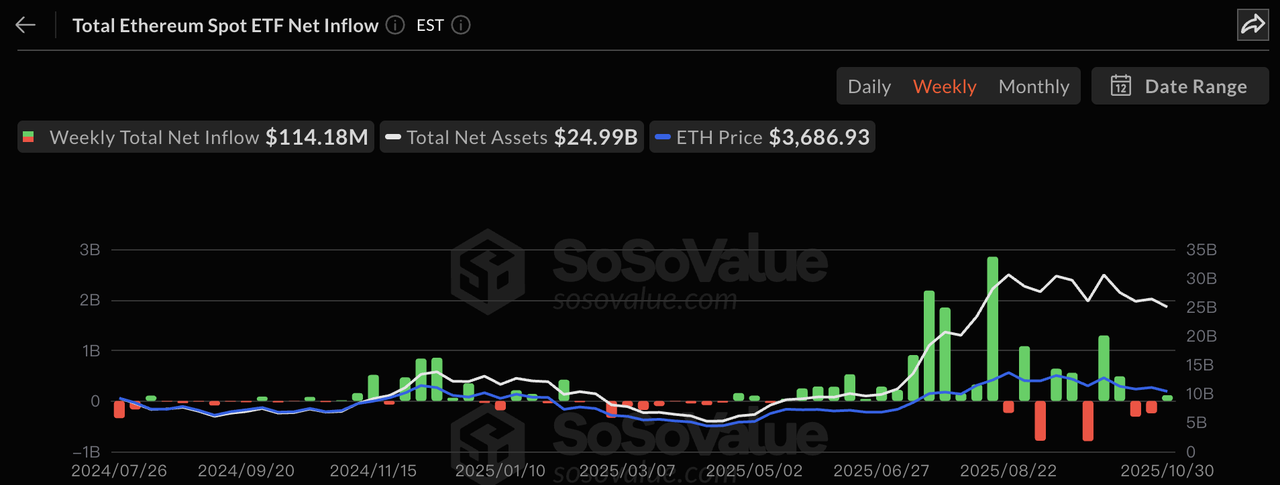

ETF flows pointed to a pullback in sentiment: spot Bitcoin ETFs recorded a net outflow of $607M last week, while spot Ether ETFs saw a $114M net inflow, ending two weeks of small net outflows.

On product developments, against the backdrop of a potential U.S. government shutdown, the SEC issued guidance indicating that S-1 registrations without a delaying amendment can become effective automatically after 20 days, and it approved listing standards for commodity-based trust shares on three exchanges—together helping accelerate multiple crypto ETF launches. Bitwise listed a Solana ETF on the NYSE; Canary listed Litecoin and HBAR ETFs on Nasdaq; and Grayscale converted GSOL into an ETF on NYSE Arca with SOL staking enabled.

Data Source: SoSoValue

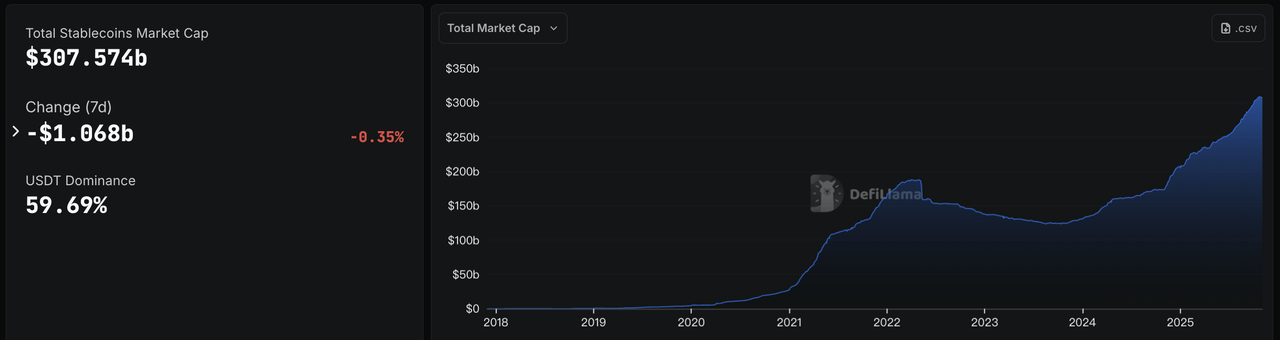

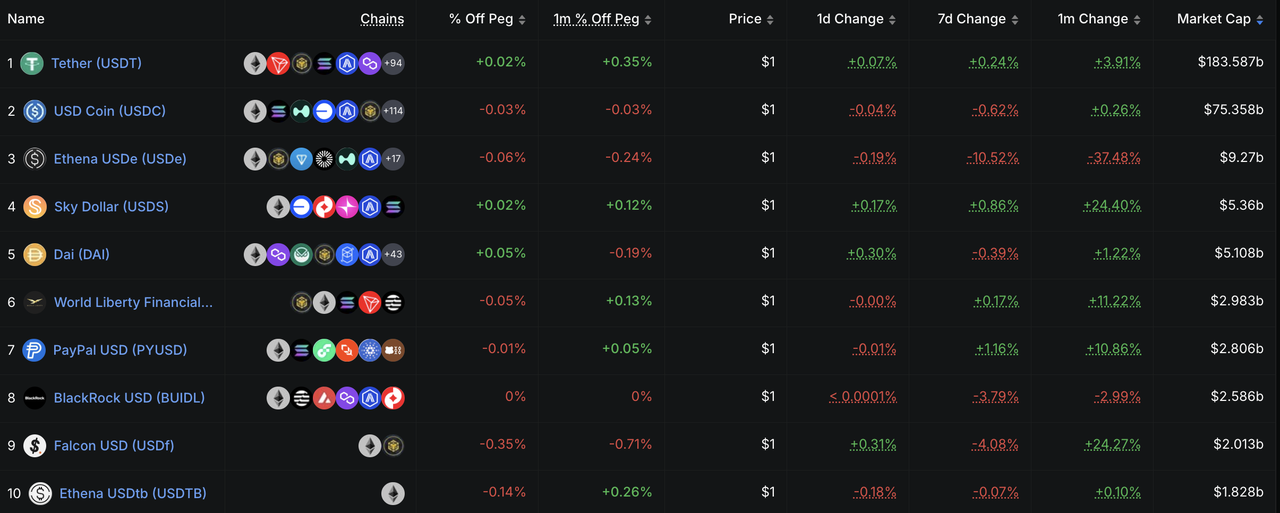

Stablecoins continued to diverge. Total supply fell 0.35% week-over-week but remained above $300B. Post-depeg, USDe supply dropped below $10B with a weekly decline of over 10%, and sUSDe APY fell to 5.1%; USDC decreased 0.63% over the same period.

On the regulatory front, Bloomberg reports that global regulators have restarted discussions on new rules for banks’ crypto-asset exposures. The Basel Committee’s 2022 framework assigned a 1,250% risk weight to certain crypto assets—effectively walling them off from the traditional banking system. Rapid growth in stablecoins has prompted a reassessment, and the framework may undergo systematic revisions.

Data Source: DeFiLlama

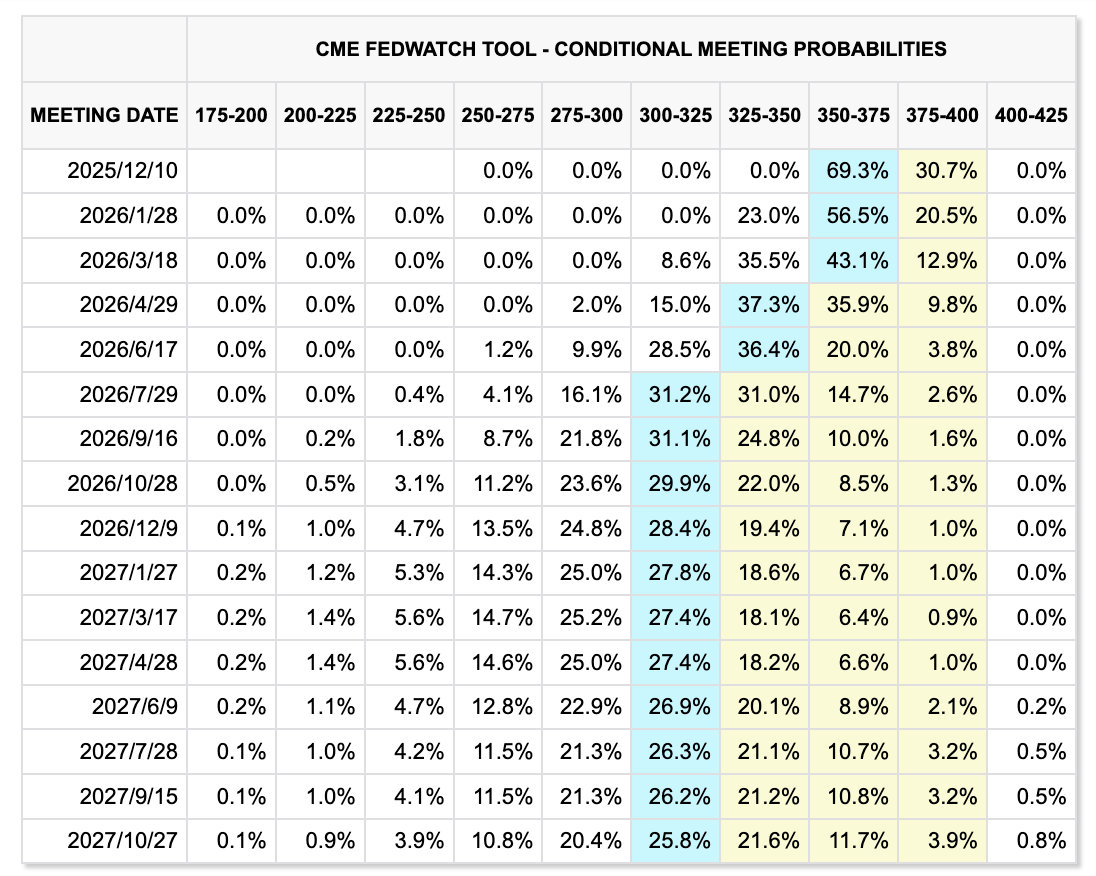

For rates expectations, the ongoing U.S. government shutdown has disrupted the release of key macro data, raising uncertainty around the December decision. Morgan Stanley argues that if the shutdown extends beyond Thanksgiving, a December pause is likely; Citi is more constructive, suggesting that if the government reopens within two weeks, the Fed could still cut 25 bps in December as the data window fills back in. The CME FedWatch Tool shows the probability of another 25 bp cut in December has fallen to 69%.

Data Source: CME FedWatch Tool

Key Events to Watch This Week: (Singapore Time)

-

Nov 3: The U.S. Senate could begin the next vote on a funding package aimed at ending the government shutdown.

-

Nov 5: U.S. October ADP employment change; former President Trump may attend a hearing related to a key Supreme Court “tariff ruling.”

-

Nov 6: Bank of England policy rate decision.

-

This week: China to release October CPI, PPI, trade, FX reserves, and PMI data.

Primary Market Observations

Crypto venture funding hit a recent-month low last week with $161.68M across 27 deals.

Data Source: CryptoRank

Average deal sizes declined noticeably, with only three rounds exceeding $10M. Notable items include: Metalpha Technology Holding Ltd. (NASDAQ: MATH) announced a ~$12M strategic private placement with Gortune International Investment Limited Partnership and Avenir Group, expected to close by Nov 30. If deployed effectively into trading capacity and the technology stack, the new capital could translate into incremental product supply and revenue elasticity.

Expanding Cash Access Points for Stablecoins: ZAR Raises $12.9M Led by a16z

Stablecoin startup ZAR has raised $12.9 million in a round led by a16z, with participation from Dragonfly, VanEck Ventures, Coinbase Ventures, and Endeavor Catalyst. The company targets small-ticket cross-border and retail payments by partnering with convenience stores, phone kiosks, and remittance agents to convert cash into “digital dollars” held in a mobile wallet that links to a Visa card usable globally. The approach is designed for low bank-account-penetration markets such as Pakistan and focuses on unbanked users—lowering the barriers created by traditional account opening and on-chain know-how. In practice, users walk into a participating store, scan a QR code, and exchange cash for stablecoins credited to their wallet, with the linked Visa card enabling everyday spend and cash-out where supported.

ZAR launched earlier this year and reports strong early momentum in Pakistan’s urban centers. The market backdrop is supportive: Pakistan is assessed by the World Bank as one of the largest unbanked populations globally, and it ranks third in Chainalysis’s 2025 Global Crypto Adoption Index. That combination—large cash economies, inflation pressure, and frequent remittance needs—provides tangible use cases for a “cash-first” on-ramp into stablecoins and a wallet-plus-card bundle.

For sustainability and scalability, ZAR plans to expand to Africa in 2026 once product-market fit is validated locally. Execution will hinge on several factors: alignment with local KYC/AML and FX regimes; the density and compliance quality of the offline agent network; cash-to-stablecoin conversion efficiency; growth in monthly active wallets; and the reliability and acceptance of the Visa linkage. If these interfaces scale smoothly, the thesis can extend beyond financial access into mainstream retail payments and low-value cross-border transfers.

3. Project Spotlight

Altcoin Spot ETFs Launch Unexpectedly During SEC Shutdown

Last week marked another milestone for the crypto asset market. Despite the ongoing federal government shutdown, the New York Stock Exchange (NYSE) and Nasdaq proceeded to list several spot ETFs for assets including Solana, Hedera, and Litecoin on October 28. At nearly the same time, the CSOP Solana ETF, issued by Harvest Global, officially began trading on the Hong Kong Stock Exchange. These moves signal that following BTC and ETH, mainstream altcoins are rapidly integrating into the global financial system, fostering a worldwide consensus on high-quality crypto assets.

The launch of these ETFs in the US surprised many, given the special circumstances of the government shutdown. The mechanism behind this may be guidance from the SEC stating that S-1 forms filed without a delay clause can become effective automatically after 20 days. This suggests the exchanges may be leveraging new general listing standards or similar procedures, allowing issuers to launch products without specific, individual approval from the SEC and showcasing the flexibility and resilience of market mechanisms in unique regulatory environments.

The most significant feature of this new batch of altcoin ETFs is the widespread adoption of a yield-bearing staking mechanism. The Bitwise Solana Staking ETF (BSOL), for instance, plans to stake all the SOL it holds, offering investors an additional potential annualized yield of around 7% on top of price exposure. This innovative model provides traditional investors with a one-stop, compliant solution to "buy, hold, and earn."

However, unlike the frenzy surrounding the Bitcoin ETF launch earlier this year, the market's initial reaction to these altcoin ETFs has been more moderate and cautious. Taking the highly anticipated Solana ETFs as an example, the total assets under management (AUM) reached approximately $502 million by the end of the first week. Notably, Grayscale's converted trust (GSOL) accounted for about $101 million of this, representing a rollover of existing assets. The genuine new net inflows were primarily driven by Bitwise's BSOL, which attracted around $197 million in its first week. Daily flow data shows that inflows peaked on the first day and then tapered off, indicating that investors have shifted from a "FOMO-driven buying" approach to a more rational "watch-and-allocate" strategy.

Currently, a large number of other ETFs for various assets are still awaiting approval. For these new products, listing is just the first step. Their ability to attract sustained inflows and consistently deliver on the promise of staking yields will be the true test of their success. The floodgates are open, but the strength of the current remains the key question for the market.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.